Allied Properties Real Estate Investment Trust Announces Normal Course Issuer Bid

05 Janvier 2009 - 6:11PM

Marketwired

Allied Properties REIT (TSX: AP.UN) announced today that the

Toronto Stock Exchange ("TSX") has accepted its notice of intention

to conduct a normal course issuer Bid (the "Bid") to enable it to

purchase up to 3,003,667 of its 31,235,668 outstanding units

("Units"), representing approximately 10% of the REIT's public

float of 30,036,674 Units as of December 23, 2008, pursuant to TSX

rules.

Purchases under the Bid may commence on January 7, 2009, and

will terminate on the earlier of January 6, 2010, the date the REIT

completes its purchases pursuant to the notice of intention to make

a normal course issuer bid filed with the TSX or the date of notice

by the REIT of termination of the Bid. Purchases will be made on

the open market by the REIT through the facilities of the TSX in

accordance with the requirements of the TSX. The price that the

REIT will pay for any such Units will be the market price of such

Units on the TSX at the time of acquisition. Units purchased under

the Bid will be cancelled. Other than block purchases allowable

under TSX rules, purchases will be subject to a daily purchase

restriction of 14,457 Units, being 25% of the average daily trading

volume of 57,830 for the preceding six calendar months. The REIT

has not purchased any of its Units within the 12 months previous to

the date hereof.

The Trustees of the REIT believe that the Units have been

trading in a price range which does not adequately reflect the

value of such Units in relation to the REIT's business and future

prospects. As a result, the Trustees of the REIT believe that the

purchase of its Units would be in the best interests of the REIT.

Such purchases will increase the proportionate interest of, and may

be advantageous to, all remaining unitholders and may increase

liquidity to unitholders.

Allied Properties REIT is the leading owner and manager of Class

I office properties in Canada, with portfolio assets in the urban

areas of Toronto, Montreal, Winnipeg, Quebec City and Kitchener.

The objectives of the REIT are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

Contacts: Allied Properties Real Estate Investment Trust Michael

R. Emory President and Chief Executive Officer (416) 977-9002

Email: memory@alliedpropertiesreit.com

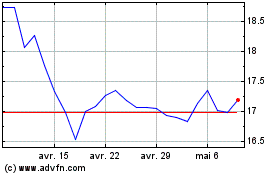

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024