Baby Boomers and Gen X Responsible for Increased Betting Activity in Q4 2024

11 Février 2025 - 2:00PM

Betting activity increased slightly in Q4 2024 to 26% of consumers,

compared to 24% in the same period of 2023. However, this uptick

was caused by significant generational changes in activity,

primarily among Baby Boomers and Millennials, according to a new

report from TransUnion (NYSE: TRU).

While Millennials have dominated all forms of betting in recent

years, this generation’s engagement dropped 5% YoY in Q4 2024.

Conversely, Baby Boomers and Gen Xers got more involved, with 7%

and 4% respective YoY increases. Gen Z bettors’ participation

remained about the same. These and many more findings are available

in TransUnion’s latest US Betting Report.

“The demographic shift in betting activity serves as a good

reminder that the best predictor of engagement is not age but

rather increased earnings and liquidity,” said Declan Raines, head

of TransUnion’s Gaming business. “Those who have a sudden influx of

disposable income are more likely to participate in betting, and

operators should keep that in mind when developing their marketing

strategies.”

In addition to Millennials, fewer high-value bettors engaged in

online and land-based betting activities. High-value bettors are

those who spend more than $500 per month on betting. This group’s

engagement dropped by 8% with land-based operators and 9% with

online operators.

Healthier finances among bettors

The report found high-value bettors also attained improved

overall finances. In Q4 2024, 54% of those betting $500 or more per

month had good or excellent credit combined with middle or high

income. This was up from 50% in the same period in 2023. In

addition, those with the riskiest financial profile—having lower

income and fair or poor credit—fell from 7% in Q4 2023 to just 4%

in Q4 2024.

Bettors proved to have a more resilient financial profile than

non-bettors. More than half of consumers who bet in either

land-based or online channels said their income had gone up a

little or a lot in the past 3 months. Only 21% of non-bettors said

the same.

Consumer Credit Scores: Bettors vs

Non-bettors

|

|

Land-based Bettors |

Online Bettors |

Non-bettors |

|

Good/Excellent |

59% |

54% |

47% |

|

Average |

22% |

24% |

19% |

|

Fair/Bad |

18% |

20% |

24% |

Excellent: 781-850 | Good: 721-780 | Average:

661-720 | Fair: 601-660 | Bad: 300-600

Consumers who bet also had stronger credit scores, with more

than half of land-based and online bettors indicating good or

excellent credit scores, compared to just 47% of non-bettors.

Conversely, one-third of non-bettors fell into credit score ranges

that indicate poorer credit quality—including those who don’t know

their score—compared to 22% of online bettors and 20% of land-based

bettors.

Mounting regulatory pressure

Regulators and consumer advocacy groups became more focused on

the betting industry in 2024. Recent studies published by

Northwestern and UCLA outlining the risks to personal finances

among a subset of players served to elevate the pressure on gaming

operators to implement reasonable procedures to identify and curb

problem gaming. In response, the industry formed the Responsible

Online Gaming Association (ROGA) to establish industry-wide

responsible gaming standards and support research and education on

safe practices.

TransUnion’s US Betting Report has consistently found bettors

experience higher levels of financial volatility—both positive and

negative—relative to non-bettors. This represents a significant

challenge for operators when engaging in responsible gaming

assessments. It is imperative that gaming operators stay vigilant

to ensure their most active players can sustain high levels of play

without compromising their financial health.

“As the industry matures, new tools have emerged to help

operators assess players’ financial resilience and promote

responsible gaming,” said Raines. “Adopting these measures will

help build on the significant investments made by the industry in

responsible gaming to date as well as demonstrate good faith

efforts to regulators and consumers while protecting profitability

for operators in the long run.”

For full details from the US Betting Report, click here.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with

over 13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the

world. http://www.transunion.com/business

|

Contact |

Dave BlumbergTransUnion |

| E-mail |

david.blumberg@transunion.com |

| Telephone |

312-972-6646 |

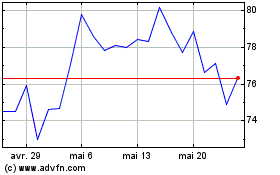

TransUnion (NYSE:TRU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

TransUnion (NYSE:TRU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025