StorageVault Completes the Purchase of 6 Storage Assets, Surpasses 11,000,000 Rentable Square Feet and Adds 4 Rooftop Solar Panel Systems

30 Juin 2022 - 10:30PM

STORAGEVAULT CANADA INC.

(“

StorageVault”) (

SVI-TSX) is

pleased to announce that, further to its May 12, 2022 news release,

it has completed the acquisition of 6 stores (collectively, the

“

Acquisitions”) from 6 vendor groups

(collectively, the “

Vendors”), for an aggregate

purchase price of $167.5 million. Five of the Acquisitions are

arm’s length and one is a related party acquisition (the

“Related Party Acquisition”) with Access Self

Storage Inc. (“

Access”) as the Vendor.

The aggregate purchase price for the

Acquisitions in the amount of $167.5 million, subject to customary

adjustments, was paid by the issuance of an aggregate of 814,686

common shares of StorageVault (“Payment Shares”)

at an aggregate price of $5,000,000, with the remainder being paid

with funds on hand, a promissory note and mortgage financing. The

Payment Shares are subject to a hold period that expires October

31, 2022.

With these Acquisitions, StorageVault has now

closed $213.6 million of acquisitions this year and now owns over

11 million square feet of rentable storage space. The one remaining

transaction announced on May 12, 2022 is expected to close in Q3

2022.

Continued Focus on Environmental

InitiativesIn our ongoing commitment to implement

sustainable environmental practices, StorageVault has added 4

rooftop solar panel systems, this brings us to 36 rooftop solar

systems and solar walls.

Exemption from MI 61-101As

Access is a non-arm’s length party to StorageVault, the Related

Party Acquisition is considered a “related party transaction” under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

StorageVault is relying on exemptions from the formal valuation and

minority approval requirements of MI 61-101, in respect of the

Related Party Acquisition, pursuant to Section 5.5(a) and Section

5.7(a) (Fair Market Value Not More Than 25% of Market

Capitalization) of MI 61-101.

About StorageVault Canada

Inc.StorageVault, before the completion of the

Acquisitions, owns and operates 235 storage locations across

Canada. StorageVault owns 203 of these locations plus over 4,500

portable storage units representing over 11.2 million rentable

square feet on over 660 acres of land. StorageVault also provides

last mile storage and logistics solutions and professional records

management services, such as document and media storage, imaging

and shredding services.

For further information, contact Mr. Steven

Scott or Mr. Iqbal Khan:

Tel: 1-877-622-0205

ir@storagevaultcanada.com

Forward-Looking Information: This news release

contains “forward-looking information” within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein are

forward-looking information. In particular, this news release

contains forward-looking information in relation to: the timing for

completion of the remaining acquisition announced in the May 12,

2022 news release. This forward-looking information reflects

StorageVault’s current beliefs and is based on information

currently available to StorageVault and on assumptions StorageVault

believes are reasonable. These assumptions include, but are not

limited to: the completion of satisfactory due diligence by

StorageVault in relation to the remaining acquisition; the

satisfactory fulfilment of all of the conditions precedent to the

remaining acquisition including satisfactory due diligence, and

satisfactory environmental site assessment reports; and the

receipt of all required approvals for the remaining acquisition,

including any board approvals. Forward-looking information is

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of StorageVault to be materially different from

those expressed or implied by such forward-looking information.

Such risks and other factors may include, but are not limited to:

general business, economic, competitive, political and social

uncertainties; general capital market conditions and market prices

for securities; delay or failure to receive board of directors,

third party or regulatory approvals; the actual results of

StorageVault’s future operations; competition; changes in

legislation, including environmental legislation, affecting

StorageVault; the timing and availability of external financing on

acceptable terms; conclusions of economic evaluations and

appraisals; lack of qualified, skilled labour or loss of key

individuals; risks related to the COVID-19 pandemic including

various recommendations, orders and measures of governmental

authorities to try to limit the pandemic, including travel

restrictions, border closures, non-essential business closures,

service disruptions, quarantines, self-isolations,

shelters-in-place and social distancing, mandatory vaccination

policies, disruptions to markets, economic activity, financing,

supply chains and sales channels, and a deterioration of general

economic conditions including a possible national or global

recession; and the impact that the COVID-19 pandemic may have on

StorageVault which may include: a short-term delay in payments from

customers, an increase in accounts receivable and an increase of

losses on accounts receivable; decreased demand for the services

that StorageVault offers; and a deterioration of financial markets

that could limit StorageVault’s ability to obtain external

financing. A description of additional risk factors that may cause

actual results to differ materially from forward-looking

information can be found in StorageVault’s disclosure documents on

the SEDAR website at www.sedar.com. Although StorageVault has

attempted to identify important risks and factors that could cause

actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Forward-looking information contained in this news release

is expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of StorageVault as of the date of this

news release and, accordingly, is subject to change after such

date. However, StorageVault expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities law.

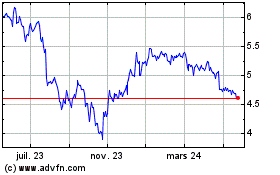

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

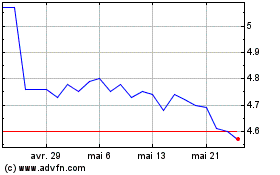

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025