Athabasca Q1 2013 Financial Results

30 Avril 2013 - 3:01PM

Marketwired Canada

Athabasca Minerals Inc. (the "Corporation" or "Athabasca") (TSX VENTURE:ABM) is

pleased to announce the filing of its Q1 financial results for the three months

ended February 28, 2013. Athabasca reports the following highlights from Q1

2013:

-- Record revenues in the amount of $6,683,396 compared with $3,629,619

during Q1 2012, an increase of 84.1%;

-- Record net aggregate sales from corporate-owned operations in the amount

of $5,194,379 compared with $1,607,110 during Q1 2012, an increase of

223.2%;

-- More than 25% of a 375,000 tonne contract fulfilled from the Logan

aggregate operation;

-- Continued progress on developing its frac sand project area and progress

with Alberta Government regarding permitting.

The Corporation continues to transition from primarily performing aggregate

management services to increasing its aggregate supply and services provided

from corporate-owned aggregate operations. Q1 2013 generated the highest single

quarter revenues in the Corporation's history, as Athabasca continues to grow

its business at corporate-owned operations. During this transition, the

Corporation experienced seasonal challenges related to aggregate delivery. The

Corporation has identified and addressed these issues and plans to continue to

expand corporate owned aggregate operations at new locations in addition to the

existing Logan, Kearl and House River aggregate operations.

Challenges encountered during the quarter resulted in the Corporation incurring

a net loss of $374,582 during Q1 2013. The loss was a result of reduced

aggregate management fees, increased aggregate operating expenses, and increased

non-cash expenses, including share-based compensation, depreciation,

amortization and depletion. Also included is a $284,274 valuation write down of

Athabasca's land use agreement held with a work camp provider.

At the Logan aggregate operation, approximately 90,000 tonnes of high quality

aggregates is to be delivered to the customer during Q2. An additional 188,000

tonnes of aggregates have been processed and stockpiled and will be delivered

during fall / winter 2013. Additional contracts for Logan aggregates will be

pursued, with potential delivery when seasonal conditions allow for production

and delivery.

At the Kearl aggregate operation, all Q4 2012 inventory gravel production was

sold in Q1, in addition to some sand sales. Crushing activity at Kearl

recommenced early in Q2 2013, with steady demand for Kearl crushed gravel

exceeding the current level of production.

The loss on the land use agreement takes into consideration a reduction during

the Corporation's first quarter in the level of monthly occupancy at the lodges,

and which is also anticipated to prevail in the near term. The work camp

provider has announced that it sees opportunities to remarket or reposition

these beds, as activity in the region from other operators remains strong. In

the future, the Corporation may write down or increase the carrying value of its

land use agreement, as is required under International Financial Reporting

Standards, which will consider actual and projected accommodation occupancy.

"Athabasca continues to see strong demand for aggregates in and around Fort

McMurray. As Athabasca continues to expand corporate- owned operations, we will

focus on continual improvement with operating efficiency, consistent with our

objective to maximize shareholder value." reported Dom Kriangkum, President &

CEO.

Q1 (Three months ended February 28, 2013 and February 29, 2012)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Q1 February 28, 2013 Q1 February 29, 2012

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Aggregate management fees $ 1,489,017 $ 2,022,509

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net aggregate sales $ 5,194,379 $ 1,607,110

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total revenue $ 6,683,396 $ 3,629,619

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total aggregate tonnes sold 1,516,224 tonnes 1,966,979 tonnes

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net (loss) income from aggregate

operations $ (146,786)$ 784,408

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net (loss) income (including

lodging land use agreement) $ (374,582)$ 784,408

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic (loss) income per common

share $ (0.013)$ 0.029

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The complete financial statements for Athabasca for the three months ended

February 28, 2013 and Management's Discussion & Analysis for the same period are

available for viewing on the Corporation's website at www.athabascaminerals.com

(http://www.athabascaminerals.com) and on SEDAR at www.sedar.com

(http://www.sedar.com).

About Athabasca Minerals

Athabasca Minerals Inc. is a resource company involved in the management,

exploration and development of aggregate projects. These activities include

contracts work, aggregate pit management, new aggregate development and

acquisitions of sand and gravel operations. The Corporation also has industrial

mineral land holdings in the vicinity of Fort McMurray and Peace River, Alberta

for the purpose of locating and developing sources of industrial minerals and

aggregates essential to high growth economic development.

This news release contains forward-looking statements that involve risks and

uncertainties. Forward-looking statements or information are based on current

expectations, estimates and projections that involve a number of risks and

uncertainties which could cause actual results to differ materially from those

anticipated by the Corporation. The forward-looking statements or information

contained in this news release are made as of the date hereof and the

Corporation does not undertake any obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

The securities of Athabasca have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, and may not be offered or sold

within the United States or to, or for the account or benefit of, U.S. persons

absent U.S. registration or an applicable exemption from U.S. registration

requirements. This release does not constitute an offer for sale of securities

in the United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Boardmarker Group

Dean Stuart

403- 517-2270

dean@boardmarker.net

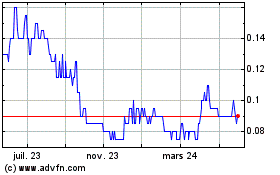

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

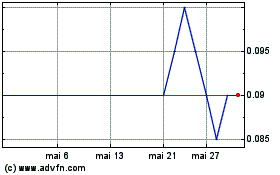

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025