goeasy Ltd. (TSX: GSY), (“

goeasy” or the

“

Company”), one of Canada’s leading non-prime

consumer lenders, announced today the acceptance by the Toronto

Stock Exchange (the “

TSX”) of goeasy’s notice of

intention to renew its normal course issuer bid (the

“

NCIB”) and has provided a capital management

update, with reference to recent purchases for cancellation of the

Company’s common shares and hedging activity related to the

contingent shares in Affirm Holdings Inc.

(“

Affirm”) held by the Company.

Renewal of Normal Course Issuer

Bid

Pursuant to the NCIB, goeasy may purchase for

cancellation up to an aggregate of 1,243,781 common shares in the

capital of the Company (the “Common Shares”),

representing approximately 10% of goeasy’s public float. As at

December 7, 2021, goeasy had 16,254,135 Common Shares issued and

outstanding.

Under the NCIB, goeasy may purchase up to 15,706

of its Common Shares on the TSX during any trading day, which

represents 25% of the average daily trading volume of 62,825 Common

Shares on the TSX for the six months ended November 30, 2021, other

than block purchase exemptions. Purchases under the NCIB may

commence on December 21, 2021 and continue until December 20, 2022

or such earlier date as goeasy completes its purchases pursuant to

the NCIB.

The NCIB will be conducted through the

facilities of the TSX or alternative trading systems, if eligible,

and the price that goeasy will pay for any Common Shares will be

the market price prevailing at the time of purchase or such other

price as may be permitted. Purchases under the NCIB will be made by

means of open market transactions or other such means as a

securities regulatory authority may permit, including pre-arranged

crosses, exempt offers and private agreements under an issuer bid

exemption order issued by a securities regulatory authority.

In connection with the NCIB renewal, the Company

also announces that it has entered into an issuer automatic

purchase plan agreement (the “Plan”) with an

independent designated broker (the “Broker”)

responsible for making purchases of Common Shares pursuant to the

Plan. Under the Plan, the Broker will have sole discretion to

purchase Common Shares pursuant to the NCIB during trading

black-out periods established under the Company’s Insider Trading

Policy, subject to the price limitations and other terms of the

Plan and the rules of the TSX. The Company may instruct the Broker

to make specific purchases and suspend or terminate the Plan,

provided in each case that the Company certifies to the Broker that

it is not in possession of any material undisclosed information and

such request is otherwise in compliance with the terms of the

Plan.

Share Purchases Under the Normal Course

Issuer Bid

Under its current normal course issuer bid,

which commenced on December 21, 2020 and expires on December 20,

2021, the number of Common Shares that could be repurchased for

cancellation was 1,079,703. Pursuant to the NCIB, between November

8, 2021 and December 7, 2021, the Company has purchased for

cancellation a total of 322,327 Common Shares, through the

facilities of the TSX and alternative trading systems, at a volume

weighted average price of $187.16 per Common Share, resulting in a

total investment of $60.3 million.

The purchase for cancellation of Common Shares

is part of the Company’s capital management strategy, which is

designed to effectively allocate capital in a manner that will

produce the greatest long-term return for shareholders. Provided

the Company can access and maintain a sufficient level of liquidity

to fund organic growth, invest in capital expenditures that produce

future revenue growth, and maintain its target level of financial

leverage, the Company distributes a quarterly dividend

proportionate to approximately 35% of the prior year’s adjusted net

earnings per share, while utilizing its excess capital to

opportunistically invest in new business lines, or purchase its

common shares when they are deemed to be trading below their

intrinsic value. The Company continues to maintain a level of

liquidity sufficient to fund its organic growth plans through 2023,

allowing it to deploy excess capital in a manner consistent with

this approach going forward.

Total Return Swap Agreement

Subsequent to quarter end, the Company entered

into a 7-month total return swap agreement (the

"TRS") to substantively hedge its market exposure

related to an additional 75,000 contingent shares related to the

equity held in Affirm. The TRS effectively results in the economic

value of this hedged portion of the Company’s contingent equity in

Affirm being settled in cash at maturity for US$163.00 per share,

net of applicable fees.

During the third quarter, the Company previously

entered into a 9-month total return swap agreement to substantively

hedge its market exposure related to 100,000 contingent shares

related to the equity held in Affirm, with those shares being

settled in cash at maturity for US$110.35 per share, net of

applicable fees. To date, the Company has substantively hedged its

market exposure related to 175,000 of the 468,000, or approximately

37%, of the total contingent shares related to the equity held in

Affirm.

About goeasy

goeasy Ltd., a Canadian company, headquartered

in Mississauga, Ontario, provides non-prime leasing and lending

services through its easyhome, easyfinancial and LendCare brands.

Supported by more than 2,200 employees, the Company offers a wide

variety of financial products and services including unsecured and

secured instalment loans. Customers can transact seamlessly through

an omni-channel model that includes an online and mobile platform,

over 400 locations across Canada, and point-of-sale financing

offered in the retail, power sports, automotive, home improvement

and healthcare verticals, through more than 4,000 merchants across

Canada. Throughout the Company’s history, it has acquired and

organically served over 1 million Canadians and originated over

$7.2 billion in loans, with one in three easyfinancial customers

graduating to prime credit and 60% increasing their credit score

within 12 months of borrowing.

Accredited by the Better Business Bureau, goeasy

is the proud recipient of several awards including Waterstone

Canada’s Most Admired Corporate Cultures, Glassdoor Top CEO Award,

Achievers Top 50 Most Engaged Workplaces in North America, Greater

Toronto Top Employers Award, the Digital Finance Institute’s

Canada’s Top 50 FinTech Companies, ranking on the TSX30 and placing

on the Report on Business ranking of Canada’s Top Growing Companies

and has been certified as a Great Place to Work®. The company is

represented by a diverse group of team members from over 75

nationalities who believe strongly in giving back to the

communities in which it operates. To date, goeasy has raised and

donated over $3.8 million to support its long-standing partnerships

with BGC Canada, Habitat for Humanity and many other local

charities.

goeasy Ltd.’s. common shares are listed on the

TSX under the trading symbol “GSY”. goeasy is rated BB- with

a stable trend from S&P and Ba3 with a stable trend from

Moody’s. Visit www.goeasy.com.

For further information contact:Jason MullinsPresident &

Chief Executive Officer(905) 272-2788

Farhan Ali KhanSenior Vice President and Chief Corporate

Development Officer(905) 272-2788

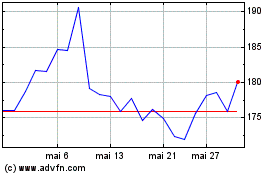

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024