FTC Seeks More Information on Pfizer-Allergan Merger

30 Mars 2016 - 7:50PM

Dow Jones News

Pfizer Inc. and Allergan PLC on Wednesday said federal

regulators are seeking more information on their pending merger

deal, a so-called inversion that would create the world's biggest

drugmaker and move one of the top names in corporate America to a

foreign country.

The request from the Federal Trade Commission was "fully

anticipated as part of the regulatory process," the companies said.

They still expect the deal to close in the second of this year.

Pfizer and Allergan agreed in November to merge in what would be

the largest inversion ever—the deal was worth more than $150

billion when struck, but the overall value has declined since as

Pfizer's share price has fallen. Such deals enable a U.S. company

to move abroad and take advantage of a lower corporate tax rate

elsewhere, and have remained popular in the face of U.S. efforts to

curb them.

To help secure that lower tax rate, the deal will be technically

structured as a reverse merger, with Dublin-based Allergan, which

is smaller, buying New York-based Pfizer.

The deal remains subject to the expiration of the waiting period

under antitrust law, regulatory approval in other jurisdictions

including the European Union, approval from both Pfizer and

Allergan shareholders, and the completion of Allergan's pending

divestiture of its generics business to Teva Pharmaceuticals

Industries Ltd.

Shares of Pfizer and Allergan were up 0.1% and 0.5%,

respectively, in afternoon trading.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

March 30, 2016 13:35 ET (17:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

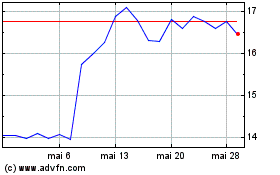

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024