Wallbridge Mining

Company Limited

(TSX: WM,

OTCQX:WLBMF) (

“Wallbridge” or the

“Company”) has scheduled a special meeting of

shareholders (the

“Special Meeting”) for 4:30 pm

on October 18, 2022. The Special Meeting is related to the proposed

distribution of Archer Exploration Corp. (

CSE:

RCHR) (

“Archer”) shares to Wallbridge

shareholders.

As announced on July 13, 2022, Wallbridge has

entered into a definitive agreement (the

“Agreement”) with Archer, under which Archer will

acquire all of Wallbridge’s property, assets, rights, and

obligations related to its portfolio of nickel assets, including

the Grasset property (the “Transaction”).

Under the terms of the Agreement, Wallbridge

will receive 198,635,786 common shares of Archer (“Archer

Shares”), valued using the July 12, 2022, closing price of

Archer Shares, at C$53.6 million. Wallbridge shareholders of record

will receive a pro-rata distribution in the form of Archer Shares

(the “Distribution”) within 60 days of closing of

the Transaction, such that following the Distribution, the Company

will retain an approximately 19.9% basic ownership interest in

Archer (after giving effect to, among other things, the private

placement of securities to raise gross proceeds of not less than

$10,000,000 to be carried out by Archer on or before closing of the

Transaction). At the Special Meeting, Wallbridge shareholders will

be asked to approve a special resolution authorizing and approving

a reduction of the stated capital account of the common shares of

Wallbridge for the purposes of effecting a return of capital to

Wallbridge shareholders by way of the Distribution, and will not be

asked to approve the Distribution or the Transaction themselves.

Further information regarding the special resolution, including

Canadian tax matters, will be made available on SEDAR at

www.sedar.com and www.wallbridgemining.com in due course.

Marz Kord, Wallbridge’s President and CEO,

commented:

“We believe the Transaction is a major milestone

in the evolution of Wallbridge while providing a substantial,

tangible benefit to our shareholders via a return of capital in the

form of Archer shares.

First, it immediately unlocks the value of the

Company’s non-gold assets. It puts that value back in the hands of

Wallbridge shareholders, giving them near-term liquidity and growth

potential. Second, shareholders will retain additional upside

potential from the non-gold assets through Wallbridge’s retention

of a significant equity interest in Archer, a 2% royalty on the

Grasset property and continued rights for the Company to explore

for gold at Grasset. Third, Wallbridge retains oversight of its

shareholders’ interests in Archer through its two seats on the

Archer board. Finally, the Transaction will allow us to reshape the

Company as a pure gold investment by optimizing our portfolio to

focus on unlocking value from Fenelon, Martiniere and our other

gold properties on the Detour-Fenelon Gold Trend.”

Backed by Inventa Capital Corp., a

resource-focused venture capital firm, Archer is focused on

building a portfolio of high-quality, high-potential exploration

and development nickel sulfide projects. As a result of the

Transaction, Archer’s portfolio will include 42 prospective

properties in the mining-friendly jurisdictions of Ontario and

Quebec. Further information about Archer can be found in Archer’s

regulatory filings available on SEDAR at www.sedar.com.

About

Wallbridge Mining

Wallbridge is focused on creating value through

discovering, acquiring, developing, and producing gold from a

portfolio of advanced exploration stage assets in established

Canadian mining jurisdictions. Wallbridge’s flagship Fenelon

Project is situated on the highly prospective Detour-Fenelon Gold

Trend in Northern Abitibi, Quebec. Fenelon and Martiniere are

located within a highly prospective 910-square-kilometre

exploration land package controlled by Wallbridge. The Projects are

located near existing power and transportation infrastructure.

A 2021 Mineral Resource Estimate at Fenelon

returned 2.67 million ounces of Indicated Resources and 1.72

million ounces of Inferred Resources. The Mineral Resource Estimate

validated the multi-million-ounce gold potential of Fenelon and

Wallbridge’s nearby Martiniere Property.

Wallbridge also has interests in several copper,

nickel and platinum group metal properties, including a 17.8%

interest in Lonmin Canada Inc.

Further information about Wallbridge can be

found in the Company’s regulatory filings available on SEDAR at

www.sedar.com and on the Company’s website

at www.wallbridgemining.com.

This news release has been authorized by the

undersigned on behalf of Wallbridge Mining Company Limited.

Wallbridge

Mining Company

Limited

Marz Kord, P. Eng., M. Sc., MBA President &

CEOTel: (705) 682‒9297 ext. 251Email:

mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics,

MBAInvestor Relations AdvisorEmail:

vvargas@wallbridgemining.com

Cautionary Note Regarding

Forward-Looking Information

This press release contains forward-looking

statements or information (collectively, “FLI”)

within the meaning of applicable Canadian securities legislation.

FLI is based on expectations, estimates, projections, and

interpretations as at the date of this press release.

All statements, other than statements of

historical fact, included herein are FLI that involve various

risks, assumptions, estimates and uncertainties. Generally, FLI can

be identified by the use of statements that include words such as

“seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”,

“scheduled”, “estimates”, “expects”, “forecasts”, “intends”,

“projects”, “predicts”, “proposes”, "potential", “targets” and

variations of such words and phrases, or by statements that certain

actions, events or results “may”, “will”, “could”, “would”,

“should” or “might”, “be taken”, “occur” or “be achieved.”

FLI herein includes, but is not limited to,

statements regarding the completion of the Transaction and the

Distribution, the timing and terms of financing activities to be

carried out by Archer, and the intentions of Wallbridge and Archer

upon completion of the Transaction. FLI is designed to help you

understand management’s current views of its near- and longer-term

prospects, and it may not be appropriate for other purposes. FLI by

their nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance, or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such FLI. Although the FLI

contained in this press release is based upon what management

believes, or believed at the time, to be reasonable assumptions,

the Company cannot assure shareholders and prospective purchasers

of securities of the Company that actual results will be consistent

with such FLI, as there may be other factors that cause results not

to be as anticipated, estimated or intended, and neither the

Company nor any other person assumes responsibility for the

accuracy and completeness of any such FLI. Except as required by

law, the Company does not undertake, and assumes no obligation, to

update or revise any such FLI contained herein to reflect new

events or circumstances, except as may be required by law. Unless

otherwise noted, this press release has been prepared based on

information available as of the date of this press release.

Accordingly, you should not place undue reliance on the FLI or

information contained herein.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in FLI.

Assumptions upon which FLI is based, without

limitation, include the ability of the Company and Archer to obtain

required approvals and satisfy the closing conditions under the

Agreement (including completion of the Financing by Archer), the

results of exploration activities, the Company’s financial position

and general economic conditions. Risks and uncertainties about

Wallbridge's business are more fully discussed in the disclosure

materials filed with the securities regulatory authorities in

Canada, which are available at www.sedar.com.

Information Concerning Estimates of

Mineral Resources

The disclosure in this press release and

referred to herein was prepared in accordance with NI 43-101 which

differs significantly from the requirements of the U.S. Securities

and Exchange Commission (the "SEC"). Any use of

the terms "measured mineral resource", "indicated mineral resource"

and "inferred mineral resource" in this press release are in

reference to the mining terms defined in the Canadian Institute of

Mining, Metallurgy and Petroleum Standards (the "CIM

Definition Standards"), which definitions have been

adopted by NI 43-101. Accordingly, information contained in this

press release providing descriptions of the Company’s mineral

deposits in accordance with NI 43-101 may not be comparable to

similar information made public by U.S. companies subject to the

United States federal securities laws and the rules and regulations

thereunder.

Investors are cautioned not to assume that any

part or all of mineral resources will ever be converted into

reserves. Pursuant to CIM Definition Standards, inferred mineral

resources are that part of a mineral resource for which quantity

and grade or quality are estimated on the basis of limited

geological evidence and sampling. Such geological evidence is

sufficient to imply but not verify geological and grade or quality

continuity. An inferred mineral resource has a lower level of

confidence than that applying to an indicated mineral resource and

must not be converted to a mineral reserve. However, it is

reasonably expected that the majority of inferred mineral resources

could be upgraded to indicated mineral resources with continued

exploration. Under Canadian rules, estimates of inferred mineral

resources may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. Investors are cautioned not to

assume that all or any part of an inferred mineral resource is

economically or legally mineable. Disclosure of "contained ounces"

in a resource is permitted disclosure under Canadian regulations;

however, the SEC normally only permits issuers to report

mineralization that does not constitute "reserves" by SEC standards

as in place tonnage and grade without reference to unit

measures.

Canadian standards, including the CIM Definition

Standards and NI 43-101, differ significantly from standards in the

SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted

new mining disclosure rules under subpart 1300 of Regulation S-K of

the United States Securities Act of 1933, as amended (the

"SEC Modernization Rules"), with compliance

required for the first fiscal year beginning on or after January 1,

2021. The SEC Modernization Rules replace the historical property

disclosure requirements included in SEC Industry Guide 7. As a

result of the adoption of the SEC Modernization Rules, the SEC now

recognizes estimates of "measured mineral resources", "indicated

mineral resources" and "inferred mineral resources". Information

regarding mineral resources contained or referenced in this press

release may not be comparable to similar information made public by

companies that report according to U.S. standards. While the SEC

Modernization Rules are purported to be "substantially similar" to

the CIM Definition Standards, readers are cautioned that there are

differences between the SEC Modernization Rules and the CIM

Definitions Standards. Accordingly, there is no assurance any

mineral resources that the Company may report as "measured mineral

resources", "indicated mineral resources" and "inferred mineral

resources" under NI 43-101 would be the same had the Company

prepared the resource estimates under the standards adopted under

the SEC Modernization Rules.

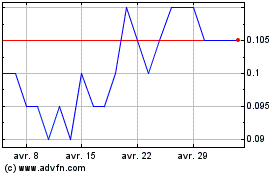

Wallbridge Mining (TSX:WM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wallbridge Mining (TSX:WM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024