DIRTT Environmental Solutions Ltd. (TSX: DRT; OTC: DRTTF) ("DIRTT"

or the "Company"), a leader in industrialized construction,

announced today that the Toronto Stock Exchange ("TSX") has

accepted DIRTT’s notice of intention to make a normal course issuer

bid (the "NCIB") for DIRTT's 6.00% convertible unsecured

subordinated debentures due January 31, 2026 ("January Debentures")

and its 6.25% convertible unsecured subordinated debentures due

December 31, 2026 ("December Debentures", and together with the

January Debentures, the "Debentures"). The NCIB is expected to

commence on August 28, 2024 and terminate on August 27, 2025.

Under the NCIB, DIRTT is permitted to acquire up

to C$1,664,200 principal amount of the January Debentures and

C$1,558,700 principal amount of the December Debentures, which

represents 10% of the total public float of each series of

Debentures, being C$16,642,000 principal amount of January

Debentures and C$15,587,000 principal amount of the December

Debentures outstanding, respectively, as of August 22, 2024. Except

as permitted under the TSX rules, DIRTT will not purchase more than

C$111,507 principal amount of the January Debentures or more than

C$416,071 principal amount of the December Debentures on any given

trading day. The daily purchase limit for the January December and

the December Debentures is approximately 25% of C$446,031 and

C$1,664,285, respectively, being the average daily trading volume

of the January Debentures and December Debentures on the TSX for

the six most recently completed calendar months. All purchases will

be made on the open market through the facilities of the TSX and/or

alternative Canadian trading systems, at the market price of such

Debentures at the time of acquisition. Any Debentures acquired

through the NCIB will be immediately cancelled. DIRTT believes that

the NCIB provides it with the flexibility to use its capital to

acquire Debentures from time to time under the appropriate

circumstances. Management's decisions regarding any Debenture

repurchases will be based on market conditions, the market price of

the Debentures, and other factors.

While DIRTT has not purchased any Debentures

under a normal course issuer bid in the past 12 months, the Company

completed a substantial issuer bid and tender offer for the

Debentures on March 22, 2024, pursuant to which DIRTT repurchased

C$4,693,000 principal amount of the January Debentures and

C$5,775,000 principal amount of the December Debentures for

cancellation. As previously announced, DIRTT also repurchased

C$18,915,000 principal amount of January Debentures and

C$13,638,000 principal amount of December Debentures from 22NW

Fund, LP, DIRTT's largest shareholder, in a private transaction on

August 2, 2024.

In connection with the NCIB, DIRTT expects to

enter into an issuer repurchase plan agreement ("IRPA") and an

automatic repurchase plan agreement ("ARPP") in relation to

purchases made under the NCIB. The IRPA and ARPP have been

pre-cleared by the TSX and are expected to be implemented on August

28, 2024. The ARPP is intended to facilitate repurchases of

Debentures under the NCIB at times when DIRTT would ordinarily not

be permitted to make purchases due to regulatory restriction or

customary self-imposed blackout periods. Before the commencement of

any particular trading black-out period, and provided that DIRTT is

not in possession of material non-public information about itself

or its securities, DIRTT may, but is not required to, instruct its

designated broker to make purchases of Debentures under the NCIB

during the ensuing black-out period in accordance with the terms of

the ARPP. The timing and amount of such purchases will be

determined by the designated broker at its sole discretion based on

the purchasing parameters set by DIRTT and in accordance with the

rules of the TSX, applicable securities laws and the terms of the

ARPP. All purchases of Debentures made under the IRPA and ARPP will

be included in determining the aggregate number of Debentures

purchased under the NCIB. If adopted, the ARPP will constitute an

"automatic securities purchase plan" under applicable Canadian

securities law, and will be adopted in accordance with applicable

U.S. securities laws, including the requirements of Rule 10b5-1

under the U.S. Securities Exchange Act of 1934. Outside of

pre-determined blackout periods, Debentures may be purchased under

the NCIB based on management's discretion, subject to TSX rules and

applicable securities laws in Canada and the United States.

ABOUT DIRTT

DIRTT is a leader in industrialized

construction. DIRTT’s system of physical products and digital tools

empowers organizations, together with construction and design

leaders, to build high-performing, adaptable, interior

environments. Operating in the workplace, healthcare, education,

and public sector markets, DIRTT’s system provides total design

freedom, and greater certainty in cost, schedule, and outcomes.

DIRTT’s interior construction solutions are designed to be highly

flexible and adaptable, enabling organizations to easily

reconfigure their spaces as their needs evolve. Headquartered in

Calgary, AB Canada, DIRTT trades on the Toronto Stock Exchange

under the symbol “DRT”.

FOR FURTHER INFORMATION, PLEASE CONTACT

DIRTT Investor Relations

at ir@dirtt.com

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news

release are “forward-looking statements” within the meaning of

“safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 and Section 21E of the Securities

Exchange Act of 1934 and “forward-looking information” within the

meaning of applicable Canadian securities laws. All statements,

other than statements of historical fact included in this news

release are forward-looking statements. When used in this news

release, the words “anticipate,” “expect,” “intend,” “may,” “will,”

“should,” “would,” “could,” “can,” the negatives thereof,

variations thereon and other similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain such identifying words. In

particular, and without limitation, this news release contains

forward-looking information pertaining to the NCIB, the principal

amount of Debentures to the acquired under the NCIB, the method of

purchase, price and cancellation of Debentures, and reasons for and

benefits of any purchases made under the NCIB.

Forward-looking statements are based on certain

estimates, beliefs, expectations, and assumptions made in light of

management’s experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that may be appropriate. Forward-looking statements

necessarily involve unknown risks and uncertainties, which could

cause actual results or outcomes to differ materially from those

expressed or implied in such statements. Due to the risks,

uncertainties, and assumptions inherent in forward-looking

information, you should not place undue reliance on forward-looking

statements. Factors that could have a material adverse effect on

our business, financial condition, results of operations and growth

prospects include, but are not limited to, risks described under

the section titled “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2023, and in our subsequently filed

Quarterly Reports on Form 10-Q and also in the Company’s other

continuous disclosure filings available under the Company’s profile

on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Our past

results of operations are not necessarily indicative of our future

results. You should not rely on any forward-looking statements,

which represent our beliefs, assumptions and estimates only as of

the dates on which they were made, as predictions of future events.

We undertake no obligation to update these forward-looking

statements, even though circumstances may change in the future,

except as required under applicable securities laws. We qualify all

of our forward-looking statements by these cautionary

statements.

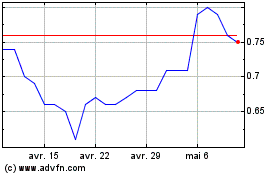

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024