Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

15 Février 2024 - 2:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File No. 001-39000

Vista Energy, S.A.B. de C.V.

(Exact Name of the Registrant as Specified in the Charter)

N.A.

(Translation of

Registrant’s Name into English)

Pedregal 24, Floor 4,

Colonia Molino del Rey, Alcaldía Miguel Hidalgo

Mexico City, 11040

Mexico

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): Not applicable.

Vista reports 27% annual increase in total P1 reserves

Mexico City, February 15, 2024 – Vista Energy, S.A.B. de C.V. (“Vista” or the “Company”) (NYSE: VIST; BMV: VISTA) today reported

its estimated certified proved (“P1”) oil and gas reserves as of December 31, 2023, reflecting a 27% increase year-over-year, for a total of 318.5 million barrels of oil equivalent (MMboe). P1 reserves additions totaled 85.5

MMboe, implying a reserves replacement ratio of 458%. The proved oil and gas reserves in Vista’s flagship Bajada del Palo Oeste project were estimated at 221.8 MMboe.

“During 2023 we made solid progress in our development hub in Vaca Muerta. I am particularly pleased with the results in Bajada del Palo Este, which de-risked substantial amount of acreage and contributed significantly to our P1 reserves additions”, commented Miguel Galuccio, Vista’s Chairman and CEO, and added: “We continue to demonstrate our

ability to generate organic and profitable growth”.

P1 reserves breakdown

The table below shows the certified P1 reserves breakdown. The Company has booked 297 proved well locations, of which 105 are booked as Proved developed and

192 are booked as Proved undeveloped.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proved reserves breakdown by type (MMboe) |

|

2023 |

|

|

2022 |

|

|

p y/y (MMboe) |

|

|

p y/y (%) |

|

| Proved developed reserves |

|

|

88.7 |

|

|

|

86.2 |

|

|

|

2.5 |

|

|

|

3 |

% |

| Oil |

|

|

72.7 |

|

|

|

68.5 |

|

|

|

4.2 |

|

|

|

6 |

% |

| Natural Gas |

|

|

16.0 |

|

|

|

17.7 |

|

|

|

(1.7 |

) |

|

|

(9 |

)% |

| Proved undeveloped reserves |

|

|

229.7 |

|

|

|

165.4 |

|

|

|

64.3 |

|

|

|

39 |

% |

| Oil |

|

|

196.8 |

|

|

|

139.5 |

|

|

|

57.3 |

|

|

|

41 |

% |

| Natural Gas |

|

|

32.9 |

|

|

|

25.9 |

|

|

|

7.0 |

|

|

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total proved reserves |

|

|

318.5 |

|

|

|

251.6 |

|

|

|

66.8 |

|

|

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Considering a total production of 18.7 MMboe for 2023, the implied P1 reserves life was 17.1 years, as shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves replacement ratio |

|

Oil (MMbbl) |

|

|

Natural Gas (MMboe) |

|

|

Total (MMboe) |

|

| Proved reserves YE 2022 |

|

|

208.0 |

|

|

|

43.6 |

|

|

|

251.6 |

|

| (-) Production |

|

|

(16.0 |

) |

|

|

(2.7 |

) |

|

|

(18.7 |

) |

| (+) Additions |

|

|

77.5 |

|

|

|

8.0 |

|

|

|

85.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proved reserves YE 2023 |

|

|

269.6 |

|

|

|

48.9 |

|

|

|

318.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves replacement ratio |

|

|

485 |

% |

|

|

296 |

% |

|

|

458 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves life (years) |

|

|

16.9 |

|

|

|

18.1 |

|

|

|

17.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The table below shows the certified P1 reserves breakdown by concession:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proved net reserves by concession |

|

Oil (MMbbl) |

|

|

Natural Gas (MMboe) |

|

|

Total (MMboe) |

|

| Bajada del Palo Oeste |

|

|

188.0 |

|

|

|

33.9 |

|

|

|

221.8 |

|

| Bajada del Palo Este |

|

|

36.7 |

|

|

|

3.5 |

|

|

|

40.1 |

|

| Aguada Federal |

|

|

33.7 |

|

|

|

5.6 |

|

|

|

39.3 |

|

| CS-01 |

|

|

7.3 |

|

|

|

2.8 |

|

|

|

10.1 |

|

| Entre Lomas Rio Negro |

|

|

0.9 |

|

|

|

1.5 |

|

|

|

2.4 |

|

| Aguila Mora |

|

|

1.1 |

|

|

|

0.2 |

|

|

|

1.3 |

|

| 25 de Mayo–Medanito SE |

|

|

0.8 |

|

|

|

0.2 |

|

|

|

1.0 |

|

| Jagüel de los Machos |

|

|

0.5 |

|

|

|

0.3 |

|

|

|

0.8 |

|

| Acambuco |

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.6 |

|

| Entre Lomas Neuquén |

|

|

0.3 |

|

|

|

0.2 |

|

|

|

0.5 |

|

| Coirón Amargo Norte |

|

|

0.2 |

|

|

|

0.0 |

|

|

|

0.3 |

|

| Charco del Palenque |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.2 |

|

| Jarilla Quemada |

|

|

0.0 |

|

|

|

0.1 |

|

|

|

0.1 |

|

| Bandurria Norte |

|

|

0.0 |

|

|

|

0.0 |

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

269.6 |

|

|

|

48.9 |

|

|

|

318.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production update

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q4-23 |

|

|

Q3-23 |

|

|

Q4-22 |

|

|

Q4-22

proforma* |

|

|

p y/y

proforma* |

|

|

p y/y |

|

|

p q/q |

|

| Total (boe/d) |

|

|

56,353 |

|

|

|

49,450 |

|

|

|

54,718 |

|

|

|

48,709 |

|

|

|

16 |

% |

|

|

3 |

% |

|

|

14 |

% |

| Oil (bbl/d) |

|

|

48,469 |

|

|

|

41,490 |

|

|

|

45,745 |

|

|

|

41,019 |

|

|

|

18 |

% |

|

|

6 |

% |

|

|

17 |

% |

| Natural Gas (MMm3/d) |

|

|

1.19 |

|

|

|

1.22 |

|

|

|

1.35 |

|

|

|

1.15 |

|

|

|

3 |

% |

|

|

(12 |

)% |

|

|

(2 |

)% |

| NGL (boe/d) |

|

|

409 |

|

|

|

304 |

|

|

|

460 |

|

|

|

460 |

|

|

|

(11 |

)% |

|

|

(11 |

)% |

|

|

34 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

2022

proforma* |

|

|

p y/y

proforma* |

|

|

p y/y |

|

| Total (boe/d) |

|

|

51,149 |

|

|

|

48,560 |

|

|

|

42,435 |

|

|

|

21 |

% |

|

|

5 |

% |

| Oil (bbl/d) |

|

|

43,313 |

|

|

|

40,078 |

|

|

|

35,260 |

|

|

|

23 |

% |

|

|

8 |

% |

| Natural Gas (MMm3/d) |

|

|

1.18 |

|

|

|

1.28 |

|

|

|

1.07 |

|

|

|

10 |

% |

|

|

(8 |

)% |

| NGL (boe/d) |

|

|

418 |

|

|

|

450 |

|

|

|

450 |

|

|

|

(7 |

)% |

|

|

(7 |

)% |

| (*) |

Adjusted by the transfer of the conventional assets (see “Transfer of conventional assets” section

below) |

Average daily production during Q4 2023 was 56,353 boe/d, a 16% increase year-over-year on a proforma basis, adjusting by the

transfer of the conventional assets (see “Transfer of conventional assets” section below), and 14% quarter-over-quarter, driven by the tie-in of 11 new wells in Bajada del Palo Oeste during the

quarter. Oil production was 48,469 bbl/d during Q4 2023, an interannual increase of 18% on a pro forma basis, or 17% on a sequential basis. Natural gas production in Q4 2023 was 1.19 MMm3/d, 2% below the previous quarter, mainly driven by the fact

that the Company tied-in 7 of the 11 wells of the quarter in the Northeast section of Bajada del Palo Oeste, which has a lower

gas-to-oil ratio than other sectors of the Company’s development hub.

Total production in 2023 averaged 51,149 boe/d, a 21% year-over-year on a pro forma basis, or 5% without

such adjustment. Oil production was 43,313 bbl/d, in 2023, reflecting an interannual increase of 23% on a pro forma basis, of 8% without such adjustment.

The table below shows the Company’s production breakdown per block during Q4 2023 and Q3 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q4 2023 |

|

|

Q3 2023 |

|

| |

|

Oil

(bbl/d) |

|

|

Gas

(MMm3/d) |

|

|

NGL

(boe/d) |

|

|

Total

(boe/d) |

|

|

Oil

(bbl/d) |

|

|

Gas

(MMm3/d) |

|

|

NGL

(boe/d) |

|

|

Total

(boe/d) |

|

| Total WI production per concession |

|

|

48,469 |

|

|

|

1.19 |

|

|

|

409 |

|

|

|

56,353 |

|

|

|

41,490 |

|

|

|

1.22 |

|

|

|

304 |

|

|

|

49,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bajada del Palo Oeste (shale) |

|

|

34,872 |

|

|

|

0.76 |

|

|

|

7 |

|

|

|

39,649 |

|

|

|

24,792 |

|

|

|

0.66 |

|

|

|

88 |

|

|

|

29,000 |

|

| Aguada Federal |

|

|

3,914 |

|

|

|

0.09 |

|

|

|

4 |

|

|

|

4,507 |

|

|

|

5,119 |

|

|

|

0.10 |

|

|

|

8 |

|

|

|

5,736 |

|

| Bajada del Palo Este (shale) |

|

|

3,905 |

|

|

|

0.01 |

|

|

|

25 |

|

|

|

4,018 |

|

|

|

5,034 |

|

|

|

0.04 |

|

|

|

11 |

|

|

|

5,291 |

|

| Águila Mora |

|

|

1,411 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

1,589 |

|

|

|

2,245 |

|

|

|

0.06 |

|

|

|

— |

|

|

|

2,623 |

|

| Bajada del Palo Oeste (conv.) |

|

|

284 |

|

|

|

0.08 |

|

|

|

— |

|

|

|

763 |

|

|

|

363 |

|

|

|

0.14 |

|

|

|

— |

|

|

|

1,235 |

|

| Bajada del Palo Este (conv.) |

|

|

159 |

|

|

|

0.03 |

|

|

|

28 |

|

|

|

357 |

|

|

|

281 |

|

|

|

0.03 |

|

|

|

28 |

|

|

|

516 |

|

| Coirón Amargo Norte |

|

|

139 |

|

|

|

0.00 |

|

|

|

— |

|

|

|

162 |

|

|

|

128 |

|

|

|

0.00 |

|

|

|

— |

|

|

|

133 |

|

| CS-01 (México) |

|

|

860 |

|

|

|

0.00 |

|

|

|

— |

|

|

|

886 |

|

|

|

714 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

777 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operated production |

|

|

45,544 |

|

|

|

1.00 |

|

|

|

64 |

|

|

|

51,929 |

|

|

|

38,677 |

|

|

|

1.03 |

|

|

|

134 |

|

|

|

45,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Entre Lomas |

|

|

1,271 |

|

|

|

0.11 |

|

|

|

338 |

|

|

|

2,274 |

|

|

|

1,160 |

|

|

|

0.10 |

|

|

|

162 |

|

|

|

1,940 |

|

| Jagüel de los Machos |

|

|

776 |

|

|

|

0.04 |

|

|

|

— |

|

|

|

1,005 |

|

|

|

733 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

952 |

|

| 25 de Mayo-Medanito |

|

|

775 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

839 |

|

|

|

806 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

882 |

|

| Agua Amarga |

|

|

85 |

|

|

|

0.01 |

|

|

|

7 |

|

|

|

150 |

|

|

|

97 |

|

|

|

0.02 |

|

|

|

8 |

|

|

|

203 |

|

| Acambuco |

|

|

17 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

157 |

|

|

|

17 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operated production |

|

|

2,925 |

|

|

|

0.18 |

|

|

|

345 |

|

|

|

4,425 |

|

|

|

2,813 |

|

|

|

0.18 |

|

|

|

170 |

|

|

|

4,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bajada del Palo Oeste

The certified P1 oil and gas reserves in Bajada del Palo Oeste were 221.8 MMboe as of December 31, 2023, a 19% increase with respect to year-end 2022. The increase was mainly driven by new well activity and strong results in well productivity, as the Company tied-in 23 new wells during 2023. This led to the

addition of 40 P1 shale oil well locations in the block, resulting in a total of 206 booked P1 locations. Proved additions in the block totaled 47.8 MMboe.

Bajada del Palo Este

The certified P1 oil and gas

reserves in Bajada del Palo Este were 40.1 MMboe as of December 31, 2023, which quadrupled from 8.5 MMboe in 2022. The increase was mainly driven by new well activity and strong results in well productivity, as the Company tied-in 2 new wells during 2023, which led to the addition of 26 P1 shale oil well locations in the block, resulting in a total of 30 booked P1 locations. Proved additions in the block totaled 33.4 MMboe.

Transfer of conventional assets

Based on the terms of the Conventional Assets Transaction1, the Company has estimated that 5.9 MMboe of P1

reserves that had been booked on December 31, 2022, have been divested as part of such transaction.

P1 reserves valuation

The estimated certified future net cash flows attributable to Vista’s interests in the P1 reserves as of December 31, 2023, evaluated using the

regulations established by the United States Securities and Exchange Commission (“SEC”) and discounted at 10% per annum, were 3,336 $MM.

In

accordance with the regulations set forth by the SEC, future net cash flows were calculated by applying current prices of oil and gas reserves (with consideration of price changes only to the extent provided by contractual arrangements) to estimated

future production of proved oil and gas reserves as of the date reported, less the estimated future expenditures (based on current costs) to be incurred in developing and producing the proved reserves. Future net cash flows were then discounted

using a factor of 10% per annum.

For the Argentina assets, the proved reserves as of December 31, 2023, were calculated using a price of 66.5 $/bbl

for oil, 25.4 $/boe for LPG and 3.8 $/MMbtu for natural gas, in accordance with SEC regulations. For CS-01 block, in Mexico, the proved reserves as of December 31, 2023, were calculated using a price of

68.7 $/bbl for oil, and 2.7 $/MMbtu for natural gas, in accordance with SEC regulations.

The estimated certified future net cash flows attributable to

Vista’s interests in the P1 reserves, as of December 31, 2023, are summarized below:

|

|

|

|

|

|

|

|

|

| Future net cash flows (Cumulative $MM) |

|

Undiscounted |

|

|

Discounted at 10% p.a. |

|

| Argentina, proved developed |

|

|

2,154 |

|

|

|

1,425 |

|

| Argentina, proved undeveloped |

|

|

4,262 |

|

|

|

1,867 |

|

|

|

|

|

|

|

|

|

|

| Argentina, total proved |

|

|

6,416 |

|

|

|

3,292 |

|

|

|

|

|

|

|

|

|

|

| Mexico, proved developed |

|

|

29 |

|

|

|

21 |

|

| Mexico, proved undeveloped |

|

|

69 |

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

| Mexico, total proved |

|

|

98 |

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

| Total proved |

|

|

6,515 |

|

|

|

3,336 |

|

|

|

|

|

|

|

|

|

|

Definitions and Methodology

| |

• |

|

The information included regarding estimated quantities of proved reserves is derived from estimates of the

proved reserves as of December 31, 2023, from the reports dated February 7, 2024, prepared by DeGolyer and MacNaughton for Vista’s concessions located in Argentina and Mexico. |

| 1 |

The Company signed an agreement with Petrolera Aconcagua to transfer, as of March 1, 2023, the operations

of the following concessions (the “Concessions”): Entre Lomas Neuquén, Entre Lomas Río Negro, Jarilla Quemada, Charco del Palenque, Jagüel de los Machos and 25 de Mayo-Medanito S.E. (the “Transaction”). Under

the terms of the Transaction, Vista retains 40% of the crude oil and natural gas production, and 100% of Liquified Petroleum Gas production, from the Concessions, until the earliest of (i) February 28, 2027, or (ii) the date when

Vista Argentina has received a cumulative production of 4 million barrels of crude oil and 300 million m3 of natural gas. Aconcagua keep 60% of the crude oil and natural gas production from the Concessions. |

| |

• |

|

According to SEC regulations, proved reserves are those quantities of oil and gas which, by analysis of

geoscience and engineering data, can be estimated with “reasonable certainty” to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government

regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation.

|

| |

• |

|

Oil includes crude oil and condensate and NGL; NGLs represent less than 1% of total reserves of the Company.

|

| |

• |

|

$MM: million US Dollars |

| |

• |

|

Boe: barrels of oil equivalent |

| |

• |

|

MMm3: million cubic meters |

| |

• |

|

MMboe: million barrels of oil equivalent |

| |

• |

|

MMBtu: million British thermal units |

| |

• |

|

1 cubic meter of oil = 6.2898 barrels of oil |

| |

• |

|

1,000 cubic meters of gas = 6.2898 barrels of oil equivalent |

| |

• |

|

Note on the tables of this document. Totals in tables might not add-up to

the components of the individual lines due to rounding. |

Forward-Looking Statements

Any statements contained herein or in the attachments hereto regarding Vista that are not historical or current facts are forward-looking statements. These

forward-looking statements convey Vista’s current expectations or forecasts of future events. Forward-looking statements regarding Vista involve known and unknown risks, uncertainties and other factors that may cause Vista’s actual

results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk

Factors,” “Forward-Looking Statements” and other applicable sections of Vista’s annual report filed with the SEC on Form 20-F and other applicable filings with the SEC and Vista’s

latest annual report available on the Mexican Stock Exchange’s (Bolsa Mexicana de Valores, S.A.B. de C.V.) website: www.bmv.com.mx, the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores) website:

www.gob.mx/cnbv and our website: www.vistaenergy.com.

Enquiries:

Investor Relations:

ir@vistaenergy.com

Argentina: +54 11 3754 8500

Mexico: +52 55 8647 0128

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: February 15, 2024

|

|

|

| VISTA ENERGY, S.A.B. DE C.V. |

|

|

| By: |

|

/s/ Alejandro Cherñacov |

| Name: |

|

Alejandro Cherñacov |

| Title: |

|

Strategic Planning and Investor Relations Officer |

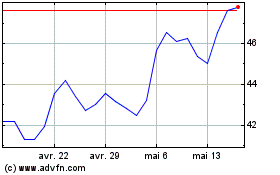

Vista Energy SAB de CV (NYSE:VIST)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Vista Energy SAB de CV (NYSE:VIST)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024