Filed by Smurfit WestRock Limited (Commission File No.

333-278185)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: WestRock Company (Commission File No. 001-38736) |

Smurfit Kappa Group plc

(“Smurfit Kappa”)

Results of the Irish High Court Convened Scheme

Meeting and the Extraordinary General Meeting

All resolutions proposed at the Irish

High Court Convened Scheme Meeting (the “Scheme Meeting”) and the Extraordinary General Meeting (the “EGM”)

of Smurfit Kappa held today, 13 June 2024, were duly passed by way of a poll.

The full text of each resolution was

set out in the Notice of Scheme Meeting and the Notice of EGM, which were contained in the circular made available to the shareholders

of Smurfit Kappa on 14 May 2024 (the “Circular”). The Circular is available on Smurfit Kappa’s website at: www.smurfitkappa.com/investors/meetings2024.

Scheme Meeting

| Resolution |

FOR |

% |

AGAINST |

% |

TOTAL

VOTES |

|

VOTES

WITHHELD* |

| Approval of the Scheme |

197,218,442 |

98.96% |

2,079,164 |

1.04% |

199,297,606 |

|

65,546 |

Extraordinary General M

eeting

| Resolution |

FOR |

% |

AGAINST |

% |

TOTAL

VOTES |

|

VOTES

WITHHELD* |

|

Resolution 1

Approval of the Combination |

190,768,891 |

98.92% |

2,082,071 |

1.08% |

192,850,962 |

|

163,990 |

|

Resolution 2

Approval of the Scheme |

191,366,559 |

99.23% |

1,484,417 |

0.77% |

192,850,976 |

|

163,976 |

|

Resolution 3

Approval of the LSE Listing Change |

192,600,763 |

99.82% |

345,665 |

0.18% |

192,946,428 |

|

68,524 |

|

Resolution 4

Approval of Amendment to Smurfit Kappa Articles

of Association |

191,462,108 |

99.23% |

1,484,410 |

0.77% |

192,946,518 |

|

68,434 |

|

Resolution 5

Approval of the Share Capital Reduction of

Smurfit WestRock |

191,462,012 |

99.23% |

1,484,410 |

0.77% |

192,946,422 |

|

68,530 |

* As a "Vote Withheld" is not

a vote in law, it is not taken account in the calculation of the proportion of votes for or against the resolution or in the Total Votes

shown.

Additional Information about the Combination and Where to Find It

In connection with the proposed combination of Smurfit Kappa and WestRock

(the “Combination”), Smurfit WestRock has filed with the US Securities and Exchange Commission (the “US SEC”)

a registration statement on Form S-4 (Reg. No. 333-278185) (as amended and as may be further amended or supplemented from time to time,

the “US Registration Statement”), which was declared effective by the US SEC on 26 April 2024, that includes a prospectus

(the “US Prospectus”) relating to the offer and sale of the Smurfit WestRock Shares to WestRock stockholders (the “WestRock

Shareholders”) in connection with the Combination. In addition, on 26 April 2024, WestRock filed a separate definitive proxy

statement with the US SEC with respect to the special meeting of WestRock Shareholders in connection with the Combination (as it may be

amended or supplemented from time to time, the “US Proxy Statement”). WestRock commenced mailing of the US Proxy Statement

to WestRock Shareholders on or about 1 May 2024. This announcement is not a substitute for any registration statement, prospectus, proxy

statement or other document that Smurfit Kappa, WestRock and/or Smurfit WestRock have filed or may file with the US SEC or the FCA in

connection with the Combination.

Before making any voting or investment decisions, investors, stockholders

and shareholders of WestRock are urged to read carefully and in their entirety, the US Registration Statement, the US Prospectus, the

US Proxy Statement, and any other relevant documents that are filed or will be filed with the US SEC, as well as any amendments or supplements

to these documents, in connection with the Combination when they become available, because they contain or will contain important information

about the Combination, the parties to the Combination, the risks associated with the Combination and related matters, including information

about certain of the parties’ respective directors, executive officers and other employees who may be deemed to be participants

in the solicitation of proxies in connection with the Combination and about their interests in the solicitation.

The US Registration Statement, the US Prospectus, the US Proxy Statement

and other documents filed by Smurfit WestRock, Smurfit Kappa and WestRock with the US SEC are available free of charge at the US SEC’s

website at www.sec.gov. In addition, investors and shareholders or stockholders are able to obtain free copies of the US Registration

Statement, the US Proxy Statement and other documents filed with the US SEC by WestRock online at ir.westrock.com/ir-home/, upon written

request delivered to 1000 Abernathy Road, Atlanta, Georgia 30328, United States, or by calling +1 (770) 448-2193, and are able to obtain

free copies of the US Registration Statement, the US Prospectus, the US Proxy Statement and other documents filed with the US SEC by Smurfit

WestRock or Smurfit Kappa online at www.smurfitkappa.com/investors, upon written request delivered to Beech Hill, Clonskeagh, Dublin 4,

D04 N2R2, Ireland or by calling +353 1 202 7000. The information included on, or accessible through, Smurfit WestRock’s, Smurfit

Kappa’s or WestRock’s websites is not incorporated by reference into this announcement.

Important Information regarding Financial Advisers

Citigroup Global Markets Limited (“Citi”),

which is authorised by the Prudential Regulation Authority (the “PRA”) and regulated by the FCA and the PRA in

the United Kingdom, is acting as lead financial adviser and sponsor to Smurfit Kappa and as listing advisor to Smurfit WestRock and

no one else in connection with the Combination. PJT Partners (UK) Limited (“PJT Partners”), which is authorised

and regulated by the FCA in the United Kingdom, is acting as financial adviser to Smurfit Kappa and Smurfit WestRock and no one else

in connection with the contents of this announcement and the Combination. In connection with such matters, Citi and PJT Partners,

their affiliates and their respective directors, officers, employees and agents will not regard any other person as a client in

relation to the matters set out in this announcement, nor will they be responsible to anyone other than Smurfit Kappa and Smurfit

WestRock for providing the protections afforded to their clients or for providing advice in relation to the Combination, the

contents of this announcement or any transaction arrangement or other matter referred to herein.

Forward-Looking Statements

This announcement and other statements made or to be made by

Smurfit WestRock, Smurfit Kappa and WestRock relating to the Combination, include certain “forward-looking statements”

(including within the meaning of US federal securities laws) regarding the Combination and the listing of Smurfit WestRock, the

rationale and expected benefits of the Combination (including, but not limited to, synergies), and any other statements regarding

Smurfit WestRock’s, Smurfit Kappa’s and WestRock’s future expectations, beliefs, plans, objectives, results of

operations, financial condition and cash flows, or future events or performance. Statements that are not historical facts, including

statements about the beliefs and expectations of the management of each of Smurfit WestRock, Smurfit Kappa and WestRock, are

forward-looking statements. Words such as “may”, “will”, “could”, “should”,

“would”, “anticipate”, “intend”, “estimate”, “project”,

“plan”, “believe”, “expect”, “target”, “prospects”,

“potential”, “commit”, “forecasts”, “aims”, “considered”,

“likely”, “estimate” and variations of these words and similar future or conditional expressions are

intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While Smurfit

WestRock, Smurfit Kappa and WestRock believe these expectations, assumptions, estimates and projections are reasonable, such

forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the

control of Smurfit WestRock, Smurfit Kappa and WestRock. By their nature, forward-looking statements involve risk and uncertainty

because they relate to events and depend upon future circumstances that may or may not occur. Actual results may differ materially

from the current expectations of Smurfit WestRock, Smurfit Kappa and WestRock depending upon a number of factors affecting their

businesses and risks associated with the successful execution of the Combination and the integration and performance of their

businesses following the Combination. Important factors that could cause actual results to differ materially from such plans,

estimates or expectations include: developments related to pricing cycles and volumes; economic, competitive and market conditions

generally, including macroeconomic uncertainty, customer inventory rebalancing, the impact of inflation and increases in energy, raw

materials, shipping, labour and capital equipment costs; reduced supply of raw materials, energy and transportation, including from

supply chain disruptions and labour shortages; intense competition; risks related to international sales and operations; failure to

respond to changing customer preferences and to protect intellectual property; results and impacts of acquisitions by Smurfit Kappa,

WestRock or, following Completion, Smurfit WestRock; the amount and timing of Smurfit Kappa’s, WestRock’s and, following

Completion, Smurfit WestRock’s capital expenditures; evolving legal, regulatory and tax regimes; changes in economic,

financial, political and regulatory conditions in Ireland, the United Kingdom, the United States and elsewhere, and other factors

that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics (such as the COVID-19

pandemic), geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade and policy changes

associated with the current or subsequent Irish, US or UK administrations; the ability of Smurfit Kappa, WestRock or, following

Completion, Smurfit WestRock, to successfully recover from a disaster or other business continuity problem due to a hurricane,

flood, earthquake, terrorist attack, war, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other

natural or man-made event, including the ability to function remotely during long-term disruptions such as the COVID-19 pandemic;

the impact of public health crises, such as pandemics (including the COVID-19 pandemic) and epidemics and any related company or

governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain

the functioning of national or global economies and markets; the potential impairment of assets and goodwill; the scope, costs,

timing and impact of any restructuring of operations and corporate and tax structure; actions by third parties, including government

agencies; a condition to the closing of the Combination may not be satisfied; the occurrence of any event that can give rise to the

termination of the Combination; a regulatory approval that may be required for the Combination is delayed, is not obtained in a

timely manner or at all or is obtained subject to conditions that are not anticipated; Smurfit WestRock may be unable to achieve the

synergies and value creation contemplated by the Combination; Smurfit WestRock’s availability of sufficient cash to distribute

to Smurfit WestRock shareholders in line with current expectations; Smurfit WestRock may be unable to promptly and effectively

integrate Smurfit Kappa’s and WestRock’s businesses; failure to successfully implement strategic transformation

initiatives; each of Smurfit Kappa’s, WestRock’s and, following Completion, Smurfit WestRock’s management’s

time and attention is diverted on issues related to the Combination; disruption from the Combination makes it more difficult to

maintain business, contractual and operational relationships; significant levels of indebtedness; credit ratings may decline

following the Combination; legal proceedings may be instituted against Smurfit WestRock, Smurfit Kappa or WestRock; Smurfit Kappa,

WestRock and, following Completion, Smurfit WestRock, may be unable to retain or hire key personnel; the consummation of the

Combination may have a negative effect on Smurfit Kappa’s or WestRock’s share prices, or on their operating results; the

risk that disruptions from the Combination will harm Smurfit Kappa’s or WestRock’s business, including current plans and

operations; certain restrictions during the pendency of the Combination that may impact Smurfit Kappa’s or WestRock’s

ability to pursue certain business opportunities or strategic transactions; Smurfit WestRock’s ability to meet expectations

regarding the accounting and tax treatments of the Combination, including the risk that the Internal Revenue Service may assert that

Smurfit WestRock should be treated as a US corporation or be subject to certain unfavourable US federal income tax rules under

Section 7874 of the Internal Revenue Code of 1986, as amended, as a result of the Combination; and other factors such as future

market conditions, currency fluctuations, the behaviour of other market participants, the actions of regulators and other factors

such as changes in the political, social and regulatory framework in which the Combined Group will operate or in economic or

technological trends or conditions.

None of Smurfit WestRock, Smurfit Kappa, WestRock or any of their

respective associates or directors, officers or advisers provides any representation, assurance or guarantee that the occurrence of

the events expressed or implied in any such forward-looking statements will actually occur. You are cautioned not to place undue

reliance on these forward-looking statements. Other than in accordance with its legal or regulatory obligations (including under the

UK Prospectus Regulation, the UK Listing Rules, the Disclosure Guidance and Transparency Rules, the Prospectus Regulation Rules, the

UK Market Abuse Regulation and other applicable regulations), Smurfit Kappa is under no obligation, and Smurfit Kappa expressly

disclaims any intention or obligation, to update or revise publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

No Offer of Securities

This announcement does not constitute or form part of any offer or

invitation to purchase, acquire, subscribe for, sell, dispose of or issue, or any solicitation of any offer to sell, dispose of, purchase,

acquire or subscribe for, any security, including any ordinary shares of Smurfit WestRock, with a nominal value of $0.001 each (“Smurfit

WestRock Shares”), expected to be issued to Smurfit Kappa Shareholders and WestRock Shareholders in connection with the Combination.

In particular, the issuance of the Smurfit WestRock Shares in connection with the Combination to Smurfit Kappa Shareholders has not been,

and is not expected to be, registered under the US Securities Act of 1933, as amended (the “US Securities Act”) or

the securities laws of any other jurisdiction. The Smurfit WestRock Shares to be issued in connection with the Combination to Smurfit

Kappa Shareholders will be issued pursuant to an exemption from the registration requirements provided by Section 3(a)(10) of the US Securities

Act based on the approval of the proposed scheme of arrangement (the “Scheme”) under Section 450 of the Companies Act

2014 of Ireland to effect the acquisition by Smurfit WestRock of the entire issued share capital of Smurfit Kappa (the “Smurfit

Kappa Share Exchange”) under the terms of the Transaction Agreement by the Irish High Court. Section 3(a)(10) of the US Securities

Act exempts securities issued in exchange for one or more bona fide outstanding securities from the general requirement of registration

where the fairness of the terms and conditions of the issuance and exchange of the securities have been approved by any court or authorised

governmental entity, after a hearing upon the fairness of the terms and conditions of the exchange at which all persons to whom securities

will be issued have the right to appear and to whom adequate notice of the hearing has been given. In determining whether it is appropriate

to authorise the Scheme, the Irish High Court will consider at the hearing of the motion to sanction the Scheme under Section 453 of the

Irish Companies Act (the “Irish Court Hearing”) whether the terms and conditions of the Scheme are fair to Scheme shareholders.

The Irish High Court will fix the date and time for the Irish Court Hearing. If the Irish High Court approves the Scheme, its approval

will constitute the basis for the Smurfit WestRock Shares to be issued without registration under the US Securities Act in reliance on

the exemption from the registration requirements of the US Securities Act provided by Section 3(a)(10) of the US Securities Act.

Participants in the Solicitation of Proxies

This announcement is not a solicitation of proxies in connection with

the Combination. However, under US SEC rules, Smurfit WestRock, WestRock, Smurfit Kappa, and certain of their respective directors, executive

officers and other members of the management and employees may be deemed to be participants in the solicitation of proxies in connection

with the Combination.

Information about (i) WestRock’s directors is set forth in

the section entitled “Board Composition” on page 8 of WestRock’s proxy statement on Schedule 14A filed with the US

SEC on 13 December 2023 and (ii) WestRock’s executive officers is set forth in the section entitled “Executive

Officers” on page 141 of WestRock’s Annual Report on Form 10-K (the “WestRock 2023 Annual Report”) filed

with the US SEC on 17 November 2023. Information about the compensation of WestRock’s directors for the financial year ended

30 September 2023 is set forth in the section entitled “Director Compensation” starting on page 19 of WestRock’s

proxy statement on Schedule 14A filed with the US SEC on 13 December 2023. Information about the compensation of WestRock’s

executive officers for the financial year ended 30 September 2023 is set forth in the section entitled “Executive Compensation

Tables” starting on page 38 of WestRock’s proxy statement on Schedule 14A filed with the US SEC on 13 December 2023.

Transactions with related persons (as defined in Item 404 of Regulation S-K promulgated under the US Securities Act) are disclosed

in the section entitled “Certain Relationships and Related Person Transactions” on page 20 of WestRock’s proxy

statement on Schedule 14A filed with the US SEC on 13 December 2023. Information about the beneficial ownership of WestRock’s

securities by WestRock’s directors and named executive officers as of 22 April 2024 is set forth in the section entitled

“Security Ownership of Certain Beneficial Holders, Directors and Management of WestRock” starting on page 277 of each of

the US Proxy Statement and the US Prospectus. As of 22 April 2024, none of the participants (within the meaning of Rule 13d¬3

under the Securities Exchange Act of 1934, as amended) owned more than 1% of shares of WestRock. Other information regarding certain

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise

are contained in the section entitled “Interests of WestRock’s Directors and Executive Officers in the

Combination” beginning on page 139 of each of the US Prospectus and the US Proxy Statement.

Information about Smurfit Kappa’s directors and executive officers

is set forth in the section entitled “Board of Directors,” starting on page 112 of Smurfit Kappa’s 2023 Annual Report

(the “Smurfit Kappa 2023 Annual Report”) published on Smurfit Kappa’s website on 15 March 2024, which was filed with

the FCA on 15 March 2024 and Euronext Dublin in Ireland on 15 March 2024. Information about the compensation of Smurfit Kappa executive

officers and directors is set forth in the remuneration report starting on page 129 of the Smurfit Kappa 2023 Annual Report. Transactions

with related persons (as defined under Paragraph 24 of the International Accounting Standards) are disclosed in the subsection entitled

“Related Party Transactions” to the section entitled “Notes to the Consolidated Financial Statements,” on page

223 of the Smurfit Kappa 2023 Annual Report. Information about the beneficial ownership of Smurfit Kappa’s securities by Smurfit

Kappa’s directors and executive officers is set forth in the sections entitled “Executive Directors’ Interests in Share

Capital at 31 December 2023” on page 147 and “Non-executive Directors’ Interests in Share Capital at 31 December 2023”

on page 150 of the Smurfit Kappa 2023 Annual Report.

Information about the expected beneficial ownership of Smurfit WestRock

securities by the individuals who are expected to be executive officers and directors of Smurfit WestRock at Completion is set forth in

the section entitled “Security Ownership of Certain Beneficial Holders, Directors and Management of Smurfit WestRock” beginning

on page 279 of each of the US Prospectus and the US Proxy Statement. Information required by Item 402 of the SEC’s Regulation S-K

with respect to the executive officers of Smurfit WestRock who served as executives of Smurfit Kappa during Smurfit Kappa’s fiscal

year 2023, as well as a description of certain post-Completion compensation arrangements that are expected to apply to the executive officers

of Smurfit WestRock, is set forth in the section entitled “Executive Compensation” beginning on page 327 of each of the US

Prospectus and the US Proxy Statement.

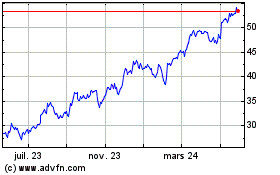

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

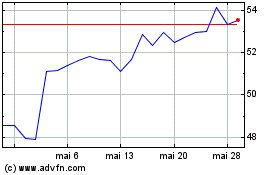

WestRock (NYSE:WRK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025