American Hotel Income Properties REIT LP (“

AHIP”,

or the “

Company”) (TSX: HOT.UN, TSX: HOT.U, TSX:

HOT.DB. V), today announced its financial results for the three and

six months ended June 30, 2023.

All amounts presented in this news release are

in United States dollars (“U.S. dollars”) unless

otherwise indicated.

“We are pleased with the ongoing revenue

performance of our select service hotel portfolio in Q2." commented

Jonathan Korol, CEO. "Occupancy (1) and room rate trends remain

positive with broad demand from leisure, corporate and group guest

segments. Continuing the trend since early last year,

we achieved a 7.7% growth rate in revenue per available room

(“RevPAR”) (1). Key operating metrics were positive with year over

year growth in average daily rate (“ADR”) (1), occupancy, and

RevPAR.”

2023 SECOND QUARTER HIGHLIGHTS

- Diluted FFO per

unit (1) and normalized diluted FFO per unit (1) were $0.19 and

$0.14, respectively, for the second quarter of 2023, compared to

$0.18 and $0.15 for the same period of 2022.

- RevPAR increased

7.7% to $98 for the second quarter of 2023, compared to $91 for the

same period of 2022.

- ADR increased 6.4%

to $133 for the second quarter of 2023, compared to $125 for the

same period of 2022.

- Occupancy was 73.8%

for the second quarter of 2023, an increase of 100 basis points

(“bps”) compared to 72.8% for the same period of

2022.

- NOI (1) and

normalized NOI (1) were $25.3 million and $27.2 million,

respectively, for the second quarter of 2023, decreases of 5.2% and

0.7%, compared to $26.7 million and $27.4 million for the same

period in 2022.

- Debt to gross book

value (1) was 51.6% as of June 30, 2023, decreases of 100 bps

and 200 bps, respectively, compared to 52.6% as of

December 31, 2022, and 53.6% as of June 30, 2022.

- Weighted average

interest rate for all term loans and credit facility, was 4.55% as

of June 30, 2023, an increase of 9 bps compared to 4.46% as of

December 31, 2022.

- Distributions of

$0.015 U.S. dollar per unit paid in each month since March

2022.

“This quarter we achieved the highest ADR in the

history of the company.” Mr. Korol added: “While the mix is

evolving, the overall demand picture remains strong with sustained

demand from our leisure guests as well as the gradual return of

business and group travel, as demonstrated by the 8.8% growth in

RevPAR in our Embassy Suites portfolio during the quarter,” said

Mr. Korol.

Mr. Korol continued, "Consistent with recent

quarters, operating results were negatively impacted by inflation

and labor shortages. We are continuing to focus on

hiring more in-house labor, reducing turnover and improving

housekeeping productivity to address these issues. However,

progress is slow and labor costs will remain elevated into

2024. We are making steady progress on our leverage reduction

with improvements over the last twelve months of 200 bps on debt to

gross book value and 0.2x on Debt to EBITDA (1). We remain

confident in our ability to navigate a

dynamic operating environment and to add long-term

unitholder value."

2023 SECOND QUARTER REVIEW

HIGHEST QUARTERLY ADR IN HISTORY

AHIP’s portfolio of Premium Branded select

service hotel properties continued to demonstrate strong demand

metrics in the second quarter of 2023. For the three months ended

June 30, 2023, ADR was $133, and occupancy was 73.8%, increases of

6.4% and 100 bps, respectively, compared to the same period in

2022. Collectively, strong ADR and increasing occupancy resulted in

an increase of 7.7% in RevPAR compared to the same period in 2022.

This result is attributable to steady improvements in the corporate

traveler segment, sustained demand from leisure travelers, as well

as the disposition of properties with lower than portfolio average

ADR and occupancy. The ability to control and manage daily rates is

a key advantage of the lodging sector, which has enabled AHIP to

achieve strong growth in ADR, partially mitigating the effects of

rising labor costs and general inflationary pressures impacting the

portfolio.

Improving demand levels resulted in enhanced

pricing power and greater opportunity to manage revenue for various

hotel segments. Despite the dispositions of six non-core hotel

properties since the second quarter of 2022 (five in the fourth

quarter of 2022, and one in the second quarter of 2023), and out of

order rooms at two hotel properties as a result of weather-related

damage in late December 2022, revenue for the second quarter of

2023 was $75.5 million, consistent with the $75.6 million revenue

achieved in the same period of 2022.

AHIP’s five Embassy Suites properties represent

16.6% of the portfolio by room count. The performance of these

properties is a key indicator of the recovery level in business and

group travel. For the three months ended June 30, 2023, RevPAR

for these properties was $111, an increase of 8.8% compared to $102

for the same period in 2022. These properties experienced continued

recovery in business and group travel in the second quarter of

2023, supplemented by leisure‐oriented groups. All five Embassy

Suites hotels were renovated in 2018 and 2019 and are well

positioned to capture improving business and corporate group

demand.

NOI

(1), NOI MARGIN

(1) AND FFO PER UNIT

(1)

NOI and normalized NOI were $25.3 million and

$27.2 million, respectively, for the second quarter of 2023,

decreases of 5.2% and 0.7%, compared to $26.7 million and $27.4

million for the same period in 2022. NOI margin was 33.5% in the

current quarter, a decrease of 170 bps compared to the same period

in 2022. The decreases in NOI and NOI margin were due to higher

operating expenses as a result of cost inflation and labor

shortages. General inflation resulted in higher costs of operating

supplies and higher utilities expenses. Shortages in the overall

U.S. labor market resulted in increased room labor expenses due to

overtime, higher wages for employees and dependency on contract

labor. For the three months ended June 30, 2023, normalized NOI

included $1.9 million in business interruption proceeds related to

the weather-related damage at several hotel properties in late

December 2022. For the three months ended June 30, 2022, normalized

NOI included a $0.7 million government grant for the loss of

revenue as a result of the COVID-19 pandemic.

Diluted FFO per unit and normalized diluted FFO

per unit were $0.19 and $0.14 for the second quarter of 2023,

respectively, compared to $0.18 and $0.15 for the same period of

2022. The decrease in normalized diluted FFO per unit was primarily

due to lower NOI in the current quarter. Normalized diluted FFO per

unit in the current quarter excluded non-recurring insurance

proceeds of $4.1 million for property damage related to the

weather-related damage at several hotel properties in late December

2022. For the same period in 2022, normalized diluted FFO per unit

excluded a $2.3 million gain on debt settlement as well as $0.9

million of other income that included a $0.7 million government

grant for the loss of revenue as a result of the COVID-19

pandemic.

INSURANCE AND WEATHER-RELATED

DAMAGE

During the final week of December 2022, cold

weather caused weather related damage at several hotel properties.

Of the hotel properties damaged, two had a significant number of

rooms out of order. At the Residence Inn Neptune in New Jersey, all

105 rooms were out of order from December 25, 2022. Of the 105

rooms, 72 rooms returned to service in May 2023, and 19 rooms

returned to service in June 2023. The remaining 14 rooms are

expected to return to service in August 2023.

At the Courtyard Wall in New Jersey, all 113

rooms were out of order from December 25, 2022. Of the 113 rooms,

54 rooms returned to service in mid-January 2023, and 31 rooms

returned to service in June 2023. The remaining 28 rooms are

expected to return to service by the end of the third quarter of

2023.

As a result of the weather-related damage, the

total write-down of these hotel properties is $9.0 million as of

June 30, 2023. This is comprised of remediation costs of $3.0

million and rebuilding costs of $6.0 million. As of June 30, 2023,

AHIP had incurred $7.9 million in costs to remediate and rebuild

the damaged hotel properties. AHIP expects most of the total cost

of remediation and rebuilding to be reimbursed in 2023, which is

currently estimated to be $9.0 million.

For business interruption insurance, AHIP

expects to recover most of the lost income from late December 2022,

until the damaged hotel properties are fully operational, which is

expected to be by the end of the third quarter of 2023. AHIP

recorded $1.9 million for the business interruption claim in the

current quarter, and $2.9 million for the six months ended June 30,

2023.

As a result of the claims noted above, higher

replacement costs and generally higher premiums, AHIP completed its

property insurance renewal effective June 1, 2023 with a

significant increase in premiums compared to the expiring policy.

On an annualized basis, the increase from the prior year is

approximately $3.5 million, which will be recognized in earnings

over a twelve-month period.

LEVERAGE AND LIQUIDITY

|

KPIs |

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

Debt to gross book value |

51.6% |

52.0% |

52.6% |

52.6% |

53.6% |

|

Debt to EBITDA (trailing twelve months) |

9.8x |

9.6x |

9.8x |

10.2x |

10.0x |

Debt to gross book value as of June 30,

2023, decreased by 100 bps to 51.6% compared to 52.6% as of

December 31, 2022. AHIP is making steady progress on this

measure and intends to bring its leverage to a level closer to its

peer group over time, which would be a debt to gross book value in

the range of 40-50%. This is expected to be achieved through a

combination of improving operating results, a sustainable

distribution policy and selective equity issuance in support of

growth transactions. Debt to EBITDA has been stable over the last

twelve months.

AHIP has 91.4% of its debt at fixed interest

rates or effectively fixed by interest rate swaps until November

2023. The debt maturities in the fourth quarter of 2023 are

approximately $16.3 million for two hotels in Pennsylvania. The

notional value of the interest rate swaps is $130.0 million, and

they will mature on November 30, 2023.

As of June 30, 2023, AHIP had $39.9 million

in available liquidity, compared to $24.1 million as of

December 31, 2022. The available liquidity of $39.9 million

was comprised of an unrestricted cash balance of $24.9 million and

borrowing availability of $15.0 million under the revolving credit

facility. In addition, AHIP has a restricted cash balance of $27.6

million as of June 30, 2023. The increase in unrestricted cash

was primarily due to the transfer of $12.0 million from restricted

to unrestricted cash, as a result of the improved operations in

2022 at the three Embassy Suites hotels located in Ohio and

Kentucky.

Commencing in the first quarter of 2024, the

borrowing base availability under the revolving credit facility

includes a test based on 65% of the capitalized value of the

underlying properties. This loan to value test may reduce the

borrowing availability under the revolving credit facility and

could result in a required repayment of a portion of amounts drawn

at such time.

If a repayment is required, AHIP intends to

address this potential outcome with some or all of the following:

refinancing the credit facility or other term loans to generate

proceeds in excess of amounts currently outstanding (including by

adding additional properties to the borrowing base under the credit

facility); amending the terms of the Fifth Amendment; and/or using

cash on hand to satisfy all or a portion of any required

repayment.

GROWTH AND STRATEGIC CAPITAL

DEPLOYMENT

As a result of the 2021 investment by

BentallGreenOak and Highgate (collectively, the

“Investor”), AHIP is aligned with two

well-capitalized strategic partners who support the pursuit of

attractive acquisition opportunities. AHIP is also reviewing

strategies for divesting assets to recycle proceeds into higher

return assets in more attractive markets.

In 2022, AHIP completed the strategic

dispositions of seven non-core hotel properties for total gross

proceeds of $47.5 million. These dispositions: (i) increased

portfolio RevPAR by approximately $3; (ii) improved AHIP’s Debt to

EBITDA by approximately 0.4x; and (iii) allowed AHIP to avoid

future PIP investments that would not have achieved returns

available elsewhere in the portfolio.

In June 2023, AHIP completed the disposition of

a non-core hotel property for gross proceeds of $11.7 million. AHIP

used $6.5 million of the total proceeds to repay the term loan on

the property and intends to use the remaining proceeds to further

pay down debt or purchase assets with higher returns in more

attractive markets.

U.S. DOLLAR DISTRIBUTION

The current distribution policy provides for the

payment of regular monthly U.S. dollar distributions at an annual

rate of $0.18 per unit (monthly rate of $0.015 per unit). Monthly

distributions have been paid each month since March 2022.

SAME PROPERTY KPIS

The following table summarizes key performance

indicators (“KPIs”) for the portfolio for the five

most recent quarters with a comparison to the same period in the

prior year. In Q1 and Q2 2023, same property ADR, occupancy and

RevPAR calculation excluded the seven hotels sold in 2022, the one

hotel sold in 2023, and Residence Inn Neptune and Courtyard Wall in

New Jersey as these two hotels had limited availability due to

remediation and rebuilding after the weather-related damage in late

December 2022. In Q2, Q3 and Q4 2022, same property ADR, occupancy

and RevPAR calculation excluded the seven hotels sold in 2022 and

the one hotel sold in 2023. Same property NOI margin calculation

for the five most recent quarters excluded the seven hotels sold in

2022 and the one hotel sold in 2023.

|

KPIs |

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

ADR |

$133 |

$132 |

$126 |

$129 |

$126 |

|

% Change compared to same period in prior year |

5.6% |

10.9% |

9.6% |

7.5% |

13.5% |

|

Occupancy |

73.8% |

65.5% |

67.3% |

73.7% |

74.5% |

|

Change compared to same period in prior year – bps

increase/(decrease) |

(70) |

(20) |

40 |

290 |

240 |

|

RevPAR |

$98 |

$86 |

$85 |

$95 |

$94 |

|

% Change compared to same period in prior year |

4.3% |

10.3% |

10.4% |

11.8% |

17.5% |

|

NOI Margin |

33.3% |

28.6% |

30.8% |

33.3% |

35.4% |

|

Change compared to same period in prior year – bps

increase/(decrease) |

(210) |

(90) |

(410) |

(660) |

(680) |

Same property ADR increased by 5.6% to $133 in

the current quarter compared to $126 in the same period of 2022.

Same property occupancy decreased by 70 bps to 73.8% in the current

quarter compared to 74.5% in the same period of 2022 due to lower

demand at the extended stay properties. Same property NOI margin

decreased by 210 bps to 33.3% for the second quarter of 2023,

compared to the same period of 2022. Although same property RevPAR

increased by 4.3%, same property NOI margin decreased due to higher

operating expenses as a result of inflation and labor shortages.

General inflation resulted in higher costs of operating supplies

and higher utilities expenses. Shortages in the overall U.S. labor

market resulted in increased room labor expenses due to overtime,

higher wages for employees and contract labor.

SELECTED INFORMATION

|

|

|

|

|

|

|

(thousands of dollars, except per unit

amounts) |

Three months endedJune 30,

2023 |

Three months endedJune 30,

2022 |

Six months endedJune 30,

2023 |

Six months endedJune 30,

2022 |

|

|

|

|

|

|

| Revenue |

75,483 |

75,649 |

140,941 |

137,425 |

| Income from operating

activities |

17,919 |

17,863 |

27,337 |

24,601 |

| Income and comprehensive

income |

10,658 |

13,685 |

9,058 |

9,810 |

| NOI (1) |

25,287 |

26,655 |

44,025 |

44,155 |

| NOI Margin (1) |

33.5% |

35.2% |

31.2% |

32.1% |

| |

|

|

|

|

| Hotel EBITDA (1) |

22,867 |

24,165 |

39,469 |

39,547 |

| Hotel EBITDA Margin (1) |

30.3% |

31.9% |

28.0% |

28.8% |

| EBITDA (1) |

20,233 |

22,243 |

34,277 |

35,050 |

| EBITDA Margin (1) |

26.8% |

29.4% |

24.3% |

25.5% |

| |

|

|

|

|

| Cashflow from operating

activities |

12,403 |

14,694 |

25,497 |

22,359 |

| Distributions declared per unit -

basic and diluted |

0.045 |

0.045 |

0.09 |

0.075 |

| Distributions declared to

unitholders - basic |

3,548 |

3,543 |

7,094 |

5,905 |

| Distributions declared to

unitholders - diluted |

4,033 |

4,019 |

8,059 |

6,399 |

| Dividends declared to Series C

holders |

1,011 |

1,011 |

2,011 |

2,011 |

| |

|

|

|

|

| FFO diluted (1) |

16,653 |

16,304 |

26,454 |

20,937 |

| FFO per unit - diluted (1) |

0.19 |

0.18 |

0.30 |

0.23 |

| FFO payout ratio - diluted,

trailing twelve months (1) |

33.9% |

11.9% |

33.9% |

11.9% |

| Normalized FFO per unit - diluted

(1) |

0.14 |

0.15 |

0.21 |

0.18 |

| |

|

|

|

|

| AFFO diluted (1) |

13,514 |

13,622 |

20,595 |

16,098 |

| AFFO per unit - diluted (1) |

0.15 |

0.15 |

0.23 |

0.18 |

|

AFFO payout ratio - diluted, trailing twelve months (1) |

44.8% |

14.1% |

44.8% |

14.1% |

| (1)

See “Non-IFRS and Other Financial Measures” |

|

|

|

|

|

SELECTED INFORMATION |

|

(thousands of dollars) |

June 30, 2023 |

December 31, 2022 |

|

|

|

|

|

Total assets |

1,055,155 |

1,052,795 |

|

Total liabilities |

732,959 |

730,689 |

|

Total non-current liabilities |

641,657 |

667,807 |

|

Term loans and revolving credit facility |

639,431 |

643,929 |

|

|

|

|

|

Debt to gross book value (1) |

51.6% |

52.6% |

|

Debt to EBITDA (times) (1) |

9.8 |

9.8 |

|

Interest coverage ratio (times) (1) |

2.1 |

2.1 |

|

|

|

|

|

Term loans and revolving credit facility: |

|

|

|

Weighted average interest rate |

4.55% |

4.46% |

|

Weighted average term to maturity (years) |

2.5 |

3.0 |

|

|

|

|

|

Number of rooms |

7,917 |

8,024 |

|

Number of properties |

70 |

71 |

|

Number of restaurants |

14 |

14 |

(1) See “Non-IFRS and Other Financial

Measures”

2023 SECOND QUARTER OPERATING

RESULTS

|

(thousands of dollars) |

Three months ended June 30,

2023 |

Three months ended June 30,

2022 |

Six months ended June 30,

2023 |

Six months ended June 30,

2022 |

|

|

|

|

|

|

| ADR (1) |

133 |

125 |

132 |

121 |

| Occupancy (1) |

73.8% |

72.8% |

69.7% |

68.3% |

|

RevPAR (1) |

98 |

91 |

92 |

83 |

|

|

|

|

|

|

|

Revenue |

75,483 |

75,649 |

140,941 |

137,425 |

| |

|

|

|

|

| Operating expenses |

38,732 |

37,762 |

74,258 |

70,362 |

| Energy |

3,021 |

2,981 |

6,243 |

6,214 |

| Property maintenance |

3,768 |

3,496 |

7,292 |

6,868 |

|

Property taxes, insurance and ground lease before IFRIC 21 |

4,675 |

4,755 |

9,123 |

9,826 |

| Total expenses |

50,196 |

48,994 |

96,916 |

93,270 |

|

|

|

|

|

|

| NOI |

25,287 |

26,655 |

44,025 |

44,155 |

|

NOI Margin % |

33.5% |

35.2% |

31.2% |

32.1% |

| |

|

|

|

|

| IFRIC 21 property taxes

adjustment |

(1,279) |

(1,287) |

(580) |

(744) |

|

Depreciation and amortization |

8,647 |

10,079 |

17,268 |

20,298 |

|

Income from operating activities |

17,919 |

17,863 |

27,337 |

24,601 |

|

|

|

|

|

|

| Other expenses |

6,761 |

3,364 |

19,188 |

14,825 |

| Current income tax expense/

(recovery) |

515 |

68 |

531 |

131 |

|

Deferred income tax (recovery)/ expense |

(15) |

746 |

(1,440) |

(165) |

| |

|

|

|

|

|

Income and comprehensive income |

10,658 |

13,685 |

9,058 |

9,810 |

|

(1) See “Non-IFRS and Other Financial Measures”. For the three and

six months ended June 30, 2023, the ADR, occupancy and RevPAR

calculations excluded Residence Inn Neptune and Courtyard Wall in

New Jersey as these two hotels had limited availability due to

remediation and rebuilding after the weather-related damage in late

December 2022, and included the one hotel property sold in June

2023. |

FINANCIAL INFORMATION

This news release should be read in conjunction

with AHIP’s unaudited condensed consolidated interim financial

statements, and management’s discussion and analysis for the three

and six months ended June 30, 2023 and 2022, that are available on

AHIP’s website at www.ahipreit.com, and under AHIP’s profile on

SEDAR+ at www.sedarplus.com.

Q2 2023 CONFERENCE CALL

Management will host a webcast and conference

call at 10:00 a.m. pacific time on Wednesday, August 9, 2023, to

discuss the financial and operational results for the three and six

months ended June 30, 2023 and 2022.

To participate in the conference call,

participants should register online via AHIP’s website. A dial-in

and unique PIN will be provided to join the call. Participants are

requested to register a minimum of 15 minutes before the start of

the call. An audio webcast of the conference call is also

available, both live and archived, on the Events &

Presentations page of AHIP’s website: www.ahipreit.com.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, IHG and Choice

Hotels through license agreements. AHIP’s long-term objectives are

to build on its proven track record of successful investment,

deliver monthly U.S. dollar denominated distributions to

unitholders, and generate value through the continued growth of its

diversified hotel portfolio. More information is available at

www.ahipreit.com.

NON-IFRS AND OTHER FINANCIAL

MEASURES

Management believes the following non-IFRS

financial measures, non-IFRS ratios, capital management measures

and supplementary financial measures are relevant measures to

monitor and evaluate AHIP’s financial and operating performance.

These measures and ratios do not have any standardized meaning

prescribed by IFRS and are therefore unlikely to be comparable to

similar measures presented by other issuers. These measures and

ratios are included to provide investors and management additional

information and alternative methods for assessing AHIP’s financial

and operating results and should not be considered in isolation or

as a substitute for performance measures prepared in accordance

with IFRS.

NON-IFRS FINANCIAL

MEASURES:

FFO: FFO measures operating

performance and is calculated in accordance with Real Property

Association of Canada’s (“REALPAC”) definition.

FFO – basic is calculated by adjusting income (loss) and

comprehensive income (loss) for depreciation and amortization, gain

or loss on disposal of property, IFRIC 21 property taxes, fair

value gain or loss, impairment of property, deferred income tax,

and other applicable items. FFO – diluted is calculated as FFO –

basic plus the interest, accretion, and amortization on convertible

debentures if convertible debentures are dilutive. The most

comparable IFRS measure to FFO is net and comprehensive income

(loss), for which a reconciliation is provided in this news

release.

AFFO: AFFO is defined as a

recurring economic earnings measure and calculated in accordance

with REALPAC’s definition. AFFO – basic is calculated as FFO –

basic less maintenance capital expenditures. AFFO – diluted is

calculated as FFO – diluted less maintenance capital expenditures.

The most comparable IFRS measure to AFFO is net and comprehensive

income (loss), for which a reconciliation is provided in this news

release.

Normalized FFO: calculated as

FFO excluding non-recurring items. For the three months ended June

30, 2023, normalized FFO is calculated as FFO excluding the

non-recurring insurance proceeds of $4.1 million for property

damage related to the weather-related damage at several hotel

properties in late December 2022. For the three months ended June

30, 2022, normalized FFO is calculated as FFO excluding the

non-recurring $2.3 million gain on debt settlement as well as $0.9

million of other income that included a $0.7 million government

grant for the loss of revenue as a result of the COVID-19 pandemic.

The most comparable IFRS measure to normalized FFO is net and

comprehensive income (loss), for which a reconciliation is provided

in this news release.

Net Operating Income

(“NOI”): calculated by adjusting income

from operating activities for depreciation and amortization, and

IFRIC 21 property taxes. The most comparable IFRS measure to NOI is

income from operating activities, for which a reconciliation is

provided in this news release.

Normalized NOI: calculated as

NOI plus business interruption proceeds or government grant for the

loss of revenue for the reporting periods. For the three months

ended June 30, 2023, normalized NOI included $1.9 million in

business interruption proceeds related to the weather-related

damage at several hotel properties in late December 2022. For the

three months ended June 30, 2022, normalized NOI included a $0.7

million government grant for the loss of revenue as a result of the

COVID-19 pandemic. The most comparable IFRS measure to normalized

NOI is income from operating activities, for which a reconciliation

is provided in this news release.

Hotel EBITDA: calculated by

adjusting income from operating activities for depreciation and

amortization, IFRIC 21 property taxes and hotel management fees.

The most comparable IFRS measure to hotel EBITDA is income from

operating activities, for which a reconciliation is provided in

this news release.

EBITDA: calculated by adjusting

income from operating activities for depreciation and amortization,

IFRIC 21 property taxes, hotel management fees and general

administrative expenses. The sum of management fees for hotel and

general administrative expenses is equal to corporate and

administrative expenses in the Financial Statements. The most

comparable IFRS measure to EBITDA is income from operating

activities, for which a reconciliation is provided in this news

release.

Debt: calculated as the sum of

term loans and revolving credit facility, the face value of

convertible debentures, unamortized portion of debt financing

costs, government guaranteed loan, lease liabilities and

unamortized portion of mark-to-market adjustments. The most

comparable IFRS measure to debt is total liabilities, for which a

reconciliation is included in this news release.

Gross book value: calculated as

the sum of total assets, accumulated depreciation and impairment on

property, buildings and equipment, and accumulated amortization on

intangible assets. The most comparable IFRS measure to gross book

value is total assets, for which a reconciliation is included in

this news release.

Interest expense: calculated by

adjusting finance costs for gain/loss on debt settlement,

amortization of debt financing costs, accretion of debenture

liability, amortization of debenture costs, dividends on series B

preferred shares of US REIT and amortization of mark-to-market

adjustments because interest expense excludes certain non-cash

accounting items and dividends on preferred shares. The most

comparable IFRS measure to interest expense is finance costs, for

which a reconciliation is included in this news release.

NON-IFRS RATIOS:

FFO per unit – basic/diluted:

calculated as FFO – basic/diluted divided by weighted average

number of units outstanding - basic/diluted respectively for the

reporting periods.

Normalized FFO per unit –

basic/diluted: calculated as normalized FFO –

basic/diluted divided by weighted average number of units

outstanding - basic/diluted respectively for the reporting

periods.

AFFO per unit – basic/diluted: calculated as

AFFO – basic/diluted divided by weighted average number of units

outstanding - basic/diluted respectively for the reporting

periods.

FFO payout ratio – basic,

trailing twelve months:

calculated as total distributions declared to unitholders – basic,

divided by total FFO – basic, for the twelve months ended June 30,

2023, and 2022.

FFO payout ratio – diluted,

trailing twelve months: calculated as total

distributions declared to unitholders – diluted, divided by total

FFO – diluted, for the twelve months ended June 30, 2023, and

2022.

AFFO payout ratio – basic,

trailing twelve months:

calculated as total distributions declared to unitholders – basic,

divided by total AFFO – basic, for the twelve months ended June 30,

2023, and 2022.

AFFO payout ratio – diluted,

trailing twelve months:

calculated as total distributions declared to unitholders –

diluted, divided by total AFFO – diluted, for the twelve months

ended June 30, 2023, and 2022.

NOI margin: calculated as NOI

divided by total revenue.

Hotel EBITDA margin: calculated as hotel EBITDA

divided by total revenue.

EBITDA margin: calculated as

EBITDA divided by total revenue.

CAPITAL MANAGEMENT

MEASURES:

Debt to gross book value:

calculated as debt divided by gross book value. Debt to gross book

value is a primary measure of capital management and leverage.

Debt to EBITDA: calculated as

debt divided by the trailing twelve months of EBITDA. Debt to

EBITDA measures the amount of income generated and available to pay

down debt before covering interest, taxes, depreciation, and

amortization expenses.

Interest coverage ratio:

calculated as EBITDA for the trailing twelve months divided by

interest expense for the trailing twelve months period. The

interest coverage ratio measures AHIP’s ability to meet required

interest payments related to its outstanding debt and dividends on

the series B preferred shares of US REIT.

SUPPLEMENTARY FINANCIAL

MEASURES:

Occupancy is a major driver of room revenue as

well as food and beverage revenues. Fluctuations in occupancy are

accompanied by fluctuations in most categories of variable hotel

operating expenses, including housekeeping and other labor costs.

ADR also helps to drive room revenue with limited impact on other

revenues. Fluctuations in ADR are accompanied by fluctuations in

limited categories of hotel operating expenses, such as franchise

fees and credit card commissions, since variable hotel operating

expenses, such as labor costs, generally do not increase or

decrease correspondingly. Thus, increases in RevPAR attributable to

increases in occupancy typically reduce EBITDA and EBITDA Margins,

while increases in RevPAR attributable to increases in ADR

typically result in increases in EBITDA and EBITDA Margins.

Occupancy: calculated as total

number of hotel rooms sold divided by total number of rooms

available for the reporting periods. Occupancy is a metric commonly

used in the hotel industry to measure the utilization of hotels’

available capacity. In Q1 and Q2 2023, the occupancy calculation

excluded Residence Inn Neptune and Courtyard Wall in New Jersey as

these two hotels had limited availability due to remediation and

rebuilding after the weather-related damage in late December

2022.

Average daily rate (“ADR”):

calculated as total room revenue divided by total number of rooms

sold for the reporting periods. ADR is a metric commonly used in

the hotel industry to indicate the average revenue earned per

occupied room in a given time period. In Q1 and Q2 2023, the ADR

calculation excluded Residence Inn Neptune and Courtyard Wall in

New Jersey as these two hotels had limited availability due to

remediation and rebuilding after the weather-related damage in late

December 2022.

Revenue per available room

(“RevPAR”): calculated as occupancy multiplied by ADR for

the reporting periods. In Q1 and Q2 2023, the RevPAR calculation

excluded Residence Inn Neptune and Courtyard Wall in New Jersey as

these two hotels had limited availability due to remediation and

rebuilding after the weather-related damage in late December

2022.

Same property ADR, occupancy, RevPAR,

and NOI margin: measured for properties owned by AHIP for

both the current reporting periods and the same periods in 2022. In

Q1 and Q2 2023, same property ADR, occupancy and RevPAR calculation

excluded the seven hotels sold in 2022, the one hotel sold in 2023,

and Residence Inn Neptune and Courtyard Wall in New Jersey as these

two hotels had limited availability due to remediation and

rebuilding after the weather-related damage in late December 2022.

In Q4, Q3 and Q2 2022, same property ADR, occupancy and RevPAR

calculation excluded the seven hotels sold in 2022 and the one

hotel sold in 2023. Same property NOI margin calculation for the

five most recent quarters excluded the seven hotels sold in 2022

and the one hotel sold in 2023.

NON-IFRS RECONCILIATION

The following table reconciles FFO to income

(loss) and comprehensive income (loss), the most comparable IFRS

measure as presented in the financial statements:

|

|

|

|

|

|

|

(thousands of dollars, except per unit

amounts) |

Three months ended June 30,

2023 |

Three months ended June 30,

2022 |

Six months endedJune 30,

2023 |

Six months ended June 30,

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income and comprehensive

income |

10,658 |

13,685 |

9,058 |

9,810 |

| |

|

|

|

|

| Income attributable to

non-controlling interest |

(1,011) |

(1,011) |

(2,011) |

(2,011) |

| Depreciation and

amortization |

8,647 |

10,079 |

17,268 |

20,298 |

| (Gain) loss on sale of

property |

(2,401) |

555 |

(2,401) |

(1,049) |

| Loss on property, building and

equipment |

276 |

- |

4,168 |

- |

| IFRIC 21 property taxes

adjustment |

(1,279) |

(1,287) |

(580) |

(744) |

| Change in fair value of interest

rate swap contracts |

834 |

(1,281) |

1,925 |

(4,629) |

| Change in fair value of

warrants |

(149) |

(6,195) |

(1,719) |

(2,850) |

| Impairment of cash-generating

units |

- |

- |

- |

257 |

|

Deferred income tax (recovery) expense |

(15) |

746 |

(1,440) |

(165) |

|

|

|

|

|

|

| FFO basic (1) |

15,560 |

15,291 |

24,268 |

18,917 |

|

Interest, accretion and amortization on convertible debentures |

1,093 |

1,013 |

2,186 |

2,020 |

|

FFO diluted (1) |

16,653 |

16,304 |

26,454 |

20,937 |

|

|

|

|

|

|

| FFO per unit – basic (1) |

0.20 |

0.19 |

0.31 |

0.24 |

| FFO per unit – diluted (1) |

0.19 |

0.18 |

0.30 |

0.23 |

| FFO payout ratio – basic –

trailing twelve months (1) |

32.8% |

11.5% |

32.8% |

11.5% |

|

FFO payout ratio – diluted – trailing twelve months (1) |

33.9% |

11.9% |

33.9% |

11.9% |

|

Non-recurring items: |

|

|

|

|

| Gain on debt settlement |

- |

(2,344) |

- |

(2,344) |

|

Other income |

(4,126) |

(898) |

(7,468) |

(2,192) |

|

Measurements excluding non-recurring items: |

|

|

|

|

|

Normalized FFO diluted (1) |

12,527 |

13,062 |

18,986 |

16,401 |

|

Normalized FFO per unit – diluted (1) |

0.14 |

0.15 |

0.21 |

0.18 |

|

|

|

|

|

|

| Weighted average number of units

outstanding: |

|

|

|

|

| Basic (000’s) |

78,834 |

78,749 |

78,817 |

78,737 |

|

Diluted (000’s) (2) |

89,622 |

89,308 |

89,484 |

89,124 |

|

(1) See “Non-IFRS and Other Financial

Measures” (2) The calculation of

weighted average number of units outstanding for FFO per unit -

diluted and normalized FFO per unit - diluted included the

convertible debentures for the three and six months ended June 30,

2023 and 2022 because they were dilutive. |

|

RECONCILIATION OF FFO TO AFFO |

|

|

|

|

(thousands of dollars, except per unit

amounts) |

Three months ended June 30,

2023 |

Three months ended June 30,

2022 |

Six months ended June 30,

2022 |

|

|

|

|

|

| FFO basic (1) |

15,560 |

15,291 |

18,917 |

| FFO diluted (1) |

16,653 |

16,304 |

20,937 |

|

Maintenance capital expenditures |

(3,139) |

(2,682) |

(4,839) |

|

|

|

|

|

| AFFO basic (1) |

12,421 |

12,609 |

14,078 |

| AFFO diluted (1) |

13,514 |

13,622 |

16,098 |

| AFFO per unit - basic (1) |

0.16 |

0.16 |

0.18 |

|

AFFO per unit - diluted (1) |

0.15 |

0.15 |

0.18 |

|

|

|

|

|

| AFFO payout ratio – basic –

trailing twelve months (1) |

44.9% |

13.7% |

13.7% |

|

AFFO payout ratio – diluted – trailing twelve months (1) |

44.8% |

14.1% |

14.1% |

|

|

|

|

|

| Measurements excluding

non-recurring items: |

|

|

|

| AFFO diluted (1) |

9,388 |

10,380 |

11,562 |

| AFFO per unit - diluted (1) |

0.10 |

0.12 |

0.13 |

|

|

|

|

|

| (1) See

“Non-IFRS and Other Financial Measures” |

| |

| DEBT TO GROSS

BOOK VALUE |

|

|

(thousands of dollars) |

June 30, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

| Debt (1) |

694,377 |

699,881 |

| Gross Book

Value (1) |

1,346,663 |

1,329,865 |

|

Debt-to-Gross Book Value (1) |

51.6% |

52.6% |

|

(1) See “Non-IFRS and Other Financial Measures” |

|

|

|

|

|

|

|

(thousands of dollars) |

June 30, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

| Term loans and

revolving credit facility |

639,431 |

643,929 |

| 2026 Debentures (at

face value) |

50,000 |

50,000 |

| Unamortized portion

of debt financing costs |

3,521 |

4,437 |

| Lease

liabilities |

1,431 |

1,591 |

|

Unamortized portion of mark-to-market adjustments |

(6) |

(76) |

|

Debt (1) |

694,377 |

699,881 |

|

(1) See “Non-IFRS and Other Financial Measures” |

|

|

|

|

|

|

|

(thousands of dollars) |

June 30, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

| Total Assets |

1,055,155 |

1,052,795 |

| Accumulated

depreciation and impairment |

286,626 |

272,540 |

|

on property, buildings and equipment |

|

|

|

Accumulated amortization on intangible assets |

4,882 |

4,530 |

|

Gross Book Value (1) |

1,346,663 |

1,329,865 |

| (1) See

“Non-IFRS and Other Financial Measures” |

DEBT TO EBITDA

|

|

|

|

|

(thousands of dollars) |

June 30, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

| Debt (1) |

694,377 |

699,881 |

| EBITDA (trailing twelve months)

(1) |

71,001 |

71,293 |

|

Debt-to-EBITDA (times) (1) |

9.8x |

9.8x |

(1) See “Non-IFRS and Other Financial

Measures”

The reconciliation of income from operating

activities to NOI, hotel EBITDA and EBITDA is shown below:

|

|

|

|

|

|

(thousands of dollars) |

Three months endedJune 30,

2023 |

Three months endedJune 30,

2022 |

Six months ended June 30,

2023 |

Six months ended June 30,

2022 |

|

|

|

|

|

|

| Income from operating

activities |

17,919 |

17,863 |

27,337 |

24,601 |

| Depreciation and

amortization |

8,647 |

10,079 |

17,268 |

20,298 |

|

IFRIC 21 property taxes |

(1,279) |

(1,287) |

(580) |

(744) |

|

NOI (1) |

25,287 |

26,655 |

44,025 |

44,155 |

| |

|

|

|

|

|

Management fees |

(2,420) |

(2,490) |

(4,556) |

(4,608) |

|

Hotel EBITDA (1) |

22,867 |

24,165 |

39,469 |

39,547 |

| |

|

|

|

|

|

General administrative expenses |

(2,634) |

(1,922) |

(5,192) |

(4,497) |

|

EBITDA (1) |

20,233 |

22,243 |

34,277 |

35,050 |

| |

|

|

|

(1) See “Non-IFRS and Other Financial

Measures”

The reconciliation of finance costs to interest

expense is shown below:

|

|

|

|

|

|

|

(thousands of dollars) |

Three months ended June 30,

2023 |

Three months ended June 30,

2022 |

Six months ended June 30,

2023 |

Six months ended June 30,

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Finance costs |

9,233 |

6,799 |

17,925 |

16,241 |

| Gain on debt settlement |

- |

2,344 |

- |

2,344 |

| Amortization of debt financing

costs |

(496) |

(593) |

(851) |

(1,085) |

| Accretion of Debenture

liability |

(241) |

(183) |

(483) |

(365) |

| Amortization of Debenture

costs |

(100) |

(72) |

(200) |

(146) |

| Dividends on Series B

preferred shares |

12 |

(4) |

(9) |

(8) |

| Debt

defeasance and other costs |

(19) |

- |

(19) |

- |

|

Interest expense (1) |

8,389 |

8,291 |

16,363 |

16,981 |

|

(1) See “Non-IFRS and Other Financial Measures” |

|

|

|

For information on the most directly comparable

IFRS measures, composition of the measures, a description of how

AHIP uses these measures, and an explanation of how these measures

provide useful information to investors, please refer to AHIP’s

management discussion and analysis for the three and six months

ended June 30, 2023 and 2022, available on AHIP’s website at

www.ahipreit.com, and under AHIP’s profile on SEDAR+ at

www.sedarplus.com.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” and “financial outlook”

within the meaning of applicable securities laws. Forward-looking

information and financial outlook generally can be identified by

words such as “anticipate”, “believe”, “continue”, “expect”,

“estimates”, “intend”, “may”, “outlook”, “objective”, “plans”,

“should”, “will” and similar expressions suggesting future outcomes

or events. Forward-looking information and financial outlook

include, but are not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information and financial

outlook in this news release includes, but is not limited to,

statements with respect to: AHIP’s expectations with respect to its

future performance, including specific expectations in respect to

certain categories of its properties, including the Embassy Suites

properties; AHIP’s leverage and liquidity strategies and goals,

including its target debt to gross book value ratio; AHIP’s planned

strategies to manage pressures imposed by inflation and labor

shortages; AHIP’s expectation that most of the estimated amount of

weather-related damage to buildings and equipment of four hotel

properties will be covered by insurance, and AHIP’s expectation

with respect to the recovery of most of the lost income from these

properties through business interruption insurance; the expected

timing for the return to operation for rooms currently out of

service at the weather-damaged properties; AHIP’s evaluation and

review of growth and divesture opportunities; AHIP’s expectations

with respect to inflation, labor supply, labor costs, interest

rates, consumer spending and other market financial and

macroeconomic conditions in 2023 and beyond and the expected

impacts thereof on AHIP’s financial position and performance;;

AHIP’s outlook on the U.S. travel market; the expected timing for

the declaration, record date and payment of monthly distributions,

and any increase thereof; and AHIP’s stated long-term

objectives.

Although the forward-looking information and

financial outlook contained in this news release are based on what

AHIP’s management believes to be reasonable assumptions, AHIP

cannot assure investors that actual results will be consistent with

such information. Forward-looking information is based on a number

of key expectations and assumptions made by AHIP, including,

without limitation: inflation, labor shortages, and supply chain

disruptions will negatively impact the U.S. economy, U.S. hotel

industry and AHIP’s business; AHIP will continue to have sufficient

funds to meet its financial obligations; AHIP’s strategies with

respect to margin enhancement, completion of capital projects,

liquidity and divestiture of non-core assets and acquisitions will

be successful; capital projects will be completed on time and on

budget; AHIP will receive insurance proceeds in an amount

consistent with AHIP’s estimates in respect of its weather-damaged

properties, and such properties will resume operations in

accordance with currently contemplated schedules; AHIP will

continue to have good relationships with its hotel brand partners;

ADR and Occupancy will be stable or rise in 2023; AHIP’s

distribution policy will be sustainable and AHIP will not be

prohibited from paying distributions under the terms of its credit

facility and investor rights agreement; capital markets will

provide AHIP with readily available access to equity and/or debt

financing on terms acceptable to AHIP, including the ability to

refinance maturing debt as it becomes due on terms acceptable to

AHIP; AHIP will be able to renew or replace its interest rate swaps

on reasonable terms; AHIP’s future level of indebtedness and its

future growth potential will remain consistent with AHIP’s current

expectations; and AHIP will achieve its long term objectives.

Forward-looking information and financial

outlook involve significant risks and uncertainties and should not

be read as guarantees of future performance or results as actual

results may differ materially from those expressed or implied in

such forward-looking information and financial outlook, accordingly

undue reliance should not be placed on such forward-looking

information and financial outlook. Those risks and uncertainties

include, among other things, risks related to: AHIP may not achieve

its expected performance levels in 2023; inflation, labor

shortages, supply chain disruptions; AHIP’s insurance claims with

respect to its weather damaged properties may be denied in whole or

in part; AHIP may not achieve its expected performance levels in

2023; AHIP’s weather-damaged properties may not resume service in

accordance with currently contemplated schedules; AHIP’s brand

partners may impose revised service standards and capital

requirements which are adverse to AHIP; property improvement plan

renovations may not commence or complete in accordance with

currently expected timing and may suffer from increased material

and labor costs; recent recovery trends at AHIP’s properties may

not continue and may regress; AHIP’s strategies with respect to

margin enhancement, completion of accretive capital projects,

liquidity, divestiture of non-core assets and acquisitions may not

be successful; AHIP may not be successful in reducing its leverage;

monthly cash distributions are not guaranteed and remain subject to

the approval of the Board of Directors, compliance with the terms

of its credit facility and investor rights agreement and may be

reduced or suspended at any time at the discretion of the Board;

AHIP may not be able to refinance debt obligations as they become

due or may due so on terms less favorable to AHIP than under AHIP’s

existing loan agreements; AHIP may not be successful in renewing or

replacing its interest rate swaps on reasonable terms or at all;

general economic conditions and consumer confidence; the growth in

the U.S. hotel and lodging industry; prices for AHIP’s units and

its debentures; liquidity; tax risks; ability to access debt and

capital markets; financing risks; changes in interest rates; the

financial condition of, and AHIP’s relationships with, its external

hotel manager and franchisors; real property risks, including

environmental risks; the degree and nature of competition; ability

to acquire accretive hotel investments; ability to integrate new

hotels; environmental matters; increased geopolitical instability;

and changes in legislation and AHIP may not achieve its long term

objectives. Management believes that the expectations reflected in

the forward-looking information and financial outlook are based

upon reasonable assumptions and information currently available;

however, management can give no assurance that actual results will

be consistent with the forward-looking information and financial

outlook contained herein. Additional information about risks and

uncertainties is contained in AHIP’s management’s discussion and

analysis for the three and six months ended June 30, 2023 and 2022,

and AHIP’s annual information form for the year ended December 31,

2022, copies of which are available on SEDAR+ at

www.sedarplus.com.

To the extent any forward-looking information

constitutes a “financial outlook” within the meaning of applicable

securities laws, such information is being provided to investors to

assist in their understanding of AHIP’s expected costs of

remediation and renovation and expected proceeds of insurance in

respect of AHIP’s weather-damaged properties, and management’s

expectations for certain aspects of AHIP’s financial performance

for the remainder of 2023.

The forward-looking information and financial

outlook contained herein is expressly qualified in its entirety by

this cautionary statement. Forward-looking information and

financial outlook reflect management's current beliefs and are

based on information currently available to AHIP. The

forward-looking information and financial outlook are made as of

the date of this news release and AHIP assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

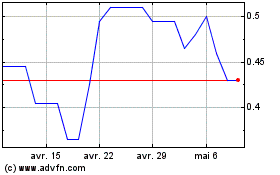

American Hotel Income Pr... (TSX:HOT.U)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

American Hotel Income Pr... (TSX:HOT.U)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025