Record AUM of $109.7 Billion

940 bps of Operating Margin Expansion vs. YTD

June 30, 2023

Diluted Earnings Per Share of $0.13 ($0.16, as

Adjusted)

WisdomTree, Inc. (NYSE: WT), a global financial innovator, today

reported financial results for the second quarter of 2024.

$21.8 million of net income ($27.1(1) million of net income,

as adjusted), see “Non-GAAP Financial Measurements” for

additional information.

$109.7 billion of ending AUM, an increase of 2.3% from

the prior quarter arising from market appreciation and net

inflows.

$0.3 billion of net inflows, primarily driven by inflows

into our international developed equity, fixed income and U.S.

equity products, partially offset by outflows from our commodity

products.

0.37% average advisory fee, a 1 basis point increase from

the prior quarter.

$107.0 million of operating revenues, an increase of

10.5% from the prior quarter due to higher average AUM and higher

other revenues attributable to our European listed products.

81.2% gross margin(1), a 1.8 point increase from the

prior quarter due to higher revenues.

31.3% operating income margin (35.3%(1) as adjusted), a

2.4 point increase (5.7 point increase, as adjusted(1)) compared to

our operating margin of 28.9% (29.6%(1), as adjusted)

in the prior quarter primarily due to higher revenues.

$0.03 quarterly dividend declared, payable on

August 21, 2024 to stockholders of record as of the close of

business on August 7, 2024.

Update from Jonathan Steinberg, WisdomTree

CEO

“WisdomTree continued to thrive in the

second quarter, generating record assets under management with a

global footprint and leadership in advisor solutions and

tokenization on the back of only 300 employees. It is truly a

testament to the efficiency of our business model and reflects our

mission, vision and values. The broadening of our product lineup

over the years while adding portfolio solutions for our advisor

clients are showcased in our three-plus years of strong net inflows

and record assets under management. Continued traction in those

areas, alongside our leadership position in the industry’s secular

shift toward ETFs, tokenization and blockchain technology, further

set the company up for success in the long run.”

Update from Jarrett Lilien, WisdomTree COO

and President

“WisdomTree once again delivered strong

revenue growth on the back of record assets under management, net

inflows and expanding other revenue streams. With well-managed

expenses and scale benefits, we’ve expanded adjusted operating

margins 840 basis points this year as compared to the first half of

last year. This all translates into an accelerated pace of EPS

growth and strong returns for stockholders.”

OPERATING AND FINANCIAL HIGHLIGHTS

Three Months Ended

June 30, 2024

Mar. 31, 2024

Dec. 31, 2023

Sept. 30, 2023

June 30, 2023

Consolidated

Operating Highlights ($ in billions):

AUM—end of period

$

109.7

$

107.2

$

100.1

$

93.7

$

93.7

Net inflows/(outflows)

$

0.3

$

2.0

$

(0.3

)

$

2.0

$

2.3

Average AUM

$

108.4

$

102.4

$

96.6

$

95.7

$

91.6

Average advisory fee

0.37

%

0.36

%

0.36

%

0.36

%

0.36

%

Consolidated

Financial Highlights ($ in millions, except per share

amounts):

Operating revenues

$

107.0

$

96.8

$

90.8

$

90.4

$

85.7

Net income

$

21.8

$

22.1

$

19.1

$

13.0

$

54.3

Diluted earnings per share

$

0.13

$

0.13

$

0.16

$

0.07

$

0.32

Operating income margin

31.3

%

28.9

%

28.7

%

29.5

%

21.2

%

As Adjusted

(Non-GAAP(1)):

Gross margin

81.2

%

79.4

%

79.7

%

80.1

%

79.3

%

Net income, as adjusted

$

27.1

$

20.3

$

18.6

$

18.0

$

14.9

Diluted earnings per share, as

adjusted

$

0.16

$

0.12

$

0.11

$

0.10

$

0.09

Operating income margin, as adjusted

35.3

%

29.6

%

28.7

%

29.5

%

26.9

%

RECENT BUSINESS DEVELOPMENTS

Company

News

- In June 2024, WisdomTree stockholders voted for all proposals,

including to overwhelmingly elect all nine of WisdomTree’s nominees

to the Board of Directors at its 2024 Annual Meeting of

Stockholders.

- Also in June 2024, WisdomTree Europe was named ‘Best ETF

Provider’ at the Online Money Awards for the third year in a

row.

Product

News

- In May 2024, we launched the WisdomTree India Hedged Equity

Fund (INDH) on the NASDAQ; we were one of the first issuers to list

Crypto ETPs on the London Stock Exchange, including the WisdomTree

Physical Bitcoin ETP (BTCW) and the WisdomTree Physical Ethereum

ETP (ETHW); and we listed eight 5x short-and-leveraged equity ETPs

on the London Stock Exchange, B�rse Xetra and Borsa Italiana.

- In June 2024, we launched the WisdomTree Global Sustainable

UCITS ETF (WSDG) on the London Stock Exchange and B�rse Xetra, in

collaboration with Irish Life Investment Managers.

- In July 2024, we introduced Portfolio Solutions, a

comprehensive suite of solutions empowering new and deeper advisor

relationships through scalable model portfolios; we cross-listed

the WisdomTree Global Sustainable UCITS ETF (WSDG) on Borsa

Italiana; and we partnered with Trading 212, one of the UK’s most

popular commission-free investing apps, to offer six ETF model

portfolios for European retail investors.

WISDOMTREE, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

Mar. 31, 2024

Dec. 31, 2023

Sept. 30, 2023

June 30, 2023

June 30, 2024

June 30, 2023

Operating Revenues:

Advisory fees

$

98,938

$

92,501

$

86,988

$

86,598

$

82,004

$

191,439

$

159,641

Other revenues

8,096

4,337

3,856

3,825

3,720

12,433

8,127

Total revenues

107,034

96,838

90,844

90,423

85,724

203,872

167,768

Operating Expenses:

Compensation and benefits

30,790

31,054

27,860

27,955

26,319

61,844

53,717

Fund management and administration

20,139

19,962

18,445

18,023

17,727

40,101

34,880

Marketing and advertising

5,110

4,408

4,951

3,833

4,465

9,518

8,472

Sales and business development

3,640

3,611

3,881

3,383

3,326

7,251

6,320

Contractual gold payments

—

—

—

—

1,583

—

6,069

Professional fees

6,594

3,630

3,201

3,719

8,334

10,224

12,049

Occupancy, communications and

equipment

1,314

1,210

1,208

1,203

1,172

2,524

2,273

Depreciation and amortization

418

383

335

307

121

801

230

Third-party distribution fees

2,687

2,307

2,549

2,694

1,881

4,994

4,134

Other

2,831

2,323

2,379

2,601

2,615

5,154

4,872

Total operating expenses

73,523

68,888

64,809

63,718

67,543

142,411

133,016

Operating income

33,511

27,950

26,035

26,705

18,181

61,461

34,752

Other Income/(Expenses):

Interest expense

(4,140

)

(4,128

)

(3,758

)

(3,461

)

(4,021

)

(8,268

)

(8,023

)

Gain on revaluation/termination of

deferred consideration—gold payments

—

—

—

—

41,361

—

61,953

Interest income

1,438

1,398

1,225

791

1,000

2,836

2,083

Impairments

—

—

(339

)

(2,703

)

—

—

(4,900

)

Loss on extinguishment of convertible

notes

—

—

—

—

—

—

(9,721

)

Other losses and gains, net

(1,283

)

2,592

1,602

(2,512

)

1,286

1,309

(721

)

Income before income taxes

29,526

27,812

24,765

18,820

57,807

57,338

75,423

Income tax expense

7,767

5,701

5,688

5,836

3,555

13,468

4,938

Net income

$

21,759

$

22,111

$

19,077

$

12,984

$

54,252

$

43,870

70,485

Earnings per share—basic

$

0.13(2)

$

0.14(2

)

$

0.16(2

)

$

0.07(2

)

$

0.32(2

)

$

0.27(2

)

$

0.43(2

)

Earnings per share—diluted

$

0.13

$

0.13

$

0.16(2

)

$

0.07

$

0.32

$

0.26

$

0.42(2

)

Weighted average common shares—basic

146,896

146,464

145,310

145,284

144,351

146,680

144,108

Weighted average common shares—diluted

166,359

165,268

171,703

177,140

170,672

165,872

165,468

As Adjusted (Non-GAAP(1))

Total operating expenses

$

69,252

$

68,193

$

64,809

$

63,718

$

62,630

Operating income

$

37,782

$

28,645

$

26,035

$

26,705

$

23,094

Income before income taxes

$

36,083

$

26,987

$

23,908

$

23,902

$

19,752

Income tax expense

$

9,008

$

6,731

$

5,342

$

5,854

$

4,833

Net income

$

27,075

$

20,256

$

18,566

$

18,048

$

14,919

Earnings per share—diluted

$

0.16

$

0.12

$

0.11

$

0.10

$

0.09

Weighted average common shares—diluted

166,359

165,268

171,703

177,140

170,672

QUARTERLY HIGHLIGHTS

Operating Revenues

- Operating revenues increased 10.5% and 24.9% from the first

quarter of 2024 and the second quarter of 2023, respectively, due

to higher average AUM and higher other revenues attributable to our

European listed exchange-traded products (“ETPs”).

- Our average advisory fee was 0.37%, 0.36% and 0.36% during the

second quarter of 2024, the first quarter of 2024 and the second

quarter of 2023, respectively.

Operating Expenses

- Operating expenses increased 6.7% from the first quarter of

2024 primarily due to higher professional fees arising from

expenses incurred in connection with an activist campaign, as well

as higher marketing expenses.

- Operating expenses increased 8.9% from the second quarter of

2023 primarily due to higher incentive and stock-based compensation

expense and increased headcount, fund management and administration

costs, third-party distribution fees and marketing expenses. These

increases were partly offset by lower professional fees and the

termination of the deferred consideration—gold payments obligation

on May 10, 2023.

Other Income/(Expenses)

- Interest expense was essentially unchanged from the first

quarter of 2024. Interest expense increased 3.0% from the second

quarter of 2023 due to the recognition of imputed interest on our

obligation payable to Gold Bullion Holdings (Jersey) Limited

(“GBH”), a subsidiary of the World Gold Council, in connection with

our repurchase in November 2023 of our Series C Non-Voting

Convertible Preferred Stock, partly offset by a lower level of debt

outstanding.

- Interest income increased 2.9% and 43.8% from the first quarter

of 2024 and second quarter of 2023, respectively, due to a higher

level of interest-earning assets.

- Other losses and gains, net was a loss of $1.3 million for the

second quarter of 2024. The quarter included net losses of $1.3

million and $0.3 million on our investments and financial

instruments owned, respectively. Gains and losses also generally

arise from the sale of gold and crypto earned from management fees

paid by our physically-backed gold and crypto ETPs, foreign

exchange fluctuations and other miscellaneous items.

Income Taxes

- Our effective income tax rate for the second quarter of 2024

was 26.3%, resulting in income tax expense of $7.8 million. The

effective tax rate differs from the federal statutory rate of 21.0%

primarily due to non-deductible executive compensation, an increase

in the deferred tax asset valuation allowance on losses recognized

on our investments and state and local income taxes. These items

were partly offset by a lower tax rate on foreign earnings.

- Our adjusted effective income tax rate for the second quarter

of 2024 was 25.0%(1).

SIX MONTH HIGHLIGHTS

- Operating revenues increased 21.5% as compared to 2023 due to

higher average AUM and higher other revenues attributable to our

European listed ETPs.

- Operating expenses increased 7.1% as compared to 2023 primarily

due to higher incentive and stock-based compensation expense and

increased headcount, fund management and administration costs,

marketing expenses, sales and business development expenses,

third-party distribution fees, as well as higher depreciation and

amortization. These increases were partly offset by lower

contractual gold payments and professional fees.

- Significant items reported in other income/(expense) in 2024

include: an increase in interest expense of 3.1% due to imputed

interest on our obligation payable to GBH, partly offset by a lower

level of debt outstanding; an increase in interest income of 36.1%

due to an increase in our interest-earning assets; net gains on our

financial instruments owned of $1.8 million; and losses on our

investments of $1.2 million. Gains and losses also generally arise

from the sale of gold earned on management fees paid by our

physically-backed gold ETPs, foreign exchange fluctuations and

other miscellaneous items.

- Our effective income tax rate for 2024 was 23.5%, resulting in

an income tax expense of $13.5 million. Our tax rate differs from

the federal statutory rate of 21.0% primarily due to non-deductible

executive compensation and state and local income taxes. These

items were partly offset by a lower tax rate on foreign earnings

and tax windfalls associated with the vesting of stock-based

compensation awards.

CONFERENCE CALL DIAL-IN AND WEBCAST DETAILS

WisdomTree will discuss its results and operational highlights

during a live webcast on Friday, July 26, 2024 at 11:00 a.m. ET,

which can be accessed using the following link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=5z2QQw8B.

Participants also can dial in using the following numbers: (877)

407-9210 or (201) 689-8049. Click here to access the participant

international toll-free access numbers. To avoid delays, we

encourage participants to log in or dial into the conference call

10 minutes ahead of the scheduled start time. All earnings

materials and the webcast can be accessed through WisdomTree’s

investor relations website at https://ir.wisdomtree.com. A replay

of the webcast will also be available shortly after the call.

About WisdomTree

WisdomTree is a global financial innovator, offering a

well-diversified suite of exchange-traded products (ETPs), models,

solutions and products leveraging blockchain technology. We empower

investors and consumers to shape their future and support financial

professionals to better serve their clients and grow their

businesses. WisdomTree is leveraging the latest financial

infrastructure to create products that provide access, transparency

and an enhanced user experience. Building on our heritage of

innovation, we are also developing and have launched

next-generation digital products, services and structures,

including digital or blockchain-enabled mutual funds and tokenized

assets, as well as our blockchain-native digital wallet, WisdomTree

Prime®.*

* The WisdomTree Prime digital wallet and digital asset services

are made available through WisdomTree Digital Movement, Inc., a

federally registered money services business, state-licensed money

transmitter and financial technology company (NMLS ID: 2372500) or

WisdomTree Digital Trust Company, LLC, in select U.S. jurisdictions

and may be limited where prohibited by law. WisdomTree Digital

Trust Company, LLC is chartered as a limited purpose trust company

by the New York State Department of Financial Services to engage in

virtual currency business. Visit https://www.wisdomtreeprime.com or

the WisdomTree Prime mobile app for more information.

WisdomTree currently has approximately $111.2 billion in assets

under management globally.

For more information about WisdomTree and WisdomTree Prime®,

visit: https://www.wisdomtree.com.

Please visit us on X, at @WisdomTreeNews.

WisdomTree® is the marketing name for WisdomTree, Inc. and its

subsidiaries worldwide.

PRODUCTS AND SERVICES AVAILABLE VIA WISDOMTREE PRIME:

NOT FDIC INSURED | NO BANK GUARANTEE | NOT A BANK DEPOSIT |

MAY LOSE VALUE | NOT SIPC PROTECTED | NOT INSURED BY ANY GOVERNMENT

AGENCY

The products and services available through the WisdomTree Prime

app are not endorsed, indemnified or guaranteed by any regulatory

agency.

____________________

(1)

See “Non-GAAP Financial Measurements.”

(2)

Earnings per share (“EPS”) is calculated

pursuant to the two-class method as it results in a lower EPS

amount as compared to the treasury stock method. In addition, the

three months ended December 31, 2023 includes a gain of $7.966

recognized upon the repurchase of our Series C non-voting preferred

shares convertible into approximately 13.1 million shares of common

stock from GBH, which is excluded from net income, but required to

be added to net income to arrive at income available to common

stockholders in the calculation of EPS. This gain is excluded from

our EPS when computed on a non-GAAP basis.

WISDOMTREE, INC. AND

SUBSIDIARIES

KEY OPERATING

STATISTICS

(Unaudited)

Three Months Ended

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

GLOBAL ETPs ($ in

millions)

Beginning of period assets

$

107,230

$

100,124

$

93,735

$

93,666

$

90,740

Inflows/(outflows)

340

1,990

(255

)

1,983

2,327

Market appreciation/(depreciation)

2,116

5,116

6,644

(1,914

)

599

End of period assets

$

109,686

$

107,230

$

100,124

$

93,735

$

93,666

Average assets during the period

$

108,392

$

102,360

$

96,534

$

95,743

$

91,578

Average advisory fee during the period

0.37

%

0.36

%

0.36

%

0.36

%

0.36

%

Revenue days

91

91

92

92

91

Number of ETFs—end of the period

350

338

337

344

344

U.S. LISTED ETFs

($ in millions)

Beginning of period assets

$

78,087

$

72,486

$

68,018

$

65,903

$

61,283

Inflows/(outflows)

1,106

1,983

(67

)

3,601

3,249

Market appreciation/(depreciation)

529

3,618

4,535

(1,486

)

1,371

End of period assets

$

79,722

$

78,087

$

72,486

$

68,018

$

65,903

Average assets during the period

$

78,436

$

74,730

$

69,694

$

68,008

$

62,712

Number of ETFs—end of the period

78

77

76

80

80

EUROPEAN LISTED

ETPs ($ in millions)

Beginning of period assets

$

29,143

$

27,638

$

25,717

$

27,763

$

29,457

(Outflows)/inflows

(766

)

7

(188

)

(1,618

)

(922

)

Market appreciation/(depreciation)

1,587

1,498

2,109

(428

)

(772

)

End of period assets

$

29,964

$

29,143

$

27,638

$

25,717

$

27,763

Average assets during the period

$

29,956

$

27,630

$

26,840

$

27,735

$

28,866

Number of ETPs—end of the period

272

261

261

264

264

PRODUCT

CATEGORIES ($ in millions)

U.S. Equity

Beginning of period assets

$

31,670

$

29,156

$

25,643

$

26,001

$

24,534

Inflows

221

536

487

864

414

Market (depreciation)/appreciation

(57

)

1,978

3,026

(1,222

)

1,053

End of period assets

$

31,834

$

31,670

$

29,156

$

25,643

$

26,001

Average assets during the period

$

31,252

$

30,056

$

26,822

$

26,501

$

24,732

Commodity & Currency

Beginning of period assets

$

21,944

$

21,336

$

20,466

$

22,384

$

24,924

Outflows

(1,499

)

(460

)

(449

)

(1,814

)

(1,513

)

Market appreciation/(depreciation)

1,542

1,068

1,319

(104

)

(1,027

)

End of period assets

$

21,987

$

21,944

$

21,336

$

20,466

$

22,384

Average assets during the period

$

22,437

$

20,837

$

21,254

$

22,278

$

24,033

Fixed Income

Beginning of period assets

$

21,218

$

21,197

$

21,797

$

20,215

$

18,708

Inflows/(outflows)

236

(14

)

(715

)

1,670

1,471

Market (depreciation)/appreciation

(24

)

35

115

(88

)

36

End of period assets

$

21,430

$

21,218

$

21,197

$

21,797

$

20,215

Average assets during the period

$

21,277

$

21,082

$

21,889

$

20,965

$

19,185

Three Months Ended

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

International Developed Market

Equity

Beginning of period assets

$

18,103

$

15,103

$

13,902

$

13,423

$

11,433

Inflows

1,253

1,599

9

798

1,593

Market appreciation/(depreciation)

29

1,401

1,192

(319

)

397

End of period assets

$

19,385

$

18,103

$

15,103

$

13,902

$

13,423

Average assets during the period

$

18,809

$

16,688

$

14,266

$

13,873

$

12,276

Emerging Market Equity

Beginning of period assets

$

11,189

$

10,726

$

9,569

$

9,191

$

8,811

Inflows

57

217

412

451

329

Market appreciation/(depreciation)

629

246

745

(73

)

51

End of period assets

$

11,875

$

11,189

$

10,726

$

9,569

$

9,191

Average assets during the period

$

11,448

$

10,900

$

9,833

$

9,652

$

8,998

Leveraged & Inverse

Beginning of period assets

$

1,828

$

1,815

$

1,781

$

1,864

$

1,785

(Outflows)/inflows

(18

)

(50

)

(59

)

(1

)

12

Market appreciation/(depreciation)

112

63

93

(82

)

67

End of period assets

$

1,922

$

1,828

$

1,815

$

1,781

$

1,864

Average assets during the period

$

1,905

$

1,792

$

1,803

$

1,894

$

1,798

Cryptocurrency

Beginning of period assets

$

874

$

414

$

243

$

248

$

239

Inflows

75

158

28

10

(1

)

Market (depreciation)/appreciation

(111

)

302

143

(15

)

10

End of period assets

$

838

$

874

$

414

$

243

$

248

Average assets during the period

$

856

$

614

$

325

$

238

$

236

Alternatives

Beginning of period assets

$

404

$

377

$

334

$

340

$

306

Inflows

15

4

32

5

22

Market (depreciation)/appreciation

(4

)

23

11

(11

)

12

End of period assets

$

415

$

404

$

377

$

334

$

340

Average assets during the period

$

408

$

391

$

342

$

342

$

320

Headcount

304

300

303

299

291

Note: Previously issued statistics may be

restated due to fund closures and trade adjustments

Source: WisdomTree

WISDOMTREE, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share amounts)

June 30, 2024

Dec. 31, 2023

(Unaudited)

ASSETS

Current assets:

Cash, cash equivalents and restricted

cash

$

132,459

$

129,305

Financial instruments owned, at fair

value

69,783

58,722

Accounts receivable

42,664

35,473

Prepaid expenses

8,595

5,258

Other current assets

1,199

1,036

Total current assets

254,700

229,794

Fixed assets, net

413

427

Securities held-to-maturity

218

230

Deferred tax assets, net

6,786

11,057

Investments

8,288

9,684

Right of use assets—operating leases

847

563

Goodwill

86,841

86,841

Intangible assets, net

605,580

605,082

Other noncurrent assets

457

459

Total assets

$

964,130

$

944,137

LIABILITIES AND STOCKHOLDERS’

EQUITY

LIABILITIES

Current liabilities:

Fund management and administration

payable

$

26,551

$

30,085

Compensation and benefits payable

20,315

38,111

Payable to Gold Bullion Holdings (Jersey)

Limited (“GBH”)

14,804

14,804

Income taxes payable

1,830

3,866

Operating lease liabilities

847

578

Accounts payable and other liabilities

20,341

15,772

Total current liabilities

84,688

103,216

Convertible notes—long term

275,638

274,888

Payable to GBH

25,671

24,328

Total liabilities

385,997

402,432

Preferred stock:

Series A Non-Voting Convertible, par value

$0.01; 14.750 shares authorized, issued and outstanding

132,569

132,569

STOCKHOLDERS’ EQUITY

Common stock, par value $0.01; 400,000

shares authorized:

Issued and outstanding: 151,857 and

150,330 at June 30, 2024 and December 31, 2023, respectively

1,519

1,503

Additional paid-in capital

315,359

312,440

Accumulated other comprehensive loss

(931

)

(548

)

Retained earnings

129,617

95,741

Total stockholders’ equity

445,564

409,136

Total liabilities and stockholders’

equity

$

964,130

$

944,137

WISDOMTREE, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

(Unaudited)

Six Months Ended June

30,

Cash flows from operating

activities:

2024

2023

Net income

$

43,870

$

70,485

Adjustments to reconcile net income to net

cash provided by operating activities:

Advisory and license fees paid in gold,

other precious metals and cryptocurrency

(25,365

)

(25,692

)

Stock-based compensation

10,755

8,506

Deferred income taxes

4,326

2,964

Gains on financial instruments owned, at

fair value

(1,772

)

(947

)

Imputed interest on payable to GBH

1,342

—

Losses on investments

1,195

819

Depreciation and amortization

801

230

Amortization of issuance costs—convertible

notes

750

1,069

Amortization of right of use asset

647

640

Gain on revaluation/termination of

deferred consideration—gold payments

—

(61,953

)

Loss on extinguishment of convertible

notes

—

9,721

Impairments

—

4,900

Contractual gold payments

—

6,069

Other

—

(946

)

Changes in operating assets and

liabilities:

Accounts receivable

(7,132

)

(5,254

)

Prepaid expenses

(3,353

)

(3,425

)

Gold and other precious metals

24,972

18,441

Other assets

(118

)

347

Fund management and administration

payable

(3,430

)

6,419

Compensation and benefits payable

(17,657

)

(18,941

)

Income taxes payable

(2,028

)

(2,523

)

Operating lease liabilities

(662

)

(652

)

Accounts payable and other liabilities

4,031

9,752

Net cash provided by operating

activities

31,172

20,029

Cash flows from investing

activities:

Purchase of financial instruments owned,

at fair value

(14,193

)

(40,532

)

Purchase of investments

—

(10,000

)

Cash paid—software development

(1,184

)

—

Purchase of fixed assets

(102

)

(58

)

Proceeds from the sale of financial

instruments owned, at fair value

5,303

102,020

Proceeds from the exit from investment in

Securrency, Inc.

465

—

Proceeds from held-to-maturity securities

maturing or called prior to maturity

12

14

Receipt of contingent consideration—Sale

of Canadian ETF business

—

1,477

Acquisition of Securrency Transfers, Inc.

(net of cash acquired)

—

(985

)

Net cash (used in)/provided by investing

activities

(9,699

)

51,936

Cash flows from financing

activities:

Dividends paid

(9,873

)

(9,647

)

Shares repurchased

(7,820

)

(3,540

)

Repurchase and maturity of convertible

notes

—

(184,272

)

Proceeds from the issuance of convertible

notes

—

130,000

Termination of deferred consideration—gold

payments

—

(50,005

)

Issuance costs—convertible notes

—

(3,548

)

Issuance costs—Series C Non-Voting

Convertible Preferred Stock

—

(97

)

Net cash used in financing activities

(17,693

)

(121,109

)

(Decrease)/increase in cash flow due to

changes in foreign exchange rate

(626

)

778

Net increase/(decrease) in cash, cash

equivalents and restricted cash

3,154

(48,366

)

Cash, cash equivalents and restricted

cash—beginning of year

129,305

132,101

Cash, cash equivalents and restricted

cash—end of period

$

132,459

$

83,735

Supplemental disclosure of cash flow

information:

Cash paid for income taxes

$

11,138

$

5,900

Cash paid for interest

$

6,175

$

4,514

NON-GAAP FINANCIAL MEASUREMENTS

In an effort to provide additional information regarding our

results as determined by GAAP, we also disclose certain non-GAAP

information which we believe provides useful and meaningful

information. Our management reviews these non-GAAP financial

measurements when evaluating our financial performance and results

of operations; therefore, we believe it is useful to provide

information with respect to these non-GAAP measurements so as to

share this perspective of management. Non-GAAP measurements do not

have any standardized meaning, do not replace nor are superior to

GAAP financial measurements and are unlikely to be comparable to

similar measures presented by other companies. These non-GAAP

financial measurements should be considered in the context with our

GAAP results. The non-GAAP financial measurements contained in this

press release include:

Adjusted Operating Income, Operating Expenses, Income Before

Income Taxes, Income Tax Expense, Net Income and Diluted Earnings

per Share

We disclose adjusted operating income, operating expenses,

income before income taxes, income tax expense, net income and

diluted earnings per share as non-GAAP financial measurements in

order to report our results exclusive of items that are

non-recurring or not core to our operating business. We believe

presenting these non-GAAP financial measurements provides investors

with a consistent way to analyze our performance. These non-GAAP

financial measurements exclude the following:

Gains or losses on financial instruments owned: We

account for our financial instruments owned as trading securities,

which requires these instruments to be measured at fair value with

gains and losses reported in net income. We exclude these items

when calculating our non-GAAP financial measurements as the gains

and losses introduce volatility in earnings and are not core to our

operating business.

Tax windfalls and shortfalls upon vesting of stock-based

compensation awards: GAAP requires the recognition of tax

windfalls and shortfalls within income tax expense. These items

arise upon the vesting of stock-based compensation awards and the

magnitude is directly correlated to the number of awards

vesting/exercised as well as the difference between the price of

our stock on the date the award was granted and the date the award

vested or was exercised. We exclude these items when calculating

our non-GAAP financial measurements as they introduce volatility in

earnings and are not core to our operating business.

Imputed interest on our payable to the Gold Bullion Holdings

(Jersey) Limited (“GBH”): During the fourth quarter of 2023, we

repurchased our Series C Non-Voting Convertible Preferred Stock,

which was convertible into approximately 13.1 million shares of

WisdomTree common stock, from GBH, a subsidiary of the World Gold

Council, for aggregate cash consideration of approximately $84.4

million. Under the terms of the transaction, we paid GBH $40.0

million on the closing date, with the remainder of the purchase

price payable in equal annual installments on the first, second and

third anniversaries of the closing date, with no requirement to pay

interest. Under US GAAP, the obligation is recorded at its present

value utilizing a market rate of interest on the closing date of

7.0% and the corresponding discount is amortized as interest

expense pursuant to the effective interest method of accounting

over the life of the obligation. We exclude this item when

calculating our non-GAAP financial measurements as recognition of

interest expense is non-cash and contrary to the stated terms of

our obligation.

Other items: Gains and losses recognized on our

investments, changes in deferred tax asset valuation allowance,

expenses incurred in response to an activist campaign, unrealized

gains or losses on the revaluation/termination of deferred

consideration—gold payments which we terminated in the second

quarter of 2023, loss on extinguishment of convertible notes,

impairments and litigation expenses associated with certain

provisions of our Stockholder Rights Agreement dated as of March

17, 2023, as amended, with Continental Stock Transfer & Trust

Company, as Rights Agent, are excluded when calculating our

non-GAAP financial measurements.

Adjusted Effective Income Tax Rate

We disclose our adjusted effective income tax rate as a non-GAAP

financial measurement in order to report our effective income tax

rate exclusive of items that are non-recurring or not core to our

operating business. We believe reporting our adjusted effective

income tax rate provides investors with a consistent way to analyze

our income taxes. Our adjusted effective income tax rate is

calculated by dividing adjusted income tax expense by adjusted

income before income taxes. See above for information regarding the

items that are excluded.

Gross Margin and Gross Margin Percentage

We disclose our gross margin and gross margin percentage as

non-GAAP financial measurements because we believe they provide

investors with a consistent way to analyze the amount we retain

after paying third-party service providers to operate our ETPs.

These measures also assist us in analyzing the profitability of our

products. We define gross margin as total operating revenues less

fund management and administration expenses. Gross margin

percentage is calculated as gross margin divided by total operating

revenues.

GAAP to NON-GAAP

RECONCILIATION (CONSOLIDATED)

(in thousands)

(Unaudited)

Three Months Ended

Adjusted Net Income and Diluted

Earnings per Share:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Net income, as reported

$

21,759

$

22,111

$

19,077

$

12,984

$

54,252

Add back: Expenses incurred in response to

an activist campaign, net of income taxes

3,234

526

—

—

3,720

Add back/(deduct): Losses/(gains)

recognized on investments, net of income taxes

998

(93

)

(336

)

323

(2,346

)

Add back: Imputed interest on payable to

GBH, net of income taxes

513

504

224

—

—

Add back/(deduct): Increase/(decrease) in

deferred tax asset valuation allowance on financial instruments

owned and investments

391

(531

)

(280

)

1,234

(508

)

Add back/(deduct): Losses/(gains) on

financial instruments owned, net of income taxes

220

(1,562

)

(370

)

1,479

762

(Deduct)/add back: Tax

(windfalls)/shortfalls upon vesting of stock-based compensation

awards

(40

)

(699

)

(6

)

(18

)

33

Add back: Litigation expenses associated

with certain provisions of the Stockholder Rights Agreement, net of

income taxes

—

—

—

—

367

Add back: Impairments, net of income

taxes

—

—

257

2,046

—

Deduct: Gain on revaluation/termination of

deferred consideration—gold payments

—

—

—

—

(41,361

)

Adjusted net income

$

27,075

$

20,256

$

18,566

$

18,048

$

14,919

Weighted average common shares—diluted

166,359

165,268

171,703

177,140

170,672

Adjusted earnings per share—diluted

$

0.16

$

0.12

$

0.11

$

0.10

$

0.09

Three Months Ended

Gross Margin and Gross Margin

Percentage:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Operating revenues

$

107,034

$

96,838

$

90,844

$

90,423

$

85,724

Less: Fund management and

administration

(20,139

)

(19,962

)

(18,445

)

(18,023

)

(17,727

)

Gross margin

$

86,895

$

76,876

$

72,399

$

72,400

$

67,997

Gross margin percentage

81.2

%

79.4

%

79.7

%

80.1

%

79.3

%

Three Months Ended

Adjusted Operating Income and Adjusted

Operating

Income Margin:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Operating revenues

$

107,034

$

96,838

$

90,844

$

90,423

$

85,724

Operating income

$

33,511

$

27,950

$

26,035

$

26,705

$

18,181

Add back: Expenses incurred in response to

an activist campaign

4,271

695

—

—

4,913

Adjusted operating income

$

37,782

$

28,645

$

26,035

$

26,705

$

23,094

Adjusted operating income margin

35.3

%

29.6

%

28.7

%

29.5

%

26.9

%

Three Months Ended

Adjusted Total Operating

Expenses:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Total operating expenses

$

73,523

$

68,888

$

64,809

$

63,718

$

67,543

Deduct: Expenses incurred in response to

an activist campaign

(4,271

)

(695

)

—

—

(4,913

)

Adjusted total operating expenses

$

69,252

$

68,193

$

64,809

$

63,718

$

62,630

Three Months Ended

Adjusted Income Before Income

Taxes:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Income before income taxes

$

29,526

$

27,812

$

24,765

$

18,820

$

57,807

Add back: Expenses incurred in response to

an activist campaign

4,271

695

—

—

4,913

Add back/(deduct): Losses/(gains)

recognized on investments

1,318

(123

)

(1,003

)

426

(3,099

)

Add back: Imputed interest on payable to

GBH

677

666

296

—

—

Add back/(deduct): Losses/(gains) on

financial instruments owned

291

(2,063

)

(489

)

1,953

1,007

Add back: Litigation expenses associated

with certain provisions of the Stockholder Rights Agreement

—

—

—

—

485

Add back: Impairments

—

—

339

2,703

—

Deduct: Gain on revaluation/termination of

deferred consideration—gold payments

—

—

—

—

(41,361

)

Add back: Loss on extinguishment of

convertible notes

—

—

—

—

—

Adjusted income before income taxes

$

36,083

$

26,987

$

23,908

$

23,902

$

19,752

Three Months Ended

Adjusted Income Tax Expense and

Adjusted Effective Income Tax Rate:

June 30,

2024

Mar. 31,

2024

Dec. 31,

2023

Sept. 30,

2023

June 30,

2023

Adjusted income before income taxes

(above)

$

36,083

$

26,987

$

23,908

$

23,902

$

19,752

Income tax expense

$

7,767

$

5,701

$

5,688

$

5,836

$

3,555

Add back: Tax benefit arising from

expenses incurred in response to an activist campaign

1,037

169

—

—

1,193

(Deduct)/add back: (Increase)/decrease in

deferred tax asset valuation allowance on financial instruments

owned and investments

(391

)

531

280

(1,234

)

508

Add back/(deduct): Tax benefit/(expense)

on gains and losses on investments

320

(30

)

(667

)

103

(753

)

Add back: Tax benefit on imputed

interest

164

162

72

—

—

Add back/(deduct): Tax benefit/(expense)

arising from (gains)/losses on financial instruments owned

71

(501

)

(119

)

474

245

Add back/(deduct): Tax

windfalls/(shortfalls) upon vesting of stock-based compensation

awards

40

699

6

18

(33

)

Add back: Tax benefit arising from

litigation expenses associated with certain provisions of the

Stockholder Rights Agreement

—

—

—

—

118

Add back: Tax benefit arising from

impairments

—

—

82

657

—

Adjusted income tax expense

$

9,008

$

6,731

$

5,342

$

5,854

$

4,833

Adjusted effective income tax rate

25.0

%

24.9

%

22.3

%

24.5

%

24.5

%

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that are

based on our management’s beliefs and assumptions and on

information currently available to our management. Although we

believe that the expectations reflected in these forward-looking

statements are reasonable, these statements relate to future events

or our future financial performance, and involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity,

performance or achievements expressed or implied by these

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” “continue” or the negative of

these terms or other comparable terminology. These statements are

only predictions. You should not place undue reliance on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which are, in some cases,

beyond our control and could materially affect results. Factors

that may cause actual results to differ materially from current

expectations include, among other things, the risks described

below. If one or more of these or other risks or uncertainties

occur, or if our underlying assumptions prove to be incorrect,

actual events or results may vary significantly from those implied

or projected by the forward-looking statements. No forward-looking

statement is a guarantee of future performance. You should read

this press release completely and with the understanding that our

actual future results may be materially different from any future

results expressed or implied by these forward-looking

statements.

In particular, forward-looking statements in this press release

may include statements about:

- anticipated trends, conditions and investor sentiment in the

global markets and ETPs;

- anticipated levels of inflows into and outflows out of our

ETPs;

- our ability to deliver favorable rates of return to

investors;

- competition in our business;

- whether we will experience future growth;

- our ability to develop new products and services and their

potential for success;

- our ability to maintain current vendors or find new vendors to

provide services to us at favorable costs;

- our ability to successfully implement our strategy relating to

digital assets and blockchain-enabled financial services, including

WisdomTree Prime®, and achieve its objectives;

- our ability to successfully operate and expand our business in

non-U.S. markets;

- the effect of laws and regulations that apply to our business;

and

- actions of activist stockholders.

Our business is subject to many risks and uncertainties,

including without limitation:

- declining prices of securities, gold and other precious metals

and other commodities and changes in interest rates and general

market conditions can adversely affect our business by reducing the

market value of the assets we manage or causing WisdomTree ETP

investors to sell their fund shares and trigger redemptions;

- fluctuations in the amount and mix of our AUM, whether caused

by disruptions in the financial markets or otherwise, including but

not limited to events such as a pandemic or war, geopolitical

conflicts, political events, acts of terrorism and other matters

beyond our control, may negatively impact revenues and operating

margins, and may impede our ability to refinance our debt upon

maturity or increase the cost of borrowing upon a refinancing;

- competitive pressures could reduce revenues and profit

margins;

- we derive a substantial portion of our revenues from a limited

number of products, and, as a result, our operating results are

particularly exposed to investor sentiment toward investing in the

products’ strategies and our ability to maintain the AUM of these

products, as well as the performance of these products and

market-specific and political and economic risk;

- a significant portion of our AUM is held in products with

exposure to U.S. and international developed markets, and we

therefore have exposure to domestic and foreign market conditions

and are subject to currency exchange rate risks;

- withdrawals or broad changes in investments in our ETPs by

investors with significant positions may negatively impact revenues

and operating margins;

- we face increased operational, regulatory, financial and other

risks as a result of conducting our business internationally, and

as we expand our digital assets product offerings and services

beyond our existing ETP business;

- many of our ETPs have a limited track record, and poor

investment performance could cause our revenues to decline;

- we depend on third parties to provide many critical services to

operate our business and our ETPs. The failure of key vendors to

adequately provide such services could materially affect our

operating business and harm WisdomTree ETP investors; and

- actions of activist stockholders against us, which have been

costly and may be disruptive and cause uncertainty about the

strategic direction of our business.

Other factors, such as general economic conditions, including

currency exchange rate fluctuations, also may have an effect on the

results of our operations. For a more complete description of the

risks noted above and other risks that could cause our actual

results to differ from our current expectations, see “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31,

2023 and our quarterly report on Form 10-Q for the quarter ended

March 31, 2024.

The forward-looking statements in this press release represent

our views as of the date of this press release. We anticipate that

subsequent events and developments may cause our views to change.

However, while we may elect to update these forward-looking

statements at some point in the future, we have no current

intention of doing so except to the extent required by applicable

law. Therefore, these forward-looking statements do not represent

our views as of any date other than the date of this press

release.

Category: Business Update

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726753476/en/

Investor Relations Jeremy Campbell +1.917.267.3859

jeremy.campbell@wisdomtree.com

Corporate Communications Jessica Zaloom +1.917.267.3735

jzaloom@wisdomtree.com

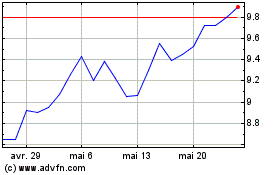

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024