Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”) announced today that it has

completed its previously announced “bought deal” private placement

(the “Private Placement”) of subscription receipts (“Subscription

Receipts”). Pursuant to the Private Placement, the Company issued

an aggregate of 125,000,000 Subscription Receipts at an issue price

of C$0.40 per Subscription Receipt, for gross proceeds of C$50

million, which included 12,500,000 Subscription Receipts issued

pursuant to the exercise, in full, of the Underwriters’ option

granted to the Underwriters in connection with the Private

Placement.

The Private Placement was co-led by Cormark Securities Inc.

(“Cormark”) and TD Securities Inc., on behalf of a syndicate of

underwriters including Desjardins Securities Inc., Haywood

Securities Inc., Canaccord Genuity Corp., and Eight Capital

(collectively, the “Underwriters”).

The Subscription Receipts were issued pursuant to a subscription

receipt agreement dated October 30, 2024, among the Company,

Cormark and Computershare Trust Company of Canada, as subscription

receipt agent. Each Subscription Receipt represents the right of

the holder thereof to receive, without payment of additional

consideration or any further action on the part of the holder, one

common share of the Company upon satisfaction of certain escrow

release conditions, including the satisfaction or waiver of all

conditions precedent to the completion of Company’s previously

announced indirect acquisition of the remaining 40% interest in the

Galena Complex in Idaho, USA (the “Acquisition”) pursuant to a

purchase agreement (the “Purchase Agreement”) between the Company,

an affiliate of Eric Sprott (“Sprott”) and Paul Andre Huet, as

seller representative.

Closing of the Acquisition is expected to occur prior to the end

of the year, subject to receipt of the relevant approvals from

Company shareholders and the TSX and NYSE American and the

satisfaction or waiver of other customary conditions to

closing.

The proceeds from the Private Placement, less a portion of the

Underwriters’ fees and expenses of the Underwriters, are being held

in escrow pending the closing of the Acquisition. Following release

of the proceeds from escrow, the Company intends to use the net

proceeds of the Private Placement for growth initiatives at the

Galena Complex, the payment of cash consideration to Sprott in

accordance with the Purchase Agreement, the repayment of certain of

the Company’s existing indebtedness, the payment of transaction

expenses and for working capital and general corporate

purposes.

The Subscription Receipts were offered by way of: (a) private

placement in each of the provinces of Canada pursuant to applicable

prospectus exemptions under applicable Canadian securities laws;

(b) in the United States or to, or for the account or benefit of

U.S. persons, by way of private placement pursuant to the

exemptions from registration provided for under Rule 506(b) of

Regulation D under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) and/or Section 4(a)(2) of the

U.S. Securities Act and similar exemptions from applicable

securities laws of any state of the United States; and (c) in

jurisdictions outside of Canada and the United States as are agreed

to by Americas and the Underwriters on a private placement or

equivalent basis.

The Subscription Receipts are subject to a four-month hold

period under applicable securities laws in Canada.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States, Canada or in any other jurisdiction where such offer,

solicitation or sale is unlawful. The securities have not been and

will not be registered under the U.S. Securities Act, or under any

securities laws of any state of the United States, and may not be

offered or sold, directly or indirectly, or delivered within the

United States or to, or for the account or benefit of, a U.S.

person or person in the United States, except in certain

transactions exempt from the registration requirements of the U.S.

Securities Act and any applicable securities laws of any state of

the United States. “United States” and “U.S. person” are as defined

in Regulation S under the U.S. Securities Act.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high‐growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%‐owned Galena Complex in Idaho, USA, and is

re‐evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR+ at www.sedarplus.ca, EDGAR

at www.sec.gov or www.americas-gold.com.

Cautionary Statement on Forward‐Looking Information:

This news release contains “forward‐looking information” and

“forward-looking statements” (“forward-looking information”) within

the meaning of applicable securities laws. Often, but not always,

forward‐looking information can be identified by forward‐looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward‐looking information

includes, but is not limited to, the intended use of proceeds from

the Private Placement and the expected timing of the closing of the

Acquisition. Forward‐looking information is based on the opinions

and estimates of Americas as of the date such information is

provided and is subject to known and unknown risks, uncertainties,

and other factors that may cause the actual results, level of

activity, performance, or achievements of Americas to be materially

different from those expressed or implied by such forward‐looking

information. With respect to the business of Americas, these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak, actions that have been and may be taken by

governmental authorities to contain such epidemic or pandemic or to

treat its impact and/or the availability, effectiveness and use of

treatments and vaccines (including the effectiveness of boosters);

interpretations or reinterpretations of geologic information;

unfavorable exploration results; inability to obtain permits

required for future exploration, development or production; general

economic conditions and conditions affecting the industries in

which the Company operates; the uncertainty of regulatory

requirements and approvals; potential litigation; fluctuating

mineral and commodity prices; the ability to obtain necessary

future financing on acceptable terms or at all; the ability to

operate the Company’s projects; risks associated with the closing

and implementation of the Acquisition; and risks associated with

the mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions, illegal blockades and other factors limiting mine

access or regular operations without interruption, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments,

risks associated with generally elevated inflation and inflationary

pressures, risks related to changing global economic conditions,

and market volatility, risks relating to geopolitical instability,

political unrest, war, and other global conflicts may result in

adverse effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward‐looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas’ filings with the Canadian

Securities Administrators on SEDAR+ and with the United States

Securities and Exchange Commission on EDGAR. Americas does not

undertake any obligation to update publicly or otherwise revise any

forward‐looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law. Americas does not give any assurance (1)

that Americas will achieve its expectations, including regarding

the closing and implementation of the Acquisition, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030610233/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416‐874‐1708 Darren Blasutti President and CEO Americas

Gold and Silver Corporation 416‐848‐9503

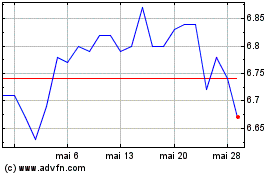

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Liberty All Star Equity (NYSE:USA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025