Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce the Company’s

unaudited financial results for the three months and six months

ended June 30, 2023 (“

Q2 2023”), and also to

provide a construction update on the Company’s Premier Gold Project

(“

PGP” or the “

project”), located

on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of

northwestern British Columbia. For details of the unaudited

condensed interim consolidated financial statements and

Management's Discussion and Analysis for the three and six months

ended June 30, 2023, please see the Company’s filings at

www.ascotgold.com or on SEDAR+ (www.sedarplus.ca).

Derek White, President and CEO, commented,

"Construction activity at the Premier Gold Project continued to

increase in the second quarter, with much progress being made on

the critical outdoor and earthworks areas, including the tailings

storage facility and new water treatment plant. As of Q2 2023,

detailed engineering and major procurement are substantially

complete, and project construction excluding mine development is at

48%.

Additionally, at the corporate level we have

made steady progress on important agreements including the signing

of a 3-year mining contract with Procon, the US$15 million

equipment lease facility with CAT Financial, and the US$14 million

convertible facility with Nebari.

The 2023 exploration program has been steadily

progressing, with encouraging results encountered in both the

drilling program and the IP geophysics program. We anticipate

starting to release exploration results in the coming weeks as we

receive them.”

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise

specified.

Q2 2023 AND RECENT

HIGHLIGHTS

- The earthworks

contract for the tailings storage facility was signed in March 2023

and the contractor was mobilized to the site in April 2023.

Tailings pond de-watering was completed in June 2023 and the

construction of the tailings storage facility commenced.

- On April 20,

2023, the Company closed a previously announced non-brokered

private placement (the “Offering”). The Offering raised total gross

proceeds of $4,050 and consisted of 5,000,000 common shares of the

Company, which qualify as "flow-through shares" within the meaning

of the Income Tax Act (Canada) (the “FT Shares”), at a price of

C$0.81 per FT Share. The proceeds from the Offering will be used to

fund the 2023 exploration program at PGP.

- On May 11, 2023,

the Company announced the 2023 exploration program at PGP. The

program consists of an initial 10,000 metres of surface drilling

and will include exploration drilling for resource expansion as

well as in-fill drilling of initial mining areas at the Big

Missouri and Premier deposits. The exploration drilling will focus

on extending the Day Zone at Big Missouri and the Sebakwe Zone

north of the Premier mill. Up to an additional 4,000 meters of

drilling have been budgeted and will be deployed towards surface

and underground drilling depending on results of the initial 10,000

metres. The 2023 exploration program commenced on June 21,

2023.

- On June 27,

2023, the Company closed a previously announced US$14 million

subordinated convertible credit facility (the “Convertible

Facility”) with Nebari Gold Fund 1, LP (“Nebari”). The full

proceeds from the Convertible Facility were used to repay

principal, accrued interest and fees of Ascot’s existing

subordinated convertible credit facility with Beedie Investments

Ltd. (“Beedie”).

- On July 31,

2023, the Company entered into a master lease agreement with

Caterpillar Financial Services (“CAT Financial”) for an equipment

lease facility up to US$15 million on an uncommitted basis for

surface mining equipment and construction equipment. The lease

terms of the equipment are 4 to 5 years at an interest rate of the

Canadian Dollar Offered Rate plus 4.25%.

- On August 8,

2023, the Company entered into a contract with Procon Mining &

Tunnelling Ltd. for underground mining services for an initial term

of 3 years with option to renew for two consecutive 1-year

periods.

PROJECT CONSTRUCTION

In January 2023, the Company closed a project

financing package consisting of US$110 million as a deposit in

respect of gold and silver streaming agreements (the “Stream”) and

a strategic equity investment (the “Strategic Investment”) of

C$45 million, a portion of which is structured as Canadian

Development Expenditures flow through shares, such that the total

gross proceeds to the Company were C$50 million. Upon securing the

new project financing, Ascot re-mobilized various contractors to

progress activities for the remainder of construction scope for the

Project. At the start of Q2 2023, there were approximately 118

employees and contractors working at the project site, and by the

end of the quarter on June 30, 2023, there were over 180 people

working at site.

Progress key performance indicators

(“KPI”) and budgetAt the end of Q2 2023, overall

construction excluding mine development was 48% complete, with

engineering at 99% and procurement at 99%. The Project remains on

schedule and budget for first gold production in the first quarter

of 2024. Capital costs, including mining, incurred as of June 30,

2023 were $200 million. As of June 30, 2023, the remaining project

construction capital required to complete construction and achieve

the first gold pour is approximately $110 million including mining

but excluding certain pre-operating costs and working capital. This

is slightly higher than the most recent total project budget of

$300 million to achieve first gold production reported in the

Company’s News Release dated December 12, 2022. The modest cost

increase is attributable to a slight delay of several weeks to

achieve initial gold production, which arose as the Company

progressed the detailed commissioning schedule. However, the target

for initial gold production in Q1 of 2024 is unchanged. The company

is assessing the working capital requirements as the project

progresses from commissioning to production and ramp up phases, and

is evaluating various potential financing options should additional

funding be required.

SafetyThe Project continues to

have an excellent safety record with 633,224 hours of work to date

and zero lost time incidents. The total recordable incident

frequency has been reduced from 1.28 at the end of Q1 2023, to 0.95

by the end of Q2 2023. However, with the increased activity on site

and additional work areas, the number of incidents has increased

including property damage, first aid injuries, and near misses.

Reporting activity has been encouragingly high, and the Company

will continue to work on proactive safety training and measures to

reduce overall incidents at the Project site.

Processing PlantMechanical work

continued in the mill during Q2 2023; various trommels, dust

collection and chute infrastructure were installed around the SAG

and Ball mills. The Intensive Leach Reactor was assembled.

Electricians continued installing electrical cabinetry, pulling

wire, installing cable trays, and working in the mine control

centre room. Piping installation at the mill is approximately 50%

complete. The tailings thickener and cyanide destruction tank

outside the mill was also substantially completed in the quarter.

Concrete and structural steel contractors also have been restarted

and their scope updated for the mill completion.

Tailings Storage Facility (“TSF”) and

Cascade Creek Diversion Channel (“CCDC”)The earthworks

contract for the TSF and CCDC was signed in March 2023 and the

contractor was mobilized to the site in April 2023. In order to

de-water the tailings facility for the required earthworks, an

additional temporary water treatment plant (“WTP”) was mobilized to

site and commissioned in May 2023. Despite minor issues with

initial ramp up, at the end of May the plant was operating at full

capacity and in combination with other discharge points, the TSF

was discharging near the permitted rate of 20,000 m3 per day.

By the end of June 2023, dewatering was completed and the temporary

WTP was demobilized. Drilling and blasting were started on the CCDC

in May, with a target of one blast of 7,000 to 8,000 m3 every other

day. To date, geological monitoring hasn’t noted potentially acid

generating (“PAG”) material, and work is progressing well. Work

continued at the TSF with earthworks contractors producing and

placing T-zone material at the south dam, preparing the foundation

at the east dam, blasting rock from the CCDC and bringing it to the

crusher plant. The earthworks contractor added a night shift at the

end of June to increase productivity.

Water Treatment Plant

(“WTP”)Crews have also made progress on the new WTP and

associated infrastructure, including the tailings thickener, lime

silos, moving bed bio-reactor (“MBBR”) tanks and clarifier

foundation pedestals. Construction remains targeted for July and

August to coincide with new WTP completion in September and

subsequent commissioning.

Site InfrastructureDuring Q2

2023, much work was completed on constructing the new electrical

substation near the Premier mill. With the substation mostly

complete, crews are now working on the 138kV power line to connect

to the power grid less than 500 metres away. Crews also have been

making progress on relocating the Big Missouri water pipeline from

one side of the Big Missouri haul road to the other, which is

expected to enhance the long-term safety and integrity of the

pipeline.

Mine DevelopmentAfter an

extensive and competitive process involving six contracting

companies, Ascot selected Procon Mining & Tunnelling (“Procon”)

for a 3-year contract to advance the underground portion of the

project. Procon is headquartered in Burnaby, BC and has extensive

underground mining experience in the province, including its

current mining and development contract at the nearby Brucejack

underground gold mine.

In 2022, work commenced on the S1 portal and

approximately 907 metres of underground development was completed

in the Big Missouri area before being paused for the winter. Procon

will pick up from this existing development and continue the ramp

and ore accesses as planned in September 2023, eventually

connecting over to the Silver Coin deposit.

In late summer 2023, Procon will also start a

new ramp development at the Premier deposit immediately adjacent to

the existing mill facilities. They will drive the initial access

ramp from surface down into the Premier deposit for initial mining

at the Prew zone and will eventually connect a footwall ramp over

to 602 area in the Premier deposit to commence mining there.

RecruitmentDuring Q2 2023,

Ascot hired and onboarded a full-time recruitment professional to

lead the Company’s staffing efforts as it advances towards

operations in 2024. Recruitment has already begun to ramp up for a

number of key positions added recently, including Health, Safety,

Training and Emergency Preparedness, Human Resources and Fixed

Maintenance Planner.

As recruitment efforts continue to ramp up in

the coming months. The interest in Ascot is high and many good

quality candidates continue to apply for open positions.

Encouragingly, local interest is high, as many applications are

coming from candidates in the area of Stewart and northwestern

B.C.

Permitting and Environmental

ComplianceAs a result of the project slowdown in 2022 due

to the required re-financing process, a Joint Permit Amendment

Application (“JPAA”) will be submitted in August 2023 to change

targeted conditions within the permit, mostly due to the delay of

meeting the new water treatment and quality requirements from

December 2022 to Q4 2023. In addition, a Mines Act Permit Amendment

(“MAPA”) was submitted in mid-June 2023 with respect to changing

the planned location of the Premier mine portal from the southern

location to an area much closer to the mill facility. All comments

and information requests from the Nisga’a Lisims Government have

been addressed and closed, and comments from the regulator are

expected to be finalized in the coming weeks.

2023 EXPLORATION PROGRAM

The exploration program commenced on June 21,

2023 when a drill rig was mobilized to the Prew zone of the Premier

deposit. The first nine drill holes have been completed and have

intercepted visual sulfide mineralization very close to expected

depth and corresponding stope locations. Visible gold was

intercepted in at least one of the drill holes. It appears that the

location and geometry of the mineralization at the Prew is well

defined and should provide a good starting point for mining

operations. Four more holes are planned in this area aiming at

extensions of stopes and gaps between designed stopes. On

completion of the drilling at the Prew zone, the rig will move up

to Big Missouri to conduct additional drilling in that area.

The ground geophysical induced polarization

(“IP”) survey commenced on June 26, 2023 and is now approximately

70% complete. The crew completed two grids, one near the Premier

mill targeting the western extension of the Sebakwe Zone that

yielded very good exploration results last year. The grid has been

designed to cover approximately 1,000 metres of strike extent to

the west of the drilling in 2022. It is not known if the Sebakwe

Zone extends further west and if so, where it is located in terms

of northing. The mineralization at Premier shows very well in

induced polarization data and preliminary results are highly

anticipated.

The second grid was completed around the

Dilworth deposit in the northern part of the property. The geology

of this area is not as well understood as Premier and Big Missouri

and the exploratory induced polarization data should help with

effective targeting of prospective areas. A third grid is currently

being laid out at the northern extension of the Day Zone. This area

has yielded very good exploration results in the last two years and

mineralization remains open towards the north and south. The strike

extent to the north could potentially connect the Day Zone with the

Martha Ellen deposit further north. The results from the IP survey

will be utilized for drill targeting in the second half of the 2023

field season.

FINANCIAL RESULTS FOR THE THREE MONTHS

ENDED JUNE 30, 2023

The Company reported a net loss of $3,073 for Q2

2023 compared to $1,054 for Q2 2022. The higher net loss in current

quarter is driven by a $2,262 loss on extinguishment of convertible

debt.

LIQUIDITY AND CAPITAL

RESOURCES

As at June 30, 2023, the Company had cash &

cash equivalents of $119,324 and working capital of $103,147. In H1

2023, the Company issued 120,048,007 common shares, no vested

warrants, 613,334 stock options, 32,665 deferred share units, no

restricted share units and no performance share units. Also,

520,250 stock options expired and 55,530 stock options, 352,006

deferred share units and 683,398 restricted share units were

exercised in H1 2023.

As at August 11, 2023, the Company had

555,909,153 common shares outstanding, 23,822,382 stock options,

13,710,500 vested share purchase warrants, 1,557,071 deferred share

units, 3,796,930 restricted share units and 108,108 performance

share units outstanding. Also, 25,767,777 unvested Prepayment

Warrants issued to Nebari are outstanding.

MANAGEMENT’S OUTLOOK FOR

2023

With the financing package closed on January 19,

2023 and refinancing of the existing convertible debt on June 28,

2023, the Company is focusing on the completion of construction of

the Project and achieving first gold production in early 2024. The

key activities for remainder of 2023 include:

- Construction of

the processing plant and associated surface infrastructure such

that the plant is expected to be in pre-commissioning by the end of

2023

- Completion of

the tailings dam improvements and start up of the new water

treatment plant by Q4 2023

- Advancement of

the Premier portal and underground development and additional

underground development of the Big Missouri mine, as well as

initial production stoping to provide mill feed for

commissioning.

- Maintaining a

Health and Safety record of zero lost time incidents and achieving

the 2023 goals outlined in the Company’s 2022 Sustainability

Report

- Advancing the

recruitment of site personnel in line with the site personnel plan

by the end of 2023

- Maintaining

permitting and environmental compliance so that there are no delays

in the project construction schedule

- More exploration

and infill drilling north and west of existing resources at the

Premier Northern Light and Day zone resources areas

CONSTRUCTION PROGRESS

PHOTOS

Figure 1 – New electrical substation

constructionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/f4031c7f-d5dd-4684-bcc5-a6386ed781c1

Figure 2 – New WTP

overviewhttps://www.globenewswire.com/NewsRoom/AttachmentNg/642c8f63-f145-45ef-99ce-a5d54f897a2f

Figure 3 – New WTP clarifier

constructionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/b3285f8d-f345-4bd2-8ef6-194c26bbf579

Figure 4 – New WTP MBBR tanks and

electrical

buildinghttps://www.globenewswire.com/NewsRoom/AttachmentNg/2bafa887-b5e7-46a1-8ba4-7161d952f378

Figure 5 – Tailings thickener and CN

destruction

tankhttps://www.globenewswire.com/NewsRoom/AttachmentNg/06e91084-3316-4373-88e1-63762df9fd29

Figure 6 – CCDC excavation

overviewhttps://www.globenewswire.com/NewsRoom/AttachmentNg/8e7bd5df-bf39-4ad0-b617-ba4609314307

Figure 7 – CCDC excavation looking

southhttps://www.globenewswire.com/NewsRoom/AttachmentNg/ecbed584-0a96-4e08-8ae7-bcb1d107d5f8

Figure 8 – Tailings south dam

earthworkshttps://www.globenewswire.com/NewsRoom/AttachmentNg/8de29e0f-56b0-44a9-bf0f-7cbb22739a66

Figure 9 – Temporary crushing plant for

tailings

earthworkshttps://www.globenewswire.com/NewsRoom/AttachmentNg/036c60dd-d6d5-48aa-b2b0-3c7c6b53d573

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

David Stewart, P.Eng.VP, Corporate Development & Shareholder

Communicationsdstewart@ascotgold.com778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian junior exploration and

development company focused on re-starting the past producing

Premier gold mine, located on Nisga’a Nation Treaty Lands, in

British Columbia’s prolific Golden Triangle. Ascot shares trade on

the TSX under the ticker AOT. Concurrent with progressing the

development of Premier, the Company continues to successfully

explore its properties for additional high-grade underground

resources. Ascot is committed to the safe and responsible

development of Premier in collaboration with Nisga’a Nation as

outlined in the Benefits Agreement.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedar.ca or visit

the Company’s web site at www.ascotgold.com, or for a virtual tour

visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could" or "might"

occur or be achieved and other similar expressions. All statements,

other than statements of historical fact, included herein are

forward-looking statements, including statements in respect of the

advancement and development of the PGP and the timing related

thereto, the exploration of the Company’s properties and

management’s outlook for the remainder of 2023 and beyond. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including risks associated with the business of Ascot;

risks related to exploration and potential development of Ascot's

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology, continuity and grade of mineral deposits; the need

for cooperation of government agencies and indigenous groups in the

exploration and development of properties and the issuance of

required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; risks associated with COVID-19

including adverse impacts on the world economy, construction timing

and the availability of personnel; and other risk factors as

detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR+ at

www.sedar.ca including the Annual Information Form of the Company

dated March 23, 2023 in the section entitled "Risk Factors".

Forward-looking statements are based on assumptions made with

regard to: the estimated costs associated with construction of the

Project; the timing of the anticipated start of production at the

Project; the ability to maintain throughput and production levels

at the Premier Mill; the tax rate applicable to the Company; future

commodity prices; the grade of Resources and Reserves; the ability

of the Company to convert inferred resources to other categories;

the ability of the Company to reduce mining dilution; the ability

to reduce capital costs; and exploration plans. Forward-looking

statements are based on estimates and opinions of management at the

date the statements are made. Although Ascot believes that the

expectations reflected in such forward-looking statements and/or

information are reasonable, undue reliance should not be placed on

forward-looking statements since Ascot can give no assurance that

such expectations will prove to be correct. Ascot does not

undertake any obligation to update forward-looking statements. The

forward-looking information contained in this news release is

expressly qualified by this cautionary statement.

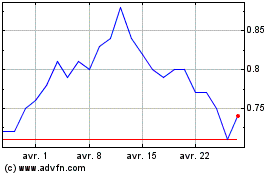

Ascot Resources (TSX:AOT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ascot Resources (TSX:AOT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025