Kelso Technologies Inc. (“Kelso” or the “Company”), (TSX: KLS),

(NYSE American: KIQ) reports that the Company has released the

unaudited consolidated interim financial statements and Management

Discussion and Analysis for the three months ended March 31, 2021.

The unaudited consolidated interim financial

statements were prepared in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). All amounts herein are

expressed in United States dollars (the Company’s functional

currency) unless otherwise indicated.

SUMMARY OF FINANCIAL

PERFORMANCE

|

Three months ended March 31 |

|

|

2021 |

|

|

2020 |

|

|

Revenues |

|

$ |

1,220,487 |

|

$ |

5,643,428 |

|

|

Gross profit |

|

$ |

453,517 |

|

$ |

2,602,326 |

|

|

Gross profit margin |

|

|

37% |

|

|

46% |

|

|

EBITDA (loss) |

|

$ |

(687,848) |

|

$ |

1,404,488 |

|

|

Non-cash expenses |

|

$ |

112,265 |

|

$ |

121,193 |

|

|

Taxes |

|

$ |

nil |

|

$ |

nil |

|

|

Net income (loss) |

|

$ |

(800,113) |

|

$ |

1,283,295 |

|

|

Basic earnings (loss) per share |

|

$ |

(0.02) |

|

$ |

0.03 |

|

LIQUIDITY AND CAPITAL

RESOURCES

As at March 31, 2021 the Company had cash on

deposit in the amount of $4,522,725, accounts receivable of

$646,429, prepaid expenses of $236,879 and inventory of $5,659,758

compared to cash on deposit in the amount of $1,049,049, accounts

receivable of $535,659, prepaid expenses of $162,739 and inventory

of $5,462,532 as at December 31, 2020.

The Company has income tax payable of $91,566 as

at March 31, 2021 compared to income tax payable of $91,566 as at

December 31, 2020.

The working capital position of the Company as

at March 31, 2021 was $10,180,050 compared to $6,251,893 as at

December 31, 2020. The improvement in the working capital position

came about on March 4, 2021 when the Company completed a private

equity placement whereby 7,000,000 units were issued at a price of

CAD$0.91 per unit, with each unit being comprised of one common

share of the Company and one-half of one common share purchase

warrant. Each whole warrant can be exercised at a price of CAD$1.15

per common share on or before 4:00 p.m. (Vancouver time) on March

4, 2022 and CAD$1.30 on or before 4:00 p.m. (Vancouver time) on

March 4, 2023. The private placement was entirely arm’s length and

the transaction did not materially affect control of the Company.

Capital resources are now expected to protect the Company’s ability

to conduct ongoing business operations as planned for the

foreseeable future.

Net assets of the Company improved to

$14,830,136 as at March 31, 2021 compared to $10,960,923 as at

December 31, 2020 due to the new equity placement. Total assets of

the Company increased to $15,806,499 as at March 31, 2021 compared

to $12,016,515 as at December 31, 2020. The Company had no

interest-bearing long-term liabilities or debt as at March 31,

2021.

OUTLOOK

The return to pre-pandemic business volumes is

happening slowly. The negative trend from diminished rail tank car

activity in 2020 continued to be problematic throughout the first

quarter of 2021. This accounts for the Company’s weak financial

performance for the three months ended March 31, 2021.

The COVID-19 driven rail recession clearly

highlighted the potential threat to the Company’s business

survival. The OEM rail tank car producers went into hibernation in

April 2020 and their activities were minimal but there are now

signs that rail tank car activity is beginning to return in a more

meaningful way. The retrofit and repair business remained open

throughout the pandemic crisis allowing the continuation of the

Company’s operations at a diminished level as stakeholders wait for

OEM operations to improve.

For the past year Management has focused on the

containment of the potential negative impacts on the Company’s

business model and the protection of the Company’s key productive

assets. Kelso has prepared itself for the anticipated post-pandemic

surge in business activity by way of required inventories, a new

equity financing secured in the first quarter of 2021 and

continuing R&D activities. Management is fully prepared for a

strong restart of business growth in the latter half of 2021 and

2022.

Rail industry experts anticipate that in 2021

the OEM producers will manufacture approximately 8,800 new tank

cars mostly in the latter half of the year. In addition,

significant retrofits are being evaluated to address the pending

2023 changes in ethanol regulations as the ethanol industry plans

for the appropriate post 2023 fleet size which currently stands at

more than 30,000 tank cars. Also, a significant number of tank cars

are due for re-certification and some owners are planning to

address these tank cars now while there is repair shop space

available.

Industry projections indicate that the tank car

market is entering a period of modest fleet growth coupled with

growth in rail tank car utilization. New tank car demand is

expected to grow to 14,800 tank cars in 2022 and 19,100 tank cars

in 2023. The anticipated upswing in new build and retrofit activity

for ethanol and pressure tank cars combined with a growing number

of certified Kelso products are expected to provide new longer-term

financial growth opportunities from rail operations.

The Company’s KXI Suspension System is going

through a detailed engineering design analysis to move from

innovative concept to a viable commercial vehicle for a variety of

markets. This assessment by industry specialists has provided

essential clarity to scale KXI from a design “concept” half-ton

vehicle to a more robust Heavy-Duty (“HD”) host vehicle that is

greater than 10,000 lbs. The Company has secured the services of

several OEM suspension experts that will support the Company’s

R&D schedules to produce prototypes in late 2021 with the goal

of pilot production and sales in 2022. The HD platform represents a

much larger and more accessible commercial market opportunity to

pursue. This strategic direction is expected to reduce R&D

costs as HD vehicles feature better transmissions, diesel options,

payload capacity and tougher durability. The Company’s main

objective is to ensure the KXI Suspension System provides complete

safety compliance with all federal standards and regional

regulations including warranty support from the Company and host

vehicle OEMs prior to a market launch in 2022.

In addition to KXI, Kelso continues the

development of promising new rail products such as the Company’s

pressure car PCH valve that is expected to gain full AAR regulatory

certification shortly. Field service trials are ongoing with the

Company’s pressure car angle valve, top ball valve and bottom

outlet valves despite current uncertainties and economic

disruptions. Valve products for marine and trucking applications

are also in the final stages of testing and development. In the

heavily regulated transportation industry, the Company’s R&D

projects are complex, time consuming and expensive. Management

remains bullish on the potential of all of the Company’s new

product developments although timing of regulatory approvals and

new revenue streams remains unpredictable and certainly not

guaranteed to develop at all. Management continues to assess

research discoveries, new product viability, tighter budget

restrictions and market potential of all of the Company’s R&D

programs and adjusts strategic plans as part of the Company’s

R&D risk management.

The Company’s facilities in Bonham, Texas have

remained open throughout the pandemic. Management remains committed

to the health, welfare and safety of the Company’s employees,

business partners and communities where the Company operates.

Management maintains full adherence to all COVID-19 measures put in

place by applicable government authorities.

The Company has deployed capital resources

sensibly to maintain financial health and liquidity during the

pandemic. The Company’s balance sheet strength and working capital

position remained healthy at $10,180,050 as at March 31, 2021. The

financial capital secured during the first quarter is expected to

protect the Company’s ability to conduct ongoing business

operations for the foreseeable future.

The Company’s future business prospects over the

next three years are encouraging despite the current uncertainties.

Kelso has unique products to service the new regulatory guidelines

affecting a fleet of more than 30,000 ethanol tank cars that must

be regulatory compliant in early 2023. In addition, the Company has

new products that can service a fleet of approximately 85,000

pressure tank cars.

The Company has maintained the ability to

service customer needs when the pandemic subsides. With no

interest-bearing long-term debt to service, replenished capital

reserves secured through a new equity financing, broader sales

prospects from a larger product portfolio, Kelso is working to exit

the pandemic crisis with a stronger financial future on behalf of

the shareholders of the Company.

About Kelso Technologies

Kelso is a diverse product development company

that specializes in the design, production and distribution of

proprietary service equipment used in transportation applications.

The Company’s reputation has been earned as a designer and reliable

supplier of unique high-quality rail tank car valve equipment that

provides for the safe handling and containment of hazardous and

non-hazardous commodities during transport. All Kelso products are

specifically designed to provide economic and operational

advantages to customers while reducing the potential effects of

human error and environmental harm.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at www.sec.gov in

the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Notice to Reader: References to

EBITDA refer to net earnings from continuing operations before

interest, taxes, amortization, unrealized foreign exchange and non

cash share-based expenses (Black Scholes option pricing model) and

write off of assets. EBITDA is not an earnings measure recognized

by IFRS and does not have a standardized meaning prescribed by

IFRS. Management believes that EBITDA is an alternative measure in

evaluating the Company's business performance. Readers are

cautioned that EBITDA should not be construed as an alternative to

net income as determined under IFRS; nor as an indicator of

financial performance as determined by IFRS; nor a calculation of

cash flow from operating activities as determined under IFRS; nor

as a measure of liquidity and cash flow under IFRS. The Company's

method of calculating EBITDA may differ from methods used by other

issuers and, accordingly, the Company's EBITDA may not be

comparable to similar measures used by any other issuer.

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated expectations

or intentions. Forward-looking statements in this news release

include that the Company is prepared for post-pandemic

normalization and ready for a strong restart of business growth;

that the OEM rail tank car producers projections of new tank car

and retrofits will be realized; that the anticipated upswing in new

build and retrofit activity combined with a growing number of

qualified Kelso products are expected to fuel new financial growth

from rail operations; that the Company’s KXI engineering group can

complete compliance to all federal standards and regional

regulations including warranty support from the Company and host

vehicle OEMs and push toward final pre-production HD design

specifications in 2021 and pilot production and sales in 2022; that

the financial capital secured subsequent in March 2021 is expected

to protect the Company’s ability to conduct ongoing business

operations for the foreseeable future; that we will continue with

new product development; and that broader sales prospects from a

larger product portfolio will allow Kelso to exit the pandemic

crisis with stronger financial performance. Although Kelso believes

the Company’s anticipated future results, performance or

achievements expressed or implied by the forward-looking statements

and information are based upon reasonable assumptions and

expectations, they can give no assurance that such expectations

will prove to be correct. The reader should not place undue

reliance on forward-looking statements and information as such

statements and information involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Kelso to differ materially from

anticipated future results, performance or achievement expressed or

implied by such forward-looking statements and information,

including without limitation the risk that the effects of COVID-19

may last much longer than expected delaying business orders from

OEM customers; tank car producers may produce and retrofit fewer

than expected cars and even if they meet expectations, they may not

purchase the Company’s products for many of the cars; new equity

may not be adequate enough to fund future operations as intended;

that regulatory compliance may be delayed or cancelled; the

Company’s products may not provide the intended economic or

operational advantages; or reduce the potential effects of human

error and environmental harm during the transport of hazardous

materials; or grow and sustain anticipated revenue streams; the

Company’s new rail and automotive products may not receive

regulatory certification; customer orders may not develop or be

cancelled; that competitors may enter the market with new product

offerings which could capture some of the Company’s market share;

and that the Company’s new equipment offerings may not capture

market share as well as expected. Except as required by law, the

Company does not intend to update the forward-looking information

and forward-looking statements contained in this news release.

For further information, please

contact:

| For further

information, please contact: |

|

| James R. Bond, CEO and

PresidentEmail: bond@kelsotech.com |

Richard Lee, Chief Financial

OfficerEmail: lee@kelsotech.com |

Corporate Address:13966 - 18B AvenueSouth Surrey, BC V4A

8J1www.kelsotech.com |

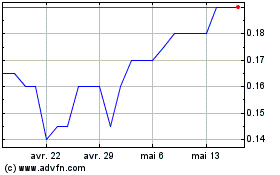

Kelso Technologies (TSX:KLS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Kelso Technologies (TSX:KLS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024