Teva Revenue Rises on Allergan Deal

15 Novembre 2016 - 3:00PM

Dow Jones News

Teva Pharmaceuticals Industries Ltd. reported acquisition-driven

revenue growth in its latest quarter, but sales fell across much of

its specialty-drug business.

Shares fell 2% in premarket trading.

Teva also disclosed that it had set aside $520 million as it was

in advanced discussions with the U.S. Department of Justice and the

U.S. Securities and Exchange Commission to settle potential

violations of foreign corruption laws. The potential settlement

relates to conduct in Russia, Mexico and Ukraine from 2007 to 2013.

Teva said the conduct doesn't involve its U.S. business. Teva said

in response to the investigation that it had ended "problematic"

business relationships, withdrawn from some countries, gotten rid

of relevant employees and overhauled the management of several

subsidiaries.

Teva also cut its revenue guidance for the year but increased

its adjusted earnings-per-share expectations. It now expects annual

revenue of between $21.6 billion and $21.9 billion, down from

between $22 billion and $22.5 billion previously. It also expects

adjusted earnings per share between $5.10 and $5.20, down from

$5.20 to $5.40 previously.

During the quarter, the Israeli pharmaceutical company known for

its generic-drugs business closed its $40.5 billion deal for

Allergan's generics business.

Revenue in its generic medicine segment grew 32% to $2.9

billion, largely due to the Allergan deal. In its specialty

segment, revenue fell 6% to $2.05 billion due to lower sales of its

multiple sclerosis drug copaxone and sleepiness treatment

nuvigil.

Research-and-development costs jumped 84% to $663 million, with

the increase largely being attributed to $250 million paid to

Regeneron Pharmaceuticals Inc. related to development of pain

medication product fasinumab.

For the quarter, Teva reported a profit of $412 million, or 35

cents a share, up from $103 million, or 12 cents a share, the same

quarter last year. Excluding certain items, per-share earnings were

$1.31, down from $1.35 a share in the prior-year quarter. Revenue

grew 15% to $5.56 billion.

Analysts polled by Thomson Reuters had expected earnings of

$1.28 a share on $5.71 billion in revenue.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 15, 2016 08:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

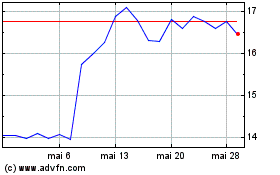

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024