Allied Properties Real Estate Investment Trust Announces 20% Growth in AFFO Per Unit in 2007 and Fifth Consecutive Annual Distri

08 Mars 2008 - 12:11AM

Marketwired

TORONTO, ONTARIO today announced results for the fourth quarter

and year ended December 31, 2007. On a fully diluted, per-unit

basis, Distributable Income ("DI"), Funds From Operations ("FFO")

and Adjusted Funds From Operations ("AFFO") were up in 2007 by 17%,

8% and 20%, respectively. The REIT's DI, FFO and AFFO payout ratios

for the year were at 76%, 76% and 84%, respectively.

The REIT also announced that its Trustees have approved a 5%

increase in monthly cash distributions from $0.105 per unit ($1.26

per unit annualized) to $0.11 per unit ($1.32 per unit annualized)

effective March, 2008. The increased distribution will be payable

on April 15, 2008, to unitholders of record on March 31, 2008.

"We brought our business to a new level in 2007," said Michael

Emory, President and CEO. "This enabled us to achieve top-tier

payout ratios and to announce today the largest of our five

consecutive annual distribution increases."

The financial results for the fourth quarter are summarized

below and compared to the same quarter in 2006:

(In thousands except for

per unit and % amounts) Q4 2007 Q4 2006 Change % Change

--------------------------------------------------------------

--------------------------------------------------------------

DI 10,626 6,562 4,064 61.9%

DI per unit (diluted) $0.423 $0.349 $0.074 21.2%

DI pay-out ratio 74.0% 86.8% (12.8%)

FFO 10,551 7,125 3,426 48.1%

FFO per unit (diluted) $0.420 $0.379 $0.041 10.8%

FFO pay-out ratio 74.6% 79.9% (5.3%)

AFFO 9,383 5,928 3,455 58.3%

AFFO per unit (diluted) $0.373 $0.315 $0.058 18.4%

AFFO pay-out ratio 83.8% 96.1% (12.3%)

--------------------------------------------------------------

The financial results for 2007 are summarized below and compared

to the 2006:

(In thousands except for

per unit and % amounts) 2007 2006 Change % Change

--------------------------------------------------------------

--------------------------------------------------------------

DI 39,258 23,982 15,276 63.7%

DI per unit (diluted) $1.653 $1.414 $0.239 16.9%

DI pay-out ratio 75.8% 85.3% (9.5%)

FFO 39,350 25,911 13,439 51.9%

FFO per unit (diluted) $1.656 $1.527 $0.129 8.4%

FFO pay-out ratio 75.6% 79.0% (3.4%)

AFFO 35,323 21,024 14,299 68.0%

AFFO per unit (diluted) $1.487 $1.239 $0.248 20.0%

AFFO pay-out ratio 84.3% 97.3% (13.0%)

--------------------------------------------------------------

In 2007, the REIT increased its leased area to 97.9% of total

GLA (not including Properties Under Development), increased

same-asset net operating income ("NOI") by 7.1% and completed $312

million in accretive acquisitions, all of which drove record

per-unit growth in DI, FFO and AFFO during the year. The REIT also

reduced the weighted average interest rate on its mortgages to 5.6%

and brought the weighted average term of its mortgages to seven

years. The REIT's debt ratio was 55.2% on December 31, 2007, and

declined to 50.5% following the closing on January 3, 2008, of the

offering of 2,900,000 units at a price of $20.75 per unit for gross

proceeds of $60 Million.

"We entered 2008 with a very strong balance sheet," added Mr.

Emory. "This will enable us to continue the systematic

consolidation of our target markets and to accelerate the pace of

our development and intensification activities."

DI, FFO, AFFO and NOI are not financial measures defined by

Canadian GAAP. Please see the REIT's MD&A for a description of

these measures and their reconciliation to net income or cash flow

from operations, as presented in the consolidated financial

statements of the REIT for the year ended December 31, 2007. These

statements, together with accompanying notes and MD&A, have

been filed with SEDAR, www.sedar.com, and are also available on the

REIT's web-site, www.alliedpropertiesreit.com.

This press release may contain forward-looking statements with

respect to the REIT, its operations, strategy, financial

performance and condition. These statements generally can be

identified by use of forward looking words such as "may", "will",

"expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The

actual results and performance of the REIT discussed herein could

differ materially from those expressed or implied by such

statements. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations.

Important factors that could cause actual results to differ

materially from expectations include, among other things, general

economic and market factors, competition, changes in government

regulations and the factors described under "Risk Factors" in the

Annual Information Form of the REIT which is available at

www.sedar.com. The cautionary statements qualify all

forward-looking statements attributable to the REIT and persons

acting on their behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and the REIT has no obligation to update such

statements.

Allied Properties REIT is the leading provider of Class I office

space in Canada, with portfolio assets in the urban areas of

Toronto, Montreal, Winnipeg, Quebec City and Kitchener. The

objectives of the REIT are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

Contacts: Allied Properties REIT Michael R. Emory President and

Chief Executive Officer (416) 977-9002 Email:

memory@alliedpropertiesreit.com Website:

www.alliedpropertiesreit.com

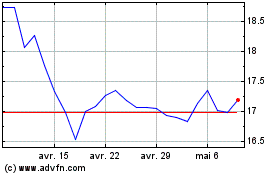

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024