Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, is pleased to provide its Q2-2024

production results.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240717934551/en/

Consolidated Quarterly Attributable

Silver Production *Based on the attributable ownership of each

operating asset (100% Cosalá Operations and 60% Galena Complex)

(Graphic: Americas Gold and Silver Corporation)

- Q2-2024 consolidated attributable silver production of 0.51

million ounces compared with approximately 0.48 million ounces in

Q1-2024. The Company also produced 8.9 million attributable pounds

of zinc and 4.4 million attributable pounds of lead during

Q2-2024.

- Galena Complex quarterly production was the highest on record

since 2013 with silver production of 560,000 ounces on a 100% basis

and attributable production of 336,000 ounces as the operation

benefitted from contributions to production from new mining areas

in the Upper Country Lead Zone between 2400 and 2800 levels and a

strong quarter from the 52-198 Silver Hanging Wall Vein.

- The Cosalá Operations focused on mining the Main Zone at the

San Rafael mine given its higher-grade zinc stopes to take

advantage of the Q2-2024 increase in zinc prices. The Cosalá

Operations produced approximately 170,000 ounces of silver, 8.9

million pounds of zinc and 2.6 million pounds of lead during the

quarter, including preproduction contribution from the 100%-owned

El Cajón and Zone 120 silver-copper project (“EC120 Project”). As

the operation transitions to higher-grade silver zones through the

rest of the year, silver production from the Cosalá Operations is

expected to increase quarter-over-quarter.

- Preliminary cash costs[1] and all-in sustaining costs

(“AISC”)[1] for Q2-2024 are estimated to be approximately $12.40

per silver ounce and $19.60 per silver ounce, respectively. These

figures compare with cash costs and all-in sustaining costs of

$20.57 per silver ounce and $30.04 per silver ounce in Q1-2024

representing decreases of ~40% and ~35% quarter-over quarter,

respectively.

- The Company has an agreement in principle with a metal trader

to provide concentrate prepayment financing for the entire initial

capital requirement at its EC120 Project. The Company expects to

close on this financing in the next few weeks with the goal of

producing higher-grade silver-copper concentrates from the EC120

Project in early 2025.

“The Galena Complex had a terrific operating quarter with silver

production at the highest level in over 10 years.” stated Americas

President and CEO Darren Blasutti. “In just one quarter, the

Company saw an average increase of ~$6 per silver ounce in its

realized silver price and an estimated $10 per silver ounce

reduction in AISC, significantly improving the Company’s operating

margin with silver prices continuing to move higher into early

Q3-2024. We are in the final stretch of signing a non-dilutive

financing with a metal trader to provide concentrate prepayment for

the capital requirements at the EC120 Project with higher-grade

silver-copper production from the Cosalá Operations expected at the

beginning of 2025, coinciding perfectly with the recent and

expected further increase in silver and copper prices.”

Consolidated Quarterly Attributable* Silver

Production

Consolidated attributable silver production in Q2-2024 was

approximately 506,000 ounces compared with approximately 484,000

ounces in Q1-2024. Quarterly silver production in Q2-2024 remained

on a steady upward trend that has been evident for the last three

years and is expected to continue with increased working faces at

the Galena Complex as well as the exploitation of EC120 Project at

the Cosalá Operations starting at the beginning of 2025 which

contains high-grade silver and copper mineralization. The Company

also produced 8.9 million attributable pounds of zinc and 4.4

million attributable pounds of lead during Q2-2024. The Company’s

stated goal is to generate more than 80% of its revenue from silver

production by the end of 2025 which would be among the silver

industry leaders in percentage revenue from silver.

Preliminary cash costs and all-in sustaining costs for Q2-2024

are estimated to be approximately $12.40 per silver ounce and

$19.60 per silver ounce, respectively. These figures compare with

cash costs and all-in sustaining costs of $20.57 per silver ounce

and $30.04 per silver ounce in Q1-2024, representing a decrease of

~40% in cash costs and ~35% in AISC, respectively,

quarter-over-quarter. Galena Complex cash costs per silver ounce

benefitted from the significant increase in silver production as

most costs at the Galena Complex are fixed. Cash costs per silver

ounce at the Cosalá Operations were reduced because of increased

by-product credits from the increased zinc production and

prices.

Production from the 60% owned Galena Complex was approximately

560,000 ounces of silver and 3.0 million pounds of lead with

attributable production of approximately 336,000 ounces of silver

and 1.8 million pounds of lead in Q2-2024. This compares favorably

with attributable production of approximately 187,000 ounces of

silver and 1.1 million pounds of lead in Q1-2024. Attributable

silver production increased by approximately 80%

quarter-over-quarter. The Galena Complex benefitted from the recent

horizontal development work in the Upper Country Lead Zone between

the 2400 and 2800 Levels which allowed the operation to access

additional working areas which is expected to continue to benefit

the operation in subsequent quarters and a strong contribution from

the 52-198 Silver Hanging Wall Vein. Development work on the 3700

Level is expected to be completed by the end of July 2024 and is

expected to contribute to silver-copper production immediately

thereafter and benefit production beginning in Q3-2024.

The Cosalá Operations produced approximately 170,000 ounces of

silver, 2.6 million pounds of lead and 8.9 million pounds of zinc

in Q2-2024 compared with 297,000 ounces of silver, 2.8 million

pounds of lead and 8.0 million pounds of zinc in Q1-2024 which

includes preproduction from the EC120 Project. With the recent

increase in zinc prices, the Company focused on mining higher grade

zinc and lower grade silver areas of the San Rafael Main and Upper

Zones to maximize its revenue mix as it continues to advance the

financing for the EC120 Project which led to lower

quarter-over-quarter silver production.

The Company has an agreement in principle with an international

metals trader to provide concentrate prepayment financing options

for the capital requirements at the EC120 Project. The Company is

completing final documentation and expects to close on this

financing in the next few weeks with the goal of completing the

required development and preparations to be producing higher-grade

silver-copper concentrates from the Cosalá Operations at the

beginning of 2025.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%-owned Galena Complex in Idaho, USA, and is

re-evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR+ or

www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Chris McCann,

P.Eng., VP Technical Services of the Company. The Company’s current

Annual Information Form and the NI 43-101 Technical Reports for its

other material mineral properties, all of which are available on

SEDAR+ at www.sedarplus.ca, and EDGAR at www.sec.gov, contain

further details regarding mineral reserve and mineral resource

estimates, classification and reporting parameters, key assumptions

and associated risks for each of the Company’s material mineral

properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ from the

requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas’

expectations, intentions, plans, assumptions and beliefs with

respect to, among other things, estimated and targeted production

rates and results for gold, silver and other metals, the expected

prices of gold, silver and other metals, as well as the related

costs, expenses and capital expenditures; production from the

Galena Complex and Cosalá Operations, including the expected number

of producing stopes and production levels; the expected timing and

completion of required development work and the expected

operational and production results therefrom, including the

anticipated improvements to production rates and cash costs per

silver ounce and all-in sustaining costs per silver ounce; and

statements relating to Americas’ EC120 Project, including expected

prepayment financing availability and timing and capital

expenditures required to develop such project and reach production

thereat. Guidance and outlook references contained in this press

release were prepared based on current mine plan assumptions with

respect to production, development, costs and capital expenditures,

the metal price assumptions disclosed herein, and assumes no

further adverse impacts to the Cosalá Operations from blockades or

work stoppages, and completion of the shaft repair and shaft rehab

work at the Galena Complex on its expected schedule and budget, the

realization of the anticipated benefits therefrom, and is subject

to the risks and uncertainties outlined below. The ability to

maintain cash flow positive production at the Cosalá Operations,

which includes the EC120 Project, through meeting production

targets and at the Galena Complex through implementing the Galena

Recapitalization Plan, including the completion of the Galena shaft

repair and shaft rehab work on its expected schedule and budget,

allowing the Company to generate sufficient operating cash flows

while facing market fluctuations in commodity prices and

inflationary pressures, are significant judgments in the

consolidated financial statements with respect to the Company’s

liquidity. Should the Company experience negative operating cash

flows in future periods, the Company may need to raise additional

funds through the issuance of equity or debt securities. Often, but

not always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume”

and “will” or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions,

or statements about future events or performance. Forward-looking

information is based on the opinions and estimates of Americas as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas, these risks and uncertainties include risks

relating to widespread epidemics or pandemic outbreak, actions that

have been and may be taken by governmental authorities to contain

such epidemic or pandemic or to treat its impact and/or the

availability, effectiveness and use of treatments and vaccines

(including the effectiveness of boosters); interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

potential litigation; fluctuating mineral and commodity prices; the

ability to obtain necessary future financing on acceptable terms or

at all; the ability to operate the Company’s projects; and risks

associated with the mining industry such as economic factors

(including future commodity prices, currency fluctuations and

energy prices), ground conditions, illegal blockades and other

factors limiting mine access or regular operations without

interruption, failure of plant, equipment, processes and

transportation services to operate as anticipated, environmental

risks, government regulation, actual results of current exploration

and production activities, possible variations in ore grade or

recovery rates, permitting timelines, capital and construction

expenditures, reclamation activities, labor relations or

disruptions, social and political developments, risks associated

with generally elevated inflation and inflationary pressures, risks

related to changing global economic conditions, and market

volatility, risks relating to geopolitical instability, political

unrest, war, and other global conflicts may result in adverse

effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas’ filings with the Canadian

Securities Administrators on SEDAR+ and with the SEC. Americas does

not undertake any obligation to update publicly or otherwise revise

any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas does not give any

assurance (1) that Americas will achieve its expectations, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

1 This metric is a non-GAAP financial measure or ratio. The

Company uses the financial measures “Cash Cost”, “Cash Cost/Ag Oz

Produced”, “All-In Sustaining Cost”, and “All-In Sustaining Cost/Ag

Oz Produced” in accordance with measures widely reported in the

silver mining industry as a benchmark for performance measurement

and because it understands that, in addition to conventional

measures prepared in accordance with IFRS, certain investors and

analysts use this information to evaluate the Company’s underlying

cash costs and total costs of operations. Cash costs are determined

on a mine-by-mine basis and include mine site operating costs such

as mining, processing, administration, production taxes and

royalties which are not based on sales or taxable income

calculations, while all-in sustaining costs is the cash costs plus

all development, capital expenditures, and exploration spending. A

full reconciliation of these non-GAAP financial measures will be

provided when the Company reports its quarterly results on or

before August 14, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717934551/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

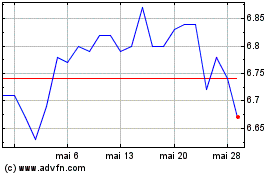

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024