Dundee Corporation Strengthens Commitment to Core Strategy and Announces the Sale of its Investment Management Business

30 Septembre 2024 - 11:01PM

Dundee Corporation (TSX: DC.A) (the “

Company” or

“

Dundee”) announced today that, in alignment with

its commitment to its core strategic objectives, it has entered

into a definitive agreement to sell its investment management

business (the “

Investment Management Business”)

operated through Goodman & Company, Investment Counsel Inc. to

Next Edge Capital Corp. (“

Next Edge”) (the

“

Transaction”). The decision to sell the

Investment Management Business enables the Company to enhance its

focus on its core investment strategy while streamlining operations

and further rationalizing its cost structure.

Lila Manassa Murphy, Executive Vice President

and Chief Financial Officer of Dundee, commented:

“This transaction represents a significant

strategic step toward cost rationalization, allowing us to more

fully concentrate our resources on our core investment strategy.

While these funds have played a significant role in Dundee’s

history, this move ensures we can streamline our operations and

optimize our expense structure. As we look to the future, we are

well-positioned to capitalize on investment and growth

opportunities for the benefit of our shareholders.”

Rob Anton, President of Next Edge,

commented:

“We are excited to close on this transaction and

we look forward to further diversifying our alternative and

value-added product offerings in Canada.”

The Transaction is subject to customary closing

conditions, including regulatory approval and the approval of the

unitholders of CMP 2023 Resource Limited Partnership (“CMP

2023”) and the shareholders of Dundee Global Fund

Corporation (“Dundee Global Fund”).

Unitholders of CMP 2023 and shareholders of

Dundee Global Fund will be asked to approve the change of manager

at a special meeting. Details about the Transaction will be

contained in the meeting materials mailed to unitholders and

shareholders.

Following the closing of the Transaction, Next

Edge will become investment fund manager and portfolio manager of

both CMP 2023 and Dundee Global Fund.

CMP 2023 and Dundee Global Fund referred the

Transaction to their independent review committee (the

“IRC”), and the IRC determined that, if

implemented, the Transaction would achieve a fair and reasonable

result for CMP 2023 and Dundee Global Fund.

ABOUT DUNDEE

CORPORATION

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

is an active investor focused on delivering long-term, sustainable

value as a trusted partner in the mining sector with more than 30

years of experience making accretive mining investments.

ABOUT NEXT EDGE CAPITAL

CORP.

Next Edge Capital Corp. is an investment fund

manager and a leader in the structuring and distribution of

alternative, private credit and value-added fund products in

Canada. The firm is led by an experienced management team that has

launched numerous investment solutions in a variety of product

structures and has been responsible for raising over $3 billion of

alternative assets since 2000.1 Next Edge specializes and focuses

on providing unique, non-correlated pooled investment vehicles to

the Canadian marketplace.

FORWARD-LOOKING

STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects the Company’s current expectations

regarding future events. Forward- looking information is based on a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond the Company’s control,

which could cause actual results and events to differ materially

from those that are disclosed in or implied by such forward-looking

information. Such risks and uncertainties include, but are not

limited to, the factors discussed under “Risk Factors” in the

Annual Information Form of the Company and subsequent filings made

with securities commissions in Canada. The Company does not

undertake any obligation to update such forward-looking

information, whether as a result of new information, future events

or otherwise, except as expressly required by applicable law.

FOR FURTHER

INFORMATION PLEASE

CONTACT:

Investor and Media Relations T: (416) 864-3584E:

ir@dundeecorporation.com

1 Please note that over CAD $2 billion of the CAD $3 billion of

alternative assets raised relates to assets that were raised at a

previous firm(s).

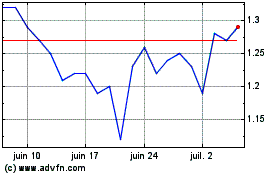

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024