Allied Properties Real Estate Investment Trust Announces Acquisition of Upgrade Opportunities in Vancouver and Montreal and Stra

19 Mai 2011 - 12:15AM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into

agreements to purchase the following upgrade opportunities for $56.3 million:

Total Office Retail Parking

Address GLA GLA GLA Spaces

----------------------------------------------------------------------------

948 Homer Street, Vancouver 45,321 22,031 23,290 7

5455 Avenue de Gaspe, Montreal 527,395 527,395 0 150

----------------------------------------------------------------------------

Total 572,716 549,426 23,290 157

----------------------------------------------------------------------------

Allied also announced that it has entered into an agreement to acquire an

undivided 50% interest in the retail component of Victory Lofts, a condominium

project nearing completion in Toronto's King & Spadina area. This agreement

augments the agreement announced in 2009 to acquire an undivided 50% interest in

the 92-stall underground commercial parking component of Victory Lofts, bringing

the estimated total consideration for the two components to approximately $4.9

million.

"We see an opportunity to add value to the Vancouver and Montreal properties in

the next 36 months through a combination of building and tenant upgrades and

mark-to-market re-leasing opportunities," said Michael Emory, President & CEO.

"The Toronto acquisition will afford a good yield on our capital and will add to

our competitive advantages at King & Spadina."

Thus far in 2011, Allied has completed three acquisitions for total

consideration of $40.7 million. Allied elected during the conditional period not

to proceed with the agreement to acquire 353 Water Street in Vancouver, which

was one of the four agreements announced on March 31, 2011. On closing of the

agreements announced today, Allied's acquisitions for 2011 will total $101.9

million.

Montreal Upgrade Opportunity

Located on the east side of de Gaspe Avenue in Montreal, in close proximity to

Allied's property at 5505 Saint-Laurent Boulevard, 5455 de Gaspe is a Class I

property with 527,395 square feet of GLA, 150 underground parking spaces and

19,000 square feet of surplus land. It is 85% leased to a large number of small

tenants on shorter-term leases at low rents. While carrying 5455 de Gaspe as a

rental property, Allied plans to upgrade the building and the tenant-base with a

view to boosting the annual net operating income ("NOI") materially over a

36-month period.

Vancouver Upgrade Opportunity

Located in Yaletown on the east side of Homer Street, between Nelson and Smithe

Streets, 948 Homer Street is a Class I property with 45,321 square feet of GLA

and seven surface parking spaces. It is fully leased to tenants consistent in

character and quality with Allied's tenant base. While carrying 948 Homer as a

rental property, Allied plans to upgrade the retail component and take advantage

of a mark-to-market opportunity on the office space, all with a view to boosting

the annual NOI materially over a 36-month period. The opportunity also exists to

add additional office floors to the property.

Toronto Acquisition

In March of 2009, Allied announced that it had entered into an agreement to

purchase an undivided 50% interest the 92-stall underground commercial parking

component of the Victory Lofts, a condominium project at 478 King Street West in

Toronto. Victory Lofts is adjacent to three of Allied's properties, 468 King

Street West, 500-522 King Street West and the King-Brant underground commercial

parking structure.

Allied has now entered into an agreement to purchase an undivided 50% interest

in the retail component of Victory Lofts, which is comprised of 6,552 square

feet of GLA. On closing, the retail component will be fully leased to tenants

consistent in character and quality with Allied's tenant base. Allied will

manage both the parking and the retail components on behalf of the co-owners.

This will enhance its significant operating control over surface and underground

commercial parking spaces and retail space in the King & Spadina area.

Closing and Financing of Acquisitions

The acquisitions of the upgrade opportunities in Vancouver and Montreal are

expected to close in June of 2011, subject to customary conditions, and the

acquisition of the interest in the parking and retail components of Victory

Lofts is expected to close in the third quarter of 2011, subject to condominium

registration. The purchase price for the upgrade opportunities represents a

capitalization rate of approximately 6% applied to the current annual NOI. The

purchase price for the parking and retail components of Victory Lofts represents

a capitalization rate of approximately 7% applied to the anticipated annual NOI.

On closing, all three properties will be free and clear of mortgage financing.

Allied will place first mortgage financing on the properties as it deems

advisable.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

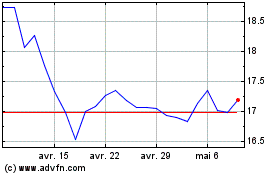

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024