SmartCentres Real Estate Investment Trust (“SmartCentres”, the

“Trust” or the “REIT”) (TSX: SRU.UN) is pleased to report its

financial and operating results for the quarter ended

September 30, 2023.

“Building on a successful first half of the

year, we are pleased to report stronger performances in all areas

of the business for Q3,” said Mitchell Goldhar, CEO of

SmartCentres. “Our core retail portfolio has gone into a higher

gear and become more offensive, with even stronger numbers in our

centres anchored by Walmart, which drove an increase in net rental

income compared to the same quarter of last year. In-place and

committed occupancy has increased by 30 basis points from last

quarter to 98.5%, continuing our industry leadership. We expect to

continue delivering strong occupancy levels and solid rental income

for the balance of the year.”

“In addition to the strength of our core

recurring retail income, our mixed-use development program also

continues to grow and deliver strong results. We are delighted with

the progress we have made on our Transit City 4 & 5 condominium

projects at the Vaughan Metropolitan Centre,” said Mr. Goldhar.

“During the quarter, we closed on an additional 274 units in

Transit City 4 & 5, and the remaining 106 units at these two

towers are expected to close by the end of this year.”

“We also commenced construction or initial

siteworks on four new mixed-use development projects during the

quarter. These include the sold-out, 40-storey ArtWalk condominium

project at the Vaughan Metropolitan Centre, a new 200,000 square

foot flagship Canadian Tire store in the Leaside neighbourhood in

Toronto, and two additional multi-level self-storage projects. We

are confident that each of these projects will deliver strong

financial results to the Trust in the years to come.”

2023 Third Quarter

Highlights

Operational

- Shopping centre

leasing activity continued to strengthen from Q2 2023, with an

industry-leading in-place and committed occupancy rate of 98.5% as

at September 30, 2023 (June 30, 2023 – 98.2%).

- Executed new

leases of 182,682 square feet during the quarter.

- Renewed 84.2% of

the 5,083,274 square feet of current year expiries, with average

growth in renewed rents of 8.4% (excluding anchors).

Development

- Occupancy and

condo closings for Transit City 4 and 5 continued with an

additional 274 units closed during the third quarter generating

$6.9 million of FFO(1). The remaining 106 units are expected to

take place in Q4 2023.

- The Millway, a

458 rental unit apartments project is nearing completion. Leasing

continues to benefit from strong demand and is ahead of budget. As

of the end of the quarter, 67% of the 331 completed units were

leased. The remaining units are expected to be completed and ready

for lease by the end of 2023.

- Siteworks at

ArtWalk condominium Phase 1 commenced in September 2023, with all

320 released units sold out and the remaining units expected to be

released for sale in Q4 2023.

- The second phase

of the purpose-built residential rental project in Laval,

comprising 211 units, opened on July 1, 2023, and reached 82%

occupancy at the end of Q3 2023. Occupancy for the first phase has

reached 99%.

- The Trust,

together with its partner, Penguin, has also commenced preliminary

siteworks for the 224,000 square foot retail project on Laird Drive

in Toronto, that is expected to feature a flagship 200,000 square

foot Canadian Tire store together with 24,000 square feet of

additional retail space. Canadian Tire is expected to take

possession in early 2026.

- The Trust obtained municipal

approvals for two self-storage facilities in Stoney Creek and in

Toronto (Gilbert Ave), and commenced construction.

Financial

- Same Properties

NOI(1) increased by $2.6 million or 1.9% in Q3 2023 as compared to

the same period in 2022, which was attributable to lease-up

activity and higher rental renewal rates.

- Net rental

income for the three months ended September 30, 2023 increased

by $2.9 million or 2.3% as compared to the three months ended

September 30, 2022, primarily due to lease-up activity, higher

rental renewal rates and percentage rents.

- Net income and

comprehensive income per Unit was $1.19 (three months ended

September 30, 2022 – $0.02). The increase was primarily due to

a valuation adjustment in the prior year.

- FFO per Unit(1)

was $0.55 for the three months ended September 30, 2023

compared to $0.49 for the three months ended September 30,

2022. The increase was mainly attributable to higher profits from

condo closings at Transit City 4 & 5 and higher rental income,

partially offset by higher interest costs and a non-cash loss on

the total return swap.

- The Payout Ratio

to AFFO(1) for the three months ended September 30, 2023 was

96.1%, as compared to 101.6% for the same period ended

September 30, 2022, and 87.8% payout ratio to cash flows

provided by operating activities for the three months ended

September 30, 2023.

|

(1) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

Selected Consolidated Operational,

Mixed-Use Development and Financial Information

| (in thousands of

dollars, except per Unit and other non-financial data) |

|

|

|

| As

at |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

Portfolio Information (Number of properties) |

|

|

|

|

| Retail properties |

|

|

155 |

|

|

155 |

|

|

155 |

|

| Office properties |

|

|

4 |

|

|

4 |

|

|

4 |

|

| Self-storage properties |

|

|

9 |

|

|

6 |

|

|

6 |

|

| Residential properties |

|

|

2 |

|

|

2 |

|

|

2 |

|

| Industrial properties |

|

|

1 |

|

|

0 |

|

|

0 |

|

|

Properties under development |

|

|

20 |

|

|

19 |

|

|

19 |

|

|

Total number of properties with an ownership interest |

|

|

191 |

|

|

186 |

|

|

186 |

|

|

Leasing and Operational

Information(1) |

|

|

|

|

| Gross leasable

retail and office area (in thousands of sq. ft.) |

|

35,033 |

|

|

34,750 |

|

|

34,685 |

|

| In-place and committed

occupancy rate |

|

|

98.5% |

|

|

98.0% |

|

|

98.1% |

|

| Average lease term to maturity

(in years) |

|

|

4.3 |

|

|

4.2 |

|

|

4.3 |

|

| Net

annualized retail rental rate excluding Anchors (per occupied sq.

ft.) |

$22.43 |

|

$22.20 |

|

$22.40 |

|

| Mixed-Use Development

Information |

|

|

|

|

| Trust’s

share of future development area (in thousands of sq. ft.) |

|

40,325 |

|

|

41,200 |

|

|

39,500 |

|

| Financial

Information |

|

|

|

|

| Investment properties(2) |

|

|

10,433,183 |

|

|

10,250,392 |

|

|

10,211,384 |

|

| Total unencumbered

assets(3) |

|

|

9,067,121 |

|

|

8,415,900 |

|

|

8,383,900 |

|

| Debt to Aggregate

Assets(3)(4)(5) |

|

|

43.0% |

|

|

43.6% |

|

|

43.7% |

|

| Adjusted Debt to Adjusted

EBITDA(3)(4)(5) |

|

|

9.7X |

|

|

10.3X |

|

|

10.0X |

|

| Weighted average interest

rate(3)(4) |

|

|

4.13% |

|

|

3.86% |

|

|

3.67% |

|

| Weighted average term of debt

(in years) |

|

|

3.7 |

|

|

4.0 |

|

|

4.2 |

|

| Interest coverage

ratio(3)(4) |

|

|

2.8X |

|

|

3.1X |

|

|

3.3X |

|

|

Weighted average number of units outstanding – diluted(7) |

|

|

180,069,508 |

|

|

179,696,944 |

|

|

179,678,009 |

|

|

|

Three Months Ended September 30 |

|

|

Nine Months Ended September 30 |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Financial Information |

|

|

|

|

| Rentals from investment

properties and other(2) |

206,016 |

|

|

196,962 |

|

|

623,560 |

|

|

598,375 |

|

| Net income and comprehensive

income(2) |

215,175 |

|

|

3,548 |

|

|

495,938 |

|

|

535,655 |

|

| FFO(3)(4)(6) |

98,405 |

|

|

88,403 |

|

|

294,072 |

|

|

269,102 |

|

| AFFO(3)(4)(6) |

85,788 |

|

|

81,093 |

|

|

262,237 |

|

|

248,230 |

|

| Cash flows provided by

operating activities(2) |

93,855 |

|

|

97,011 |

|

|

237,108 |

|

|

243,800 |

|

| Net rental income and

other(2) |

130,402 |

|

|

127,481 |

|

|

385,110 |

|

|

373,453 |

|

| NOI(3)(4) |

143,834 |

|

|

130,986 |

|

|

424,407 |

|

|

384,888 |

|

| Change in net rental income

and other(3) |

2.3% |

|

|

2.9% |

|

|

3.1% |

|

|

3.8% |

|

| Change in SPNOI(3) |

1.9% |

|

|

3.1% |

|

|

3.2% |

|

|

3.3% |

|

| Net income and comprehensive

income per Unit(2) |

$1.21/$1.19 |

|

|

$0.02/$0.02 |

|

|

$2.78/$2.76 |

|

|

$3.01/$2.98 |

|

| FFO per Unit(3)(4)(6) |

$0.55/$0.55 |

|

|

$0.50/$0.49 |

|

|

$1.65/$1.64 |

|

|

$1.51/$1.50 |

|

| FFO with adjustments per

Unit(3)(4) |

$0.54/$0.54 |

|

|

$0.53/$0.52 |

|

|

$1.60/$1.59 |

|

|

$1.57/$1.56 |

|

| AFFO per Unit(3)(4)(6) |

$0.48/$0.48 |

|

|

$0.46/$0.45 |

|

|

$1.47/$1.46 |

|

|

$1.39/$1.38 |

|

| AFFO with adjustments per

Unit(3)(4) |

$0.47/$0.47 |

|

|

$0.48/$0.48 |

|

|

$1.42/$1.41 |

|

|

$1.45/$1.44 |

|

| Payout Ratio to

AFFO(3)(4)(6) |

96.1% |

|

|

101.6% |

|

|

94.3% |

|

|

99.6% |

|

| Payout Ratio to AFFO with

adjustments(3)(4) |

97.7% |

|

|

95.6% |

|

|

97.6% |

|

|

95.6% |

|

| Payout

Ratio to cash flows provided by operating activities |

87.8% |

|

|

84.9% |

|

|

104.3% |

|

|

101.4% |

|

|

(1) |

Excluding residential and self-storage area. |

|

(2) |

Represents a Generally Accepted Accounting Principles (“GAAP”)

measure. |

|

(3) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

|

(4) |

Includes the Trust’s proportionate share of equity accounted

investments. |

|

(5) |

As at September 30, 2023, cash-on-hand of $45.3 million was

excluded for the purposes of calculating the applicable ratios

(December 31, 2022 – $33.4 million, September 30,

2022 – $150.0 million). |

|

(6) |

The calculation of the Trust’s FFO and AFFO and related payout

ratios, including comparative amounts, are financial metrics that

were determined based on the REALpac White Paper on FFO and AFFO

issued in January 2022 (“REALpac White Paper”). Comparison with

other reporting issuers may not be appropriate. The payout ratio to

AFFO is calculated as declared distributions divided by AFFO. |

|

(7) |

The diluted weighted average includes the vested portion of the

deferred units issued pursuant to the deferred unit plan. |

Development and Intensification

SummaryThe following table provides additional details on

the Trust’s 13 development initiatives that are currently under

construction or where initial siteworks have began (in order of

estimated initial occupancy/closing date):

|

Projects under construction (Location/Project

Name) |

Type |

Trust’s Share (%) |

Actual / estimated initial occupancy / closing

date |

% of completion |

GFA(2) (sq.

ft.) |

No. of units |

|

|

|

|

|

|

|

|

| Mixed-use

Developments |

|

|

|

|

|

|

|

Vaughan / The Millway |

Apartment |

50 |

Q1 2023 |

94 |

% |

— |

458 |

|

Vaughan / Transit City 4 |

Condo |

25 |

Q1 2023 |

96 |

% |

— |

498 |

|

Vaughan / Transit City 5 |

Q2 2023 |

96 |

% |

528 |

|

Pickering (Seaton Lands) |

Industrial |

100 |

Q2 2023 |

90 |

% |

229,000 |

— |

|

Markham East / Boxgrove |

Self-storage |

50 |

Q1 2024 |

63 |

% |

133,000 |

910 |

|

Whitby |

Self-storage |

50 |

Q1 2024 |

59 |

% |

126,000 |

811 |

|

Vaughan NW |

Townhouse |

50 |

Q3/Q4 2024 |

34 |

% |

— |

174 |

|

Toronto (Gilbert Ave.) |

Self-storage |

50 |

Q4 2024 |

41 |

% |

176,000 |

1,469 |

|

Stoney Creek |

Self-storage |

50 |

Q4 2024 |

16 |

% |

138,000 |

973 |

|

Ottawa SW (2) |

Retirement Residence |

50 |

Q2 2025 |

25 |

% |

— |

402 |

|

Ottawa SW (2) |

Seniors’ Apartments |

|

Vaughan / ArtWalk (40 Storeys) |

Condo |

50 |

Q2 2027 |

12 |

% |

— |

373 |

|

Retail Development |

|

|

|

|

|

|

|

Toronto (Laird) |

Retail |

50 |

Q1 2026 |

19 |

% |

224,000 |

— |

| (1) |

GFA represents

Gross Floor Area. |

| (2) |

Figure represents capital spend of both retirement residence

and seniors’ apartments projects. |

Reconciliations of Non-GAAP

MeasuresThe following tables reconcile the non-GAAP

measures to the most comparable GAAP measures for the three and

nine months ended September 30, 2023 and the comparable

periods in 2022. Such measures do not have a standardized meaning

prescribed by IFRS and may not be comparable to similar measures

disclosed by other issuers.

Net Operating Income (including the

Trust’s Interests in Equity Accounted

Investments)Quarterly Comparison to Prior

Year

| (in

thousands of dollars) |

Three Months Ended September 30, 2023 |

Three Months Ended September 30, 2022 |

|

|

GAAP Basis |

Proportionate Share Reconciliation |

Total Proportionate Share(1) |

GAAP Basis |

Proportionate Share Reconciliation |

Total Proportionate Share(1) |

|

Net rental income and other |

|

|

|

|

|

|

|

Rentals from investment properties and other |

$206,016 |

|

$9,580 |

|

$215,596 |

|

$196,962 |

|

$7,286 |

|

$204,248 |

|

|

Property operating costs and other |

|

(74,551 |

) |

|

(4,397 |

) |

|

(78,948 |

) |

|

(69,451 |

) |

|

(3,567 |

) |

|

(73,018 |

) |

|

|

$131,465 |

|

$5,183 |

|

$136,648 |

|

$127,511 |

|

$3,719 |

|

$131,230 |

|

|

Residential sales revenue and other(2) |

|

— |

|

|

37,934 |

|

|

37,934 |

|

|

— |

|

|

7 |

|

|

7 |

|

|

Residential cost of sales and other |

|

(1,063 |

) |

|

(29,685 |

) |

|

(30,748 |

) |

|

(30 |

) |

|

(221 |

) |

|

(251 |

) |

|

|

$(1,063 |

) |

$8,249 |

|

$7,186 |

|

$(30 |

) |

$(214 |

) |

$(244 |

) |

|

NOI |

$130,402 |

|

$13,432 |

|

$143,834 |

|

$127,481 |

|

$3,505 |

|

$130,986 |

|

|

(1) |

This column contains non-GAAP measures because it includes figures

that are recorded in equity accounted investments. The Trust’s

method of calculating non-GAAP measures may differ from other

reporting issuers’ methods and, accordingly, may not be comparable.

For additional information, please see “Non-GAAP Measures” in this

Press Release. |

|

(2) |

Includes additional partnership profit and other revenues. |

Year-to-Date Comparison to Prior

Year

| (in

thousands of dollars) |

Nine Months Ended September 30, 2023 |

Nine Months Ended September 30, 2022 |

|

|

GAAP Basis |

Proportionate Share Reconciliation |

Total Proportionate Share(1) |

GAAP Basis |

Proportionate Share Reconciliation |

Total Proportionate Share(1) |

|

Net rental income and other |

|

|

|

|

|

|

|

Rentals from investment properties and other |

$623,560 |

|

$26,105 |

|

$649,665 |

|

$598,375 |

|

$20,202 |

|

$618,577 |

|

|

Property operating costs and other |

|

(235,074 |

) |

|

(12,680 |

) |

|

(247,754 |

) |

|

(224,497 |

) |

|

(9,688 |

) |

|

(234,185 |

) |

|

|

$388,486 |

|

$13,425 |

|

$401,911 |

|

$373,878 |

|

$10,514 |

|

$384,392 |

|

|

Residential sales revenue and other(2) |

|

— |

|

|

125,401 |

|

|

125,401 |

|

|

— |

|

|

4,524 |

|

|

4,524 |

|

|

Residential cost of sales and other |

|

(3,376 |

) |

|

(99,529 |

) |

|

(102,905 |

) |

|

(425 |

) |

|

(3,603 |

) |

|

(4,028 |

) |

|

|

$(3,376 |

) |

$25,872 |

|

$22,496 |

|

$(425 |

) |

$921 |

|

$496 |

|

|

NOI |

$385,110 |

|

$39,297 |

|

$424,407 |

|

$373,453 |

|

$11,435 |

|

$384,888 |

|

|

(1) |

This column contains non-GAAP measures because it includes figures

that are recorded in equity accounted investments. The Trust’s

method of calculating non-GAAP measures may differ from other

reporting issuers’ methods and, accordingly, may not be comparable.

For additional information, please see “Non-GAAP Measures” in this

Press Release. |

|

(2) |

Includes additional partnership profit and other revenues. |

Same Properties NOI

| |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

(in thousands of dollars) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net rental income and other |

$130,402 |

|

$127,481 |

|

$385,110 |

|

$373,453 |

|

| NOI

from equity accounted investments(1) |

|

13,432 |

|

|

3,505 |

|

|

39,297 |

|

|

11,435 |

|

|

Total portfolio NOI before adjustments(1) |

$143,834 |

|

$130,986 |

|

$424,407 |

|

$384,888 |

|

| |

|

|

|

|

| Adjustments: |

|

|

|

|

|

Lease termination |

|

(230 |

) |

|

12 |

|

|

(691 |

) |

|

(133 |

) |

|

Net profit on condo and townhome closings |

|

(7,186 |

) |

|

244 |

|

|

(22,496 |

) |

|

(496 |

) |

|

Non-recurring items and other adjustments(2) |

|

1,814 |

|

|

3,073 |

|

|

5,324 |

|

|

6,143 |

|

|

Total portfolio NOI after adjustments(1) |

$138,232 |

|

$134,315 |

|

$406,544 |

|

$390,402 |

|

| |

|

|

|

|

| NOI

sourced from: |

|

|

|

|

|

Acquisitions |

|

(576 |

) |

|

27 |

|

|

(5,537 |

) |

|

(3,857 |

) |

|

Dispositions |

|

— |

|

|

1 |

|

|

2 |

|

|

(12 |

) |

|

Earnouts and Developments |

|

(970 |

) |

|

(226 |

) |

|

(3,017 |

) |

|

(818 |

) |

|

Same Properties NOI(1) |

$136,686 |

|

$134,117 |

|

$397,992 |

|

$385,715 |

|

|

(1) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

|

(2) |

Includes non-recurring items such as one-time adjustments relating

to vaccination centre costs, royalties, straight-line rent and

amortization of tenant incentives. |

Reconciliation of FFO

| |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

(in thousands of dollars) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income and comprehensive income |

$215,175 |

|

$3,548 |

|

$495,938 |

|

$535,655 |

|

| Add (deduct): |

|

|

|

|

|

Fair value adjustment on investment properties and financial

instruments(1) |

|

(67,063 |

) |

|

80,790 |

|

|

(157,989 |

) |

|

(279,703 |

) |

|

Loss on derivative – TRS |

|

(5,482 |

) |

|

(4,900 |

) |

|

(13,519 |

) |

|

(11,138 |

) |

|

Loss on sale of investment properties |

|

— |

|

|

112 |

|

|

23 |

|

|

216 |

|

|

Amortization of intangible assets and tenant improvement

allowance |

|

2,085 |

|

|

2,294 |

|

|

6,730 |

|

|

6,197 |

|

|

Distributions on Units classified as liabilities and vested

deferred units |

|

2,172 |

|

|

1,801 |

|

|

6,321 |

|

|

5,333 |

|

|

Adjustment on debt modification |

|

— |

|

|

— |

|

|

— |

|

|

(1,960 |

) |

|

Salaries and related costs attributed to leasing activities(2) |

|

1,776 |

|

|

2,216 |

|

|

5,810 |

|

|

5,994 |

|

|

Acquisition-related costs |

|

— |

|

|

(25 |

) |

|

— |

|

|

298 |

|

|

Adjustments relating to equity accounted investments(3) |

|

(50,258 |

) |

|

2,567 |

|

|

(49,242 |

) |

|

8,210 |

|

|

FFO(4) |

$98,405 |

|

$88,403 |

|

$294,072 |

|

$269,102 |

|

| Add (deduct) non-recurring

adjustments: |

|

|

|

|

|

Loss on derivative – TRS |

|

5,482 |

|

|

4,900 |

|

|

13,519 |

|

|

11,138 |

|

|

FFO sourced from condominium and townhome closings |

|

(6,918 |

) |

|

216 |

|

|

(21,354 |

) |

|

(860 |

) |

|

Transactional FFO – loss on sale of land to co-owner |

|

— |

|

|

— |

|

|

(1,008 |

) |

|

— |

|

|

FFO with adjustments(4) |

$96,969 |

|

$93,519 |

|

$285,229 |

|

$279,380 |

|

|

(1) |

Includes fair value adjustments on investment properties and

financial instruments. Fair value adjustment on investment

properties is described in “Investment Properties” in the Trust’s

MD&A. Fair value adjustment on financial instruments comprises

the following financial instruments: units classified as

liabilities, Deferred Unit Plan (“DUP”), Equity Incentive Plan

(“EIP”), TRS, interest rate swap agreements, and LTIP recorded in

the same period in 2022. The significant assumptions made in

determining the fair value are more thoroughly described in the

Trust’s unaudited interim condensed consolidated financial

statements for the three and nine months ended September 30,

2023. For details, please see discussion in “Results of Operations”

in the Trust’s MD&A. |

|

(2) |

Salaries and related costs attributed to leasing activities of $5.8

million were incurred in the nine months ended September 30,

2023 (nine months ended September 30, 2022 – $6.0 million) and

were eligible to be added back to FFO based on the definition of

FFO, in the REALpac White Paper, which provided for an adjustment

to incremental leasing expenses for the cost of salaried staff.

This adjustment to FFO results in more comparability between

Canadian publicly traded real estate entities that expensed their

internal leasing departments and those that capitalized external

leasing expenses. |

|

(3) |

Includes tenant improvement amortization, indirect interest with

respect to the development portion, fair value adjustment on

investment properties, loss (gain) on sale of investment

properties, and adjustment for supplemental costs. |

|

(4) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

Reconciliation of AFFO

| |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

(in thousands of dollars) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

FFO(1) |

$98,405 |

|

$88,403 |

|

$294,072 |

|

$269,102 |

|

| Add (Deduct): |

|

|

|

|

|

Straight-line of rents |

|

(410 |

) |

|

(24 |

) |

|

(211 |

) |

|

(403 |

) |

|

Adjusted salaries and related costs attributed to leasing |

|

(1,776 |

) |

|

(2,216 |

) |

|

(5,810 |

) |

|

(5,994 |

) |

|

Actual sustaining capital expenditures, leasing commissions, and

tenant improvements |

|

(10,431 |

) |

|

(5,070 |

) |

|

(25,814 |

) |

|

(14,475 |

) |

|

AFFO(1) |

$85,788 |

|

$81,093 |

|

$262,237 |

|

$248,230 |

|

| Add (deduct) non-recurring

adjustments: |

|

|

|

|

| Loss on derivative – TRS |

|

5,482 |

|

|

4,900 |

|

|

13,519 |

|

|

11,138 |

|

| FFO sourced from condominium

and townhome closings |

|

(6,918 |

) |

|

216 |

|

|

(21,354 |

) |

|

(860 |

) |

|

Transactional FFO – loss on sale of land to co-owner |

|

— |

|

|

— |

|

|

(1,008 |

) |

|

— |

|

|

AFFO with adjustments(1) |

$84,352 |

|

$86,209 |

|

$253,394 |

|

$258,508 |

|

|

(1) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

Adjusted EBITDAThe following

table presents a reconciliation of net income and comprehensive

income to Adjusted EBITDA:

| |

Rolling 12 Months Ended |

| (in

thousands of dollars) |

September 30, 2023 |

September 30, 2022 |

|

Net income and comprehensive income |

$596,309 |

|

$1,187,736 |

|

| Add

(deduct) the following items: |

|

|

|

Net interest expense |

|

151,810 |

|

|

137,054 |

|

| Amortization of equipment,

intangible assets and tenant improvements |

|

11,367 |

|

|

10,907 |

|

| Fair value adjustments on

investment properties and financial instruments |

|

(228,795 |

) |

|

(840,441 |

) |

| Fair value adjustment on

TRS |

|

(7,298 |

) |

|

(6,958 |

) |

| Adjustment for supplemental

costs |

|

5,212 |

|

|

5,035 |

|

| (Gain) loss on sale of

investment properties |

|

(509 |

) |

|

521 |

|

| Gain on sale of land to

co-owners (Transactional FFO) |

|

— |

|

|

336 |

|

|

Acquisition-related costs |

|

— |

|

|

3,089 |

|

|

Adjusted EBITDA(1) |

$528,096 |

|

$497,279 |

|

|

(1) |

Represents a non-GAAP measure. The Trust’s method of calculating

non-GAAP measures may differ from other reporting issuers’ methods

and, accordingly, may not be comparable. For additional

information, please see “Non-GAAP Measures” in this Press

Release. |

Non-GAAP Measures

The non-GAAP measures used in this Press

Release, including but not limited to, AFFO, AFFO with adjustments,

AFFO per Unit, AFFO with adjustments per Unit, Payout Ratio to

AFFO, Payout Ratio to AFFO with adjustments, Unencumbered Assets,

NOI, Debt to Aggregate Assets, Interest Coverage Ratio, Adjusted

Debt to Adjusted EBITDA, Unsecured/Secured Debt Ratio, FFO, FFO

with adjustments, FFO per Unit, FFO with adjustments per Unit, Same

Properties NOI, Debt to Gross Book Value, Weighted Average Interest

Rate, Transactional FFO, and Total Proportionate Share, do not have

any standardized meaning prescribed by International Financial

Reporting Standards (“IFRS”) and are therefore unlikely to be

comparable to similar measures presented by other issuers.

Additional information regarding these non-GAAP measures is

available in the Management’s Discussion and Analysis of the Trust

for the three and nine months ended September 30, 2023, dated

November 8, 2023 (the “MD&A), and is incorporated by

reference. The information is found in the “Presentation of Certain

Terms Including Non-GAAP Measures” and “Non-GAAP Measures” sections

of the MD&A, which is available on SEDAR+ at www.sedarplus.ca.

Reconciliations of non-GAAP financial measures to the most directly

comparable IFRS measures are found in “Reconciliations of Non-GAAP

Measures” of this Press Release.

Full reports of the financial results of the

Trust for the three and nine months ended September 30, 2023

are outlined in the unaudited interim condensed consolidated

financial statements and the related MD&A of the Trust for the

three and nine months ended September 30, 2023, which are

available on SEDAR+ at www.sedarplus.ca.

Conference Call

Management will hold a conference call on

Thursday, November 9, 2023 at 8:00 a.m. (ET).

Interested parties are invited to access the

call by dialing 1-888-440-5675 and then keying in the participant

access code 2010586#.

A recording of this call will be made available

Thursday, November 9, 2023 through to Thursday,

November 16, 2023. To access the recording, please call

1-800-770-2030 and enter the conference access code 2010586#.

About SmartCentres

SmartCentres is one of Canada’s largest fully

integrated REITs, with a best-in-class and growing mixed-use

portfolio featuring 191 strategically located properties in

communities across the country. SmartCentres has approximately

$12.0 billion in assets and owns 35.0 million square feet of

income producing value-oriented retail and first-class office

properties with 98.5% in place and committed occupancy, on 3,500

acres of owned land across Canada.

Cautionary Statements Regarding

Forward-looking Statements

Certain statements in this Press Release are

"forward-looking statements" that reflect management's expectations

regarding the Trust's future growth, results of operations,

performance and business prospects and opportunities. More

specifically, certain statements including, but not limited to,

statements related to SmartCentres’ expectations relating to cash

collections, SmartCentres’ expected or planned development plans

and joint venture projects, including the described type, scope,

costs and other financial metrics and the expected timing of

construction and condominium closings and statements that contain

words such as "could", "should", "can", "anticipate", "expect",

"believe", "will", "may" and similar expressions and statements

relating to matters that are not historical facts, constitute

"forward-looking statements". These forward-looking statements are

presented for the purpose of assisting the Trust's Unitholders and

financial analysts in understanding the Trust's operating

environment and may not be appropriate for other purposes. Such

forward-looking statements reflect management's current beliefs and

are based on information currently available to management.

However, such forward-looking statements involve

significant risks and uncertainties. A number of factors could

cause actual results to differ materially from the results

discussed in the forward-looking statements, including risks

associated with potential acquisitions not being completed or not

being completed on the contemplated terms, public health crises,

real property ownership and development, debt and equity financing

for development, interest and financing costs, construction and

development risks, and the ability to obtain commercial and

municipal consents for development. These risks and others are more

fully discussed under the heading “Risks and Uncertainties” and

elsewhere in SmartCentres’ most recent Management’s Discussion and

Analysis, as well as under the heading “Risk Factors” in

SmartCentres’ most recent annual information form. Although the

forward-looking statements contained in this Press Release are

based on what management believes to be reasonable assumptions,

SmartCentres cannot assure investors that actual results will be

consistent with these forward-looking statements. The

forward-looking statements contained herein are expressly qualified

in their entirety by this cautionary statement. These

forward-looking statements are made as at the date of this Press

Release and SmartCentres assumes no obligation to update or revise

them to reflect new events or circumstances unless otherwise

required by applicable securities legislation.

Material factors or assumptions that were applied in drawing a

conclusion or making an estimate set out in the forward-looking

information may include, but are not limited to: a stable retail

environment; a continuing trend toward land use intensification,

including residential development in urban markets and continued

growth along transportation nodes; access to equity and debt

capital markets to fund, at acceptable costs, future capital

requirements and to enable our refinancing of debts as they mature;

that requisite consents for development will be obtained in the

ordinary course, construction and permitting costs consistent with

the past year and recent inflation trends.

Contact

For information, visit www.smartcentres.com or please

contact:

| Mitchell

Goldhar |

Peter

Slan |

| Executive Chairman and CEO |

Chief Financial Officer |

| SmartCentres |

SmartCentres |

| (905) 326-6400 ext. 7674 |

(905) 326-6400 ext. 7571 |

| mgoldhar@smartcentres.com |

pslan@smartcentres.com |

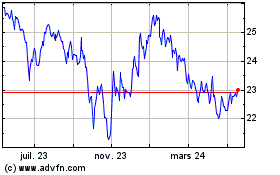

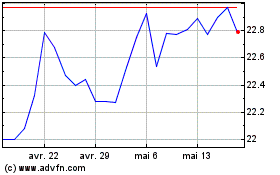

SmartCentres Real Estate... (TSX:SRU.UN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

SmartCentres Real Estate... (TSX:SRU.UN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024