DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company”, “we”,

“our”, “us” or “ours”) (TSX: DRT; OTC: DRTTF), a leader in

industrialized construction, today announced its financial results

for the three and nine months ended September 30, 2024. All

financial information in this news release is presented in U.S.

dollars, unless otherwise stated.

Third Quarter 2024

Highlights

- Revenue of $43.4 million in the third quarter of 2024, a

decrease of 12% from the prior year period.

- Gross profit increased to 38.8% of revenue in the third quarter

of 2024 from 34.4% of revenue in the third quarter of 2023.

- Net income after tax and net income margin for the third

quarter of 2024 of $7.1 million and 16.3%, respectively, compared

to a net loss after tax of $6.3 million and net loss margin of

12.7% in the third quarter of 2023.

- Adjusted EBITDA(1) was $4.1 million (9.4% of revenue) in the

third quarter of 2024, compared to $5.3 million (10.6% of revenue)

in the third quarter of 2023.

- Liquidity, comprising unrestricted cash and available

borrowings, was $34.3 million at September 30, 2024 compared to

$35.0 million at December 31, 2023.

- On August 2, 2024, the Company and 22NW Fund, LP (“22NW”)

closed a private repurchase of convertible debentures (the

“Debenture Repurchase”) in which the Company purchased for

cancellation an aggregate of C$18,915,000 principal amount of its

6.00% convertible unsecured debentures due January 31, 2026 (the

“January Debentures”) and C$13,638,000 principal amount of its

6.25% convertible unsecured debentures due December 31, 2026 (the

“December Debentures” and collectively with the January Debentures,

the “Debentures”). As at September 30, 2024, C$16,642,000 principal

amount of the January Debentures and C$15,587,000 principal amount

of the December Debentures remained outstanding, and 22NW no longer

holds any Debentures.

- On August 2, 2024, the Board of Directors adopted the amended

and restated shareholder rights plan (the “Amended and Restated

SRP”) which supersedes the plan adopted on March 22, 2024 and was

approved by the Company’s shareholders at a special meeting held on

September 20, 2024 (the “SRP Meeting”). The Company also entered

into a support and standstill agreement (the “Support Agreement”)

with 22NW, DIRTT’s largest shareholder, and WWT Opportunity #1 LLC

(“WWT”), DIRTT’s second largest shareholder. The Support Agreement

replaces the previously announced support and standstill agreement

entered into with 22NW on March 22, 2024.

- On August 28, 2024, the Company commenced a normal course

issuer bid for the Company’s Debentures, which permits DIRTT to

acquire up to C$1,664,200 principal amount of the January

Debentures and C$1,558,700 principal amount of the December

Debentures (the "NCIB"). As at September 30, 2024, C$0.1 million

and C$nil principal amounts of the December Debentures and January

Debentures were acquired through the NCIB, respectively.

(1) See “Non-GAAP Financial Measures”

Management Commentary

Benjamin Urban, chief executive officer,

remarked “We are continuing on our Journey to Excellence. Our

financial position remains strong and we believe we have a robust

short- and long-term pipeline. We recently finalized a commercial

strategy that will diversify our business and have new senior

leadership across key parts of the organization to help drive this

forward. Our key differentiators, including a custom, adaptable

product, industry-leading delivery time and sustainability benefits

continue to attract end customers seeking a better alternative to

traditional construction. With regard to the Falkbuilt litigation,

we are very pleased with the decision of the Court of King’s Bench

of Alberta to schedule a trial after December 8, 2025 and before

June 30, 2026. We have confidence in the strength of our case

and are glad that this matter will finally be heard in court. On

the U.S. Falkbuilt litigation, we are seeking $100 million of

damages as part of the second amended complaint.”

Fareeha Khan, chief financial officer, added “We

are reporting another quarter of positive Adjusted EBITDA despite

lower revenue compared to the prior year quarter. As we plan for

2025, we are aligning our budget and investments with our strategic

priorities of revenue growth, innovation, reinvesting in our ICE

software and talent development.”

Third Quarter 2024 Results

Third quarter 2024 revenue was $43.4 million, a

decrease of $6.2 million, or 12.4%, from $49.5 million for the same

period of 2023, and an increase of $2.2 million, or 5.3%, from the

second quarter of 2024. Third quarter revenue was in line with the

expected guidance range of $40 million to $44 million provided last

quarter. The decrease in revenue, as compared to the same period of

2023, was primarily the result of three large commercial projects

and one large healthcare project that were completed in the third

quarter of 2023 and were not repeated in the same period in 2024,

partially offset by higher volume in the education sector.

Gross profit and gross profit margin for the

quarter ended September 30, 2024 were $16.8 million or 38.8% of

revenue, a decrease of $0.3 million from $17.1 million or 34.4% of

revenue for the quarter ended September 30, 2023. Adjusted Gross

Profit (see “Non-GAAP Financial Measures”) for the three months

ended September 30, 2024 was $17.6 million, a decrease of $0.7

million from $18.3 million for the third quarter of 2023. Adjusted

Gross Profit Margin (see “Non-GAAP Financial Measures”) for the

third quarter of 2024 was 40.7% as compared to 36.9% in the

comparative period of 2023. These increases in Adjusted Gross

Profit Margin are the result of improved material optimization to

offset the inflationary impacts on material costs.

Sales and marketing expenses decreased by $1.0

million to $5.2 million for the three months ended September 30,

2024 from $6.2 million for the three months ended September 30,

2023. The decrease was driven by a $0.4 million decrease in

commissions, a $0.3 million decrease in salaries and benefits

costs, a $0.3 million decrease in pass through charges, and a $0.2

million decrease in other individual costs, offset by a $0.2

million increase in marketing and tradeshow expenses related to the

“Partner Camp” event hosted by the Company for our construction

partners held at the end of the third quarter of 2024.

General and administrative expenses increased by

$1.2 million to $5.8 million for the three months ended September

30, 2024, from $4.7 million for the three months ended September

30, 2023. The increase was primarily related to a $1.1 million

increase in professional services costs, a $0.1 million increase in

salaries and benefits costs, and a $0.1 million increase in

building costs, offset by a $0.1 million decrease in office costs,

and a $0.1 million decrease in communications costs. Professional

services costs increased as a result of the special meeting held in

the third quarter, the private repurchase of convertible

debentures, the Support Agreement and the normal course issuer bid

that we commenced during the third quarter.

Operations support is comprised primarily of

project managers, order entry and other professionals that

facilitate the integration of our construction partner project

execution and our manufacturing operations. Operations support

expenses for the three months ended September 30, 2024 were $1.9

million, an increase of $0.1 million from $1.8 million for the

comparative period of 2023.

Technology and development expenses increased by

$0.1 million to $1.3 million for the three months ended September

30, 2024 from $1.2 million for the three months ended September 30,

2023. This increase was primarily related to a $0.1 million

increase in professional services costs.

Stock-based compensation expense for the three

months ended September 30, 2024 was $0.8 million compared to $1.1

million in the same period of 2023. The decrease in this expense

was largely due to a higher number of RSUs outstanding in the prior

year’s period compared to the third quarter of 2024. The decrease

in RSU expense was offset by a higher DSU expense, as a result of a

higher share price during the third quarter of 2024 compared to the

third quarter of 2023.

During the quarter, the Company incurred $0.6

million in reorganization costs, which related primarily to

movement of equipment from the closed Rock Hill facility to the

manufacturing facility in Calgary. The Company is in the process of

moving the remaining assets at the Rock Hill facility to other

operating locations.

During the first nine months of 2024, C$43.1

million ($31.7 million) of principal amount of Debentures was

repurchased for cancellation through a substantial issuer bid

completed in the first quarter of 2024, a private repurchase, and a

normal course issuer bid which triggered an extinguishment of debt.

The gain on extinguishment of $7.5 million for the three months

ended September 30, 2024, was calculated as the difference between

the repayment and the net carrying value of the extinguished

principal less unamortized issuance costs of C$1.2 million ($0.9

million) (refer to Note 9 of our Interim Condensed Consolidated

Financial Statements for additional information).

Interest expense increased by $0.3 million from

$1.2 million in the quarter ended September 30, 2023, to $1.5

million in the quarter ended September 30, 2024. During the three

months ended September 30, 2024, $0.9 million of unamortized

issuance costs related to Debentures were expensed as a result of

the repurchase and cancellation of such debt, offset by lower

interest expense due to repayment of debt during the period.

Net income after tax for the third quarter of

2024 was $7.1 million compared to a $6.3 million net loss after tax

for the same period of 2023. The increase in net income is

primarily the result of a $7.5 million decrease in operating

expenses (operating expenses in the third quarter of 2023 included

an $8.0 million impairment charge on the Rock Hill facility which

was not repeated in the third quarter of 2024), $7.5 million gain

on extinguishment of debt relating to the private repurchase of

convertible debentures and the normal course issuer bid, and a $0.2

million increase in interest income, offset by a $1.2 million

increase in foreign exchange loss, a $0.3 million increase in

interest expense, and a $0.3 million decrease in gross profit.

Adjusted EBITDA (see “Non-GAAP Financial

Measures”) for the third quarter of 2024 was $4.1 million, or 9.4%

of revenue, a decrease of $1.2 million from $5.3 million, or 10.6%

of revenue, for the third quarter of 2023. Lower Adjusted EBITDA

was mainly driven by the decrease in gross profit and an increase

in operating expenses due to the above noted reasons.

Outlook

This quarter we continued on our Journey to

Excellence, reporting net profit after tax of $7.1 million and 9.4%

Adjusted EBITDA Margin. At September 30, 2024, we held $23.6

million in cash on hand with total liquidity (inclusive of

borrowing availability) of $34.3 million. Improved operational

results have also led to positive cash flow in the last six

quarters. We have strengthened our balance sheet through the

repurchase and cancellation of a significant portion of our debt.

Our debt at September 30, 2024 is $23.9 million, down from $56.1

million at December 31, 2023. We expect to be in a position to pay

off or refinance the remaining Debentures when they come due.

Construction is a multi-billion-dollar industry

and growing. Increasing challenges, such as rising costs, labor

shortages and environmental impact are leaving end users in search

of a better alternative, which increases the business case to build

with DIRTT. We believe that we stand apart from competition with

project certainty, our core focus on sustainability, adaptability,

and our “custom is standard” offering.

DIRTT’s executive and senior leadership team met

this fall to plan for the future. We finalized our new mission,

vision and values and determined four strategic priorities for the

next three years: Revenue growth, continued expansion of DIRTT’s

proprietary ICE software, accelerated innovation, and investment in

talent. New leadership in our commercial organization is driving

forward a commercial strategy focusing on our core principles as

stated in our mission, vision and values. Our vision is to

“Transform how the world builds,” which comes to life through what

we view as our key differentiators:

- Product Design: DIRTT’s reconfigurable system offers a paradigm

shift in how end users interact with their spaces. Our design

offers a compelling alternative to conventional construction and

our drywall alternative installs significantly faster and requires

fewer trades

- Speed: Our industry-leading 10-business-day lead time is among

the fastest in our peer group. We have delivered on that commitment

more than 99% of the time year-to-date

- Quality: Our comprehensive 10-year warranty which typically

exceeds conventional alternatives

- Innovation: Our 20-year ethos of “custom is standard” allows us

to serve a diversity of clientele and respond to their needs

- Customer Service: Our sales representatives, project managers

and internal teams are available to our customers to deliver on

“custom is standard” as well as other organizational

commitments

- Technology: Our ICE software (as defined below) provides an

end-to-end system for customers to design and for DIRTT to

manufacture a diverse mix of products at scale

As we lean into these values, we continue to

focus on removing bottlenecks for our commercial team and

construction partners. We also continue to focus on accelerating

pipeline growth from our new, diversified sales channels such as

other prefabricators that are meaningfully contributing to our

commercial strategy. We are reducing administrative tasks and

offering our internal teams to support the sales cycle. We also

enable our construction partners to pursue an increasing share of

healthcare work through unique and differentiated products, such as

our applied headwall offerings and the Clinical Observation

Vertical Exam (the “COVE™”), a new innovative product designed to

help improve patient care in emergency rooms. Just as we have

implemented best practices for operational excellence in our

plants, we are doing the same in our commercial organization.

Officially launching in November, we’re already

seeing positive demand for the COVE with interest from over 15

major health systems. The industry also recognized the COVE with

two significant product awards for “Most Innovative” and

“Architect’s Choice” at the 2024 Healthcare Facilities Symposium

and Expo.

A critical driver of our innovative process is

our proprietary design integration software, ICE (“ICE” or “ICE

Software”). We have committed to an ongoing process of enhancing

this software to deliver more value and drive more efficiency. In

Q3, in addition to launching ICE Manager and Design Editor, DIRTT’s

team made updates to enable our partners to rely less on the DIRTT

support team to specify their designs in ICE.

Our operations team continues to excel in its

goal of zero defects, missed deliveries, and workplace

injuries. For the nine months ended September 30, 2024, our

total recordable incident rate (TRIF) rate was 0.63, which is 85%

below the industry average. Our on-time in full (OTIF) delivery

performance was 99.2% for the quarter.

We believe that DIRTT has significant untapped

manufacturing capacity that can serve a multiple of our current

revenue base. Improvements to our cost structure, including a

materially reduced fixed cost base and incremental growth in

revenue, will flow through to Adjusted EBITDA and free cash

flow.

Looking at macroeconomic conditions through the

third quarter of 2024, the US economy remains uncertain, but we are

increasingly optimistic. On the positive side, inflation has

tempered considerably from a high in 2022. Unemployment has only

risen modestly during that period of disinflation. It appears that

the US economy is on the path to a soft-landing scenario. With

commercial office as our largest segment, factors affecting

workplace investment and occupancy are closely monitored. We

continue to see a slow but steady increase in Kastle Systems

occupancy data as well as large employers continuing their

requirement for in-person attendance. Conversely, the AIA/Deltek

Architectural Billings Index continues its twentieth month of

declining billings for architecture firms. Additionally, the

interest rate environment has begun to ease, but the tailwinds of

that reduction have yet to reach the commercial real estate market.

Overall, we remain confident in our continued ability to navigate

diverse economic environments through our exceptional operational

excellence and continued focus on scaling our organization for

profitable growth.

As we look forward, our year-over-year 12-month

pipeline is 10% lower than 2023. However, this is almost

exclusively driven by winning a bid for a three-year +$25 million

opportunity which began production in Q2 and will continue shipping

into 2026. Clients order large projects (>$1m USD) in phases due

to install schedules. Our full pipeline continues to grow and reach

post-COVID highs. As we analyze the integrity of our pipeline, we

have more won work year-over-year which reinforces our view for

revenue growth in 2025. We have maintained the 2024 and 2025

guidance numbers that were provided in our Q2 outlook:

- 2024 Revenue: $165-175 million

- 2024 Adjusted EBITDA: $12-15 million

- 2025 Revenue: $194-209 million

- 2025 Adjusted EBITDA: $18-25 million

We have minimal capital expenditure needs in the

short term and with the availability of tax losses, we expect most

of our Adjusted EBITDA will flow through to free cash flow. Our

expected 2025 Adjusted EBITDA takes into account planned

investments to achieve our strategic breakthroughs. The level of

investments made will be finalized as we go through our budget

process in the next quarter. We expect the Company will have

approximately one turn of debt to Adjusted EBITDA financial

leverage by the end of 2025 and we expect to have improved access

to traditional bank lines.

DIRTT could not have achieved the past two years

of organizational improvements without the support of our talented

employee base. We are advancing our goal to make DIRTT an employer

of choice and we will aspire to maintain this stance in our

industry.

Conference Call and Webcast

Details

A conference call and webcast for the investment

community is scheduled for November 7, 2024 at 08:00 a.m. MDT

(10:00 a.m. EDT). The call and webcast will be hosted by Benjamin

Urban, chief executive officer, and Fareeha Khan, chief financial

officer.

The call is being webcast live on the Company’s

website at dirtt.com/investors. Alternatively, click here to listen

to the live webcast. The webcast is listen-only.

A webcast replay of the call will be available on DIRTT’s

website.

|

Interim Condensed Consolidated Statement of

Operations |

|

(Unaudited - Stated in thousands of U.S. dollars) |

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Product

revenue |

|

|

42,475 |

|

|

|

48,095 |

|

|

|

121,690 |

|

|

|

127,105 |

|

| Service revenue |

|

|

900 |

|

|

|

1,442 |

|

|

|

3,733 |

|

|

|

3,893 |

|

| Total revenue |

|

|

43,375 |

|

|

|

49,537 |

|

|

|

125,423 |

|

|

|

130,998 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Product cost of sales |

|

|

26,208 |

|

|

|

31,622 |

|

|

|

76,589 |

|

|

|

88,529 |

|

| Service cost of sales |

|

|

354 |

|

|

|

850 |

|

|

|

1,998 |

|

|

|

2,165 |

|

| Total cost of sales |

|

|

26,562 |

|

|

|

32,472 |

|

|

|

78,587 |

|

|

|

90,694 |

|

| Gross profit |

|

|

16,813 |

|

|

|

17,065 |

|

|

|

46,836 |

|

|

|

40,304 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

|

5,183 |

|

|

|

6,161 |

|

|

|

17,165 |

|

|

|

18,302 |

|

| General and administrative |

|

|

5,834 |

|

|

|

4,669 |

|

|

|

14,791 |

|

|

|

16,003 |

|

| Operations support |

|

|

1,915 |

|

|

|

1,752 |

|

|

|

5,531 |

|

|

|

5,564 |

|

| Technology and development |

|

|

1,294 |

|

|

|

1,239 |

|

|

|

3,981 |

|

|

|

4,055 |

|

| Stock-based compensation |

|

|

803 |

|

|

|

1,069 |

|

|

|

1,905 |

|

|

|

2,543 |

|

| Reorganization |

|

|

604 |

|

|

|

321 |

|

|

|

944 |

|

|

|

2,857 |

|

| Impairment charge on Rock Hill facility |

|

|

- |

|

|

|

7,952 |

|

|

|

530 |

|

|

|

7,952 |

|

| Related party expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,524 |

|

| Total operating expenses |

|

|

15,633 |

|

|

|

23,163 |

|

|

|

44,847 |

|

|

|

58,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

1,180 |

|

|

|

(6,098 |

) |

|

|

1,989 |

|

|

|

(18,496 |

) |

| Gain on extinguishment of convertible debt |

|

|

7,478 |

|

|

|

- |

|

|

|

10,409 |

|

|

|

- |

|

| Foreign exchange (loss) gain |

|

|

(360 |

) |

|

|

822 |

|

|

|

917 |

|

|

|

(59 |

) |

| Interest income |

|

|

341 |

|

|

|

161 |

|

|

|

1,312 |

|

|

|

271 |

|

| Interest expense |

|

|

(1,525 |

) |

|

|

(1,196 |

) |

|

|

(3,524 |

) |

|

|

(3,636 |

) |

| Government subsidies |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

236 |

|

| Gain on sale of software and patents |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,145 |

|

| |

|

|

5,934 |

|

|

|

(213 |

) |

|

|

9,114 |

|

|

|

2,957 |

|

| Net income (loss) before tax |

|

|

7,114 |

|

|

|

(6,311 |

) |

|

|

11,103 |

|

|

|

(15,539 |

) |

| Income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

| Current and deferred income tax expense |

|

|

23 |

|

|

|

- |

|

|

|

371 |

|

|

|

- |

|

| |

|

|

23 |

|

|

|

- |

|

|

|

371 |

|

|

|

- |

|

| Net income (loss) after tax |

|

|

7,091 |

|

|

|

(6,311 |

) |

|

|

10,732 |

|

|

|

(15,539 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share - basic |

|

|

0.04 |

|

|

|

(0.05 |

) |

|

|

0.06 |

|

|

|

(0.14 |

) |

| Net income (loss) per share - diluted |

|

|

0.03 |

|

|

|

(0.05 |

) |

|

|

0.05 |

|

|

|

(0.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares

outstanding (in thousands) |

|

|

|

|

|

|

|

| Basic |

|

|

193,020 |

|

|

|

118,943 |

|

|

|

189,585 |

|

|

|

115,055 |

|

| Diluted |

|

|

241,272 |

|

|

|

118,943 |

|

|

|

239,301 |

|

|

|

115,055 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

Our interim condensed consolidated financial

statements are prepared in accordance with accounting principles

generally accepted in the United States of America (“GAAP”). These

GAAP financial statements include non-cash charges and other

charges and benefits that we believe are unusual or infrequent in

nature or that we believe may make comparisons to our prior or

future performance difficult.

As a result, we also provide financial

information in this news release that is not prepared in accordance

with GAAP and should not be considered as an alternative to the

information prepared in accordance with GAAP. Management uses these

non-GAAP financial measures in its review and evaluation of the

financial performance of the Company. We believe that these

non-GAAP financial measures also provide additional insight to

investors and securities analysts as supplemental information to

our GAAP results and as a basis to compare our financial

performance period-over-period and to compare our financial

performance with that of other companies. We believe that these

non-GAAP financial measures facilitate comparisons of our core

operating results from period to period and to other companies by

removing the effects of our capital structure (net interest income

on cash deposits, interest expense on outstanding debt and debt

facilities, or foreign exchange movements), asset base

(depreciation and amortization), tax consequences, reorganization

expense, unusual or infrequent charges or gains (such as gain on

sale of software and patents, gain on extinguishment of debt, and

impairment charges), stock-based compensation, related party

expense, and government subsidies. We remove the impact of foreign

exchange gain (loss) from Adjusted EBITDA. Foreign exchange gains

and losses can vary significantly period-to-period due to the

impact of changes in the U.S. and Canadian dollar exchange rates on

foreign currency denominated monetary items on the balance sheet

and are not reflective of the underlying operations of the Company.

In periods where production levels are abnormally low, unallocated

overheads are recognized as an expense in the period in which they

are incurred. In addition, management bases certain forward-looking

estimates and budgets on non-GAAP financial measures, primarily

Adjusted EBITDA. We have not reconciled non-GAAP forward-looking

measures, including Adjusted EBITDA guidance, to its corresponding

GAAP measures due to the high variability and difficulty in making

accurate forecasts and projections, particularly with respect to

non-operating income and expenditures, which are difficult to

predict and subject to change.

Government subsidies, depreciation and

amortization, stock-based compensation expense, reorganization

expense, foreign exchange gains and losses, gain on extinguishment

of debt, impairment charges, gain on sale of software and patents,

net interest income on cash deposits, interest expense on

outstanding debt and debt facilities, tax expense, and related

party expense are excluded from our non-GAAP financial measures

because management considers them to be outside of the Company’s

core operating results, even though some of those receipts and

expenses may recur, and because management believes that each of

these items can distort the trends associated with the Company’s

ongoing performance. We believe that excluding these receipts and

expenses provides investors and management with greater visibility

to the underlying performance of the business operations, enhances

consistency and comparativeness with results in prior periods that

do not, or future periods that may not, include such items, and

facilitates comparison with the results of other companies in our

industry.

The following non-GAAP financial measures are

presented in this news release, and a description of the

calculation for each measure is included.

|

|

|

|

Adjusted Gross Profit |

Gross profit before deductions for depreciation and

amortization |

|

|

|

|

Adjusted Gross Profit Margin |

Adjusted Gross Profit divided by revenue |

|

|

|

|

EBITDA |

Net income before interest, taxes, depreciation and

amortization |

|

|

|

|

Adjusted EBITDA |

EBITDA adjusted to remove foreign exchange gains or losses;

reorganization expenses; stock-based compensation expense;

government subsidies; unusual or infrequent charges and gains such

as gain on sale of software and patents, gain on extinguishment of

debt, and impairment charges; related party expense; and any other

non-core gains or losses |

|

|

|

|

Adjusted EBITDA Margin |

Adjusted EBITDA divided by revenue |

|

|

|

You should carefully evaluate these non-GAAP

financial measures, the adjustments included in them, and the

reasons we consider them appropriate for analysis supplemental to

our GAAP information. Each of these non-GAAP financial measures has

important limitations as an analytical tool due to exclusion of

some but not all items that affect the most directly comparable

GAAP financial measures. You should not consider any of these

non-GAAP financial measures in isolation or as substitutes for an

analysis of our results as reported under GAAP. You should also be

aware that we may recognize income or incur expenses in the future

that are the same as, or similar to, some of the adjustments in

these non-GAAP financial measures. Because these non-GAAP financial

measures may be defined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

The following table presents a reconciliation

for the three and nine months ended September 30, 2024 and 2023 of

EBITDA and Adjusted EBITDA to our net income (loss) after tax, and

of Adjusted EBITDA Margin to net income (loss) margin , which are

the most directly comparable GAAP measure for the periods

presented:

| (Unaudited - Stated

in thousands of U.S. dollars) |

| |

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

($ in thousands) |

|

|

($ in thousands) |

|

| Net

income (loss) after tax for the period |

|

|

7,091 |

|

|

|

(6,311 |

) |

|

|

10,732 |

|

|

|

(15,539 |

) |

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

1,525 |

|

|

|

1,196 |

|

|

|

3,524 |

|

|

|

3,636 |

|

| Interest income |

|

|

(341 |

) |

|

|

(161 |

) |

|

|

(1,312 |

) |

|

|

(271 |

) |

| Tax expense |

|

|

23 |

|

|

|

- |

|

|

|

371 |

|

|

|

- |

|

| Depreciation and amortization |

|

|

1,487 |

|

|

|

2,017 |

|

|

|

4,542 |

|

|

|

7,216 |

|

| EBITDA |

|

|

9,785 |

|

|

|

(3,259 |

) |

|

|

17,857 |

|

|

|

(4,958 |

) |

| Foreign exchange loss (gain) |

|

|

360 |

|

|

|

(822 |

) |

|

|

(917 |

) |

|

|

59 |

|

| Stock-based compensation |

|

|

803 |

|

|

|

1,069 |

|

|

|

1,905 |

|

|

|

2,543 |

|

| Reorganization expense(3) |

|

|

604 |

|

|

|

321 |

|

|

|

944 |

|

|

|

2,857 |

|

| Gain on extinguishment of convertible debt(3) |

|

|

(7,478 |

) |

|

|

- |

|

|

|

(10,409 |

) |

|

|

- |

|

| Impairment charge on Rock Hill facility(3) |

|

|

- |

|

|

|

7,952 |

|

|

|

530 |

|

|

|

7,952 |

|

| Gain on sale of software and patents(3) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,145 |

) |

| Related party expense(2) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,524 |

|

| Government subsidies |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(236 |

) |

| Adjusted EBITDA |

|

|

4,074 |

|

|

|

5,261 |

|

|

|

9,910 |

|

|

|

3,596 |

|

| Net Income (Loss) Margin(1) |

|

|

16.3 |

% |

|

|

(12.7 |

)% |

|

|

8.6 |

% |

|

|

(11.9 |

)% |

| Adjusted EBITDA Margin |

|

|

9.4 |

% |

|

|

10.6 |

% |

|

|

7.9 |

% |

|

|

2.7 |

% |

(1) Net income (loss) after tax divided by

revenue.(2) The related party transaction is a non-recurring

transaction that is not core to our business and is excluded from

the Adjusted EBITDA calculation (Refer to Note 17 of the interim

condensed consolidated financial statements).(3) Reorganization

expenses, the gain on sale of software and patents, the gain on

extinguishment of convertible debt and the impairment charge on the

Rock Hill facility are not core to our business and are therefore

excluded from the Adjusted EBITDA calculation (Refer to Note 4,

Note 5 and Note 6 of the interim condensed consolidated financial

statements).

The following table presents a reconciliation

for the three and nine months ended September 30, 2024 and 2023 of

Adjusted Gross Profit to our gross profit and Adjusted Gross Profit

Margin to gross profit margin, which are the most directly

comparable GAAP measures for the periods presented:

|

(Unaudited - Stated in thousands of U.S. dollars) |

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

($ in thousands) |

|

|

($ in thousands) |

|

|

Gross profit |

|

|

16,813 |

|

|

|

17,065 |

|

|

|

46,836 |

|

|

|

40,304 |

|

| Gross profit

margin |

|

|

38.8 |

% |

|

|

34.4 |

% |

|

|

37.3 |

% |

|

|

30.8 |

% |

| Add: Depreciation and

amortization expense |

|

|

823 |

|

|

|

1,231 |

|

|

|

2,512 |

|

|

|

4,656 |

|

| Adjusted Gross

Profit |

|

|

17,636 |

|

|

|

18,296 |

|

|

|

49,348 |

|

|

|

44,960 |

|

| Adjusted Gross Profit

Margin |

|

|

40.7 |

% |

|

|

36.9 |

% |

|

|

39.3 |

% |

|

|

34.3 |

% |

|

|

Special Note Regarding Forward-Looking

Statements

Certain statements contained in this news

release are “forward-looking statements” within the meaning of

“safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 and Section 21E of the Securities

Exchange Act of 1934 and “forward-looking information” within the

meaning of applicable Canadian securities laws. All statements,

other than statements of historical fact included in this news

release, regarding our strategy, future operations, financial

position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management are forward-looking

statements. When used in this news release, the words “anticipate,”

“believe,” “expect,” “estimate,” “intend,” “plan,” “project,”

“outlook,” “may,” “will,” “should,” “would,” “could,” “can,”

“continue,” the negatives thereof, variations thereon and other

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. In particular and without limitation, this

news release contains forward-looking information pertaining to our

expectations regarding 2024 and 2025 revenues; 2024 and 2025

Adjusted EBITDA; the importance of sustainability in the

interior construction industry; future revenues, Adjusted

EBITDA, unrestricted cash, activity levels and the timing thereof;

project delivery and the timing thereof; implementation of our

strategic plan, including the effects of our improved cost

structure; profitable future growth; the effects of our strategic

initiatives and the timing thereof; general economic conditions,

including in the construction industry; our beliefs about our

twelve-month forward sales and qualified leads pipeline and

short-term pipeline; our beliefs about commerical strategy; our

standing in the interior construction market; large projects and

the timing and revenue as a result thereof; our beliefs about the

impact of future revenue on cash flow; raw material costs and their

effect on DIRTT; the continued reduction of DIRTT’s debt; DIRTT’s

continued journey to excellence; our ability to weather economic

conditions and invest in technology and commercial organizations;

and the continued evaluation of our cost structure.

Forward-looking statements are based on certain

estimates, beliefs, expectations, and assumptions made in light of

management’s experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that may be appropriate.

Forward-looking statements necessarily involve

unknown risks and uncertainties, which could cause actual results

or outcomes to differ materially from those contained in, or

expressed or implied by such statements. Due to the risks,

uncertainties, and assumptions inherent in forward-looking

information, you should not place undue reliance on forward-looking

statements. Factors that could have a material adverse effect on

our business, financial condition, results of operations and growth

prospects include, but are not limited to, risks described under

the section titled “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2023, filed with the U.S.

Securities and Exchange Commission (the “SEC”) and applicable

securities commissions or similar regulatory authorities in Canada

on February 21, 2024 as supplemented by our Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024 filed with the

SEC and applicable securities commissions or similar regulatory

authorities in Canada on November 6, 2024.

Our past results of operations are not

necessarily indicative of our future results. You should not rely

on any forward-looking statements, which represent our beliefs,

assumptions and estimates only as of the dates on which they were

made, as predictions of future events. We undertake no obligation

to update these forward-looking statements, even though

circumstances may change in the future, except as required under

applicable securities laws. We qualify all of our forward-looking

statements by these cautionary statements.

About DIRTT Environmental

Solutions

DIRTT is a leader in industrialized

construction. DIRTT’s system of physical products and digital tools

empowers organizations, together with construction and design

leaders, to build high-performing, adaptable, interior

environments. Operating in the workplace, healthcare, education,

and public sector markets, DIRTT’s system provides total design

freedom, and greater certainty in cost, schedule, and outcomes.

DIRTT's interior construction solutions are designed to be highly

flexible and adaptable, enabling organizations to easily

reconfigure their spaces as their needs evolve. Headquartered in

Calgary, AB Canada, DIRTT trades on the Toronto Stock Exchange

under the symbol “DRT”.

FOR FURTHER INFORMATION PLEASE CONTACT

ir@dirtt.com

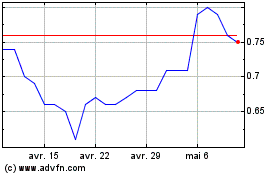

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024