WestRock Company (NYSE:WRK), a leading provider of sustainable

paper and packaging solutions, today announced results for its

fiscal fourth quarter and year ended September 30, 2023.

Fourth Quarter Highlights and other notable items:

- Net sales of $5.0 billion

- Net income of $110 million, Adjusted Net Income of $210

million; net income included $344 million ($239 million of which

was non-cash) of restructuring and other costs, net and a $239

million gain on sale of the Company’s interior partitions

converting operations and Chattanooga, Tennessee uncoated recycled

paperboard mill

- Earned $0.43 per diluted share (“EPS”) and $0.81 of Adjusted

EPS

- Consolidated Adjusted EBITDA of $736 million; Corrugated

Packaging segment Adjusted EBITDA increased 13.0% compared to the

fourth quarter of fiscal 2022

- Results negatively impacted by $64 million due to economic

downtime and a $40 million increase in non-cash pension costs, each

compared to the fourth quarter of fiscal 2022; WestRock’s U.S.

qualified and non-qualified pension plans remain overfunded

- Announced 10% dividend increase in October 2023

- Announced proposed business combination with Smurfit Kappa

Group plc to create a global leader in sustainable packaging (the

“Transaction”)

Full Year 2023 Highlights:

- Net sales of $20.3 billion

- Net loss of $1.6 billion, Adjusted Net Income of $778 million

- Results reflected a $1.9 billion pre-tax, non-cash goodwill

impairment and $859 million ($605 million of which was non-cash) of

pre-tax restructuring and other costs, net

- Consolidated Adjusted EBITDA of $3.0 billion

- Loss per share of $6.44 and generated $3.02 of Adjusted

EPS

- Generated net cash provided by operating activities of $1.8

billion and Adjusted Free Cash Flow of $933 million

- Exceeded cost savings expectations in fiscal 2023, and exited

fiscal 2023 with greater than $450 million in run-rate savings

- Invested $1.1 billion in capital expenditures and returned $281

million in capital to stockholders in dividend payments.

- Simplified the Company’s portfolio to streamline its business

and improve performance

“The WestRock team delivered another strong quarter,

demonstrating the power and resilience of our diversified

portfolio, innovative solutions and scale,” said David B. Sewell,

chief executive officer. “I’m incredibly proud of our team’s

commitment to serving our customers, while executing on and

accelerating our transformation actions. Through our portfolio

optimization actions, cost savings initiatives and strategic growth

plans, we are positioning WestRock well to deliver shareholder

value. As we turn to fiscal 2024, we remain committed to unlocking

additional cost savings and driving profitable growth.”

Consolidated Financial Results

WestRock’s performance for the three months ended September 30,

2023 and 2022 (in millions):

Three Months Ended

Sep. 30, 2023

Sep. 30, 2022

$ Var.

% Var.

Net sales

$

4,988.2

$

5,402.5

$

(414.3)

-7.7%

Net income

$

109.8

$

344.5

$

(234.7)

-68.1%

Consolidated Adjusted EBITDA

$

736.0

$

919.7

$

(183.7)

-20.0%

The decline in net sales compared to the fourth quarter of

fiscal 2022 was driven primarily by a $417 million, or 29.2%,

decrease in Global Paper segment sales, which was partially offset

by a $138 million, or 5.8%, increase in Corrugated Packaging

segment sales. The increase in Corrugated Packaging segment sales

in the current year quarter includes the operations of the

Company’s former joint venture in Mexico that were acquired in

December 2022 (“Mexico Acquisition”).

Net income declined in the fourth quarter of fiscal 2023

compared to the prior year quarter primarily due to higher

restructuring and other costs, net, lower selling price/mix, lower

volumes excluding the Mexico Acquisition, the impact of increased

economic downtime, increased non-cash pension costs, the prior year

ransomware insurance recoveries, higher net interest expense and

business systems transformation costs. These costs were partially

offset by the gain on sale of the Company’s interior partitions

converting operations and Chattanooga, Tennessee mill (collectively

referred to as “gain on sale of RTS and Chattanooga”), increased

cost savings, net cost deflation and the contribution from the

Mexico Acquisition.

Consolidated Adjusted EBITDA decreased $184 million, or 20.0%,

compared to the fourth quarter of fiscal 2022, primarily due to

lower Global Paper segment Adjusted EBITDA that was partially

offset by higher Adjusted EBITDA in the Company’s Corrugated

Packaging segment.

Additional information about the changes in segment sales and

Adjusted EBITDA by segment is included below.

Restructuring and Other Costs,

Net

Restructuring and other costs, net during the fourth quarter of

fiscal 2023 were $344 million ($239 million of which was non-cash).

The charges were primarily costs associated with the closure of the

Tacoma, Washington containerboard mill, and the consolidation of

converting facilities, ongoing costs related to previously closed

operations, and acquisition, integration and divestiture costs,

including those associated with the proposed Transaction, the sale

of the Company’s interior partitions converting operations and

Chattanooga, Tennessee uncoated recycled paperboard mill.

Gain (Loss) on Extinguishment of

Debt

In the fourth quarter, the Company discharged $500 million

aggregate principal amount of our 3.00% senior notes due September

2024 using cash and cash equivalents and borrowings under our

commercial paper program and recorded a $10.5 million gain on

extinguishment of debt.

Gain on Sale of RTS and

Chattanooga

In the fourth quarter, the Company completed the previously

announced sale of the Company’s interior partitions converting

operations and the sale of the Chattanooga mill to its joint

venture partner and received $318 million of proceeds, including a

preliminary working capital adjustment and other customary

adjustments, and recorded a pre-tax gain on sale of $239 million,

excluding divestiture costs.

Cash Flow Activities

Net cash provided by operating activities was $584 million in

the fourth quarter of fiscal 2023 compared to $540 million in the

prior year quarter.

Total debt was $8.6 billion at September 30, 2023, and Adjusted

Net Debt was $8.0 billion. Total debt decreased $443 million

compared to the third quarter of fiscal 2023. The Company had

approximately $3.4 billion of available liquidity from long-term

committed credit facilities and cash and cash equivalents at

September 30, 2023.

During the fourth quarter of fiscal 2023, WestRock invested $324

million in capital expenditures and returned $71 million in capital

to stockholders in dividend payments.

Segment Results

We have included the financial results of the Mexico Acquisition

in the Company’s Corrugated Packaging segment.

WestRock’s segment performance for the three months ended

September 30, 2023 and 2022 was as follows (in millions):

Corrugated Packaging Segment

Three Months Ended

Sep. 30, 2023

Sep. 30, 2022

Var.

% Var.

Segment sales

$

2,524.4

$

2,386.1

$

138.3

5.8%

Adjusted EBITDA

$

433.8

$

383.9

$

49.9

13.0%

Adjusted EBITDA Margin

17.2%

16.1%

110 bps

Corrugated Packaging segment sales increased primarily due to

sales from the Mexico Acquisition that were partially offset by

lower volumes excluding the Mexico Acquisition and lower selling

price/mix. In addition, the fourth quarter of fiscal 2023 included

$35 million of segment sales for certain converting operations that

were included in the Consumer Packaging segment in the prior year

period.

Corrugated Packaging Adjusted EBITDA increased primarily due to

increased cost savings, net cost deflation and the incremental

contribution from the Mexico Acquisition, which were partially

offset by the margin impact from lower selling price/mix, lower

volumes excluding the Mexico Acquisition, the net impact of

economic downtime and prior year mill closures, the prior year

ransomware insurance recoveries and non-cash pension costs, each as

compared to the prior year period. Corrugated Packaging Adjusted

EBITDA margin was 17.2% and Adjusted EBITDA margin excluding trade

sales was 17.8%.

Consumer Packaging Segment

Three Months Ended Sep. 30, 2023 Sep. 30, 2022 Var. % Var.

Segment sales

$

1,211.1

$

1,305.7

$

(94.6)

-7.2%

Adjusted EBITDA

$

203.8

$

219.2

$

(15.4)

-7.0%

Adjusted EBITDA Margin

16.8%

16.8%

0 bps

Consumer Packaging segment sales decreased primarily due to

lower volumes. In addition, the fourth quarter of fiscal 2022

included $34 million of segment sales for certain converting

operations now included in the Corrugated Packaging segment. These

items were partially offset by higher selling price/mix and the

favorable impact of foreign currency.

Consumer Packaging Adjusted EBITDA decreased primarily due to

lower volumes, net cost inflation, the impact of increased economic

downtime and non-cash pension costs. In addition, the fourth

quarter of fiscal 2022 included $4 million of Adjusted EBITDA for

certain converting operations now included in the Corrugated

Packaging segment. These items were largely offset by the margin

impact from higher selling price/mix and increased cost savings,

each as compared to the prior year period. Consumer Packaging

Adjusted EBITDA margin was 16.8%.

Global Paper Segment

Three Months Ended

Sep. 30, 2023

Sep. 30, 2022

Var.

% Var.

Segment sales

$

1,012.4

$

1,429.2

$

(416.8)

-29.2%

Adjusted EBITDA

$

133.6

$

306.4

$

(172.8)

-56.4%

Adjusted EBITDA Margin

13.2%

21.4%

-820 bps

Global Paper segment sales decreased primarily due to lower

volumes and lower selling price/mix. Additionally, segment sales

are lower than the prior year period because sales to the

operations acquired in the Mexico Acquisition are now

eliminated.

Global Paper Adjusted EBITDA decreased primarily due to the

margin impact of lower selling price/mix, lower volumes, the impact

of increased economic downtime and prior year mill closures, the

prior year ransomware insurance recoveries and increased non-cash

pension costs, which were partially offset by increased cost

savings and net cost deflation, each as compared to the prior year

period. Global Paper Adjusted EBITDA margin was 13.2%.

Distribution Segment

Three Months Ended

Sep. 30, 2023

Sep. 30, 2022

Var.

% Var.

Segment sales

$

314.1

$

374.1

$

(60.0)

-16.0%

Adjusted EBITDA

$

10.9

$

26.0

$

(15.1)

-58.1%

Adjusted EBITDA Margin

3.5%

7.0%

-350 bps

Distribution segment sales decreased primarily due to lower

volumes. The lower volumes were primarily due to lower moving and

storage business volumes in the current quarter.

Distribution Adjusted EBITDA decreased primarily due to lower

volumes and increased cost inflation which were partially offset by

increased cost savings, each as compared to the prior year

period.

Conference Call

Due to the proposed Transaction, WestRock will not host a

conference call to discuss its financial results for the fiscal

fourth quarter and year ended September 30, 2023. A slide

presentation and other relevant financial and statistical

information along with this release, can be accessed at

ir.westrock.com.

About WestRock

WestRock (NYSE:WRK) partners with our customers to provide

differentiated, sustainable paper and packaging solutions that help

them win in the marketplace. WestRock’s team members support

customers around the world from locations spanning North America,

South America, Europe, Asia and Australia. Learn more at

www.westrock.com.

Cautionary Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on our current expectations,

beliefs, plans or forecasts and use words or phrases such as "may,"

"will," "could," "should," "would," "anticipate," "estimate,"

"expect," "project," "intend," "plan," "believe," "target,"

"prospects," "potential," “commit,” and "forecast," and other

words, terms and phrases of similar meaning or refer to future time

periods. Forward-looking statements involve estimates,

expectations, projections, goals, targets, forecasts, assumptions,

risks and uncertainties. A forward-looking statement is not a

guarantee of future performance, and actual results could differ

materially from those contained in the forward-looking

statement.

Forward-looking statements are subject to a number of

assumptions, risks and uncertainties, many of which are beyond our

control, such as developments related to pricing cycles and

volumes; economic, competitive and market conditions generally,

including macroeconomic uncertainty, customer inventory

rebalancing, the impact of inflation and increases in energy, raw

materials, shipping, labor and capital equipment costs; reduced

supply of raw materials, energy and transportation, including from

supply chain disruptions and labor shortages; intense competition;

results and impacts of acquisitions, including operational and

financial effects from the Mexico Acquisition, and divestitures;

business disruptions, including from the occurrence of severe

weather or a natural disaster or other unanticipated problems, such

as labor difficulties, equipment failure or unscheduled maintenance

and repair, or public health crises; failure to respond to changing

customer preferences and to protect our intellectual property; the

amount and timing of capital expenditures, including installation

costs, project development and implementation costs, and costs

related to resolving disputes with third parties with which we work

to manage and implement capital projects; risks related to

international sales and operations; the production of faulty or

contaminated products; the loss of certain customers; adverse

legal, reputational, operational and financial effects resulting

from information security incidents and the effectiveness of

business continuity plans during a ransomware or other cyber

incident; work stoppages and other labor relations difficulties;

inability to attract, motivate and retain qualified personnel,

including as a result of the proposed Transaction; risks associated

with sustainability and climate change, including our ability to

achieve our sustainability targets and commitments and realize

climate-related opportunities on announced timelines or at all; our

inability to successfully identify and make performance

improvements and deliver cost savings and risks associated with

completing strategic projects on anticipated timelines and

realizing anticipated financial or operational improvements on

announced timelines or at all, including with respect to our

business systems transformation; risks related to the proposed

Transaction, including our ability to complete the Transaction on

the anticipated timeline, or at all, restrictions imposed on our

business under the transaction agreement, disruptions to our

business while the proposed Transaction is pending, the impact of

management’s time and attention being focused on consummation of

the proposed Transaction, costs associated with the proposed

Transaction, and integration difficulties; risks related to our

indebtedness, including increases in interest rates; the scope,

costs, timing and impact of any restructuring of our operations and

corporate and tax structure; the scope, timing and outcome of any

litigation, claims or other proceedings or dispute resolutions and

the impact of any such litigation (including with respect to the

Brazil tax liability matter); and additional impairment charges.

Such risks and other factors that may impact forward-looking

statements are discussed in our Annual Report on Form 10-K for the

fiscal year ended September 30, 2022, including in Item 1A “Risk

Factors”, as well as in our subsequent filings with the Securities

and Exchange Commission. The information contained herein speaks as

of the date hereof, and the Company does not have or undertake any

obligation to update or revise its forward-looking statements,

whether as a result of new information, future events or otherwise,

except to the extent required by law.

WestRock Company Consolidated Statements of

Operations In millions, except per share amounts (unaudited)

Three Months Ended

Twelve Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net sales

$

4,988.2

$

5,402.5

$

20,310.0

$

21,256.5

Cost of goods sold

4,110.2

4,340.4

16,725.5

17,237.5

Gross profit

878.0

1,062.1

3,584.5

4,019.0

Selling, general and administrative expense excluding intangible

amortization

494.9

482.3

2,014.4

1,932.6

Selling, general and administrative intangible amortization expense

83.9

86.8

341.5

350.4

Multiemployer pension withdrawal expense (income)

0.1

3.5

(12.1

)

0.2

Restructuring and other costs, net

343.6

31.1

859.2

383.0

Impairment of goodwill and mineral rights

-

-

1,893.0

26.0

Operating (loss) profit

(44.5

)

458.4

(1,511.5

)

1,326.8

Interest expense, net

(104.1

)

(81.1

)

(417.9

)

(318.8

)

Gain (loss) on extinguishment of debt

10.5

(0.3

)

10.5

(8.5

)

Pension and other postretirement non-service (cost) income

(5.5

)

39.1

(21.8

)

157.4

Other expense, net

(14.9

)

(10.3

)

(6.1

)

(11.0

)

Equity in income of unconsolidated entities

11.2

15.6

3.4

72.9

Gain on sale of RTS and Chattanooga

238.8

-

238.8

-

Income (loss) before income taxes

91.5

421.4

(1,704.6

)

1,218.8

Income tax benefit (expense)

19.2

(76.5

)

60.4

(269.6

)

Consolidated net income (loss)

110.7

344.9

(1,644.2

)

949.2

Less: Net income attributable to noncontrolling interests

(0.9

)

(0.4

)

(4.8

)

(4.6

)

Net income (loss) attributable to common stockholders

$

109.8

$

344.5

$

(1,649.0

)

$

944.6

Computation of diluted earnings per share under the

two-class method (in millions, except per share data): Net

income (loss) attributable to common stockholders

$

109.8

$

344.5

$

(1,649.0

)

$

944.6

Less: Distributed and undistributed income available to

participating securities

-

-

-

(0.1

)

Distributed and undistributed income (loss) available to common

stockholders

$

109.8

$

344.5

$

(1,649.0

)

$

944.5

Diluted weighted average shares outstanding

257.9

256.4

255.9

261.5

Diluted earnings (loss) per share

$

0.43

$

1.34

$

(6.44

)

$

3.61

WestRock Company Segment Information In

millions (unaudited)

Three Months Ended

Twelve Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net sales: Corrugated Packaging

$

2,524.4

$

2,386.1

$

10,054.9

$

9,307.6

Consumer Packaging

1,211.1

1,305.7

4,941.8

4,965.2

Global Paper

1,012.4

1,429.2

4,369.9

5,930.2

Distribution

314.1

374.1

1,260.7

1,418.9

Intersegment Eliminations

(73.8

)

(92.6

)

(317.3

)

(365.4

)

Total

$

4,988.2

$

5,402.5

$

20,310.0

$

21,256.5

Adjusted EBITDA: Corrugated Packaging

$

433.8

$

383.9

$

1,600.4

$

1,386.7

Consumer Packaging

203.8

219.2

835.7

829.2

Global Paper

133.6

306.4

655.0

1,246.4

Distribution

10.9

26.0

37.0

79.7

Total

782.1

935.5

3,128.1

3,542.0

Depreciation, depletion and amortization

(384.3

)

(371.2

)

(1,535.8

)

(1,488.6

)

Multiemployer pension withdrawal (expense) income

(0.1

)

(3.5

)

12.1

(0.2

)

Restructuring and other costs, net

(343.6

)

(31.1

)

(859.2

)

(383.0

)

Impairment of goodwill and mineral rights

-

-

(1,893.0

)

(26.0

)

Non-allocated expenses

(46.1

)

(15.8

)

(149.5

)

(82.6

)

Interest expense, net

(104.1

)

(81.1

)

(417.9

)

(318.8

)

Gain (loss) on extinguishment of debt

10.5

(0.3

)

10.5

(8.5

)

Other expense, net

(14.9

)

(10.3

)

(6.1

)

(11.0

)

Gain on sale of RTS and Chattanooga

238.8

-

238.8

-

Other adjustments

(46.8

)

(0.8

)

(232.6

)

(4.5

)

Income (loss) before income taxes

$

91.5

$

421.4

$

(1,704.6

)

$

1,218.8

Depreciation, depletion and amortization: Corrugated

Packaging

$

205.7

$

179.4

$

813.3

$

683.0

Consumer Packaging

83.7

84.9

339.1

349.5

Global Paper

86.3

96.1

350.7

425.1

Distribution

7.3

9.9

28.0

27.3

Corporate

1.3

0.9

4.7

3.7

Total

$

384.3

$

371.2

$

1,535.8

$

1,488.6

Other adjustments: Corrugated Packaging

$

6.3

$

0.8

$

39.5

$

(4.8

)

Consumer Packaging

0.5

-

60.4

7.7

Global Paper

21.0

(2.2

)

52.8

(0.6

)

Distribution

0.1

-

0.2

-

Corporate

18.9

2.2

79.7

2.2

Total

$

46.8

$

0.8

$

232.6

$

4.5

WestRock Company Consolidated Statements of Cash

Flows In millions (unaudited)

Three Months Ended

Twelve Months Ended

September 30,

September 30,

2023

2022

2023

2022

Cash flows from operating activities: Consolidated net

income (loss)

$

110.7

$

344.9

$

(1,644.2

)

$

949.2

Adjustments to reconcile consolidated net income (loss) to net cash

provided by operating activities: Depreciation, depletion and

amortization

384.3

371.2

1,535.8

1,488.6

Deferred income tax benefit (expense)

(125.9

)

16.2

(475.2

)

(98.2

)

Share-based compensation expense

8.6

19.0

64.2

93.3

401(k) match and company contribution in common stock

-

-

-

2.5

Pension and other postretirement funding (more) less than cost

(income)

3.1

(33.8

)

16.5

(135.6

)

Cash surrender value increase in excess of premiums paid

(0.4

)

0.5

(38.2

)

(2.0

)

Equity in income loss of unconsolidated entities

(11.2

)

(15.6

)

(3.4

)

(72.9

)

Gain on sale of RTS and Chattanooga

(238.8

)

-

(238.8

)

-

Gain on sale of other businesses

-

-

(11.2

)

-

Impairment of goodwill and mineral rights

-

-

1,893.0

26.0

Other impairment adjustments

229.8

11.2

637.1

325.5

Loss (gain) on disposal of plant and equipment and other, net

5.4

(5.2

)

(3.2

)

(17.5

)

Other, net

(5.3

)

7.1

(34.4

)

(0.4

)

Changes in operating assets and liabilities, net of acquisitions /

divestitures: Accounts receivable

131.0

98.5

407.1

(161.5

)

Inventories

137.2

(46.5

)

107.8

(310.4

)

Other assets

(144.3

)

259.5

(263.9

)

86.6

Accounts payable

(40.6

)

(40.5

)

(280.3

)

79.5

Income taxes

(21.3

)

(112.5

)

91.0

16.9

Accrued liabilities and other

162.0

(333.7

)

68.2

(249.2

)

Net cash provided by operating activities

584.3

540.3

1,827.9

2,020.4

Investing activities: Capital expenditures

(323.8

)

(293.1

)

(1,142.1

)

(862.6

)

Cash paid for purchase of businesses, net of cash acquired

-

-

(853.5

)

(7.0

)

Proceeds from corporate owned life insurance

6.2

31.0

42.2

60.8

Proceeds from sale of RTS and Chattanooga, net

318.2

-

318.2

-

Proceeds from sale of other businesses

1.3

-

27.6

-

Proceeds from sale of unconsolidated entities

9.6

-

53.4

-

Proceeds from currency forward contracts

-

-

23.2

-

Proceeds from sale of property, plant and equipment

5.1

2.6

26.8

28.2

Proceeds from property, plant and equipment insurance settlement

-

-

-

1.7

Other, net

(1.8

)

(2.3

)

(3.0

)

2.9

Net cash provided by (used for) investing activities

14.8

(261.8

)

(1,507.2

)

(776.0

)

Financing activities: Additions to revolving credit

facilities

-

382.4

52.9

382.4

Repayments of revolving credit facilities

(32.7

)

(278.3

)

(344.2

)

(378.3

)

Additions to debt

76.2

6.9

1,836.4

888.2

Repayments of debt

(595.2

)

(210.0

)

(1,720.8

)

(1,376.5

)

Changes in commercial paper, net

134.3

(182.8

)

283.9

-

Other debt (repayment) additions, net

(42.6

)

24.4

(7.1

)

31.5

Purchases of common stock

-

-

-

(600.0

)

Cash dividends paid to stockholders

(70.5

)

(63.6

)

(281.3

)

(259.5

)

Other, net

0.8

5.5

(13.3

)

30.9

Net cash used for financing activities

(529.7

)

(315.5

)

(193.5

)

(1,281.3

)

Effect of exchange rate changes on cash and cash equivalents, and

restricted cash

(2.3

)

(8.2

)

6.0

6.2

Changes in cash and cash equivalents, and restricted cash in assets

held-for-sale

11.5

-

-

-

Increase (decrease) in cash and cash equivalents and restricted

cash

78.6

(45.2

)

133.2

(30.7

)

Cash and cash equivalents, and restricted cash at beginning of

period

314.8

305.4

260.2

290.9

Cash and cash equivalents, and restricted cash at end of period

$

393.4

$

260.2

$

393.4

$

260.2

Supplemental disclosure of cash flow information:

Cash paid during the period for: Income taxes, net of refunds

$

124.4

$

159.4

$

321.6

$

335.2

Interest, net of amounts capitalized

$

146.1

$

125.8

$

452.2

$

363.9

WestRock Company Condensed Consolidated Balance

Sheets In millions (unaudited)

September 30,

September 30,

2023

2022

Assets Current assets: Cash and

cash equivalents

$

393.4

$

260.2

Accounts receivable (net of allowances of $60.2 and $66.3)

2,591.9

2,683.9

Inventories

2,331.5

2,317.1

Other current assets (amount related to SPEs of $862.1 and $0)

1,584.8

689.8

Assets held for sale

91.5

34.4

Total current assets

6,993.1

5,985.4

Property, plant and equipment, net

11,063.2

10,081.4

Goodwill

4,248.7

5,895.2

Intangibles, net

2,576.2

2,920.6

Prepaid pension asset

618.3

440.3

Other noncurrent assets (amount related to SPEs of $382.7 and

$1,253.0)

1,944.2

3,082.6

Total Assets

$

27,443.7

$

28,405.5

Liabilities and Equity

Current liabilities: Current portion of debt

$

533.0

$

212.2

Accounts payable

2,123.9

2,252.1

Accrued compensation and benefits

524.9

627.9

Other current liabilities (amount related to SPEs of $776.7 and $0)

1,737.6

810.6

Total current liabilities

4,919.4

3,902.8

Long-term debt due after one year

8,050.9

7,575.0

Pension liabilities, net of current portion

191.2

189.4

Postretirement medical liabilities, net of current portion

99.1

105.4

Deferred income taxes

2,433.2

2,761.9

Other noncurrent liabilities (amount related to SPEs of $330.2 and

$1,117.8)

1,652.2

2,445.8

Redeemable noncontrolling interests

-

5.5

Total stockholders' equity

10,080.7

11,402.0

Noncontrolling interests

17.0

17.7

Total Equity

10,097.7

11,419.7

Total Liabilities and Equity

$

27,443.7

$

28,405.5

Definitions, Non-GAAP Financial

Measures and Reconciliations

We calculate cost savings as the year-over-year change in

certain costs incurred for manufacturing, procurement, logistics,

and selling, general and administrative, in each case excluding the

impact of economic downtime and inflation. Cost savings achieved to

date may not recur in future periods, and estimates of future

savings are subject to change.

WestRock reports its financial results in accordance with

accounting principles generally accepted in the United States

("GAAP"). However, management believes certain non-GAAP financial

measures provide additional meaningful financial information that

may be relevant when assessing our ongoing performance. Non-GAAP

financial measures should be viewed in addition to, and not as an

alternative for, WestRock’s GAAP results. The non-GAAP financial

measures we present may differ from similarly captioned measures

presented by other companies.

Business Systems

Transformation Costs

In the fourth quarter of fiscal 2022,

WestRock launched a multi-year phased business systems

transformation project. Due to the nature, scope and magnitude of

this investment, management believes these incremental

transformation costs are above the normal, recurring level of

spending for information technology to support operations. Since

these strategic investments, including incremental nonrecurring

operating costs, will cease at the end of the investment period,

are not expected to recur in the foreseeable future, and are not

considered representative of our underlying operating performance,

management believes presenting these costs as an adjustment in the

non-GAAP results provides additional information to investors about

trends in our operations and is useful for period-over-period

comparisons. This presentation also allows investors to view our

underlying operating results in the same manner as they are viewed

by management.

We discuss below details of the non-GAAP financial measures

presented by us and provide reconciliations of these non-GAAP

financial measures to the most directly comparable financial

measures calculated in accordance with GAAP.

Consolidated Adjusted EBITDA and

Adjusted EBITDA

WestRock uses the non-GAAP financial measure “Consolidated

Adjusted EBITDA”, along with other measures such as “Adjusted

EBITDA” (a measure of performance the Company uses to evaluate

segment results in accordance with Accounting Standards

Codification 280 (“ASC 280”)), to evaluate our overall performance.

Management believes that the most directly comparable GAAP measure

to “Consolidated Adjusted EBITDA” is “Net income (loss)

attributable to common stockholders”. It can also be derived by

adding together each segment’s “Adjusted EBITDA” plus

“Non-allocated expenses”. Management believes this measure provides

WestRock’s management, board of directors, investors, potential

investors, securities analysts and others with useful information

to evaluate WestRock’s performance because it excludes

restructuring and other costs, net, impairment of goodwill and

mineral rights, business systems transformation costs and other

specific items that management believes are not indicative of the

ongoing operating results of the business. WestRock’s management

and board use this information in making financial, operating and

planning decisions and when evaluating WestRock’s performance

relative to other periods.

Adjusted EBITDA, a measure of segment performance in accordance

with ASC 280, is defined as pretax earnings of a reportable segment

before depreciation, depletion and amortization, and excludes the

following items the Company does not consider part of our segment

performance: multiemployer pension withdrawal (expense) income,

restructuring and other costs, net, impairment of goodwill and

mineral rights, non-allocated expenses, interest expense, net, gain

(loss) on extinguishment of debt, other expense, net, gain on sale

of RTS and Chattanooga and other adjustments - each as outlined in

the table on page 7 ("Adjusted EBITDA"). The composition of

Adjusted EBITDA is not addressed or prescribed by GAAP.

Adjusted Segment Sales and Adjusted

EBITDA Margin, Excluding Trade Sales

WestRock uses the non-GAAP financial measures “Adjusted Segment

Sales” and “Adjusted EBITDA Margin, excluding trade sales”.

Management believes that adjusting segment sales for trade sales is

consistent with how our peers present their sales for purposes of

computing segment margins and helps WestRock’s management, board of

directors, investors, potential investors, securities analysts and

others compare companies in the same peer group. Management

believes that the most directly comparable GAAP measure to

“Adjusted Segment Sales” is “segment sales”. Additionally, the most

directly comparable GAAP measure to “Adjusted EBITDA Margin,

excluding trade sales” is “Adjusted EBITDA Margin”. “Adjusted

EBITDA Margin, excluding trade sales” is calculated by dividing

that segment’s Adjusted EBITDA by Adjusted Segment Sales. “Adjusted

EBITDA Margin” is a profitability measure in accordance with ASC

280, and it is calculated for each segment by dividing that

segment’s Adjusted EBITDA by segment sales.

Adjusted Net Income and Adjusted

Earnings Per Diluted Share

WestRock uses the non-GAAP financial measures “Adjusted Net

Income” and “Adjusted Earnings Per Diluted Share”. Management

believes these measures provide WestRock’s management, board of

directors, investors, potential investors, securities analysts and

others with useful information to evaluate WestRock’s performance

because they exclude restructuring and other costs, net, impairment

of goodwill and other assets, business systems transformation costs

and other specific items that management believes are not

indicative of the ongoing operating results of the business.

WestRock and its board of directors use this information in making

financial, operating and planning decisions and when evaluating

WestRock’s performance relative to other periods. WestRock believes

that the most directly comparable GAAP measures to Adjusted Net

Income and Adjusted Earnings Per Diluted Share are Net income

(loss) attributable to common stockholders and Earnings (loss) per

diluted share, respectively.

Adjusted Net Debt

WestRock uses the non-GAAP financial measure “Adjusted Net

Debt”. Management believes this measure provides WestRock’s board

of directors, investors, potential investors, securities analysts

and others with useful information to evaluate WestRock’s repayment

of debt relative to other periods because it includes or excludes

certain items management believes are not comparable from period to

period. Management believes “Adjusted Net Debt” provides greater

comparability across periods by adjusting for cash and cash

equivalents, as well as fair value of debt step-up included in

Total Debt that is not subject to debt repayment. WestRock believes

that the most directly comparable GAAP measure is “Total Debt”

which is the sum of the current portion of debt and long-term debt

due after one year.

This release includes reconciliations of our non-GAAP financial

measures to their respective directly comparable GAAP measures, as

identified above, for the periods indicated (in millions, except

percentages and dollars per share).

Reconciliations of Consolidated

Adjusted EBITDA

Three

Months Ended

Twelve

Months Ended

Sep, 30, 2023

Sep, 30, 2022

Sep, 30, 2023

Sep, 30, 2022

Net income (loss) attributable to common stockholders

$

109.8

$

344.5

$

(1,649.0

)

$

944.6

Adjustments: (1) Less: Net Income

attributable to noncontrolling interests

0.9

0.4

4.8

4.6

Income tax (benefit) expense

(19.2

)

76.5

(60.4

)

269.6

Other expense, net

14.9

10.3

6.1

11.0

(Gain) loss on extinguishment of debt

(10.5

)

0.3

(10.5

)

8.5

Interest expense, net

104.1

81.1

417.9

318.8

Restructuring and other costs, net

343.6

31.1

859.2

383.0

Impairment of goodwill and mineral rights

-

-

1,893.0

26.0

Multiemployer pension withdrawal expense (income)

0.1

3.5

(12.1

)

0.2

Gain on sale of RTS and Chattanooga

(238.8

)

-

(238.8

)

-

Depreciation, depletion and amortization

384.3

371.2

1,535.8

1,488.6

Other adjustments

46.8

0.8

232.6

4.5

Consolidated Adjusted EBITDA

$

736.0

$

919.7

$

2,978.6

$

3,459.4

(1)

Schedule adds back expense or

subtracts income for certain financial statement and segment

footnote items to compute Consolidated Adjusted EBITDA.

Reconciliations of Adjusted Net

Income

Three

Months Ended September 30, 2023

Pre-Tax

Tax

Net of Tax

As reported (1)

$

91.5

$

19.2

$

110.7

Restructuring and other costs, net

343.6

(84.3

)

259.3

Losses at closed facilities (2)

30.6

(7.5

)

23.1

Business systems transformation costs (2)

18.8

(4.6

)

14.2

Adjustment to gain on sale of two uncoated recycled paperboard

mills

-

2.8

2.8

Work stoppages (2)

2.6

(0.6

)

2.0

Accelerated depreciation on certain closed facilities

0.4

(0.1

)

0.3

Multiemployer pension withdrawal expense

0.1

(0.1

)

-

Gain on sale of RTS and Chattanooga

(238.8

)

53.7

(185.1

)

Tax adjustment to goodwill impairment

-

(8.0

)

(8.0

)

Gain on extinguishment of debt

(10.5

)

2.6

(7.9

)

Gain on sale of unconsolidated entities, net (2)

(4.4

)

3.8

(0.6

)

Adjusted Results

$

233.9

$

(23.1

)

$

210.8

Noncontrolling interests

(0.9

)

Adjusted Net Income

$

209.9

(1)

The as reported results for

Pre-Tax, Tax and Net of Tax are equivalent to the line items

"Income (loss) before income taxes", "Income tax benefit (expense)"

and "Consolidated net income (loss)", respectively, as reported on

the Consolidated Statements of Operations.

(2)

These footnoted items are the

“Other adjustments” reported in the Segment Information table on

page 7. The “Losses at closed facilities” line includes $0.8

million of depreciation and amortization.

Three

Months Ended September 30, 2022

Pre-Tax

Tax

Net of Tax

As reported (1)

$

421.4

$

(76.5

)

$

344.9

Restructuring and other costs, net

31.1

(7.0

)

24.1

Business systems transformation costs (2)

7.4

(1.8

)

5.6

Multiemployer pension withdrawal expense

3.5

(0.8

)

2.7

Loss on extinguishment of debt

0.3

(0.1

)

0.2

MEPP liability adjustment due to interest rates

(8.9

)

2.2

(6.7

)

Ransomware recovery costs insurance proceeds (2)

(6.6

)

1.6

(5.0

)

Gains at closed facilities (2)

(0.6

)

0.1

(0.5

)

Other (2)

1.4

(0.3

)

1.1

Adjusted Results

$

449.0

$

(82.6

)

$

366.4

Noncontrolling interests

(0.4

)

Adjusted Net Income

$

366.0

(1)

The as reported results for

Pre-Tax, Tax and Net of Tax are equivalent to the line items

"Income (loss) before income taxes", "Income tax benefit (expense)"

and "Consolidated net income (loss)", respectively, as reported on

the Consolidated Statements of Operations.

(2)

These footnoted items are the

“Other adjustments” reported in the Segment Information table on

page 7. The “Losses at closed facilities” line includes $0.8

million of depreciation and amortization.

Twelve

Months Ended September 30, 2023

Pre-Tax

Tax

Net of Tax

As reported (1)

$

(1,704.6

)

$

60.4

$

(1,644.2

)

Goodwill impairment

1,893.0

(71.2

)

1,821.8

Restructuring and other costs, net

859.1

(210.6

)

648.5

Work stoppage costs (2)

80.4

(19.7

)

60.7

Business systems transformation costs (2)

79.1

(19.4

)

59.7

Losses at closed facilities (2)

42.6

(10.4

)

32.2

Loss on consolidation of previously held equity method investment

net of deferred taxes (2)

46.8

(22.2

)

24.6

Acquisition accounting inventory related adjustments (2)

13.1

(3.2

)

9.9

Accelerated depreciation on certain closed facilities

0.4

(0.1

)

0.3

Gain on sale of RTS and Chattanooga

(238.8

)

53.7

(185.1

)

Gain on sale of unconsolidated entities (2)

(23.6

)

5.8

(17.8

)

Multiemployer pension withdrawal income

(12.1

)

2.9

(9.2

)

Gain on extinguishment of debt

(10.5

)

2.6

(7.9

)

Brazil indirect tax claim (2)

(9.1

)

3.1

(6.0

)

Gain on sale of two uncoated recycled paperboard mills

(11.2

)

5.6

(5.6

)

Other (2)

0.6

(0.1

)

0.5

Adjusted Results

$

1,005.2

$

(222.8

)

$

782.4

Noncontrolling interests

(4.8

)

Adjusted Net Income

$

777.6

(1)

The as reported results for

Pre-Tax, Tax and Net of Tax are equivalent to the line items

"Income (loss) before income taxes", "Income tax benefit (expense)"

and "Consolidated net income (loss)", respectively, as reported on

the Consolidated Statements of Operations.

(2)

This footnoted item is the “Other

adjustments” reported in the Segment Information table on page 7.

The “Losses at closed facilities” line includes $2.0 million of

depreciation and amortization, and the Brazil indirect tax claim

includes $4.7 million of interest income.

Twelve

Months Ended September 30, 2022

Pre-Tax

Tax

Net of Tax

As reported (1)

$

1,218.8

$

(269.6

)

$

949.2

Restructuring and other costs, net

383.0

(93.1

)

289.9

Mineral rights impairment

26.0

(6.4

)

19.6

Loss on extinguishment of debt

8.5

(2.1

)

6.4

Accelerated depreciation on certain facility closures

7.5

(1.9

)

5.6

Business systems transformation costs (1)

7.4

(1.8

)

5.6

Multiemployer pension withdrawal expense

3.5

(0.8

)

2.7

Losses at closed facilities (1)

3.5

(0.9

)

2.6

MEPP liability adjustment due to interest rates

(36.2

)

8.9

(27.3

)

Ransomware recovery costs insurance proceeds (1)

(6.6

)

1.6

(5.0

)

Other (1)

0.5

(0.1

)

0.4

Adjusted Results

$

1,615.9

$

(366.2

)

$

1,249.7

Noncontrolling interests

(4.6

)

Adjusted Net Income

$

1,245.1

(1)

The as reported results for

Pre-Tax, Tax and Net of Tax are equivalent to the line items

"Income (loss) before income taxes", "Income tax benefit (expense)"

and "Consolidated net income (loss)", respectively, as reported on

the Consolidated Statements of Operations.

(2)

These footnoted items represent

the “Other adjustments” reported in the Segment Information table

on page 7, except the “Other” line includes adjustments of $1.4

million. The “Losses at closed facilities” line includes $1.2

million of depreciation and amortization.

Reconciliations of Adjusted Earnings

Per Diluted Share

Three Months Ended

Twelve Months Ended

Sep. 30, 2023

Sep. 30, 2022

Sep. 30, 2023

Sep. 30, 2022

Earnings (loss) per diluted share

$

0.43

$

1.34

$

(6.44

)

$

3.61

Goodwill impairment including (tax adjustment)

(0.03

)

-

7.12

-

Restructuring and other costs, net

1.00

0.10

2.53

1.11

Work stoppage costs

0.01

-

0.24

-

Business systems transformation costs

0.05

0.02

0.23

0.02

Losses at closed facilities

0.09

-

0.13

0.01

Loss on consolidation of previously held equity

method investment net of deferred taxes

-

-

0.09

-

Acquisition accounting inventory related

adjustments

-

-

0.04

-

Mineral rights impairment

-

-

-

0.08

Accelerated depreciation on certain closed

facilities

-

-

-

0.02

Gain on sale of RTS and Chattanooga

(0.72

)

-

(0.72

)

-

Gain on sale of unconsolidated entities, net

-

-

(0.07

)

-

Multiemployer pension withdrawal expense

(income)

-

0.01

(0.04

)

0.01

(Gain) loss on extinguishment of debt

(0.03

)

-

(0.03

)

0.02

Adjustment to (gain) on sale of two uncoated

recycled paperboard mills

0.01

-

(0.02

)

-

Brazil indirect tax claim

-

-

(0.02

)

-

MEPP liability adjustment due to interest rates

-

(0.02

)

-

(0.10

)

Ransomware recovery costs, net of insurance

proceeds

-

(0.02

)

-

(0.02

)

Adjustment to reflect adjusted earnings on a

fully diluted basis

-

-

(0.02

)

-

Adjusted Earnings Per Diluted Share

$

0.81

$

1.43

$

3.02

$

4.76

Reconciliations of Adjusted Segment Sales and Adjusted

EBITDA Margin, Excluding Trade Sales

Corrugated Packaging Segment

Three

Months Ended

Sep. 30, 2023

Sep. 30, 2022

Segment sales

$

2,524.4

$

2,386.1

Less: Trade Sales

(89.2

)

(85.4

)

Adjusted Segment Sales

$

2,435.2

$

2,300.7

Adjusted EBITDA

$

433.8

$

383.9

Adjusted EBITDA Margin

17.2

%

16.1

%

Adjusted EBITDA Margin, excluding Trade Sales

17.8

%

16.7

%

Reconciliation of Total Debt to

Adjusted Net Debt

Sep. 30,

2023

Jun. 30,

2023

Current portion of debt

$

533.0

$

419.4

Long-term debt due after one year

8,050.9

8,607.6

Total debt

8,583.9

9,027.0

Less: Cash and cash equivalents

(393.4

)

(314.8

)

Less: Fair value of debt step-up

(157.0

)

(161.6

)

Adjusted Net Debt

$

8,033.5

$

8,550.6

Adjusted Operating Cash Flow and

Adjusted Free Cash Flow

WestRock uses the non-GAAP financial measures “Adjusted

Operating Cash Flow” and “Adjusted Free Cash Flow”. Management

believes these measures provide WestRock’s management, board of

directors, investors, potential investors, securities analysts and

others with useful information to evaluate WestRock’s performance

relative to other periods because they exclude certain cash

restructuring and other costs, net of tax, business systems

transformation costs, net of tax and work stoppage costs, net of

tax that management believes are not indicative of the ongoing

operating results of the business. Management believes “Adjusted

Free Cash Flow” provides greater comparability across periods by

excluding capital expenditures. WestRock believes that the most

directly comparable GAAP measure is “Net cash provided by operating

activities”. Set forth below is a reconciliation of “Adjusted

Operating Cash Flow” and “Adjusted Free Cash Flow” to Net cash

provided by operating activities for the periods indicated (in

millions):

Twelve

Months Ended

Sep. 30, 2023

Sep. 30, 2022

Net cash provided by operating activities

$

1,827.9

$

2,020.4

Plus: Cash Restructuring and other costs, net of income tax benefit

of $30.9 and $9.6

95.2

29.5

Plus: Cash Business systems transformation costs, net of income tax

benefit of $29.7 and $1.7

91.7

5.3

Plus: Work stoppage costs, net of income tax benefit of $19.7 and

$0

60.7

-

Adjusted Operating Cash Flow

2,075.5

2,055.2

Less: Capital expenditures

(1,142.1

)

(862.6

)

Adjusted Free Cash Flow

$

933.4

$

1,192.6

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108100673/en/

Investors: Robert Quartaro, 470-328-6979 Vice President,

Investor Relations robert.quartaro@westrock.com

Media: Robby Johnson, 470-328-6397 Manager, Corporate

Communications s-crp-mediainquiries@westrock.com

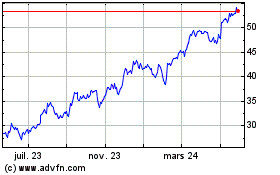

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

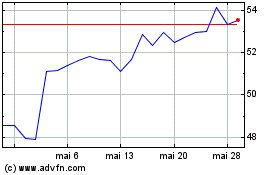

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025