Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today reported new

results from ongoing surface exploration drilling within the

Mulatos District focused on defining higher-grade mineralization at

Puerto Del Aire (“PDA”) and Cerro Pelon.

Drilling at Cerro Pelon is following up on wide,

high-grade underground oxide and sulphide intersections previously

drilled below the Cerro Pelon open pit. The 2024 drill program has

successfully expanded high-grade mineralization beyond the

historical drilling in multiple oxide and sulphide zones.

Additionally, surface drilling has extended higher-grade

mineralization across multiple zones within the PDA area.

Ongoing exploration success is expected to

support further growth in Mineral Reserves and Resources at PDA,

and an initial underground Mineral Resource at Cerro Pelon with the

year-end update expected to be released in February 2025. The

success at both deposits highlights the significant exploration

upside opportunities to the PDA project, with an initial

development plan to be released today after market close.

Cerro Pelon exploration highlights:

step-out drilling below the previously mined oxide deposit has

identified significant high-grade feeder structures that range in

size from 45 to 125 metres (“m”) in width, and up to 170 m

vertically. The top portion of the mineralized zones contain oxide

mineralization including the historical intercept of 15.35 g/t Au

(14.04 g/t cut) over 25.04 m true width (15PEL012) drilled in

2015. Cerro Pelon is located nine kilometres (“km”) by

road from the planned PDA mill and represents a potential source of

additional high-grade mill feed. New highlights include1:

- 5.45 g/t Au over 27.90 m,

including 31.07 g/t Au over 1.25 m (24PEL048);

- 12.47

g/t Au (9.41 g/t cut) over 6.46 m, including 58.10 g/t Au (40.00

g/t cut) over 1.09 m (24PEL048);

- 4.79 g/t

Au over 15.82 m (24PEL071);

- 4.46 g/t

Au over 15.40 m (24PEL051);

- 5.64 g/t

Au over 12.16 m (24PEL059);

- 5.77 g/t

Au over 9.81 m (24PEL067); and

- 4.01 g/t

Au over 13.85 m (24PEL054).

PDA exploration highlights: additional

high-grade gold mineralization extended beyond Mineral Reserves and

Resources within the GAP-Victor, PDA3 and PDA Extension

zones. New highlights include1:

GAP-Victor Zone

- 5.43 g/t

Au over 18.05 m (23MUL278);

- 23.60

g/t Au over 3.00 m (24MUL302);

- 27.62

g/t Au (23.06 g/t cut) over 2.25 m (24MUL332);

- 12.28

g/t Au over 4.95 m (24MUL363); and

- 5.77 g/t

Au over 8.65 m (24MUL304).

PDA3 Zone

- 3.03 g/t

Au over 28.40m (24MUL347); and

-

6.63 g/t Au over 5.50 m (24MUL365).

PDA Extension Zone

- 36.20

g/t Au over 0.90 m (24MUL341);

- 3.51 g/t

Au over 5.05 m (24MUL315); and

- 4.16 g/t

Au over 4.20 m (24MUL283).

1All reported composite widths are estimated

true width of the mineralized zones. Drillhole composite gold

grades reported as “cut” at PDA and Cerro Pelon include higher

grade samples which have been cut to 40 g/t Au.

“Our PDA development plan to be released later

today is expected to outline another attractive, high-return

project that will nearly triple the current mine life of the

Mulatos District. The development plan will be based on PDA’s

current Mineral Reserve of one million ounces which had more than

doubled over the previous two years. Our continued exploration

success at PDA in 2024 highlights the significant upside potential

to the project through further growth in higher-grade Mineral

Reserves and Resources,” said John A. McCluskey, President and

Chief Executive Officer.

“The addition of a mill to process higher-grade

sulphide mineralization will also open up additional opportunities

within the Mulatos District, including Cerro Pelon, where we expect

to declare an initial Mineral Resource in early 2025. With PDA and

Cerro Pelon open in multiple directions, and a number of other

promising targets, there is excellent potential to continue

defining higher-grade Mineral Reserves and Resources across the

Mulatos District,” Mr. McCluskey added.

New highlight intercepts can be found in Table

1, and in Figures 2 through 4 at the end of this news release.

2024 Exploration Budget –

Mulatos

A total of $19 million has been budgeted at

Mulatos for exploration in 2024, consistent with 2023. The

near-mine and regional drilling program is expected to total 55,000

m, including 27,000 m of surface exploration drilling at PDA and

the surrounding area. Exploration activities are focused on

following up on a successful 2023 exploration program that drove a

33% increase in Mineral Reserves at PDA to 1.0 million ounces (5.4

mt grading 5.61 g/t Au), compared to 2022, with grades also

increasing 16%.

Given the ongoing growth of the PDA deposit,

other higher-grade sulphide opportunities are being targeted within

the Mulatos District, including below the previously mined Cerro

Pelon open pit.

Cerro Pelon

The 2024 drill program at Cerro Pelon is focused

on defining high-grade mineralization below the previously mined

open pit where wide, high-grade mineralization was intersected

across multiple drill holes between 2008 to 2017. Previously

reported highlights from 2015 and 2016 include2:

- 15.35 g/t Au

(14.04 g/t cut) over 25.04 m (15PEL012);

- 9.16 g/t Au

over 19.22 m (16PEL018);

- 10.36 g/t Au

over 17.40 m (15PEL020);

- 6.95 g/t Au

over 13.53 m (15PEL069); and

- 13.47 g/t Au

over 3.47 m (15PEL085).

2All reported historic composite widths are estimated true width

of the mineralized zones. Drillhole composite gold grades

reported as “cut” include higher grade samples which have been cut

to 40 g/t Au.

An initial 2,000 m of drilling was planned at

Cerro Pelon in 2024. Given the success to date, 8,864 m has been

completed and is reported in this release. High-grade gold and

silver mineralization is localized in pipe-like geometries at the

intersection of >500 m long north north-west structures, and

>400 m long east north-east structures, thought to represent

high sulphidation feeder zones. Drilling to date has defined

higher-grade mineralization 50 to 200 m below the Cerro Pelon pit

bottom. New highlights from this drilling include:

- 5.45 g/t Au over 27.90 m,

including 31.07 g/t Au over 1.25 m (24PEL048);

- 12.47

g/t Au (9.41 g/t cut) over 6.46 m, including 58.10 g/t Au (40.00

g/t cut) over 1.09m (24PEL048);

- 4.79 g/t

Au over 15.82 m (24PEL071);

- 4.46 g/t

Au over 15.40 m (24PEL051);

- 5.64 g/t

Au over 12.16 m (24PEL059);

- 5.77 g/t

Au over 9.81 m (24PEL067);

- 4.01 g/t

Au over 13.85 m (24PEL054);

- 4.42 g/t

Au over 9.55 m (24PEL066);

- 7.13 g/t

Au over 4.22 m (24PEL046);

- 4.46 g/t

Au over 5.07 m (24PEL070);

- 4.09 g/t

Au over 5.05 m (24PEL066);

- 3.22 g/t

Au over 6.38 m (24PEL074); and

- 4.73 g/t

Au over 3.57 m (24PEL054).

An objective of the 2024 drilling campaign is to

establish the shape and extent of the high-grade gold and silver

mineralization within the zones. Drilling to date has defined more

than five pipes with lateral dimensions ranging from 150 m by 100

m, to 75 m by 60 m, and vertical extents ranging between 40 m and

150 m. There is significant potential to expand the mineralization

in all directions with limited drilling completed beyond the five

feeders identified to date.

PDA – GAP-Victor, PDA3 and PDA Extension

Zones

PDA is a higher-grade underground deposit

located adjacent to the main Mulatos pit and is comprised of

multiple mineralized zones including PDA, Gap, Victor, and Estrella

(Figure 4). Ongoing exploration success has driven substantial

growth in the deposit over the past three years. In 2023, Mineral

Reserves increased 33% to 1.0 million ounces at 16% higher grades

of 5.61 g/t Au. Over the past two years, PDA’s Mineral Reserves

have more than doubled, at 20% higher grades. Combined Mineral

Reserves and Resources also increased 26% in 2023 to total 1.2

million ounces.

Given ongoing exploration success in 2024, and

with the deposit open in multiple directions, there is excellent

potential for this growth to continue. Over the past three years,

discovery costs at PDA have averaged $19 per ounce.

PDA is located adjacent to the Mulatos pit with

the underground deposit expected to be accessed from a ramp and

development drifts from within the pit. A development plan for PDA

will be released after market close today, based on Mineral

Reserves as of the end of 2023. Ongoing exploration success at PDA

and Cerro Pelon in 2024 represents upside to the project.

The initial focus of the surface exploration

program in 2024 has been on the GAP-Victor zones, and in the

relatively untested area between the PDA zones and GAP-Victor with

14,513 m of drilling completed to date. Another 10,937 m of

drilling was completed within PDA3 and PDA Extension. New

highlights from results received since the year end 2023 Mineral

Reserves and Resources include:

GAP-Victor Zone

- 5.43 g/t

Au over 18.05 m (23MUL278);

- 23.60

g/t Au over 3.00 m (24MUL302);

- 27.62

g/t Au (23.06 g/t cut) over 2.25 m (24MUL332);

- 12.28

g/t Au over 4.95 m (24MUL363);

- 5.77 g/t

Au over 8.65 m (24MUL304);

- 16.40

g/t Au over 1.50 m (24MUL294);

- 20.10

g/t Au over 1.20 m (24MUL304);

- 12.60

g/t Au over 1.90 m (24MUL273);

- 14.90

g/t Au over 1.50 m (24MUL314);

- 5.40 g/t

Au over 4.10 m (24MUL323);

- 8.97 g/t

Au over 2.10 m (24MUL290);

- 3.04 g/t

Au over 6.00 m (24MUL302);

- 15.90

g/t Au over 1.10 m (24MUL291); and

- 5.36 g/t

Au over 3.25 m (24MUL291).

PDA3 Zone

- 3.03 g/t

Au over 28.40 m (24MUL347);

- 6.63 g/t

Au over 5.50 m (24MUL365); and

- 8.09 g/t

Au over 2.70 m (24MUL349).

PDA Extension

- 36.20

g/t Au over 0.90 m (24MUL341);

- 3.51 g/t

Au over 5.05 m (24MUL315); and

- 4.16 g/t

Au over 4.20 m (24MUL283).

Qualified Persons

Scott R.G. Parsons, P.Geo., FAusIMM, Alamos

Gold’s Vice President, Exploration, has reviewed and approved the

scientific and technical information contained in this news

release. Scott R.G. Parsons is a “Qualified Person” as defined by

Canadian Securities Administrators’ National Instrument 43-101 -

Standards of Disclosure for Mineral Projects.

Exploration programs at Mulatos are directed and

supervised by Michele Cote, P.Geo., Alamos Gold’s Chief Exploration

Geologist, Corporate. Michele Cote is a “Qualified Person” as

defined by Canadian Securities Administrators’ National Instrument

43-101 - Standards of Disclosure for Mineral Projects.

Quality Assurance and Quality

Control

Alamos Gold maintains an internal Quality

Assurance / Quality Control (QA/QC) program at Mulatos to ensure

sampling and analysis of all exploration work is conducted in

accordance with best practices.

Access to the Mulatos Property is controlled by

security personnel. The drill core is logged and sampled at the

core logging facility within the mine site under the supervision of

a Qualified Geologist. A geologist marks the individual samples for

analysis, and sample intervals, based on lithology and alteration,

standards and blanks are entered into the database. The core is cut

in half using an electric core saw equipped with a diamond tipped

blade. One half of the core is placed into a micropore sample bag

and sealed with a cable tie in preparation for shipment. The other

half of the core is returned to the core box and retained for

future reference. The samples are placed in large heavy-duty nylon

reinforced micropore bags, which are identified and sealed before

being dispatched. The core samples are picked up at the mine site

and delivered to Bureau Veritas Commodities Canada Ltd. laboratory

in Hermosillo, Mexico.

Gold is analyzed by 30 grams Lead Collection

Fire Assay Fusion (FA) that ends with an Atomic Absorption

Spectroscopy finish (AAS). Samples greater than 5.0 g/t Au are

re-analyzed starting again with a FA process but ending with a

gravimetric finish (GRAV). Bureau Veritas is an ISO/IEC 17025

accredited laboratory and has internal quality control (“QC”)

programs that include insertion of reagent blanks, reference

materials, and pulp duplicates that are in line with normal

requirements, as well as participating in yearly proficiency tests

to evaluate lab performance.

The Corporation inserts QC samples (blanks and

reference materials) at regular intervals to monitor laboratory

performance. Cross check assays are completed on a regular basis in

a secondary accredited laboratory.

About Alamos

Alamos is a Canadian-based intermediate gold

producer with diversified production from three operations in North

America. This includes the Young-Davidson mine and Island Gold

District in northern Ontario, Canada, and the Mulatos District in

Sonora State, Mexico. Additionally, the Company has a strong

portfolio of growth projects, including the Phase 3+ Expansion at

Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos

employs more than 2,400 people and is committed to the highest

standards of sustainable development. The Company’s shares are

traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

|

Scott K. Parsons |

|

|

Senior Vice President, Corporate Development & Investor

Relations |

|

|

(416) 368-9932 x 5439 |

|

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release includes certain statements

that constitute forward-looking information within the meaning of

applicable Canadian and U.S. securities laws ("forward-looking

statements"). All statements in this news release other than

statements of historical fact, which address events, results,

outcomes or developments that Alamos expects to occur are

forward-looking statements. Forward-looking statements are

generally, but not always, identified by the use of forward-looking

terminology such as “continue”, “ongoing”, "expect", "plan",

"estimate", “target”, “objective”, “budget”, “opportunity” or

“potential” or variations of such words and phrases and similar

expressions or statements that certain actions, events or

results "may", "could", "would", "might" or "will" be taken,

occur or be achieved or the negative connotation of such terms.

Such statements in this news release include,

without limitation, statements with respect to planned exploration

programs and focuses, potential drilling targets, results and

related expectations, costs and expenditures, project economics,

gold grades, mineralization, expected growth of PDA deposit,

expected method of mining the PDA deposit and the intended method

of processing ore from the PDA deposit, planned PDA mill, initial

underground Mineral Resource at Cerro Pelon, mine life and expected

mine life extension at Mulatos, returns to stakeholders and other

information that is based on forecasts and projections of future

operational, geological or financial results, estimates of amounts

not yet determinable and assumptions of management.

A Mineral Resource that is classified as

"inferred" or "indicated" has a great amount of uncertainty as to

its existence and economic and legal feasibility. It cannot be

assumed that any or part of an "Indicated Mineral Resource" or

"Inferred Mineral Resource" will ever be upgraded to a higher

category of Mineral Resource. Investors are cautioned not to assume

that all or any part of mineral deposits in these categories will

ever be converted into Proven and Probable Mineral Reserves.

Alamos cautions that forward-looking statements

are necessarily based upon several factors and assumptions that,

while considered reasonable by management at the time of making

such statements, are inherently subject to significant business,

economic, technical, legal, political and competitive uncertainties

and contingencies. Known and unknown factors could cause actual

results to differ materially from those projected in the

forward-looking statements, and undue reliance should not be placed

on such statements and information.

These factors and assumptions include, but are

not limited to: the actual results of current exploration

activities; conclusions of economic and geological evaluations;

changes in project parameters as plans continue to be refined; any

impacts of any illnesses, diseases, epidemics or pandemics on

operations and the broader market, including the nature and

duration of any regulatory responses; state and federal orders or

mandates (including with respect to mining operations generally or

auxiliary businesses or services required for the Company’s

operations) in Mexico; changes in national and local government

legislation, controls or regulations; failure to comply with

environmental and health and safety laws and regulations; labour

and contractor availability (and being able to secure the same on

favourable terms); ability to sell or deliver gold doré bars;

disruptions in the maintenance or provision of required

infrastructure and information technology systems; fluctuations in

the price of gold or certain other commodities such as, diesel

fuel, natural gas, and electricity; operating or technical

difficulties in connection with mining or development activities,

including geotechnical challenges and changes to production

estimates (which assume accuracy of projected ore grade, mining

rates, recovery timing and recovery rate estimates and may be

impacted by unscheduled maintenance); changes in foreign exchange

rates (particularly the Canadian dollar, U.S. dollar, and Mexican

peso); the impact of inflation; employee and community relations;

litigation and administrative proceedings; disruptions affecting

operations; availability of and increased costs associated with

mining inputs and labour; delays in the development or updating of

mine and/or development plans; changes that may be required to the

intended method of accessing and mining the deposit at Puerto Del

Aire and changes related to the intended method of processing any

ore from the deposit at Puerto Del Aire; inherent risks and hazards

associated with mining and mineral processing including

environmental hazards, industrial accidents, unusual or unexpected

formations, pressures and cave-ins; the risk that

the Company’s mines may not perform as planned; uncertainty

with the Company's ability to secure additional capital to execute

its business plans; the speculative nature of mineral exploration

and development, risks in obtaining and maintaining necessary

licenses, permits and authorizations, contests over title to

properties; expropriation or nationalization of property; political

or economic developments in Canada or Mexico and other

jurisdictions in which the Company may carry on business in the

future; increased costs and risks related to the potential impact

of climate change; the costs and timing of construction and

development of new deposits; risk of loss due to sabotage, protests

and other civil disturbances; the impact of global liquidity and

credit availability and the values of assets and liabilities based

on projected future cash flows; and business opportunities that may

be pursued by the Company.

For a more detailed discussion of such risks and

other factors that may affect the Company's ability to achieve the

expectations set forth in the forward-looking statements contained

in this news release, see the Company’s latest 40-F/Annual

Information Form and Management’s Discussion and Analysis, each

under the heading “Risk Factors”, available on the SEDAR website at

www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should

be reviewed in conjunction with the information and risk factors

and assumptions found in this news release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether written or oral, or whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Note to U.S. Investors – Mineral Reserve

and Resource Estimates

Unless otherwise indicated, all Mineral Resource

and Mineral Reserve estimates included in this news release have

been prepared in accordance with National Instrument 43-101 -

Standards of Disclosure for Mineral Projects (“NI 43-101”) and the

Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”)

- CIM Definition Standards on Mineral Resources and Mineral

Reserves, adopted by the CIM Council, as amended (the “CIM

Standards”). NI 43-101 is a rule developed by the Canadian

Securities Administrators, which established standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Mining disclosure in the

United States was previously required to comply with SEC Industry

Guide 7 (“SEC Industry Guide 7”) under the United States Securities

Exchange Act of 1934, as amended. The U.S. Securities and Exchange

Commission (the “SEC”) has adopted final rules, to replace SEC

Industry Guide 7 with new mining disclosure rules under sub-part

1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K

1300”) which became mandatory for U.S. reporting companies

beginning with the first fiscal year commencing on or after January

1, 2021. Under Regulation S-K 1300, the SEC now recognizes

estimates of “Measured Mineral Resources”, “Indicated Mineral

Resources” and “Inferred Mineral Resources”. In addition, the SEC

has amended its definitions of “Proven Mineral Reserves” and

“Probable Mineral Reserves” to be substantially similar to

international standards.

Investors are cautioned that while the above

terms are “substantially similar” to CIM Definitions, there are

differences in the definitions under Regulation S-K 1300 and the

CIM Standards. Accordingly, there is no assurance any mineral

reserves or mineral resources that the Company may report as

“proven mineral reserves”, “probable mineral reserves”, “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources” under NI 43-101 would be the same had the

Company prepared the mineral reserve or mineral resource estimates

under the standards adopted under Regulation S-K 1300. U.S.

investors are also cautioned that while the SEC recognizes

“measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” under Regulation S-K 1300, investors

should not assume that any part or all of the mineralization in

these categories will ever be converted into a higher category of

mineral resources or into mineral reserves. Mineralization

described using these terms has a greater degree of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, investors are cautioned not

to assume that any measured mineral resources, indicated mineral

resources, or inferred mineral resources that the Company reports

are or will be economically or legally mineable.

Table 1: Select Composite Intervals from

new Surface Exploration Drilling and PDA and Cerro

Pelon

Composite intervals greater than 3 g/t Au

weighted average, capping values 40 g/t Au.

|

Hole ID |

Including |

From (m) |

To (m) |

Core Length (m) |

True Width (m) |

Au g/t uncut |

Au g/t cut |

Depth from Surface (m) |

|

23MUL273 |

|

139.90 |

141.80 |

1.90 |

1.90 |

12.60 |

12.60 |

136 |

|

23MUL274 |

|

172.55 |

173.15 |

0.60 |

0.60 |

3.15 |

3.15 |

163 |

|

23MUL276 |

|

176.20 |

179.65 |

3.45 |

3.45 |

3.51 |

3.51 |

167 |

|

23MUL276 |

|

205.75 |

206.30 |

0.55 |

0.55 |

7.97 |

7.97 |

194 |

|

23MUL277 |

|

107.40 |

108.90 |

1.50 |

1.50 |

4.20 |

4.20 |

106 |

|

23MUL278 |

|

65.25 |

83.30 |

18.05 |

18.05 |

5.43 |

5.43 |

74 |

|

23MUL279 |

|

109.75 |

112.00 |

2.25 |

2.25 |

3.01 |

3.01 |

109 |

|

24MUL283 |

|

249.10 |

253.30 |

4.20 |

4.20 |

4.16 |

4.16 |

246 |

|

24MUL290 |

|

133.10 |

135.20 |

2.10 |

2.10 |

8.97 |

8.97 |

129 |

|

24MUL291 |

|

176.15 |

177.25 |

1.10 |

1.10 |

15.90 |

15.90 |

169 |

|

24MUL291 |

|

167.45 |

170.70 |

3.25 |

3.25 |

5.36 |

5.36 |

162 |

|

24MUL292 |

|

117.60 |

118.40 |

0.80 |

0.80 |

3.86 |

3.86 |

109 |

|

24MUL293 |

|

255.90 |

257.60 |

1.70 |

1.70 |

4.22 |

4.22 |

253 |

|

24MUL294 |

|

273.00 |

274.50 |

1.50 |

1.50 |

16.40 |

16.40 |

107 |

|

24MUL302 |

|

158.85 |

161.85 |

3.00 |

3.00 |

23.60 |

23.60 |

156 |

|

24MUL302 |

|

189.60 |

195.60 |

6.00 |

6.00 |

3.04 |

3.04 |

156 |

|

24MUL303 |

|

268.40 |

270.40 |

2.00 |

2.00 |

3.83 |

3.83 |

100 |

|

24MUL304 |

|

51.80 |

60.45 |

8.65 |

8.65 |

5.77 |

5.77 |

52 |

|

24MUL304 |

|

159.65 |

160.85 |

1.20 |

1.20 |

20.10 |

20.10 |

149 |

|

24MUL304 |

|

145.35 |

149.85 |

4.50 |

4.50 |

3.22 |

3.22 |

137 |

|

24MUL304 |

|

176.95 |

178.25 |

1.30 |

1.30 |

4.73 |

4.73 |

165 |

|

24MUL311 |

|

394.50 |

395.10 |

0.60 |

0.60 |

3.06 |

3.06 |

389 |

|

24MUL312 |

|

187.75 |

188.35 |

0.60 |

0.60 |

4.01 |

4.01 |

174 |

|

24MUL314 |

|

137.00 |

138.50 |

1.50 |

1.50 |

14.90 |

14.90 |

125 |

|

24MUL314 |

|

197.30 |

200.00 |

2.70 |

2.70 |

3.31 |

3.31 |

181 |

|

24MUL315 |

|

77.45 |

82.50 |

5.05 |

5.05 |

3.51 |

3.51 |

44 |

|

24MUL315 |

|

68.35 |

70.15 |

1.80 |

1.80 |

3.12 |

3.12 |

38 |

|

24MUL317 |

|

163.40 |

165.55 |

2.15 |

2.15 |

4.38 |

4.38 |

162 |

|

24MUL318 |

|

217.50 |

218.20 |

0.70 |

0.70 |

3.48 |

3.48 |

211 |

|

24MUL319 |

|

175.20 |

176.25 |

1.05 |

1.05 |

3.01 |

3.01 |

170 |

|

24MUL323 |

|

240.75 |

244.85 |

4.10 |

4.10 |

5.40 |

5.40 |

233 |

|

24MUL323 |

|

198.85 |

199.70 |

0.85 |

0.85 |

3.08 |

3.08 |

191 |

|

24MUL326 |

|

157.15 |

158.10 |

0.95 |

0.95 |

3.77 |

3.77 |

111 |

|

24MUL331 |

|

114.35 |

116.70 |

2.35 |

2.35 |

4.02 |

4.02 |

112 |

|

24MUL332 |

|

56.75 |

59.00 |

2.25 |

2.25 |

27.62 |

23.06 |

52 |

|

24MUL333 |

|

88.50 |

89.35 |

0.85 |

0.85 |

5.20 |

5.20 |

88 |

|

24MUL341 |

|

310.20 |

311.10 |

0.90 |

0.90 |

36.20 |

36.20 |

297 |

|

24MUL343 |

|

278.25 |

279.10 |

0.85 |

0.85 |

4.17 |

4.17 |

278 |

|

24MUL344 |

|

236.25 |

238.95 |

2.70 |

2.70 |

3.41 |

3.41 |

229 |

|

24MUL345 |

|

242.80 |

243.35 |

0.55 |

0.55 |

3.22 |

3.22 |

243 |

|

24MUL347 |

|

343.10 |

371.50 |

28.40 |

28.40 |

3.03 |

3.03 |

356 |

|

24MUL349 |

|

373.95 |

376.65 |

2.70 |

2.70 |

8.09 |

8.09 |

371 |

|

24MUL350 |

|

276.00 |

277.65 |

1.65 |

1.65 |

3.22 |

3.22 |

273 |

|

24MUL355 |

|

153.45 |

154.95 |

1.50 |

1.50 |

4.61 |

4.61 |

152 |

|

24MUL358 |

|

126.80 |

127.30 |

0.50 |

0.50 |

3.16 |

3.16 |

127 |

|

24MUL359 |

|

207.20 |

209.60 |

2.40 |

2.40 |

5.46 |

5.46 |

197 |

|

24MUL361 |

|

120.60 |

121.25 |

0.65 |

0.65 |

3.04 |

3.04 |

119 |

|

24MUL361 |

|

133.90 |

135.30 |

1.40 |

1.40 |

11.20 |

11.20 |

132 |

|

24MUL361 |

|

141.95 |

142.80 |

0.85 |

0.85 |

3.41 |

3.41 |

140 |

|

24MUL362 |

|

113.35 |

116.75 |

3.40 |

3.40 |

4.18 |

4.18 |

115 |

|

24MUL363 |

|

44.45 |

45.95 |

1.50 |

1.50 |

4.04 |

4.04 |

40 |

|

24MUL363 |

|

66.15 |

71.10 |

4.95 |

4.95 |

12.28 |

12.28 |

61 |

|

24MUL363 |

|

214.00 |

214.60 |

0.60 |

0.60 |

3.83 |

3.83 |

191 |

|

24MUL365 |

|

271.05 |

276.55 |

5.50 |

5.50 |

6.63 |

6.63 |

260 |

|

24MUL365 |

|

329.70 |

332.55 |

2.85 |

2.85 |

4.11 |

4.11 |

315 |

|

24MUL365 |

|

347.80 |

348.75 |

0.95 |

0.95 |

3.42 |

3.42 |

331 |

|

24MUL367 |

|

272.90 |

273.45 |

0.55 |

0.55 |

23.50 |

23.50 |

268 |

|

24MUL370 |

|

300.35 |

301.25 |

0.90 |

0.90 |

5.70 |

5.70 |

283 |

|

24MUL371 |

|

270.95 |

272.35 |

1.40 |

1.40 |

3.30 |

3.30 |

243 |

|

24PEL042 |

|

218.90 |

220.50 |

1.60 |

0.92 |

3.08 |

3.08 |

183 |

|

24PEL046 |

|

123.65 |

139.95 |

16.30 |

4.22 |

7.13 |

7.13 |

128 |

|

24PEL048 |

|

80.90 |

124.30 |

43.40 |

27.90 |

5.45 |

5.45 |

71 |

|

|

including |

97.75 |

99.70 |

1.95 |

1.25 |

31.07 |

31.07 |

|

|

24PEL048 |

|

156.85 |

166.90 |

10.05 |

6.46 |

12.47 |

9.41 |

120 |

|

|

including |

165.20 |

166.90 |

1.70 |

1.09 |

58.10 |

40.00 |

|

|

24PEL051 |

|

126.30 |

156.20 |

29.90 |

15.40 |

4.46 |

4.46 |

122 |

|

24PEL054 |

|

186.65 |

236.90 |

50.25 |

13.85 |

4.01 |

4.01 |

204 |

|

24PEL054 |

|

150.45 |

150.45 |

12.95 |

3.57 |

4.73 |

4.73 |

151 |

|

24PEL055 |

|

110.10 |

113.10 |

3.00 |

1.89 |

3.84 |

3.84 |

85 |

|

24PEL055 |

|

141.15 |

144.30 |

3.15 |

1.98 |

3.10 |

3.10 |

109 |

|

24PEL057 |

|

155.80 |

156.70 |

0.90 |

0.59 |

16.70 |

16.70 |

117 |

|

24PEL059 |

|

260.70 |

286.60 |

25.90 |

12.16 |

5.64 |

5.64 |

243 |

|

24PEL066 |

|

263.80 |

294.70 |

30.90 |

9.55 |

4.42 |

4.42 |

271 |

|

24PEL066 |

|

225.00 |

241.35 |

16.35 |

5.05 |

4.09 |

4.09 |

220 |

|

24PEL066 |

|

250.15 |

251.00 |

0.85 |

0.26 |

3.17 |

3.17 |

237 |

|

24PEL067 |

|

150.90 |

168.00 |

17.10 |

9.81 |

5.77 |

5.77 |

131 |

|

24PEL070 |

|

144.00 |

158.15 |

14.15 |

5.07 |

4.46 |

4.46 |

140 |

|

24PEL071 |

|

265.20 |

298.90 |

33.70 |

15.82 |

4.79 |

4.79 |

249 |

|

24PEL074 |

|

260.45 |

273.20 |

12.75 |

6.38 |

3.22 |

3.22 |

229 |

Note : 24PEL series composites are calulated using a 2 g/t

Au cut-off with up to 7 m of internal waste. 23MUL and 24MUL series

composites are calculated using a 2 g/t Au cut-off with up to 5 m

of internal waste.

Table 2: Surface drill holes; azimuth,

dip, drilled length, and collar location at

surface(UTM Zone 12 NAD27)

|

Hole ID |

Azimuth |

Dip |

Drilled Length (m) |

UTM Easting (m) |

UTM Northing (m) |

UTM Elevation (m) |

|

23MUL273 |

305 |

-75 |

221.20 |

721510 |

3172231 |

1257 |

|

23MUL274 |

268 |

-70 |

230.50 |

721686 |

3172575 |

1159 |

|

23MUL276 |

305 |

-70 |

347.20 |

721538 |

3172040 |

1286 |

|

23MUL277 |

22 |

-78 |

239.40 |

721630 |

3172557 |

1164 |

|

23MUL278 |

0 |

-90 |

174.00 |

721602 |

3172373 |

1200 |

|

23MUL279 |

100 |

-80 |

479.40 |

721684 |

3172576 |

1159 |

|

24MUL280 |

336 |

-79 |

289.10 |

721992 |

3171545 |

1212 |

|

24MUL281 |

326 |

-46 |

193.50 |

721630 |

3172307 |

1220 |

|

24MUL282 |

210 |

-75 |

302.50 |

722379 |

3172560 |

973 |

|

24MUL283 |

245 |

-78 |

332.10 |

723002 |

3172406 |

952 |

|

24MUL284 |

245 |

-78 |

279.00 |

723257 |

3172212 |

949 |

|

24MUL285 |

274 |

-86 |

301.10 |

722032 |

3171599 |

1211 |

|

24MUL286 |

260 |

-58 |

195.85 |

721624 |

3172303 |

1220 |

|

24MUL287 |

140 |

-68 |

305.60 |

721372 |

3172189 |

1304 |

|

24MUL288 |

270 |

-78 |

201.00 |

721689 |

3172413 |

1167 |

|

24MUL289 |

150 |

-35 |

162.00 |

721359 |

3172417 |

1239 |

|

24MUL290 |

252 |

-75 |

209.30 |

721642 |

3172301 |

1221 |

|

24MUL291 |

6 |

-73 |

260.70 |

721283 |

3171771 |

1315 |

|

24MUL292 |

355 |

-67 |

182.30 |

721733 |

3172598 |

1156 |

|

24MUL293 |

330 |

-80 |

308.60 |

721416 |

3171812 |

1338 |

|

24MUL294 |

197 |

-21 |

455.40 |

721418 |

3172359 |

1229 |

|

24MUL295 |

80 |

-75 |

224.10 |

721650 |

3172252 |

1230 |

|

24MUL296 |

270 |

-60 |

291.95 |

721092 |

3170329 |

1363 |

|

24MUL297 |

349 |

-84 |

335.60 |

721517 |

3171872 |

1344 |

|

24MUL298 |

294 |

-68 |

299.10 |

721565 |

3172106 |

1268 |

|

24MUL299 |

270 |

-80 |

200.70 |

721598 |

3172262 |

1232 |

|

24MUL300 |

290 |

-65 |

324.00 |

721274 |

3170624 |

1324 |

|

24MUL301 |

283 |

-55 |

284.30 |

721564 |

3172106 |

1268 |

|

24MUL302 |

315 |

-76 |

220.10 |

721622 |

3172183 |

1246 |

|

24MUL303 |

97 |

-24 |

480.00 |

722438 |

3172366 |

981 |

|

24MUL304 |

155 |

-69 |

188.30 |

721690 |

3172411 |

1167 |

|

24MUL305 |

300 |

-65 |

258.00 |

721419 |

3170850 |

1236 |

|

24MUL306 |

40 |

-75 |

320.50 |

721670 |

3172283 |

1213 |

|

24MUL306B |

10 |

-75 |

320.50 |

721670 |

3172283 |

1213 |

|

24MUL307 |

302 |

-70 |

262.00 |

721555 |

3172074 |

1281 |

|

24MUL308 |

300 |

-60 |

306.00 |

722071 |

3170937 |

1101 |

|

24MUL309 |

304 |

-84 |

241.10 |

721490 |

3172216 |

1260 |

|

24MUL310 |

275 |

-66 |

200.50 |

721628 |

3172305 |

1220 |

|

24MUL311 |

337 |

-79 |

415.20 |

721964 |

3171936 |

1256 |

|

24MUL312 |

173 |

-68 |

200.50 |

721638 |

3172353 |

1202 |

|

24MUL313 |

300 |

-60 |

345.00 |

721860 |

3170802 |

1152 |

|

24MUL314 |

317 |

-65 |

290.00 |

721617 |

3172081 |

1268 |

|

24MUL315 |

180 |

-35 |

364.50 |

722315 |

3172375 |

993 |

|

24MUL316 |

30 |

-50 |

176.00 |

721491 |

3172278 |

1254 |

|

24MUL317 |

294 |

-80 |

355.10 |

721493 |

3172033 |

1290 |

|

24MUL318 |

335 |

-75 |

278.20 |

721301 |

3171801 |

1316 |

|

24MUL319 |

315 |

-76 |

263.10 |

721278 |

3171742 |

1320 |

|

24MUL320 |

284 |

-28 |

332.20 |

723258 |

3172207 |

949 |

|

24MUL321 |

350 |

-55 |

126.90 |

721491 |

3172278 |

1254 |

|

24MUL322 |

60 |

-80 |

206.10 |

721165 |

3172249 |

1260 |

|

24MUL323 |

328 |

-73 |

340.00 |

721460 |

3172014 |

1319 |

|

24MUL324 |

42 |

-39 |

462.00 |

722583 |

3171515 |

1044 |

|

24MUL325 |

220 |

-86 |

227.35 |

721704 |

3172175 |

1233 |

|

24MUL326 |

68 |

-44 |

351.00 |

723060 |

3172299 |

972 |

|

24MUL327 |

349 |

-83 |

248.35 |

721704 |

3172176 |

1233 |

|

24MUL328 |

355 |

-80 |

251.50 |

721593 |

3171998 |

1304 |

|

24MUL329 |

315 |

-68 |

437.00 |

722533 |

3171832 |

1172 |

|

24MUL330 |

279 |

-78 |

471.00 |

721919 |

3171974 |

1256 |

|

24MUL331 |

270 |

-76 |

160.10 |

721732 |

3172596 |

1155 |

|

24MUL332 |

200 |

-65 |

93.00 |

721581 |

3172367 |

1201 |

|

24MUL333 |

0 |

-80 |

114.00 |

721636 |

3172357 |

1202 |

|

24MUL334 |

315 |

-60 |

154.00 |

720767 |

3172121 |

1147 |

|

24MUL335 |

35 |

-70 |

281.50 |

720809 |

3172132 |

1144 |

|

24MUL336 |

290 |

-80 |

280.20 |

721420 |

3171812 |

1338 |

|

24MUL337 |

325 |

-25 |

159.00 |

721086 |

3172184 |

1231 |

|

24MUL338 |

183 |

-35 |

207.00 |

721464 |

3172408 |

1216 |

|

24MUL339 |

19 |

-76 |

281.20 |

721307 |

3171802 |

1316 |

|

24MUL340 |

43 |

-73 |

295.00 |

721283 |

3171770 |

1315 |

|

24MUL341 |

40 |

-72 |

333.00 |

722871 |

3172303 |

989 |

|

24MUL342 |

92 |

-86 |

372.00 |

722179 |

3172013 |

1160 |

|

24MUL343 |

82 |

-87 |

392.30 |

722174 |

3171910 |

1175 |

|

24MUL344 |

138 |

-74 |

265.00 |

722865 |

3172322 |

988 |

|

24MUL345 |

1 |

-87 |

400.00 |

722104 |

3171975 |

1199 |

|

24MUL346 |

257 |

-86 |

231.00 |

721637 |

3172076 |

1269 |

|

24MUL347 |

359 |

-84 |

417.50 |

721973 |

3171933 |

1256 |

|

24MUL348 |

219 |

-68 |

411.00 |

722119 |

3172066 |

1159 |

|

24MUL349 |

89 |

-81 |

400.00 |

722104 |

3171975 |

1199 |

|

24MUL350 |

150 |

-80 |

402.00 |

722047 |

3171836 |

1234 |

|

24MUL351 |

325 |

-62 |

160.10 |

721770 |

3172635 |

1149 |

|

24MUL352 |

355 |

-60 |

181.10 |

721690 |

3172410 |

1167 |

|

24MUL353 |

78 |

-74 |

250.50 |

721916 |

3172818 |

1130 |

|

24MUL354 |

140 |

-66 |

163.10 |

721641 |

3172673 |

1160 |

|

24MUL355 |

295 |

-80 |

186.00 |

721740 |

3172753 |

1155 |

|

24MUL356 |

131 |

-60 |

159.90 |

721771 |

3172636 |

1149 |

|

24MUL357 |

330 |

-65 |

250.50 |

721858 |

3173079 |

1072 |

|

24MUL358 |

140 |

-85 |

214.20 |

721641 |

3172672 |

1160 |

|

24MUL359 |

310 |

-71 |

358.10 |

721393 |

3171825 |

1338 |

|

24MUL360 |

319 |

-48 |

154.50 |

721736 |

3172646 |

1153 |

|

24MUL361 |

312 |

-79 |

190.30 |

721660 |

3172480 |

1175 |

|

24MUL362 |

160 |

-85 |

190.50 |

721773 |

3172784 |

1156 |

|

24MUL363 |

57 |

-63 |

238.00 |

721633 |

3172356 |

1202 |

|

24MUL364 |

0 |

-80 |

421.10 |

721973 |

3171933 |

1256 |

|

24MUL365 |

262 |

-70 |

402.00 |

722061 |

3171941 |

1219 |

|

24MUL366 |

25 |

-81 |

409.10 |

721974 |

3171933 |

1256 |

|

24MUL367 |

250 |

-78 |

355.50 |

722120 |

3172063 |

1159 |

|

24MUL368 |

110 |

-82 |

398.25 |

722105 |

3171976 |

1199 |

|

24MUL369 |

305 |

-82 |

198.00 |

721642 |

3172673 |

1160 |

|

24MUL370 |

337 |

-70 |

331.15 |

721399 |

3171820 |

1338 |

|

24MUL371 |

236 |

-64 |

321.00 |

721400 |

3172003 |

1330 |

|

24MUL372 |

155 |

-62 |

542.00 |

722557 |

3172094 |

1173 |

|

24MUL373 |

58 |

-63 |

228.00 |

721617 |

3172385 |

1196 |

|

24MUL374 |

300 |

-78 |

240.00 |

721630 |

3172558 |

1164 |

|

24MUL375 |

238 |

-79 |

502.00 |

722778 |

3171909 |

1209 |

|

24PEL042 |

71 |

-55 |

372.00 |

717973 |

3166170 |

1467 |

|

24PEL043 |

350 |

-60 |

237.00 |

718006 |

3166145 |

1458 |

|

24PEL044 |

351 |

-84 |

213.00 |

717983 |

3166238 |

1510 |

|

24PEL045 |

35 |

-60 |

207.00 |

717984 |

3166238 |

1510 |

|

24PEL046 |

35 |

-75 |

259.50 |

718020 |

3166367 |

1526 |

|

24PEL047 |

125 |

-63 |

455.25 |

717765 |

3166934 |

1447 |

|

24PEL048 |

230 |

-50 |

279.00 |

718156 |

3166235 |

1420 |

|

24PEL049 |

50 |

-70 |

456.00 |

717765 |

3166937 |

1447 |

|

24PEL050 |

235 |

-60 |

471.00 |

717148 |

3167221 |

1449 |

|

24PEL051 |

230 |

-59 |

382.50 |

718155 |

3166234 |

1420 |

|

24PEL052 |

221 |

-68 |

190.50 |

717982 |

3166236 |

1510 |

|

24PEL053 |

239 |

-66 |

273.00 |

718148 |

3166250 |

1424 |

|

24PEL054 |

229 |

-74 |

279.00 |

717983 |

3166236 |

1510 |

|

24PEL055 |

210 |

-51 |

172.50 |

718118 |

3166274 |

1441 |

|

24PEL056 |

194 |

-67 |

225.00 |

717982 |

3166236 |

1510 |

|

24PEL057 |

220 |

-49 |

195.00 |

718155 |

3166234 |

1420 |

|

24PEL058 |

45 |

-70 |

225.00 |

718020 |

3166366 |

1526 |

|

24PEL059 |

81 |

-62 |

354.80 |

717888 |

3166361 |

1577 |

|

24PEL060 |

70 |

-43 |

250.50 |

717786 |

3166067 |

1478 |

|

24PEL061 |

80 |

-42 |

228.00 |

717786 |

3166067 |

1478 |

|

24PEL062 |

80 |

-70 |

464.00 |

717888 |

3166361 |

1577 |

|

24PEL063 |

10 |

-70 |

252.00 |

718020 |

3166366 |

1525 |

|

24PEL064 |

80 |

-75 |

201.00 |

718020 |

3166366 |

1525 |

|

24PEL065 |

40 |

-63 |

243.00 |

718019 |

3166285 |

1495 |

|

24PEL066 |

247 |

-72 |

336.00 |

717983 |

3166238 |

1510 |

|

24PEL067 |

65 |

-55 |

202.50 |

718019 |

3166285 |

1495 |

|

24PEL068 |

101 |

-50 |

207.00 |

717786 |

3166067 |

1478 |

|

24PEL069 |

244 |

-78 |

96.00 |

717983 |

3166238 |

1506 |

|

24PEL070 |

235 |

-69 |

216.00 |

717983 |

3166238 |

1510 |

|

24PEL071 |

94 |

-62 |

330.00 |

717888 |

3166361 |

1577 |

|

24PEL072 |

244 |

-78 |

40.50 |

717983 |

3166238 |

1506 |

|

24PEL073 |

244 |

-78 |

223.50 |

717983 |

3166238 |

1506 |

|

24PEL074 |

65 |

-60 |

327.00 |

717888 |

3166361 |

1577 |

Figure 1: Puerto Del Aire and Cerro Pelon

Location Map, Mulatos District

Figure 2: Cerro Pelon – New Exploration

Highlights, Plan View

Figure 3: Cerro Pelon – Cross Section

Through Mineralization with New Exploration Highlights

Figure 4: Puerto Del Aire – New

Exploration Highlights, Plan View

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/84bdd582-1f0d-406e-8577-38f62b942ee4

https://www.globenewswire.com/NewsRoom/AttachmentNg/126252ce-ee38-47dd-be4d-a5e238844565

https://www.globenewswire.com/NewsRoom/AttachmentNg/59110573-e465-49cb-982e-37c768e17fe5

https://www.globenewswire.com/NewsRoom/AttachmentNg/68d3d464-6a3d-4346-aeeb-ab1bd988ec44

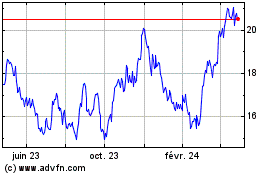

Alamos Gold (TSX:AGI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Alamos Gold (TSX:AGI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024