false

0001430723

0001430723

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

August

6, 2024 |

| ServisFirst Bancshares, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

001-36452 |

26-0734029 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2500 Woodcrest Place, Birmingham,

Alabama |

35209 |

| (Address of principal executive offices) |

(Zip Code) |

| (205) 949-0302 |

| (Registrant’s telephone number,

including area code) |

| Not Applicable |

| (Former name or former address, if

changed since last report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of exchange on which registered |

| Common |

SFBS |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01 – Regulation FD Disclosure

ServisFirst Bancshares, Inc. (the “Company”) has updated

its investor presentation to incorporate fourth quarter financial information and other data. This material may be used during discussions

with certain investors and is attached as Exhibit 99.1 to this Current Report and is incorporated by reference into this Item 7.01. The

updated presentation will also be available through the Investor Relations link at www.servisfirstbank.com.

The information in this report is being furnished, not filed, pursuant

to Regulation FD. Accordingly, the information in Items 7.01 and 9.01 of this report will not be incorporated by reference into any registration

statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated

therein by reference.

Item 9.01 – Financial Statements and Exhibits

(a)

Not applicable

(b)

Not applicable

(c)

Not applicable

(d)

Exhibits. The following exhibits are included with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | SERVISFIRST BANCSHARES, INC. |

| | |

|

| | |

|

| | |

/s/ Thomas A. Broughton, III |

| Dated: August 6, 2024 | By: |

Thomas A. Broughton, III |

| | |

Chairman, President and Chief Executive Officer |

Exhibit 99.1

ServisFirst Bancshares, Inc. NYSE: SFBS August 2024

Forward - Looking Statements ▪ Statements in this press release that are not historical facts, including, but not limited to, statements concerning future operations, results or performance, are hereby identified as "forward - looking statements" for the purpose of the safe harbor provided by Section 21 E of the Securities Exchange Act of 1934 and Section 27 A of the Securities Act of 1933 . The words "believe," "expect," "anticipate," "project," “plan,” “intend,” “will,” “could,” “would,” “might” and similar expressions often signify forward - looking statements . Such statements involve inherent risks and uncertainties . ServisFirst Bancshares, Inc . cautions that such forward - looking statements, wherever they occur in this press release or in other statements attributable to ServisFirst Bancshares, Inc . , are necessarily estimates reflecting the judgment of ServisFirst Bancshares, Inc . ’s senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward - looking statements . Such forward - looking statements should, therefore, be considered in light of various factors that could affect the accuracy of such forward - looking statements, including, but not limited to : the global health and economic crisis precipitated by the COVID - 19 outbreak ; general economic conditions, especially in the credit markets and in the Southeast ; the performance of the capital markets ; changes in interest rates, yield curves and interest rate spread relationships, including in light of the continuing high rate of domestic inflation ; changes in accounting and tax principles, policies or guidelines ; changes in legislation or regulatory requirements ; changes in our loan portfolio and the deposit base ; economic crisis and associated credit issues in industries most impacted by the COVID - 19 outbreak ; possible changes in laws and regulations and governmental monetary and fiscal policies, including, but not limited to, economic measures intended to curb rising inflation ; the cost and other effects of legal and administrative cases and similar contingencies ; possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and the value of collateral ; the effect of natural disasters, such as hurricanes and tornados, in our geographic markets ; and increased competition from both banks and non - bank financial institutions . The foregoing list of factors is not exhaustive . For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward - looking Statements” and “Risk Factors” in our most recent Annual Report on Form 10 - K, in our Quarterly Reports on Form 10 - Q, and our other SEC filings . If one or more of the factors affecting our forward - looking information and statements proves incorrect, then our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward - looking information and statements contained herein . Accordingly, you should not place undue reliance on any forward - looking statements, which speak only as of the date made . ServisFirst Bancshares, Inc . assumes no obligation to update or revise any forward - looking statements that are made from time to time . ▪ Non - GAAP Financial Measures - This presentation includes non - GAAP financial measures . Information about any such non - GAAP financial measures, including a reconciliation of those measures to GAAP, can be found in the presentation . 2

ServisFirst at a Glance Overview ▪ Founded in 2005 in Birmingham, AL ▪ Single bank BHC High - Performing Metropolitan Commercial Bank ▪ Total Assets (1) : $16.05 billion ▪ Stockholders’ Equity (1) : $1.51 billion High Growth Coupled with Pristine Credit Metrics (3) ▪ Gross Loans CAGR: 15% ▪ Total Deposits CAGR: 14% ▪ Net Income for Common CAGR: 22% ▪ Diluted EPS CAGR: 22% ▪ ROAA (2) : 1.34% ▪ Efficiency Ratio (2) : 37.31% 1) As of June 30, 2024 2) For three months ended June 30, 2024 3) 5 - year compounded annual growth rate (CAGR) calculated from 5 – year CAGR = 12/31/18 – 12/31/23 ▪ NPAs / assets (1) : 0.23% ▪ NPLs / loans (1) : 0.28% 3

Our Business Strategy 4 ▪ Simple business model – Loans and deposits are primary drivers, not ancillary services ▪ Limited branch footprint – Technology provides efficiency ▪ Big bank products and bankers – With the style of service and delivery of a community bank ▪ Core deposit focus coupled with C&I lending emphasis ▪ Scalable, decentralized business model – Regional CEOs drive revenue ▪ Opportunistic expansion, attractive geographies – Teams of the best bankers in each metropolitan market ▪ Disciplined growth company that sets high standards for performance

Opportunistic Expansion 5 ▪ Identify great bankers in attractive markets – Focus on people as opposed to places – Target minimum of $300 million in assets within 3 years – Best bankers in growing markets ▪ Market strategies – Regional CEOs execute simple business model – Back office support and risk management infrastructure – Non - legal board of directors comprised of key business people – Provide professional banking services to mid - market commercial customers that have been neglected or pushed down to branch personnel by national and other larger regional banks ▪ Opportunistic future expansion – Southern markets, metropolitan focus – Draw on expertise of industry contacts

Milestones ▪ Founded in May 2005 with initial capital raise of $35 million ▪ Reached profitability during the fourth quarter of 2005 and have been profitable every quarter since ▪ Achieved total asset milestones of $1 billion in 2008, $2 billion in 2011, $3 billion in 2013, $4 billion in 2014, $5 billion in 2015, $6 billion in 2016, $7 billion in 2017, $8 billion in 2018, $9 billion in 2019, $11 billion in 2020, $15 billion in 2021, and $16 billion in 2023 ’13: April - Nashville, TN April - Mobile, AL 6 January ‘15: Metro Bank Acquisition August ’06: Huntsville, AL September ’08: Dothan, AL January ‘17: Fairhope, AL April ’21: Orlando, FL LPO August '19: SW Florida LPO May ’05: Founded in Birmingham, AL June ’07: Montgomery, AL ’11: March - Correspondent Banking April - Pensacola, FL May ’14: Initial Public Offering January ’15: Charleston, SC January ’16: Tampa Bay, FL September ‘18: Fort Walton, FL August ‘20: Columbus, GA ’22: March - Panama City, FL LPO May - Piedmont, NC May - Tallahassee, FL September - Asheville, NC April ’23: Virginia Beach, VA July '24: Auburn, AL 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 February ’24: Memphis, TN LPO

Consistently Building Shareholder Value ▪ Tangible Book Value has increased year/year by a minimum of 10% every year since the bank opened in 2005 (18 - year CAGR (1) = 17%) ▪ Stock price has increased by more than 4,100% (2) since initial capital raise in 2005 (18 - year CAGR (1) = 24%) ▪ Dividend has increased each year since going public in 2014 7 5 - year (3) CAGR = 37% 5 - year (3) CAGR = 16% Annual Dividend Per Share 1) 18 – year CAGR = 12/31/05 – 12/31/23 2) Split adjusted (6 - for - 1) stock price for 2005 initial capital raise was $1.67 per share. Closing stock price on 12/31/2023 was $66.63 3) 5 – year CAGR = 12/31/18 – 12/31/23 4) Dividend annualized $0.60 $0.70 $0.80 $0.92 $1.14 $0.60 $1.20 (4) 2019 2020 2021 2022 2023 6/30/2024 15.45 18.15 20.99 23.64 26.20 27.46 2019 2020 2021 2022 2023 Tangible Book Value Per Share 6/30/2024

Our Footprint 8 ServisFirst Branches (30) ServisFirst LPO (4) Auburn

Our Regions 9 1) Represents metropolitan statistical areas (MSAs) 2) As of June 30, 2024 3) As reported by the FDIC as of 6/30/2023 4) Includes Sarasota LPO and Venice Full Service Office 5) includes Tallahassee Mortgage LPO and Tallahassee Full Service Office 6) Loan Production Office Market Share (3) Total MSA Deposits (3) Total Offices (2) Region (1) (%) ($ in billions) Alabama 8.7 47.0 3 Birmingham - Hoover 21.2 4.2 2 Dothan 10.7 10.3 2 Huntsville 5.5 16.7 3 Mobile 16.2 11.1 2 Montgomery 0 4.4 1 Auburn - Opelika (6) Florida 1.1 8.7 1 Crestview - Fort Walton Beach - Destin 1.9 29.9 2 North Port - Sarasota - Bradenton (4) 0.1 72.9 1 Orlando - Kissimmee - Sanford 2.4 4.7 1 Panama City 6.3 9.4 2 Pensacola - Ferry Pass - Brent .6 9.5 2 Tallahassee (5) 0.3 123.9 1 Tampa - St. Petersburg - Clearwater Georgia 0.4 237.1 2 Atlanta - Sandy Springs - Roswell 0.3 8.8 1 Columbus North Carolina 0 382.3 2 Charlotte - Concord - Gastonia 0 11.5 1 Asheville South Carolina 1.8 22.7 2 Charleston - North Charleston Tennessee 0.7 92.7 1 Nashville - Davidson - Murfreesboro - Franklin 0 41.2 1 Memphis, TN - MS - AR (6) Virginia Beach 0 33.3 1 Virginia Beach - Norfolk - Newport News 1,178 33 Total

Our Business Model 10 ▪ “Loan making and deposit taking” – Traditional commercial banking services – No emphasis on non - traditional business lines ▪ Culture of cost control – “Branch light,” with $442 million average deposits per banking center – Leverage technology and centralized infrastructure – Headcount focused on production and risk management – Key products; including remote deposit capture (63% of dollars deposited in 2024 have been via RDC), cash management, remote currency manager – Outsource selected functions ▪ C&I and Owner Occupied CRE lending expertise – 43% of gross loans – Target customers: privately held businesses $2 to $250 million in annual sales, professionals, affluent consumers

Scalable, Decentralized Structure 11 ▪ Local decision - making – Emphasize local decision - making to drive customer revenue – Centralized, uniform risk management and support – Conservative local lending authorities, covers most lending decisions – Geographic organizational structure (as opposed to line of business structure) ▪ Regional CEOs empowered and held accountable – Utilize stock based compensation to align goals ▪ Top - down sales culture – Senior management actively involved in customer acquisition

Capacity For Growth 12 ▪ Potential for significant growth in both loan and deposit book size of current calling officers – Approximately 66% of the bank’s loan book is managed by approximately 20% of the bank’s calling officers and approximately 67% of the bank’s deposits is managed by approximately 20% of the bank’s calling officers – Average outstanding loan balances per officer as of 6/30/24 was $61 million and average deposit balances per officer was $69 million – Strive for a minimum of $75 million in outstanding loans and deposits for every calling officer, resulting in approximately $5.4 billion in potential additional loan balances and $5.6 billion in potential additional deposits balances – Approximately 29% of calling officers manage loan books in excess of $75 million while 31% of calling officers manage deposit books in excess of $75 million ▪ Focused on identifying motivated, customer service oriented bankers – Regularly meet with potential new bankers – Sustainable growth achieved through exceptional customer service which builds client loyalty and leads to customer referrals

Risk Management 13 ▪ Manage risk centrally while delivering products and services by each Regional Bank ▪ Centralized/Consistent: operations, compliance, risk, accounting, audit, information technology, and credit administration ▪ Investing resources in Risk Management Group – Hired CRO in 2017; implemented enterprise risk management program – Invested in new technologies (BSA, information security, credit administration) – Enhanced staff and resources for risk, compliance, BSA, and credit administration – Increased scope of internal audits and independent loan reviews ▪ Management committees identify, monitor, and mitigate risks across enterprise ▪ Healthy Regulatory relations ▪ Independent loan portfolio stress testing performed regularly ▪ Correspondent Banking Division provides additional stable funding source

Risk Management Credit Process 14 ▪ Lending focuses on middle market clients with Regional CEO and credit officers approving secured loan relationship up to $5MM; relationships greater than $5MM are approved by the CCO and/or members of executive management ▪ Centralized monitoring of ABL relationships greater than $2MM and centralized monitoring of commercial construction projects greater than $3MM ▪ Independent loan review examines 35 - 40% of the committed balances annually to affirm risk rating accuracy and proper documentation ▪ The top three industry exposures as of 6/30/24 are: Real Estate (35%), Service Industry (12%) and Retail (8%). – The top three C&I and C&I OOCRE portfolio industries are: Retail (18%), Manufacturing (10%), and Health Care (9%). C&I and C&I OOCRE loans account for 43% of the total loan portfolio

Risk Management Credit Process ▪ The Bank does not lead any Share National Credits (SNCs); the Bank does participate in 12 relationships that are classified as SNCs with current balances of $97MM as of 6/30/24 ▪ As of 6/30/24, CRE as a percent of capital was 312% and AD&C as a percent of capital was 86% ▪ Approximately 86% of the Bank’s CRE loans are located in Bank’s seven state footprint ▪ As of 6/30/24, variable rate loans account for 46% of the loan portfolio – 83.9% of variable rate loans have a floor and the average floor rate is 4.41% ▪ The Bank’s average net credit loss from 2008 through 2010 was 52 basis points compared to a peer (1) average of 121 basis points thus the bank performed well above its peers in the last large economic downturn 15 1) Peer Group 4 as defined by The Uniform Bank Performance Report (UBPR)

Correspondent Banking Footprint Total Balance ($000s) Fed Funds Purchased Deposits (Interest Bearing) Deposits (Non Interest Bearing) # of Relationships Date $1,890,538 $1,097,153 $529,169 $264,215 377 6/30/2024 $2,173,677 $1,345,328 $564,806 $263,543 373 3/31/2024 $2,125,967 $1,256,724 $616,699 $252,544 372 12/31/2023 $2,071,940 $1,310,289 $511,439 $250,212 363 9/30/2023 $1,845,375 $1,102,936 $495,830 $246,612 360 6/30/2023 $2,239,609 $1,266,303 $760,663 $212,644 348 3/31/2023 $2,467,455 $1,353,798 $761,371 $352,286 346 12/31/2022 85+ 16

Our Management Team Thomas A. Broughton, III President and Chief Executive Officer ▪ Previously President and CEO of First Commercial Bank (acquired by Synovus Financial, 1992); subsequently, regional CEO for Synovus ▪ American Banker’s 2009 Community Banker of the Year Kirk P. Pressley EVP and Chief Financial Officer ▪ Previously Chief Financial Officer of BBVA USA ▪ Certified public accountant Rodney E. Rushing EVP and Chief Operating Officer ▪ Previously Executive Vice President of Correspondent Banking, BBVA - Compass Henry F. Abbott SVP and Chief Credit Officer ▪ Previously Senior Vice President and Chief Credit Officer of the Correspondent Banking Division, ServisFirst Bank 17

Our Regions 18 Rex D. McKinney EVP and Regional CEO Northwest Florida ▪ Previously EVP/Senior Commercial Lender for First American Bank/Coastal Bank and Trust (Synovus) Andrew N. Kattos EVP and Regional CEO Huntsville ▪ Previously EVP/Senior Lender for First Commercial Bank J. Harold Clemmer EVP and Regional CEO Atlanta ▪ Previously President of Fifth Third Bank Tennessee and Fifth Third Bank Georgia W. Bibb Lamar EVP and Regional CEO Mobile ▪ Previously CEO of BankTrust for over 20 years G. Carlton Barker EVP and Regional CEO Montgomery ▪ Previously Group President for Regions Bank Southeast Alabama Bank Group B. Harrison Morris EVP and Regional CEO Dothan ▪ Previously Market President of Wachovia’s operation in Dothan Gregory W. Bryant EVP and Regional CEO West Central Florida ▪ Previously President and CEO of Bay Cities Bank in Tampa Bay Thomas G. Trouche EVP and Regional CEO Charleston ▪ Previously Executive Vice President Coastal Division for First Citizens Bank Bradford A. Vieira EVP and Regional CEO Nashville ▪ Previously SVP and Commercial Banking Manager at ServisFirst Bank Rick Manley EVP and Regional CEO Piedmont ▪ Previously Mid Atlantic President for First Horizon Bank

Financial Results

Income Growth ▪ Rare combination of balance sheet growth and earnings power ▪ EPS growth includes impact of $55.1 million of common stock issued in five private placements as we entered new markets prior to our initial public offering (IPO) and $56.9 million from the IPO 20 5 - year (1) CAGR = 22% 5 - year (1) CAGR = 22% Net Income Available to Common Stockholders ($mm) 1) 5 – year CAGR = 12/31/18 – 12/31/23 136.9 149.2 169.5 207.7 251.5 206.8 102.2 2018 2019 2020 2021 2022 2023 6/30/2024 2.53 2.76 3.13 3.82 4.61 3.79 1.87 2018 2019 2020 2021 2022 2023 6/30/2024 Diluted Earnings Per Common Share

Balance Sheet Makeup ▪ Primary focus on building core deposits, highlighted by non - interest bearing accounts and non - reliance on CDs ▪ C&I lending expertise within a well balanced loan portfolio 21 Deposit Mix (1) 4.08% Cost of Interest Bearing Deposits (2 ) Loan Portfolio (1) 6.48% Yield on Loans (2) 1) For period ending June 30, 2024 2) Average for the three months ended June 30, 2024 Non - interest bearing 19% NOW, Money market, and savings 72% CDs 9% Commercial & industrial 24% Consumer 1% Real estate - construction 12% Consumer mortgage 11% CRE non - owner occupied 33% CRE owner occupied 19%

Loan Growth by Type 22 YTD Growth by Loan Type 6/30/2024 12/31/2023 Loan Type Dollars in Thousands $111,591 $2,935,577 $2,823,986 Commercial, financial and agricultural $(8,942) $1,510,677 $1,519,619 Real estate - construction Real estate - mortgage $142,481 $2,399,644 $2,257,163 Owner - occupied commercial $100,490 $1,350,428 $1,249,938 1 - 4 family mortgage $327,661 $4,072,007 $3,744,346 Other mortgage $570,632 $7,822,079 $7,251,447 Subtotal: Real Estate - Mortgage $670 $64,447 $63,777 Consumer $673,951 $12,332,780 $11,658,829 Total Loans

Credit Trends 23 Commercial Real Estate Trends Year Ended December 31, 6/30/2024 2023 2022 2021 2020 2019 (In Thousands) $ 95,183 $ 109,800 $ 105,954 $ 74,811 $ 62,383 $ 47,809 1 - 4 Family Construction Speculative $ 112,333 $ 90,772 $ 116,556 $ 96,144 $ 55,899 $ 56,105 1 - 4 Family Construction Sold $ 51,965 $ 47,560 $ 35,530 $ 37,753 $ 50,777 $ 37,219 Resi Acquisition & Development $ 1,167,597 $ 1,038,283 $ 869,483 $ 459,122 $ 316,372 $ 300,281 Multifamily Permanent $ 47,180 $ 49,672 $ 51,816 $ 37,130 $ 36,179 $ 26,486 Residential Lot Loans $ 35,704 $ 36,694 $ 50,717 $ 60,132 $ 51,195 $ 50,198 Commercial Lots $ 157,363 $ 151,470 $ 164,932 $ 134,774 $ 54,793 $ 45,193 Raw Land $ 1,010,950 $ 1,033,652 $ 1,006,883 $ 662,333 $ 282,389 $ 254,983 Commercial Construction $ 576,544 $ 545,866 $ 537,466 $ 363,610 $ 304,858 $ 248,817 Retail $ 313,576 $ 301,244 $ 321,210 $ 363,410 $ 342,586 $ 252,780 Nursing Home or Assisted Living Facility $ 409,230 $ 413,729 $ 384,209 $ 290,075 $ 260,982 $ 195,604 Office Building $ 518,196 $ 458,329 $ 409,720 $ 259,986 $ 134,902 $ 101,054 Hotel or Motel $ 996,719 $ 899,659 $ 978,145 $ 847,093 $ 643,979 $ 535,022 All Other CRE Income Property $ 5,492,540 $ 5,176,730 $ 5,032,620 $ 3,686,371 $ 2,597,292 $ 2,151,550 Total CRE (Excluding O/O CRE) $ 1,759,041 $ 1,691,212 $ 1,532,890 $ 1,303,623 $ 1,108,672 $ 962,616 Total Risk - Based Capital (Bank Level) 312% 306% 328% 283% 234% 224% CRE as % of Total Capital $12,332,780 $ 11,658,829 $ 11,687,968 $ 9,653,984 $ 8,465,688 $ 7,261,451 Total Gross Loans 45% 44% 43% 39% 31% 30% CRE as % of Total Portfolio $ 2,399,586 $ 2,257,163 $ 2,199,280 $ 1,874,103 $ 1,693,427 $ 1,588,148 CRE Owner Occupied 19% 19% 19% 20% 20% 22% CRE OO as % of Total Portfolio 136% 133% 143% 144% 153% 165% CRE OO as % of Total Capital Acquisition, Development, & Construction Trends $ 1,510,676 $ 1,519,619 $ 1,532,388 $ 1,103,076 $ 593,614 $ 517,992 AD&C 86% 100% 100% 85% 54% 54% AD&C as % of Total Capital 12% 13% 13% 12% 7% 7% AD&C as % of Total Portfolio

Credit Quality ▪ Strong loan growth while maintaining asset quality discipline 0.41% 0.50% 0.21% 0.09% 0.12% 0.14% 0.23% 2018 2019 2020 2021 2022 Non - Performing Assets / Total Assets 2023 6/30/2024 0.43% 0.50% 0.22% 0.13% 0.15% 0.18% 0.28% 2018 2019 2023 6/30/2024 1.05% 1.05% 1.04% 1.22% 1.25% 1.32% 1.28% 2018 2019 2020 2021 2022 2023 6/30/2024 Allowance for Credit Losses / Total Loans 0.20% 24 0.32% 2020 2021 2022 Non - Performing Loans / Total Loans 0.36% 0.08% 0.10% 0.08% 2018 2019 0.03% 2020 2021 2022 Net Charge Offs / Total Average Loans 2023 6/30/2024

Profitability Metrics ▪ Consistent earnings results and strong momentum 1.88 1.71 1.59 1.55 1.71 1.42 1.31 2018 2019 2020 2021 2022 2023 6/30/2024 Adj. Return on Average Assets (1) 20.96 19.00 18.55 19.48 20.73 15.71 14.15 2018 2019 2020 2021 2022 2023 6/30/2024 Adj. Return on Average Equity (1) 20.95 18.99 18.55 19.47 20.73 15.71 14.15 2018 2019 2020 2021 2022 2023 6/30/2024 Adj. Return on Average Common Equity (1) 3.75 25 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures" included at the end of this presentation. 3.46 3.31 2.94 3.32 2.81 2.73 2018 2019 2020 2021 2022 Net Interest Margin 2023 6/30/2024

Efficiency 45.54% 41.54% 38.69% 38.75% 40.60% 39.47 34.71% 32.57% 33.28% 30.29% 31.84% 31.30% 38.28% 38.63% 1.79% 1.67% 1.51% 1.47% 1.55% 1.41 1.32% 1.26% 1.20% 1.05% 0.98% 1.07% 1.11% 1.11% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Adj. Efficiency Ratio (1) and Adj. Non - interest Expense / Average Assets (1) 2022 2023 6/30/2024 ▪ Our operating structure and business strategy enable efficient, profitable growth Adj. Efficiency Ratio (1) Adj. Non - interest Expense / Average Assets (1) 26 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures" included at the end of this presentation.

Interest Rate Risk Profile Based on parallel shift in yield curve and a static balance sheet Scenario 46% of loans are variable rate Variable - Rate Loans 19% of deposits are held in non - interest bearing demand deposit accounts Deposit Mix 2.6% - 2.6% - 5.6% 10.1% 13.4% 14.1% - 10.0% - 5.0% 0.0% 5.0% 10.0% 15.0% 20.0% Down 100 bps Up 100 bps Up 200 bps Change in Net Interest Income Year 1 Year 2 27

Our Regions: Centers for Continued Growth 28 ▪ Birmingham, Alabama – Key Industries : Metals manufacturing, finance, insurance, healthcare services and distribution – Key Employers : Protective Life, Encompass Health, Vulcan Materials Company, AT&T, American Cast Iron Pipe Company, Southern Company, Shipt, and University of Alabama at Birmingham ▪ Huntsville, Alabama – Key Industries : U.S. government, aerospace/defense, commercial and university research – Key Employers : U.S. Army/Redstone Arsenal, Boeing Company, NASA/Marshall Space Flight Center, Intergraph Corporation, ADTRAN, Northrop Grumman, Technicolor, SAIC, DirecTV, Lockheed Martin, and Toyota Motor Manufacturing ▪ Montgomery, Alabama – Key Industries : U.S. and state government, U.S. Air Force , automotive manufacturing – Key Employers : Maxwell Gunter Air Force Base, State of Alabama, Baptist Health Systems, Hyundai Motor Manufacturing, and MOBIS Alabama

Our Regions: Centers for Continued Growth (cont.) 29 ▪ Dothan, Alabama – Key Industries : Agriculture, manufacturing, and healthcare services – Key Employers : Southeast Health Medical Center, Wayne Farms, Southern Nuclear, Michelin Tire, Globe Motors, and AAA Cooper Transportation ▪ Northwest Florida – Key Industries : Military, health services, medical technology industries, and tourism – Key Employers : Eglin Air Force Base, Hurlburt Field, Pensacola Whiting Field, Pensacola Naval Air Station and Corry Station, Ascension Health System, Baptist Healthcare, West Florida Regional Hospital, University of West Florida, Ascend Performance Materials, Tyndall Air Force Base, Coastal Systems Station Naval Surface Warfare Center, Florida State University, Amazon, Tallahassee Memorial Healthcare, GE Wind Energy, St. Joe Company, Eastern Ship building Inc., and Berg Steel Pipe Corp ▪ Mobile, Alabama – Key Industries : Aircraft assembly, aerospace, steel, ship building, maritime, construction, medicine, and manufacturing – Key Employers : Port of Mobile, Infirmary Health Systems, Austal USA, Brookley Aeroplex, ThyssenKrupp, University of South Alabama, VT Mobile Aerospace, and EADS

Our Regions: Centers for Continued Growth (cont.) 30 ▪ Tennessee – Key Industries : Healthcare, manufacturing, entertainment, transportation, and technology – Key Employers : HCA Holdings, Nissan North America, Dollar General Corporation, Asurion, Community Health Systems, FedEx, AutoZone, and International Paper ▪ Charleston, South Carolina – Key Industries : Maritime, information technology, higher education, military, manufacturing, and tourism – Key Employers : Joint Base Charleston, Medical University of South Carolina, Roper St. Francis Healthcare, Boeing Company, Robert Bosch LLC, Blackbaud, and SAIC ▪ Atlanta, Georgia – Key Industries : Logistics, media, information technology, and entertainment – Key Employers : Coca - Cola Company, Home Depot, Delta Air Lines, AT&T Mobility, UPS, Newell - Rubbermaid, Cable News Network, and Cox Enterprises

Our Regions: Centers for Continued Growth (cont.) 31 ▪ West Central Florida – Key Industries : Defense, financial services, information technology, healthcare, transportation, grocery, manufacturing, and tourism – Key Employers : Baycare Health System, University of South Florida, Tech Data, Raymond James Financial, Jabil Circuit, HSN, WellCare Health Plans, Sarasota Memorial Health Care System, Beall’s Inc., Teco Energy, Walt Disney World Resort, Advent Health, Publix, and Lockheed Martin ▪ Piedmont, North Carolina – Key Industries : Financial services, manufacturing, energy, automotive, and healthcare – Key Employers : Bank of America, Wells Fargo, Duke Energy, Atrium Health, Novant Health, Lowe’s, TIAA, Nucor, Sonic Automotive, and Compass Group North America ▪ Virginia Beach, Virginia – Key Industries : Defense, Manufacturing, Trade, Information, Utilities, Maritime, Hospitality , Professional services, and Healthcare – Key Employers : Naval Air Station Oceana - Dam Neck, Ft. Story, Sentara Healthcare, GEICO , STIHL , Novant Health, Huntington Ingalls Industries, Dominion Energy, Newport News Shipbuilding, Jefferson Labs and Siemens Gamesa

Our Financial Performance: Key Operating and Performance Metrics States, or GAAP. 32 1) For a reconciliation of these non - GAAP measures to the most comparable GAAP measure, see "GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures" included at the end of this presentation. 2) Non - GAAP financial measures. "Tangible Common Equity to Tangible Assets" and "Tangible Book value per Share" are not measures of financial performance recognized by generally accepted accounting principles in the United 6/30/2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Dollars in Millions Except per Share Amounts Balance Sheet $16,050 $16,130 $14,596 $15,449 $11,933 8948 $8,007 $7,082 $6,370 $5,096 Total Assets $12,175 $11,506 $11,542 $9,416 $8,378 7185 $6,465 $5,792 $4,860 $4,173 Net Loans $13,259 $13,274 $11,547 $12,453 $9,976 7530 $6,916 $6,092 $5,420 $4,224 Deposits 92% 87% 100% 76% 84% 95% 93% 95% 90% 99% Net Loans / Deposits $1,511 $1,440 $1,298 $1,152 $993 $843 $715 $608 $523 $449 Total Equity Profitability $102.2 $206.9 $251.5 $207.7 $169.6 $149.2 $136.9 $93.1 $81.5 $63.5 Net Income $102.1 $206.8 $251.4 $207.7 $169.5 $149.2 $136.9 $93.0 $81.4 $63.3 Net Income Available to Common $102.1 $206.8 $251.4 $210.0 $169.5 $147.9 $136.9 $96.3 $81.4 $65.0 Adj. Net Income Available to Common (1) 1.30% 1.37% 1.71% 1.55% 1.59% 1.71% 1.88% 1.48% 1.42% 1.42% Adj. ROAA (1) 13.97% 15.13% 20.73% 19.48% 18.55% 19.00% 20.96% 16.96% 16.64% 14.96% Adj. ROAE (1) 13.96% 15.13% 20.73% 19.47% 18.55% 18.99% 20.95% 16.95% 16.63% 15.73% Adj. ROACE (1) 2.73% 2.81% 3.32% 2.94% 3.31% 3.46% 3.75% 3.68% 3.42% 3.75% Net Interest Margin 38.63% 40.67% 31.30% 31.84% 30.29% 33.31% 32.57% 34.71% 39.47% 40.73% Adj. Efficiency Ratio (1) Capital Adequacy 9.33% 8.85% 8.81% 7.38% 8.22% 9.27% 8.77% 8.39% 7.99% 8.54% Tangible Common Equity to Tangible Assets (2) 10.93% 1091.43% 9.55% 9.95% 10.50% 10.50% 10.12% 9.51% 9.78% 0.0972 Common Equity Tier 1 RBC Ratio 9.81% 9.12% 9.29% 7.39% 8.23% 9.13% 9.07% 8.51% 8.22% 8.55% Tier I Leverage Ratio 10.93% 10.92% 9.55% 9.96% 10.50% 10.50% 10.13% 9.52% 9.78% 9.73% Tier I RBC Ratio 12.43% 12.45% 11.03% 11.58% 12.20% 12.31% 12.05% 11.52% 11.84% 11.95% Total RBC Ratio Asset Quality 0.23% 0.19% 0.12% 0.09% 0.21% 0.50% 0.41% 0.25% 0.34% 0.26% NPAs / Assets 0.08% 0.08% 0.08% 0.03% 0.36% 0.32% 0.20% 0.00% 0.11% 0.13% NCOs / Average Loans 1.28% 1.32% 1.25% 1.22% 1.04% 1.05% 1.05% 1.02% 1.06% 1.03% Credit Loss Reserve / Gross Loans Per Share Information 54,522,802 54,461,580 54,326,527 54,227,060 53,943,751 53,623,740 53,375,195 52,992,586 52,636,896 51,945,396 Common Shares Outstanding $27.71 $26.45 $23.89 $21.24 $18.41 $15.71 $13.40 $11.47 $9.93 $8.65 Book Value per Share $27.46 $26.20 $23.64 $20.99 $18.15 $15.45 $13.13 $11.19 $9.65 $8.35 Tangible Book Value per Share (2) $1.87 $3.79 $4.61 $3.82 $3.13 $2.76 $2.53 $1.72 $1.52 $1.20 Diluted Earnings per Share $1.89 $3.79 $4.61 $3.86 $3.13 $2.74 $2.53 $1.78 $1.52 $1.23 Adj. Diluted Earnings per Share (1)

Our Financial Performance: Asset Quality, Credit Loss Reserve and Charge - Offs 33 6/30/2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Dollars in Thousands Nonaccrual Loans: 21,221 7,217 7,108 4,343 11,709 14,729 10,503 9,712 7,282 1,918 Commercial, Financial & Agricultural - 111 - - 234 1,588 997 - 3,268 4,000 Construction 3,355 7,089 3,312 1,021 1,259 10,826 3,358 556 - - Owner - Occupied Commercial Real Estate 5,328 4,426 1,524 1,398 771 1,440 2,046 459 74 198 1 - 4 Family 498 506 506 - - 1,507 5,022 - - 1,619 Other Real Estate Loans 2 - - - - - - 38 - 31 Consumer 30,404 19,349 12,450 6,762 13,973 30,091 21,926 10,765 10,624 7,766 Total Nonaccrual Loans 1,482 2,184 5,391 5,335 4,981 6,021 5,844 60 6,263 1 Total 90+ Days Past Due & Accruing 34,936 21,533 17,841 12,097 18,954 36,112 27,770 10,825 16,887 7,767 Total Nonperforming Loans 1,458 995 248 1,208 6,497 8,178 5,169 6,701 4,988 5,392 Other Real Estate Owned & Repossessions 36,394 22,528 18,089 13,305 25,451 44,290 32,939 17,526 21,875 13,159 Total Nonperforming Assets Allowance for Credit Losses: 153,317 146,297 116,660 87,942 76,584 68,600 59,406 51,893 43,419 35,629 Beginning of Year (2,000) Impact of Adoption of ASC 326 (1) Charge - Offs: (5,197) (13,229) (9,256) (3,453) (23,936) (15,015) (11,428) (13,910) (3,791) (3,802) Commercial, Financial and Agricultural - (108) - (14) (1,032) - - (56) (815) (667) Real Estate - Construction (186) (171) (221) (279) (4,397) (6,882) (1,042) (2,056) (380) (1,104) Real Estate - Mortgage: (206) (1,073) (660) (368) (203) (592) (283) (310) (212) (171) Consumer (5,589) (14,581) (10,137) (4,114) (29,568) (22,489) (12,753) (16,332) (5,198) (5,744) Total Charge - Offs Recoveries: 605 2,800 2,012 1,135 252 306 349 337 49 279 Commercial, Financial and Agricultural 8 3 - 52 32 3 112 168 76 238 Real Estate - Construction 6 - - 86 140 13 46 89 146 169 Real Estate - Mortgage: 24 83 155 42 68 107 38 26 3 1 Consumer 643 2,886 2,167 1,315 492 429 545 620 274 687 Total Recoveries (4,946) (11,695) (7,970) (2,799) (29,076) (22,060) (12,208) (15,712) (4,924) (5,057) Net Charge - Offs - - - - - 7,406 - - - - Allocation from LGP 9,721 18,715 37,607 31,517 42,434 22,638 21,402 23,225 13,398 12,847 Provision for Credit Losses Charged to Expense 158,092 153,317 146,297 116,660 87,942 76,584 68,600 59,406 51,893 43,419 Allowance for Credit Losses at End of Period As a Percent of Year to Date Average Loans: 0.08% 0.10% 0.08% 0.03% 0.36% 0.32% 0.20% 0.29% 0.11% 0.13% Net Charge - Offs 0.16% 0.16% 0.36% 0.36% 0.52% 0.33% 0.35% 0.43% 0.30% 0.34% Provision for Credit Losses 1.28% 1.32% 1.25% 1.22% 1.04% 1.05% 1.05% 1.02% 1.06% 1.03% Allowance for Credit Losses As a Percentage of: Loans

GAAP Reconciliation and Management Explanation of Non - GAAP Financial Measures 34 During the fourth quarter of 2023 , we recorded a one - time expense of $ 7 . 2 million associated with the FDIC’s special assessment to recapitalize the Deposit Insurance Fund following bank failures in the spring of 2023 . This assessment was updated in the first quarter of 2024 resulting in additional expense of $ 1 . 8 million . These expenses are unusual, or infrequent, in nature and not part of the noninterest expense run rate . Each of adjusted net income, adjusted net income available to common stockholders, adjusted diluted earnings per share, adjusted return on average assets, adjusted return on average common stockholders’ equity and adjusted efficiency ratio excludes the impact of these items, net of tax, and are all considered non - GAAP financial measures . During the fourth quarter of 2021 , we recorded $ 3 . 0 million of expenses associated with our core operating system conversion scheduled to be completed during the third quarter of 2022 . The expenses relate to negotiated liquidated damages of our existing system contracts and the procurement of our data from those providers . We recorded a $ 1 . 7 million credit to our FDIC and other regulatory assessments expense in 2019 as a result of the FDIC’s Small Bank Assessment Credit . We recorded $ 3 . 1 million of additional tax expense as a result of revaluing our net deferred tax assets at December 31 , 2017 due to lower corporate income tax rates provided by the Tax Cuts and Jobs Act passed into law in December 2017 . The revaluation adjustment of our net deferred tax asset position was impacted by a number of factors, including increased loan charge - offs in the fourth quarter of 2017 , increases in deferred tax liabilities relating to depreciation expense on our new headquarters building, and dividends from our captive real estate investment trusts . In 2017 we also recorded expenses of $ 347 , 000 related to terminating the lease agreement on our previous headquarters building in Birmingham, Alabama and expenses of moving into our new headquarters building . We recorded expenses of $ 2 . 1 million in 2015 related to the acquisition of Metro Bancshares, Inc . and the merger of Metro Bank with and into the bank, and recorded an expense of $ 500 , 000 resulting from the initial funding of reserves for unfunded loan commitments, consistent with guidance provided in the Federal Reserve Bank’s Interagency Policy Statement SR 06 - 17 . We recorded a non - routine expense of $ 703 , 000 for the first quarter of 2014 resulting from the correction of our accounting for vested stock options previously granted to members of our advisory boards in our Dothan, Huntsville and Montgomery, Alabama markets . The table below presents computations of earnings and certain other financial measures which exclude the significant adjustments discussed above . These non - GAAP financial measures include “adjusted net income available to common stockholders,” “adjusted earnings per share, basic,” “adjusted earnings per share, diluted,” “adjusted return on average assets,” “adjusted return on average stockholders’ equity,” “adjusted return on average common stockholders’ equity” and “adjusted efficiency ratio . ” Adjusted earnings per share, basic is adjusted net income available to common stockholders divided by weighted average shares outstanding . Adjusted earnings per share, diluted is adjusted net income available to common stockholders divided by weighted average diluted shares outstanding . Adjusted return on average assets is adjusted net income divided by average total assets . Adjusted return of average stockholders’ equity is adjusted net income divided by average total stockholders’ equity . Adjusted return of average common stockholders’ equity is adjusted net income divided by average common stockholders’ equity . The adjusted efficiency ratio is adjusted non - interest expense divided by the sum of adjusted net interest income and adjusted non - interest income . Our management and board use these non - GAAP measures for reporting financial performance to internal users for management purposes and externally as part of presentations to investors . We believe these non - GAAP financial measures provide useful information to management, our board and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP ; however, we acknowledge that these non - GAAP financial measures have inherent limitations, are not audited and are not required to be uniformly applied . All amounts are in thousands, except share and per share data .

GAAP Reconciliation 35 As Of and For the Year Ended December 31, 2014 As Of and For the Year Ended December 31, 2015 As Of and For the Year Ended December 31, 2016 As Of and For the Year Ended December 31, 2017 As Of and For the Period Ended December 31, 2018 As Of and For the Period Ended December 31, 2019 As Of and For the Period Ended December 31, 2020 As Of and For the Period Ended December 31, 2021 As Of and For the Period Ended December 31, 2022 As Of and For the Period Ended December 31, 2023 As Of and For the Period Ended June 30, 2024 21,601 $ 25,465 $ 44,258 $ 37,618 $ 45,615 $ Provision for income taxes - GAAP 865 829 - 132 421 756 Adjustment for non - routine expense/credit 22,466 $ 26,294 $ 44,126 $ 38,039 $ 46,371 $ Core provision for income taxes - non - GAAP % 1.39 % 1.38 % 1.43 % 1.73 1.53 1.37 1.3 Return on average assets - GAAP 52,377 $ 63,540 $ 93,092 $ 149,180 $ 207,734 $ 206,853 $ 102,131 $ Net income - GAAP 1,612 1,767 3,274 - 1,185 2,251 7,817 1,347 Adjustment for non - routine expense/credit 53,989 $ 65,307 $ 96,366 $ 147,995 $ 209,985 $ 214,670 $ 103,478 $ Core net income - non - GAAP 3,758,184 $ 4,591,861 $ 6,495,067 $ 8,638,604 $ 13,555,221 $ 15,066,716 $ 15,827,894 $ Average assets % 1.44 % 1.42 % 1.48 % 1.71 1.55 1.42 1.31 Core return on average assets - non - GAAP % 14.43 % 15.30 % 16.37 % 19.15 19.26 15.13 13.96 Return on average common stockholders' equity - GAAP 51,946 $ 63,260 $ 93,030 $ 149,180 $ 207,672 $ 206,853 $ 102,131 $ Net income available to common stockholders - GAAP 1,612 1,767 3,274 - 1,185 2,251 7,817 1,347 Adjustment for non - routine expense/credit 53,558 $ 65,027 $ 96,304 $ 147,995 $ 209,923 $ 214,670 $ 103,478 $ Core net income available to common stockholders - non - GAAP 320,005 $ 413,445 $ 568,228 $ 779,071 $ 1,078,075 $ 1,366,708 $ 1,471,048 $ Average common stockholders' equity % 16.74 % 15.73 % 16.95 % 18.99 19.47 15.71 14.15 Core return on average common stockholders' equity - non - GAAP 1.05 $ 1.20 $ 1.72 $ 2.76 $ 3.82 $ 3.79 $ 1.87 $ Diluted earnings per share - GAAP 49,636,442 52,885,108 54,161,788 54,103,074 54,434,573 54,548,719 54,616,751 Weighted average shares outstanding, diluted - GAAP 1.08 $ 1.23 $ 1.78 $ 2.73 $ 3.86 $ 3.94 $ 1.89 $ Core diluted earnings per share - non - GAAP 7.41 $ 8.65 $ 9.93 $ 11.47 $ 13.4 $ 15.71 $ 18.41 $ 21.24 $ 23.89 $ 26.45 $ 27.71 $ Book value per share - GAAP 367,255 449,147 522,889 607,604 715,203 842,682 992,852 1,152,015 1,297,896 1,440,405 1,510,578 Total common stockholders' equity - GAAP - 15,330 14,996 14,787 14,449 14,179 13,908 13,638 13,615 13,615 13,615 Adjusted for goodwill and other identifiable intangible assets 367,255 $ 433,817 $ 507,893 $ 592,885 $ 700,754 $ 828,503 $ 978,944 $ 1,138,377 $ 1,284,281 $ 1,426,790 $ 1,496,963 $ Tangible common stockholders' equity - non - GAAP 7.41 $ 8.35 $ 9.65 $ 11.19 $ 13.13 $ 15.45 $ 18.15 $ 20.99 $ 23.64 $ 26.2 $ 27.46 $ Tangible book value per share - non - GAAP % 8.96 % 8.81 % 8.21 8.58 % 8.93 % 9.42 % 8.32 % 7.46 % 8.89 % 8.93 % 9.41 Stockholders' equity to total assets - GAAP 4,098,679 $ 5,095,509 $ 6,370,448 $ 7,082,384 $ 8,007,382 $ 8,947,653 $ 11,927,955 $ 15,448,806 $ 14,595,753 $ 16,129,668 $ 16,049,814 $ Total assets - GAAP - 15,330 14,996 - 14,719 - 14,449 - 14,179 - 13,908 - 13,638 - 13,615 - 13,615 - 13,615 Adjusted for goodwill and other identifiable intangible assets 4,098,679 $ 5,080,179 $ 6,355,452 $ 7,067,665 $ 7,992,933 $ 8,933,474 $ 11,914,047 $ 15,435,168 $ 14,582,138 $ 16,116,053 $ 16,036,199 $ Total tangible assets - non - GAAP % 8.96 % 8.54 % 7.99 8.39 % 8.77 % 9.27 % 8.22 % 7.38 % 8.81 % 8.85 % 9.33 Tangible common equity to total tangible assets - non - GAAP

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

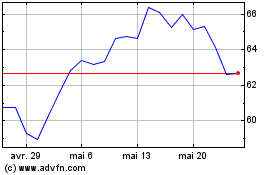

ServisFirst Bancshares (NYSE:SFBS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ServisFirst Bancshares (NYSE:SFBS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025