dynaCERT Inc. (TSX: DYA) (OTCQB: DYFSF) (FRA: DMJ) ("dynaCERT" or

the "Company") today announces its financial and operating results

for the year ended December 31, 2021. All figures are in Canadian

dollars unless otherwise stated.

Sales

During the year ended December 31, 2021, the

Company's sales continued to be significantly impacted by COVID-19

restrictions worldwide and the Company's dealers' inability to

provide installation services. During the year ended December

31, 2021, the Company shipped 139 HydraGEN™ units respectively to

dealers and clients. These sales mostly represent units bought and

installed on larger fleets or companies that are running initial

pilot projects while closely monitoring the fuel savings and

emission reductions with the support of dynaCERT and our

HydraLytica™ telematic software installed.

During the three months ended December 31, 2021,

the Company recognized sales of $200,222, and for year ended

December 31, 2021, the Company recognized sales of $757,002.

Operating Expenses

Key Influencers to the increase in expenditures

for the year ended December 31, 2021 are:

- As the Company

did not qualify for Canadian Emergency Wages Subsidy ("CEWS") for a

portion of the year ended December 31, 2021, and received more CEWS

during the year ended December 31, 2020, as a result expenditures

increased by $412,851.

- Wages and

salaries increased by $503,530, the majority of this increase was

due to additional compensation paid to a former officer.

- During the year

ended December 31, 2021, cost of goods sold increased by $1,774,765

as the Company determined that current years wages were directly

related to the production of HydraGEN™ products by specific

employees.

- During the year

ended December 31, 2021, the Company recognized a loss on loans,

investments, and prepayments of $3,481,776. See "Loss on loans,

investments, and prepayments" below.

Key influencers to the decrease in expenditures

for the year ended December 31, 2020 are:

- Research and

development costs decreased by $1,739,857, as the Company's direct

salaries related to cost of goods sold for HydraGEN™ products in

the current year. In the prior year, salaries directly related to

research and development.

- Business

development costs decreased by $541,663 as certain current year

expenses related to research and development, and expenses to loss

on loans, investments, and prepayments. In the prior year, these

expenses directly related to business development initiatives.

- A decrease in

share-based compensation expense of $608,795 in the current period

compared to the prior period, as a result of vesting conditions,

inputs into the Black-Scholes model, and the number of stock

options granted. During the year ended December 31, 2021, the

Company granted 8.81 million stock options compared to 7.14 million

in the comparative period, and cancelled 532,000 options with a

Black Scholes value of $322,395.

Cash Flow Information

As at December 31, 2021, cash on hand was

$8,337,506 as compared to $18,836,013 at December 31, 2020.

The Company had cash outflows from operating

cash flows of $8,659,758, which was due to net loss of $16,324,637,

which was affected by non-cash adjustments of $7,382,118, which is

comprised of accretion and amortization of $903,717, stock-based

compensation of $2,861,197, loss on investment in associate of

$142,213, foreign exchange loss of $77,150, interest paid of

$165,991, loss on loans, investments, and prepayments of

$3,481,776, and offset by accrued interest of $249,926. Operating

cash flows were affected by non-cash working capital items of

$282,761 which comprised an increase in amounts payable and other

liabilities of $492,512, by a decrease in accounts receivables and

sales tax receivables of $422,175, and offset by an increase in

prepaid expenses of $114,239, an increase in inventory $444,369, a

decrease in deferred revenue $73,318.

The Company had cash outflows from investing

activities of $1,409,156, which was due to acquisition of property

and equipment of $620,430, acquisition of intangible assets of

$388,726, and an investment of $250,000 in Galaxy Power, a loan to

Galaxy Placements of $150,000.

The Company had cash outflows from financing

activities of $429,593, which was funds from exercise of options of

$94,800, and offset by repayment on a promissory note of $76,086

and lease obligation of $448,307.

Accounts Payable and Accrued

Liabilities

As at December 31, 2021, the Company had

accounts payable and accrued liabilities of $1,328,005 as compared

to $835,493 at December 31, 2020.

Loss on loans, investments, and

prepayments

The Company's audit committee has engaged

independent legal counsel to assist them in examining the validity,

legal standing, enforceability, and potential future recoverability

of certain related party and other transactions as disclosed in

note 24 of the Company's audited financial statements. The

outcome of the examination is unknown at this time and may result,

amongst other matters, in the identification of one or more

weaknesses in the Company's internal controls. The Company will

disclose the results of the examination once they become available

and determine the appropriate corrective measures, if any, at such

time.

About dynaCERT Inc.

dynaCERT Inc. manufactures and distributes

Carbon Emission Reduction Technology for use with internal

combustion engines. As part of the growing global hydrogen economy,

our patented technology creates hydrogen and oxygen on-demand

through a unique electrolysis system and supplies these gases

through the air intake to enhance combustion, resulting in lower

carbon emissions and greater fuel efficiency. Our technology is

designed for use with many types and sizes of diesel engines used

in on-road vehicles, refrigerated trailers, off-road construction,

power generation, mining and forestry equipment, marine vessels and

railroad locomotives. Website: www.dynaCERT.com.

READER ADVISORYExcept for

statements of historical fact, this news release contains certain

"forward-looking information" within the meaning of applicable

securities law. Forward-looking information is frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur. In particular, forward-looking information in this

press release includes, but is not limited to the review of certain

transactions being undertaken by the Company's audit committee and

the potential future impact and reporting thereof. Although we

believe that the expectations reflected in the forward-looking

information are reasonable, there can be no assurance that such

expectations will prove to be correct. We cannot guarantee future

results, performance of achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information.

Forward-looking information is based on the

opinions and estimates of management at the date the statements are

made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to: the

Company not settling outstanding issues with its auditors.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither The Toronto Stock Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the The Toronto Stock Exchange) accepts responsibility

for the adequacy or accuracy of the release.On

Behalf of the Board Murray James Payne,

CEOFor more information, please

contact:

Jim Payne, CEO & PresidentdynaCERT Inc.#101

– 501 Alliance Avenue Toronto, Ontario M6N 2J1 +1 (416) 766-9691 x

2jpayne@dynaCERT.com

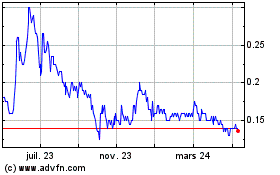

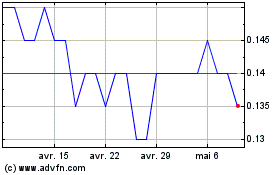

DynaCERT (TSX:DYA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

DynaCERT (TSX:DYA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025