- Entered into a definitive agreement to be acquired by

Blackstone and Vista Equity Partners

- Third quarter total revenue grew 17% year over year to $286.9

million

- Annualized recurring revenue grew 15% year over year to $1.133

billion

- Third quarter operating cash flow of $63.5 million and free

cash flow of $61.8 million

- Ended the quarter with cash, cash equivalents, and short-term

investments of $760.9 million

Smartsheet Inc. (NYSE: SMAR), the AI enhanced enterprise grade

work management platform, today announced financial results for its

third fiscal quarter ended October 31, 2024.

Third Quarter Fiscal 2025 Financial Highlights

- Revenue: Total revenue was $286.9 million, an increase

of 17% year over year. Subscription revenue was $273.7 million, an

increase of 18% year over year. Professional services revenue was

$13.2 million, a decrease of (2)% year over year.

- Operating loss: GAAP operating loss was $(3.4) million,

or (1)% of total revenue, compared to $(35.5) million, or (14)% of

total revenue, in the third quarter of fiscal 2024.

- Non-GAAP operating income: Non-GAAP operating income was

$56.4 million, or 20% of total revenue, compared to $19.4 million,

or 8% of total revenue, in the third quarter of fiscal 2024.

- Net income (loss): GAAP net income was $1.3 million,

compared to GAAP net loss of $(32.4) million in the third quarter

of fiscal 2024. GAAP basic and diluted net income per share was

$0.01, compared to GAAP basic and diluted net loss per share of

$(0.24) in the third quarter of fiscal 2024.

- Non-GAAP net income: Non-GAAP net income was $61.0

million, compared to $22.6 million in the third quarter of fiscal

2024. Non-GAAP basic and diluted net income per share was $0.44 and

$0.43, respectively, compared to non-GAAP basic and diluted net

income per share of $0.17 and $0.16, respectively, in the third

quarter of fiscal 2024.

- Cash flow: Net operating cash flow was $63.5 million,

compared to $15.1 million in the third quarter of fiscal 2024. Free

cash flow was $61.8 million, or 22% of total revenue, compared to

$11.4 million, or 5% of total revenue, in the third quarter of

fiscal 2024.

Third Quarter Fiscal 2025 Operational Highlights

- Annualized recurring revenue ("ARR") was $1.133 billion, an

increase of 15% year over year

- Average ARR per domain-based customer was $10,708, an increase

of 16% year over year

- Dollar-based net retention rate was 111%

- Number of all customers with ARR of $100,000 or more grew to

2,137, an increase of 20% year over year

- Number of all customers with ARR of $50,000 or more grew to

4,293, an increase of 15% year over year

- Number of all customers with ARR of $5,000 or more grew to

20,430, an increase of 5% year over year

Third Quarter Fiscal 2025 Business Highlights

- Announced that Smartsheet entered into a definitive agreement

to be acquired by Blackstone and Vista Equity Partners in an

all-cash transaction valued at approximately $8.4 billion, or

$56.50 per share

- Sold out our U.S. ENGAGE customer conference for the second

consecutive year, welcoming over 4,000 attendees to Seattle to

participate in more than 60 breakout sessions

- Unveiled the most comprehensive transformation of our offerings

to date, debuting a new user experience and a range of

first-of-a-kind features to empower organizations to operate at

their peak

- Introduced a Smartsheet connector for Amazon Q Business, which

will give Amazon Q Business customers the power to ask an

intelligent assistant for information about their work in

Smartsheet, eliminating data silos and enhancing visibility

The section titled "Use of Non-GAAP Financial Measures" below

contains a description of the non-GAAP financial measures with a

reconciliation between GAAP and non-GAAP information. The section

titled "Definitions of Key Business Metrics" contains definitions

of certain non-financial metrics provided within this press

release.

Transaction with Blackstone and Vista Equity Partners

In a separate press release issued on September 24, 2024, we

announced that we have entered into a definitive agreement ("Merger

Agreement"), to be acquired by Blackstone and Vista Equity

Partners. A copy of the press release and supplemental materials

can be found on the "Investors" page of our website at

www.investors.smartsheet.com and on the Securities and Exchange

Commission, or the SEC, website at www.sec.gov. Additional details

and information about the terms and conditions of the Merger

Agreement and the transactions contemplated by the Merger Agreement

are available in the Current Report on Form 8-K filed with the SEC

on September 24, 2024.

Given the announced transaction, we will not be hosting an

earnings conference call nor providing financial guidance in

conjunction with this press release. For further detail and

discussion of our financial performance, please refer to our third

quarter 2025 Form 10-Q for the quarter ended October 31, 2024,

filed today with the SEC.

Use of Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with GAAP, we use

certain non-GAAP financial measures, as described below, to

understand and evaluate our core operating performance. These

non-GAAP financial measures, which may be different than similarly

titled measures used by other companies, are presented to enhance

investors’ overall understanding of our financial performance and

should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures. A reconciliation of the non-GAAP financial

measures to such GAAP measures can be found in the accompanying

financial statements included with this press release.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects, and

allow for greater transparency with respect to important metrics

used by our management for financial and operational

decision-making. We are presenting these non-GAAP financial metrics

to assist investors in seeing our financial performance through the

eyes of management, and because we believe that these measures

provide an additional tool for investors to use in comparing our

core financial performance over multiple periods with other

companies in our industry.

We define non-GAAP operating income as GAAP operating loss

excluding share-based compensation expense, amortization of

acquisition-related intangible assets, one-time costs associated

with mergers and acquisitions, lease restructuring costs, and

litigation expenses and settlements related to matters that are

outside the ordinary course of our business, as applicable. We

define non-GAAP net income as GAAP net income (loss) excluding

non-recurring income tax adjustments associated with mergers and

acquisitions and the same exclusions that are used to derive

non-GAAP operating income.

We define basic non-GAAP net income per share as non-GAAP net

income divided by weighted-average shares outstanding ("WASO"). We

define diluted non-GAAP net income per share as non-GAAP net income

divided by diluted WASO. Diluted WASO includes the impact of

potentially dilutive securities, which include stock options,

restricted share units, performance share units, and shares subject

to our 2018 employee stock purchase plan. There are a number of

limitations related to the use of these non-GAAP measures as

compared to GAAP operating loss and net income (loss), including

that the non-GAAP measures exclude share-based compensation

expense, which has been, and will continue to be for the

foreseeable future, a significant recurring expense in our business

and an important part of our compensation strategy.

We use the non-GAAP financial measure of free cash flow, which

is defined as GAAP net cash flows from operating activities,

reduced by cash used for purchases of property and equipment

(inclusive of spend on internal-use software) and principal

payments on finance lease obligations. We believe free cash flow is

an important liquidity measure of the cash that is available, after

capital expenditures and operational expenses, for investment in

our business, share repurchases, and potential acquisitions. Free

cash flow is useful to investors as a liquidity measure because it

measures our ability to generate excess cash beyond what is

required for our operations. Once our business needs and

obligations are met, cash can be used to maintain a strong balance

sheet and invest in future growth. There are a number of

limitations related to the use of free cash flow as compared to net

cash from operating activities, including that free cash flow

includes capital expenditures, the benefits of which are realized

in periods subsequent to those when expenditures are made.

Definitions of Key Business Metrics

Annualized recurring revenue

We define annualized recurring revenue, or ARR, as the

annualized recurring value of all active subscription contracts at

the end of a reporting period. We exclude the value of

non-recurring revenue streams, such as our professional services

revenue, that are recognized at a point in time. We use ARR as one

of our operating measures to assess the strength of the Company’s

subscription services. ARR is a performance metric and should be

viewed independently of revenue and deferred revenue, and is not

intended to be a substitute for, or combined with, any of these

items. Both multi-year contracts and contracts with terms less than

one year are annualized by dividing the total committed contract

value by the number of months in the subscription term and then

multiplying by 12. Annualizing contracts with terms less than one

year results in amounts being included in our ARR calculation that

are in excess of the total contract value for those contracts at

the end of the reporting period. The value of subscription

contracts that are sold through third-party resellers, wherein we

do not have visibility into the pricing provided, is based on the

list price.

Average ARR per domain-based customer

We use average ARR per domain-based customer to measure customer

commitment to our platform and sales force productivity. We define

average ARR per domain-based customer as total outstanding ARR for

domain-based subscriptions as of the end of the reporting period

divided by the number of domain-based customers as of the same

date. We define domain-based customers as organizations with a

unique email domain name.

Dollar-based net retention rate

We calculate dollar-based net retention rate as of a period end

by starting with the ARR from the cohort of all customers as of the

12 months prior to such period end (“Prior Period ARR”). We then

calculate the ARR from these same customers as of the current

period end (“Current Period ARR”). Current Period ARR includes any

upsells and is net of contraction or attrition over the trailing 12

months, but excludes subscription revenue from new customers in the

current period. We then divide the total Current Period ARR by the

total Prior Period ARR to arrive at the dollar-based net retention

rate. Any ARR obtained through merger and acquisition transactions

does not affect the dollar-based net retention rate until one year

from the date on which the transaction closed.

The dollar-based net retention rate is used by us to evaluate

the long-term value of our customer relationships and is driven by

our ability to retain and expand the subscription revenue generated

from our existing customers.

About Smartsheet

Smartsheet (NYSE: SMAR) is the modern enterprise work management

platform trusted by millions of people at companies across the

globe, including over 85% of the 2024 Fortune 500 companies. The

category pioneer and market leader, Smartsheet delivers powerful

solutions fueling performance and driving the next wave of

innovation. Visit www.smartsheet.com to learn more.

Disclosure of Material Information

Smartsheet announces material information to its investors using

SEC filings, press releases, public conference calls, and on its

investor relations page of the company’s website at

www.investors.smartsheet.com.

SMARTSHEET INC.

Condensed Consolidated

Statements of Operations

(in thousands, except per

share data)

(unaudited)

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Revenue

Subscription

$

273,703

$

232,470

$

786,328

$

659,993

Professional services

13,168

13,448

39,939

41,396

Total revenue

286,871

245,918

826,267

701,389

Cost of revenue

Subscription

41,445

34,258

115,216

101,009

Professional services

12,291

12,780

36,693

38,948

Total cost of revenue

53,736

47,038

151,909

139,957

Gross profit

233,135

198,880

674,358

561,432

Operating expenses

Research and development

63,477

58,257

189,514

172,805

Sales and marketing

127,854

137,920

383,315

382,685

General and administrative

45,155

38,153

124,489

109,654

Total operating expenses

236,486

234,330

697,318

665,144

Loss from operations

(3,351

)

(35,450

)

(22,960

)

(103,712

)

Interest income

8,272

6,976

24,934

18,040

Other income (expense), net

47

(790

)

(593

)

(1,381

)

Income (loss) before income tax

provision

4,968

(29,264

)

1,381

(87,053

)

Income tax provision

3,644

3,164

1,057

8,602

Net income (loss)

$

1,324

$

(32,428

)

$

324

$

(95,655

)

Net income (loss) per share, basic

$

0.01

$

(0.24

)

$

0.00

$

(0.71

)

Net income (loss) per share, diluted

$

0.01

$

(0.24

)

$

0.00

$

(0.71

)

Weighted-average shares outstanding used

to compute net income (loss) per share, basic

139,007

135,189

138,287

133,868

Weighted-average shares outstanding used

to compute net income (loss) per share, diluted

142,668

135,189

141,306

133,868

Share-based compensation expense included

in the condensed consolidated statements of operations was as

follows (in thousands, unaudited):

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

Cost of subscription revenue

$

2,983

$

3,164

$

9,055

$

9,980

Cost of professional services revenue

1,485

1,777

4,734

5,602

Research and development

17,763

17,220

54,036

52,263

Sales and marketing

14,453

17,462

45,472

55,505

General and administrative

9,151

10,024

29,827

30,099

Total share-based compensation expense

$

45,835

$

49,647

$

143,124

$

153,449

SMARTSHEET INC.

Condensed Consolidated Balance

Sheets

(in thousands, except share

data)

(unaudited)

October 31, 2024

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

454,281

$

282,094

Short-term investments

306,640

346,701

Accounts receivable, net of allowances of

$5,335 and $6,560, respectively

200,436

238,708

Prepaid expenses and other current

assets

69,840

64,366

Total current assets

1,031,197

931,869

Restricted cash

18

19

Deferred commissions

156,724

148,867

Property and equipment, net

39,139

42,362

Operating lease right-of-use assets

29,693

39,480

Intangible assets, net

20,635

27,960

Goodwill

141,477

141,477

Other long-term assets

4,408

5,445

Total assets

$

1,423,291

$

1,337,479

Liabilities and shareholders’

equity

Current liabilities:

Accounts payable

$

1,128

$

2,937

Accrued compensation and related

benefits

74,840

77,453

Other accrued liabilities

37,309

30,534

Operating lease liabilities, current

15,288

16,040

Finance lease liabilities, current

255

216

Deferred revenue

556,320

568,670

Total current liabilities

685,140

695,850

Operating lease liabilities,

non-current

23,936

33,100

Finance lease liabilities, non-current

279

455

Deferred revenue, non-current

4,095

1,785

Other long-term liabilities

696

434

Total liabilities

714,146

731,624

Shareholders’ equity:

Preferred stock, no par value; 10,000,000

shares authorized, no shares issued or outstanding as of October

31, 2024 and January 31, 2024

—

—

Class A common stock, no par value;

500,000,000 shares authorized, 139,302,943 shares issued and

outstanding as of October 31, 2024; 500,000,000 shares authorized,

136,884,011 shares issued and outstanding as of January 31,

2024

—

—

Class B common stock, no par value;

500,000,000 shares authorized, no shares issued and outstanding as

of October 31, 2024 and January 31, 2024

—

—

Additional paid-in capital

1,621,429

1,468,805

Accumulated other comprehensive income

(loss)

196

(146

)

Accumulated deficit

(912,480

)

(862,804

)

Total shareholders’ equity

709,145

605,855

Total liabilities and shareholders’

equity

$

1,423,291

$

1,337,479

SMARTSHEET INC.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Nine Months Ended October

31,

2024

2023

Cash flows from operating

activities

Net income (loss)

$

324

$

(95,655

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Share-based compensation expense

143,124

153,449

Depreciation and amortization

21,121

20,008

Net amortization of premiums (discounts)

on investments

(6,059

)

(8,746

)

Amortization of deferred commission

costs

50,328

38,439

Unrealized foreign currency (gain)

loss

(577

)

684

Non-cash operating lease costs

7,513

9,450

Impairment of long-lived assets

3,237

1,448

Other, net

5,495

3,089

Changes in operating assets and

liabilities:

Accounts receivable

33,770

16,541

Prepaid expenses and other current

assets

(5,576

)

1,060

Other long-term assets

(1,039

)

(1,401

)

Accounts payable

(1,665

)

(997

)

Other accrued liabilities

6,656

4,100

Accrued compensation and related

benefits

(5,483

)

2,021

Deferred commissions

(58,185

)

(58,705

)

Deferred revenue

(9,952

)

25,439

Other long-term liabilities

262

278

Operating lease liabilities

(10,544

)

(12,326

)

Net cash provided by operating

activities

172,750

98,176

Cash flows from investing

activities

Purchases of short-term investments

(235,421

)

(375,387

)

Maturities of short-term investments

281,965

281,900

Purchases of property and equipment

(1,437

)

(2,097

)

Proceeds from sale of property and

equipment

53

28

Capitalized internal-use software

development costs

(6,549

)

(7,850

)

Net cash provided by (used in) investing

activities

38,611

(103,406

)

Cash flows from financing

activities

Proceeds from exercise of stock

options

10,957

1,330

Taxes paid related to net share settlement

of restricted stock units

(14,896

)

(1,644

)

Proceeds from contributions to Employee

Stock Purchase Plan

14,403

15,664

Principal payments of finance leases

(141

)

—

Repurchases of Class A Common Stock and

related costs

(50,000

)

—

Net cash provided by (used in) financing

activities

(39,677

)

15,350

Effects of changes in foreign currency

exchange rates on cash, cash equivalents, and restricted cash

379

(248

)

Net increase in cash, cash equivalents,

and restricted cash

172,063

9,872

Cash, cash equivalents, and restricted

cash at beginning of period

282,442

223,757

Cash, cash equivalents, and restricted

cash at end of period

$

454,505

$

233,629

Supplemental disclosures

Cash paid for interest

$

43

$

—

Cash paid for income tax

7,655

9,471

Accrued purchases of property and

equipment, including internal-use software

1,081

1,264

Share-based compensation expense

capitalized in internal-use software development costs

2,355

3,283

Right-of-use assets obtained in exchange

for new operating lease liabilities

558

1,684

Right-of-use asset reductions related to

operating leases

2,832

4,451

Purchases of fixed assets under finance

leases

—

693

SMARTSHEET INC.

Reconciliation from GAAP to

Non-GAAP Financial Measures

(unaudited)

Reconciliation from GAAP operating loss

to non-GAAP operating income and operating margin

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

(dollars in thousands)

Loss from operations

$

(3,351

)

$

(35,450

)

$

(22,960

)

$

(103,712

)

Add:

Share-based compensation expense(1)

46,842

50,170

145,511

154,919

Amortization of acquisition-related

intangible assets(2)

2,308

2,701

7,320

8,117

Lease restructuring costs(3)

40

1,934

3,359

2,051

One-time acquisition costs

10,525

—

10,525

—

Non-GAAP operating income

$

56,364

$

19,355

$

143,755

$

61,375

Operating margin

(1

)%

(14

)%

(3

)%

(15

)%

Non-GAAP operating margin

20

%

8

%

17

%

9

%

(1)

Includes amortization related to

share-based compensation that was capitalized in internal-use

software and other assets in previous periods.

(2)

Consists entirely of amortization of

intangible assets that were recorded as part of purchase

accounting. The amortization of intangible assets related to

acquisitions will recur in future periods until such intangible

assets have been fully amortized.

(3)

Includes charges related to the

reassessment of our real estate lease portfolio.

Reconciliation from GAAP net income

(loss) to non-GAAP net income and per share data

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

(in thousands, except per

share data)

Net income (loss)

$

1,324

$

(32,428

)

$

324

$

(95,655

)

Add:

Share-based compensation expense(1)

46,842

50,170

145,511

154,919

Amortization of acquisition-related

intangible assets(2)

2,308

2,701

7,320

8,117

Lease restructuring costs(3)

40

2,142

3,359

2,258

One-time acquisition costs

10,525

—

10,525

—

Non-GAAP net income

$

61,039

$

22,585

$

167,039

$

69,639

Non-GAAP net income per share, basic

$

0.44

$

0.17

$

1.21

$

0.52

Non-GAAP net income per share, diluted

$

0.43

$

0.16

$

1.18

$

0.51

(1)

Includes amortization related to

share-based compensation that was capitalized in internal-use

software and other assets in previous periods.

(2)

Consists entirely of amortization of

intangible assets that were recorded as part of purchase

accounting. The amortization of intangible assets related to

acquisitions will recur in future periods until such intangible

assets have been fully amortized.

(3)

Includes charges related to the

reassessment of our real estate lease portfolio.

SMARTSHEET INC.

Reconciliation from GAAP to

Non-GAAP Financial Measures

(unaudited)

Non-GAAP reconciliation from basic to

diluted weighted-average shares outstanding

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

(in thousands)

Weighted-average shares outstanding;

basic

139,007

135,189

138,287

133,868

Effect of dilutive securities:

Shares subject to outstanding common stock

awards

3,661

3,232

3,019

3,653

Weighted-average common shares

outstanding; diluted

142,668

138,421

141,306

137,521

Reconciliation from net operating cash

flow to free cash flow

Three Months Ended October

31,

Nine Months Ended October

31,

2024

2023

2024

2023

(in thousands)

Net cash provided by operating

activities

$

63,528

$

15,146

$

172,750

$

98,176

Less:

Purchases of property and equipment

(414

)

(702

)

(1,437

)

(2,097

)

Capitalized internal-use software

development costs

(1,232

)

(3,035

)

(6,549

)

(7,850

)

Principal payments of finance leases

(89

)

—

(141

)

—

Free cash flow

$

61,793

$

11,409

$

164,623

$

88,229

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205301940/en/

Smartsheet Inc. Investor Relations Contact Aaron

Turner investorrelations@smartsheet.com

Media Contact Lisa Henthorn pr@smartsheet.com

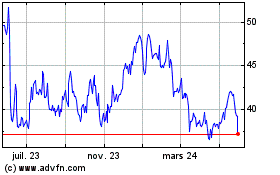

Smartsheet (NYSE:SMAR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

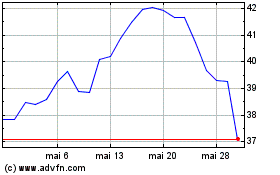

Smartsheet (NYSE:SMAR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025