Celestica Inc. (NYSE: CLS) (TSX: CLS), a leader in design,

manufacturing and supply chain solutions for the world's most

innovative companies, will host a previously-announced virtual

investor meeting today from 2:00 pm to 3:30 pm EDT. During the

meeting, Celestica’s management will discuss their multi-year

transformation and highlight their strategies for continued growth.

Additionally, management will provide an in-depth discussion

regarding the Hardware Platform Solutions business.

Celestica will discuss historical results, as

well as financial projections, objectives and targets, including

the following*:

- Anticipated 2022 revenue of $6.3+

billion

- Anticipated 2022 non-IFRS Lifecycle

Solutions revenue** growth of at least 10%

- Anticipated 2022 non-IFRS operating

margin** of between 4% and 5%

- Targeting 2022 non-IFRS free cash

flow** of at least $100 million

- Targeting 2022 non-IFRS adjusted

earnings per share (EPS)** of between $1.55 - $1.75

- Annual non-IFRS adjusted EPS**

growth objective through 2025 of 10%+

- Annual non-IFRS Lifecycle Solutions

revenue** growth objective through 2025 of 10%+

- Long term-non-IFRS operating

margin** objective of above 4%

- Targeting 2025 non-IFRS adjusted

EPS** of $2.00+

To participate in the conference call in

listen-only mode, please dial (conference ID – 9060024)

- Participant Toll-Free Dial-In

Number: (888)

440-2145

- Participant Toll Dial-In Number:

(438) 803-0540

To ensure your participation, please call in

approximately ten minutes prior to the scheduled start of the call.

Analysts will have the opportunity for a Q&A with speakers

following the formal remarks.

A webcast is also available at:

https://onlinexperiences.com/Launch/QReg/ShowUUID=B6269195-9AC6-4B88-B931-506EA3265540

A recorded webcast will be available

approximately two hours after completion of the call, and will

remain available for 12 months thereafter. To access the recorded

webcast visit www.celestica.com.

* Subject in all cases to the risks set forth in

the Cautionary Note Regarding Forward-Looking Statements below,

including, but not limited to, the impact of coronavirus 2019

disease and related mutations (COVID-19) and the constrained supply

chain environment.** Non-International Financial Reporting

Standards (IFRS) financial measures (including ratios based on

non-IFRS financial measures) do not have any standardized meanings

prescribed by IFRS and therefore may not be comparable to similar

financial measures presented by other public companies that use

IFRS or U.S. generally accepted accounting principles (GAAP). We do

not provide reconciliations for forward-looking non-IFRS financial

measures, as we are unable to provide a meaningful or accurate

calculation or estimation of reconciling items and the information

is not available without unreasonable effort. See “Non-IFRS

Measures” below.

About Celestica

Celestica enables the world's best brands.

Through our recognized customer-centric approach, we partner with

leading companies in Aerospace and Defense, Communications,

Enterprise, HealthTech, Industrial, Capital Equipment, and Energy

to deliver solutions for their most complex challenges. As a leader

in design, manufacturing, hardware platform and supply chain

solutions, Celestica brings global expertise and insight at every

stage of product development - from the drawing board to full-scale

production and after-market services. With talented teams across

North America, Europe and Asia, we imagine, develop and deliver a

better future with our customers.

For more information, visit

www.celestica.com.

Our securities filings can also be accessed at

www.sedar.com and www.sec.gov.

Cautionary Note Regarding

Forward-looking Statements

This press release contains forward-looking

statements, including, without limitation, financial projections

and guidance, as well as statements related to our targets,

objectives, expectations and anticipated operating results. Such

forward-looking statements may, without limitation, be preceded by,

followed by, or include words such as “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “targets,” “plans,”

“continues,” “project,” “potential,” “possible,” “contemplate,”

“seek,” or similar expressions, or may employ such future or

conditional verbs as “may,” “might,” “will,” “could,” “should,” or

“would,” or may otherwise be indicated as forward-looking

statements by grammatical construction, phrasing or context. For

those statements, we claim the protection of the safe harbor for

forward-looking statements contained in the U.S. Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws.

Forward-looking statements are provided to

assist readers in understanding management’s current expectations

and plans relating to the future. Readers are cautioned that such

information may not be appropriate for other purposes.

Forward-looking statements are not guarantees of future performance

and are subject to risks that could cause actual results to differ

materially from those expressed or implied in such forward-looking

statements, including, among others, risks related to customer and

segment concentration; price, margin pressures, and other

competitive factors and adverse market conditions affecting, and

the highly competitive nature of, the electronics manufacturing

services (EMS) industry in general and our segments in particular

(including the risk that anticipated market improvements do not

materialize); delays in the delivery and availability of

components, services and/or materials, as well as their costs and

quality; challenges of replacing revenue from completed, lost or

non-renewed programs or customer disengagements; our customers'

ability to compete and succeed using our products and services;

changes in our mix of customers and/or the types of products or

services we provide, including negative impacts of higher

concentrations of lower margin programs; managing changes in

customer demand; rapidly evolving and changing technologies, and

changes in our customers' business or outsourcing strategies; the

cyclical and volatile nature of our semiconductor business; the

expansion or consolidation of our operations; the inability to

maintain adequate utilization of our workforce; defects or

deficiencies in our products, services or designs; volatility in

the commercial aerospace industry; integrating and achieving the

anticipated benefits from acquisitions (including our acquisition

of PCI Private Limited (PCI)) and "operate-in-place" arrangements;

compliance with customer-driven policies and standards, and

third-party certification requirements; challenges associated with

new customers or programs, or the provision of new services; the

impact of our restructuring actions and/or productivity

initiatives, including a failure to achieve anticipated benefits;

negative impacts on our business resulting from newly-increased

third-party indebtedness; the incurrence of future restructuring

charges, impairment charges, other write-downs of assets or

operating losses; managing our business during uncertain market,

political and economic conditions, including among others,

geopolitical and other risks associated with our international

operations, including military actions, protectionism and reactive

countermeasures, economic or other sanctions or trade barriers,

including in relation to the evolving Ukraine/Russia conflict;

disruptions to our operations, or those of our customers, component

suppliers and/or logistics partners, including as a result of

events outside of our control, including, among others: U.S.

policies or legislation, U.S. and/or global tax reform, the

potential impact of significant tariffs on items imported into the

U.S. and related countermeasures, and/or the impact of (in addition

to coronavirus disease 2019 and related mutations (COVID-19) other

widespread illness or disease; the scope, duration and impact of

the COVID-19 pandemic, changes to our operating model; changing

commodity, materials and component costs as well as labor costs and

conditions; execution and/or quality issues (including our ability

to successfully resolve these challenges); non-performance by

counterparties; maintaining sufficient financial resources to fund

currently anticipated financial actions and obligations and to

pursue desirable business opportunities; negative impacts on our

business resulting from any significant uses of cash (including for

the acquisition of PCI), securities issuances, and/or additional

increases in third-party indebtedness (including as a result of an

inability to sell desired amounts under our uncommitted accounts

receivable sales program); operational impacts that may affect

PCI’s ability to achieve anticipated financial results; foreign

currency volatility; our global operations and supply chain;

competitive bid selection processes; customer relationships with

emerging companies; recruiting or retaining skilled talent; our

dependence on industries affected by rapid technological change;

our ability to adequately protect intellectual property and

confidential information; increasing taxes, tax audits, and

challenges of defending our tax positions; obtaining, renewing or

meeting the conditions of tax incentives and credits; the

management of our information technology systems, and the fact that

while we have not been materially impacted by computer viruses,

malware, ransomware, hacking attempts or outages , we have been

(and may continue to be) the target of such events; the inability

to prevent or detect all errors or fraud; the variability of

revenue and operating results; unanticipated disruptions to our

cash flows; compliance with applicable laws and regulations; our

pension and other benefit plan obligations; changes in accounting

judgments, estimates and assumptions; our ability to maintain

compliance with applicable credit facility covenants; interest rate

fluctuations and the discontinuation of LIBOR; our ability to

refinance our indebtedness from time to time; deterioration in

financial markets or the macro-economic environment; our credit

rating; the interest of our controlling shareholder; current or

future litigation, governmental actions, and/or changes in

legislation or accounting standards; negative publicity; that we

will not be permitted to, or do not, repurchase subordinate voting

shares (SVS) under any normal course issuer bid (NCIB); the impact

of climate change; and our ability to achieve our environmental,

social and governance (ESG) initiative goals, including with

respect to diversity and inclusion and climate change. The

foregoing and other material risks and uncertainties are discussed

in our public filings at www.sedar.com and www.sec.gov, including

in our most recent MD&A, our most recent Annual Report on Form

20-F filed with, and subsequent reports on Form 6-K furnished to,

the U.S. Securities and Exchange Commission, and as applicable, the

Canadian Securities Administrators.

The forward-looking statements contained in this

press release are based on various assumptions, many of which

involve factors that are beyond our control. Our material

assumptions include continued growth (and recovery from adverse

impacts due to COVID-19) in the broader economy, supporting the

expected growth outlook in Celestica’s end markets; continued

growth in the trend of manufacturing outsourcing from customers in

diversified end markets, supporting the expected long-term growth

of Celestica’s Advanced Technology Solutions (ATS) segment; no

further material impact (other than that which is already

anticipated) on revenues and costs as a result of COVID-19 related

issues, including but not limited to, measures from governments to

curb the spread of the virus and potential mutations, negative

impacts on global supply chains, and no significant negative

impacts to Celestica’s operations which would adversely affect

revenues, gross margins or non-IFRS operating margin; normal

customer retention rates and the impact of expected new program

wins, transfers, losses or disengagements; no unforeseen changes in

our mix of customers and/or the types of products or services we

provide; no unforeseen adverse impacts from the potential impact of

the pace of technological changes, customer outsourcing, program

transfers, and the global economic environment; no undue negative

impact on our customers' ability to compete and succeed using our

products and services from unforeseen developments in the broader

economy, or in those customers’ industries; no unforeseen material

price, margin pressures, or other competitive factors or adverse

market conditions affecting the EMS industry in general or our

segments in particular, as well as those related to the following:

scope and duration of materials constraints and the COVID-19

pandemic, and their impact on our sites, customers and our

suppliers; fluctuation of production schedules from our customers

in terms of volume and mix of products or services; the timing and

execution of, and investments associated with, ramping new

business; the success of our customers’ products; our ability to

retain programs and customers; the stability of general economic

and market conditions, and currency exchange rates; supplier

performance and quality, pricing and terms; compliance by third

parties with their contractual obligations; the costs and

availability of components, materials, services, equipment, labor,

energy and transportation; that our customers will retain liability

for/component tariffs and countermeasures; global tax legislation

changes; our ability to keep pace with rapidly changing

technological developments; the timing, execution and effect of

restructuring actions; the successful resolution of quality issues

that arise from time to time; the components of our leverage ratio

(as defined in our credit facility); our ability to successfully

diversify our customer base and develop new capabilities; the

availability of resources for, and the permissibility under our

credit facility of, repurchases of outstanding SVS under NCIBs, and

compliance with applicable laws and regulations pertaining to

NCIBs; compliance with applicable credit facility covenants;

anticipated demand strength in certain of our businesses;

anticipated demand weakness in, and/or the impact of anticipated

adverse market conditions on, certain of our businesses; and that:

anticipated financial results by PCI will be achieved; we are able

to successfully integrate PCI, further develop our ATS segment

business, and achieve the other expected synergies and benefits

from the acquisition; all financial information provided by PCI is

accurate and complete, and all forecasts of PCI’s operating results

are reasonable and were provided to Celestica in good faith; and we

will continue to have sufficient financial resources to fund

currently anticipated financial actions and obligations and to

pursue desirable business opportunities. Although management

believes its assumptions to be reasonable under the current

circumstances, they may prove to be inaccurate, which could cause

actual results to differ materially (and adversely) from those that

would have been achieved had such assumptions been accurate.

Forward-looking statements speak only as of the date on which they

are made, and we disclaim any intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

All forward-looking statements attributable to

us are expressly qualified by these cautionary statements.

Non-IFRS Financial Measures

The non-IFRS financial measures included in this

press release are: non-IFRS operating margin, non-IFRS free cash

flow, non-IFRS adjusted EPS, and non-IFRS Lifecycle Solutions

revenue (each as defined below). These non-IFRS measures do not

have any standardized meanings prescribed by IFRS and may not be

comparable to similar measures presented by other public companies

that use IFRS, or who report under U.S. GAAP and use non-GAAP

measures to describe similar operating metrics. Non-IFRS financial

measures are not measures of performance under IFRS and should not

be considered in isolation or as a substitute for any IFRS

financial measure.

Management uses these measures to assess

operating performance and the effective use and allocation of

resources; to provide more meaningful period-to-period comparisons

of operating results; and to enhance investors’ understanding of

the core operating results of Celestica’s business. We believe

investors use both IFRS and non-IFRS measures to assess

management's past, current and future decisions associated with our

priorities and our allocation of capital, as well as to analyze how

our business operates in, or responds to, swings in economic cycles

or to other events that impact our core operations.

We do not provide reconciliations for

forward-looking non-IFRS financial measures, as we are unable to

provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without

unreasonable effort. This is due to the inherent difficulty of

forecasting the timing or amount of various events that have not

yet occurred, are out of our control and/or cannot be reasonably

predicted, and that would impact the most directly comparable

forward-looking IFRS financial measure. For these same reasons, we

are unable to address the probable significance of the unavailable

information. Forward-looking non-IFRS financial measures may vary

materially from the corresponding IFRS financial measures.

Definitions:

Lifecycle Solutions revenue is defined as the

aggregate revenues of our ATS segment and our Hardware Platform

Solutions business.

Non-IFRS operating margin is defined as non-IFRS

operating earnings divided by revenue. Non-IFRS operating earnings

is a non-IFRS financial measure and is defined as earnings (loss)

before income taxes, Finance Costs (defined below), employee

stock-based compensation expense, amortization of intangible assets

(excluding computer software) and Other Charges (recoveries)

(defined below).

Non-IFRS free cash flow is defined as cash

provided by (used in) operations after the purchase of property,

plant and equipment (net of proceeds from the sale of certain

surplus equipment and property), lease payments and Finance Costs

paid (excluding any debt issuance costs and when applicable, waiver

fees related to our credit facility). We do not consider debt

issuance costs or such waiver fees (when applicable) to be part of

our ongoing financing expenses. As a result, these costs are

excluded from total Finance Costs paid in our determination of

non-IFRS free cash flow. Note, however, that non-IFRS free cash

flow does not represent residual cash flow available to Celestica

for discretionary expenditures.

Non-IFRS adjusted EPS is determined by dividing

non-IFRS adjusted net earnings by the number of diluted weighted

average shares outstanding. Non-IFRS adjusted net earnings is a

non-IFRS financial measure and is defined as IFRS net earnings

(loss) before employee stock-based compensation expense,

amortization of intangible assets (excluding computer software),

Other Charges (recoveries), and adjustments for taxes (representing

the tax effects of our non-IFRS adjustments and non-core tax

impacts (tax adjustments related to acquisitions, and certain other

tax costs or recoveries related to restructuring actions or

restructured sites)).

Finance Costs consist of interest expense and

fees related to our credit facility (including debt issuance and

related amortization costs), our interest rate swap agreements, our

accounts receivable sales program and customer supplier financing

programs, and interest expense on our lease obligations, net of

interest income earned.

Other Charges (recoveries) consist of

restructuring charges, net of recoveries, transition costs (costs

related to, when applicable: the relocation of our Toronto

manufacturing operations and the move of our corporate headquarters

into and out of a temporary location; and manufacturing line

transfers from closed sites); net impairment charges; Acquisition

Costs (as defined below); legal settlements (recoveries); and

specified credit facility-related charges.

Acquisition Costs consist of

acquisition-related consulting, transaction and integration costs,

and charges or releases related to the remeasurement of

indemnification assets or the release of indemnification or other

liabilities recorded in connection with acquisitions.

Contacts:

Celestica Global Communications

(416) 448-2200

media@celestica.com

Celestica Investor Relations

(416) 448-2211

clsir@celestica.com

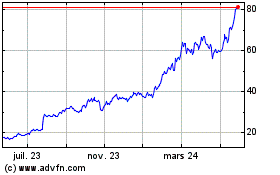

Celestica (TSX:CLS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

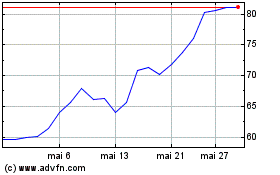

Celestica (TSX:CLS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025