Medexus Pharmaceuticals Announces Pricing of $30 Million Overnight Marketed Public Offering of Common Shares

28 Janvier 2025 - 3:33PM

Medexus Pharmaceuticals Inc. ("Medexus" or the "Company") (TSX:

MDP), is pleased to announce the pricing and terms of its

previously announced overnight marketed underwritten offering (the

“Offering”) of 7,500,000 common shares of the Company (the “Common

Shares”) at a public offering price of $4.00 for aggregate proceeds

of $30,000,000.

Raymond James Ltd. is acting as lead underwriter

and sole bookrunner (the “Lead Underwriter”), on behalf of a

syndicate of underwriters, which includes Research Capital

Corporation, A.G.P. Canada Investments ULC, Bloom Burton Securities

Inc., Canaccord Genuity Corp. and Leede Financial Inc.

(collectively with the Lead Underwriter, the “Underwriters”). The

Company has agreed to grant to the Underwriters an over-allotment

option exercisable, in whole or in part, in the sole discretion of

the Lead Underwriter, to purchase up to an additional 1,125,000 of

Common Shares sold in the Offering for up to 30 days from the

closing date of the Offering.

The closing of the Offering is expected to occur

on or about January 31, 2025 and will be subject to market and

other customary closing conditions, including the approval of the

Toronto Stock Exchange.

The Company expects that the net proceeds of the

Offering will be used: (i) to repay a US$2.5 million credit

received from medac in September 2021 and pay a portion of the

milestone payment amount to medac, and (ii) for working capital and

general corporate purposes, which may include funding the Company’s

ongoing business development activities and initiatives.

Medexus will file a prospectus supplement (the

“Prospectus Supplement”) to the Company’s base shelf prospectus

dated November 15, 2024 (the “Base Shelf Prospectus”) in each of

the provinces and territories of Canada (other than Québec). The

Common Shares may be offered and sold in other jurisdictions

outside of Canada, provided that no prospectus or registration

statement filing or comparable obligation arises in such other

jurisdiction.

Access to the Prospectus Supplement, the

corresponding Base Shelf Prospectus and any amendment to the

documents is provided in accordance with securities legislation

relating to procedures for providing access to a shelf prospectus

supplement, a base shelf prospectus and any amendment to the

documents. The Base Shelf Prospectus is accessible, and the

Prospectus Supplement will be accessible within two business days,

through SEDAR+ at www.sedarplus.ca. An electronic or paper copy of

the Prospectus Supplement, the corresponding Base Shelf Prospectus

and any amendment to the documents may be obtained, without charge,

from: Raymond James Ltd., Scotia Plaza, 40 King St. W., 54th Floor,

Toronto, Ontario M5H 3Y2, Canada, or by telephone at 416-777-7000

or by email at ECM-Syndication@raymondjames.ca, by providing the

contact with an email address or address, as applicable. The Base

Shelf Prospectus and Prospectus Supplement will contain important

detailed information about the Company and the Offering.

Prospective investors should read the Base Shelf Prospectus and

Prospectus Supplement (when filed) and the other documents the

Company has filed on SEDAR+ before making an investment

decision.

The securities have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S. state securities

laws, and may not be offered or sold in the “United States” (as

such term is defined in Regulation S under the U.S. Securities Act)

without registration under the U.S. Securities Act and all

applicable U.S. state securities laws or compliance with the

requirements of an applicable exemption therefrom. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Medexus

Medexus is a leading specialty pharmaceutical

company with a strong North American commercial platform and a

growing portfolio of innovative and rare disease treatment

solutions. Medexus' current focus is on the therapeutic areas of

oncology, hematology, rheumatology, auto-immune diseases, allergy,

and dermatology. For more information about Medexus and its product

portfolio, please see the company's corporate website at

www.medexus.com and its filings on SEDAR+ at www.sedarplus.ca.

Contacts

Ken d'Entremont | CEO, Medexus

PharmaceuticalsTel: 905-676-0003 | Email:

ken.dentremont@medexus.com

Brendon Buschman | CFO, Medexus

PharmaceuticalsTel: 416-577-6216 | Email:

brendon.buschman@medexus.com

Victoria Rutherford | Adelaide CapitalTel:

480-625-5772 | Email: victoria@adcap.ca

Forward-looking statements

Certain statements made in this press release

contain forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”). The

words “anticipates”, “believes”, “expects”, “will”, “plans” and

similar expressions are often intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Specific forward-looking statements

contained in this news release include, but are not limited to,

statements with respect to the proposed closing date of the

Offering, the receipt of regulatory approvals for the Offering, and

the anticipated use of proceeds of the Offering. These statements

are based on Medexus' current expectations and assumptions,

including factors or assumptions that were applied in drawing a

conclusion or making a forecast or projection, including

assumptions based on historical trends, current conditions and

expected future developments. Since forward-looking statements

relate to future events and conditions, by their very nature they

require making assumptions and involve inherent risks and

uncertainties. The Company cautions that although it is believed

that the assumptions are reasonable in the circumstances, these

risks and uncertainties give rise to the possibility that actual

results could differ, and could differ materially from the

expectations contemplated by the forward-looking statements.

Material risk factors include, but are not limited to, those set

out in the Company’s materials filed with the Canadian securities

regulatory authorities from time to time, including the Company’s

most recent annual information form and management’s discussion and

analysis. Accordingly, undue reliance should not be placed on these

forward-looking statements, which are made only as of the date of

this news release. Other than as specifically required by law, the

Company undertakes no obligation to update any forward-looking

statements to reflect new information, subsequent or otherwise.

Medexus Pharmaceuticals (TSX:MDP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

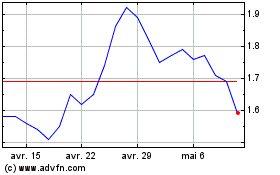

Medexus Pharmaceuticals (TSX:MDP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025