UnitedHealth Group (NYSE: UNH) issued financial guidance ahead

of its annual Investor Conference which takes place on December 4,

beginning at 8:00 a.m. ET.

UnitedHealth Group will introduce its 2025 outlook which

includes revenues of $450 billion to $455 billion, net earnings of

$28.15 to $28.65 per share and adjusted net earnings of $29.50 to

$30.00 per share. Adjusted net earnings only excludes the after-tax

non-cash amortization expense pertaining to acquisition-related

intangible assets. Cash flows from operations are expected to range

from $32 billion to $33 billion. As announced in the third quarter

earnings release, UnitedHealth Group 2024 net earnings are expected

to be $15.50 to $15.75 per share and adjusted net earnings $27.50

to $27.75 per share.

The company will stream the Investor Conference presentation and

management question-and-answer portion of this meeting on its

Investor Relations page at www.unitedhealthgroup.com. Meeting

materials and a replay of the conference will be available on the

Investor Relations page.

About UnitedHealth Group

UnitedHealth Group (NYSE: UNH) is a health care and well-being

company with a mission to help people live healthier lives and help

make the health system work better for everyone through two

distinct and complementary businesses. Optum delivers care aided by

technology and data, empowering people, partners and providers with

the guidance and tools they need to achieve better health.

UnitedHealthcare offers a full range of health benefits, enabling

affordable coverage, simplifying the health care experience and

delivering access to high-quality care. Visit UnitedHealth Group at

www.unitedhealthgroup.com and follow UnitedHealth Group on

LinkedIn.

Non-GAAP Financial

Information

This news release presents non-GAAP financial information

provided as a complement to the results provided in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). A reconciliation of the non-GAAP financial

information to the most directly comparable GAAP financial measure

is provided in the accompanying tables found at the end of this

release.

Forward-Looking

Statements

The statements, estimates, projections, guidance or outlook

contained in this document include “forward-looking” statements

which are intended to take advantage of the “safe harbor”

provisions of the federal securities laws. The words “believe,”

“expect,” “intend,” “estimate,” “anticipate,” “forecast,”

“outlook,” “plan,” “project,” “should” and similar expressions

identify forward-looking statements. These statements may contain

information about financial prospects, economic conditions and

trends and involve risks and uncertainties. Actual results could

differ materially from those that management expects, depending on

the outcome of certain factors including: our ability to

effectively estimate, price for and manage medical costs; new or

changes in existing health care laws or regulations, or their

enforcement or application; cyberattacks, other privacy/data

security incidents, or our failure to comply with related

regulations; reductions in revenue or delays to cash flows received

under government programs; changes in Medicare, the CMS star

ratings program or the application of risk adjustment data

validation audits; the DOJ’s legal action relating to the risk

adjustment submission matter; our ability to maintain and achieve

improvement in quality scores impacting revenue; failure to

maintain effective and efficient information systems or if our

technology products do not operate as intended; risks and

uncertainties associated with our businesses providing pharmacy

care services; competitive pressures, including our ability to

maintain or increase our market share; changes in or challenges to

our public sector contract awards; failure to achieve targeted

operating cost productivity improvements; failure to develop and

maintain satisfactory relationships with health care payers,

physicians, hospitals and other service providers; the impact of

potential changes in tax laws and regulations; increases in costs

and other liabilities associated with litigation, government

investigations, audits or reviews; failure to complete, manage or

integrate strategic transactions; risk and uncertainties associated

with the continuing sale of operations in South America; risks

associated with public health crises arising from large-scale

medical emergencies, pandemics, natural disasters and other extreme

events; failure to attract, develop, retain, and manage the

succession of key employees and executives; our investment

portfolio performance; impairment of our goodwill and intangible

assets; failure to protect proprietary rights to our databases,

software and related products; downgrades in our credit ratings;

and our ability to obtain sufficient funds from our regulated

subsidiaries or from external financings to fund our obligations,

reinvest in our business, maintain our debt to total capital ratio

at targeted levels, maintain our quarterly dividend payment cycle,

or continue repurchasing shares of our common stock.

This above list is not exhaustive. We discuss these matters, and

certain risks that may affect our business operations, financial

condition and results of operations, more fully in our filings with

the SEC, including our reports on Forms 10-K, 10-Q and 8-K. By

their nature, forward-looking statements are not guarantees of

future performance or results and are subject to risks,

uncertainties and assumptions that are difficult to predict or

quantify. Actual results may vary materially from expectations

expressed or implied in the Investor Conference materials, related

presentations or any of our prior communications. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. We do not undertake to update or

revise any forward-looking statements, except as required by

law.

UNITEDHEALTH GROUP RECONCILIATION OF

NON-GAAP FINANCIAL MEASURE ADJUSTED EARNINGS PER

SHARE

Use of Non-GAAP Financial

Measure

Adjusted net earnings per share is a

non-GAAP financial measure. Non-GAAP financial measures should be

considered in addition to, but not as a substitute for, or superior

to, financial measures prepared in accordance with GAAP. Management

believes the use of adjusted net earnings per share provides

investors and management useful information about the earnings

impact of the following items:

Intangible Amortization: As

amortization fluctuates based on the size and timing of the

Company’s acquisition activity, management believes this exclusion

presents a more useful comparison of the Company's underlying

business performance and trends from period to period. While

intangible assets contribute to the Company’s revenue generation,

the intangible amortization is not directly related. Therefore, the

related revenues are included in adjusted earnings per share.

South American Impacts: Represents

the effects of various international transactions, including the

loss on sale of our Brazilian operations that was completed on

February 6, 2024, the loss on our remaining South American

operations being classified as held for sale and certain other

non-recurring matters impacting our South American operations. As

these matters are related to the Company's strategy to exit South

America, the impact is not representative of the Company's

underlying business performance and therefore management believes

the exclusion presents a more useful comparison of the Company's

underlying business performance and trends from period to

period.

Direct Response Costs -

Cyberattack: Management believes the exclusion of costs

incurred to investigate and remediate the attack, other direct and

incremental costs incurred as a result of the cyberattack and

incremental costs for accommodations to support care providers

presents a more useful comparison of the Company's and its

reportable segments' underlying business performance and trends

from period to period.

Projected Year Ended

December 31,

2024

2025

Net earnings attributable to UnitedHealth

Group common shareholders

$14,375 - $14,650

$25,850 - $26,450

Intangible amortization

~1,665

~1,625

Tax effect of intangible amortization

~(410)

~(400)

South American impacts

~8,515

—

Tax effect of South American impacts

~(175)

—

Direct response costs - cyberattack

~2,000

—

Tax effect of direct response costs -

cyberattack

~(470)

—

Adjusted net earnings attributable to

UnitedHealth Group common shareholders

$25,500 - $25,775

$27,075 - $27,675

Diluted earnings per share

$15.50 - $15.75

$28.15 - $28.65

Intangible amortization per share

~1.80

~1.75

Tax effect of intangible amortization per

share

~(0.45)

~(0.40)

South American impacts per share

~9.15

—

Tax effect of South American impacts per

share

~(0.15)

—

Direct response costs - cyberattack per

share

~2.15

—

Tax effects of direct response costs -

cyberattack per share

~(0.50)

—

Adjusted diluted earnings per share

$27.50 - $27.75

$29.50 - $30.00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203502829/en/

Investors: Zack Sopcak Zack.Sopcak@uhg.com

952-936-7215

Media: Eric Hausman Eric.Hausman@uhg.com 952-936-3963

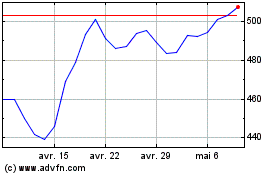

UnitedHealth (NYSE:UNH)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

UnitedHealth (NYSE:UNH)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025