P2 Gold Upsizes Financing and Closes Remaining Tranche of Financing

19 Décembre 2022 - 11:01PM

P2 Gold Inc. (“P2” or the “Company”) (TSX-V:PGLD)

(OTCQB:PGLDF) reports that it intends to increase the size of its

non-brokered private placement of non-flow-through units (the

“Units”) of the Company, at $0.27/Unit, from 4,000,000 Units to

5,771,689 Units (the “Offering”), previously announced on October

25, 2022, November 25, 2022 and December 8, 2022. The Company also

reports that it has closed the remaining tranche of the Offering

consisting of 3,058,760 Units for gross proceeds of approximately

$825,865. The Offering consisted of a total of 5,771,689 Units for

aggregate gross proceeds of $1,558,356.

Each Unit consists of one common share in the

capital of the Company (a “Share”) and one common share purchase

warrant (a “Warrant”). Each Warrant entitles the holder to purchase

one additional common share in the capital of the Company at an

exercise price of $0.40 per common share for a period of two years

from the date of issue (the “Expiry Time”), provided that, if after

four months from the date of issue, the closing price of the common

shares of the Company on the TSX Venture Exchange (the “Exchange”)

is equal to or greater than $0.80 for a period of 10 consecutive

trading days at any time prior to the Expiry Time, the Company will

have the right to accelerate the Expiry Time by giving notice to

the holders of the Warrants by news release or other form of notice

permitted by the certificate representing the Warrants that the

Warrants will expire at 4:30 p.m. (Vancouver time) on a date that

is not less than 15 days from the date notice is given.

The proceeds of the Offering will be used to

fund exploration and engineering expenditures and for general

corporate purposes. In connection with the Offering, the Company

paid finder’s fees of an aggregate of $67,580 and issued an

aggregate of 250,298 warrants to arm’s length finders, representing

6% of the proceeds raised from subscriptions by, and 6% of the

Units issued to, certain placees. All securities issued pursuant to

the Offering will be subject to a four-month hold period expiring

between April 9, 2023 and April 20, 2023. The securities offered

pursuant to the Offering have not been and will not be registered

under the United States Securities Act of 1933, as amended, and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of such

Act.

Insiders of the Company subscribed for 800,000

Units of the Offering. The issuance of Units to insiders is

considered a related party transaction subject to Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions. The Company relied on exemptions from the

formal valuation and minority shareholder approval requirements

provided under sections 5.5(a) and 5.7(1)(a) of Multilateral

Instrument 61-101 on the basis that the participation in the

Offering by the insiders did not exceed 25% of the fair market

value of the company’s market capitalization.

About P2 Gold Inc.

P2 is a mineral exploration and development

company focused on advancing precious metals and copper discoveries

and acquisitions in the western United States and British

Columbia.

For further information, please contact:

|

Joseph Ovsenek President & CEO(778) 731-1055P2 Gold Inc.Suite

1100, 355 Burrard StreetVancouver, BCV6C 2G8info@p2gold.com(SEDAR

filings: P2 Gold Inc.) |

Michelle RomeroExecutive Vice President(778) 731-1060 |

Neither the Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Forward Looking Information

This press release contains “forward-looking

information” within the meaning of applicable securities laws that

is intended to be covered by the safe harbours created by those

laws. “Forward-looking information” includes statements that use

forward-looking terminology such as “may”, “will”, “expect”,

“anticipate”, “believe”, “continue”, “potential” or the negative

thereof or other variations thereof or comparable terminology. Such

forward-looking information includes, without limitation,

information with respect to the Company’s expectations, strategies

and plans for exploration properties including the Company’s

planned expenditures and exploration activities and the use of

proceeds from the Offering.

Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made,

including without limitation, that the Company will be able to use

the proceeds from the Offering as anticipated, as well as the other

assumptions disclosed in this news release. Furthermore, such

forward-looking information involves a variety of known and unknown

risks, uncertainties and other factors which may cause the actual

plans, intentions, activities, results, performance or achievements

of the Company to be materially different from any future plans,

intentions, activities, results, performance or achievements

expressed or implied by such forward-looking information, including

without limitation, the inability to use the proceeds from the

Offering as expected and risks associated with mineral exploration,

including the risk that actual results and timing of exploration

and development will be different from those expected by

management. See “Risk Factors” in the Company’s annual information

form dated March 31, 2022 filed on SEDAR at www.sedar.com for a

discussion of these risks.

The Company cautions that there can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

investors should not place undue reliance on forward-looking

information.

Except as required by law, the Company does not

assume any obligation to release publicly any revisions to

forward-looking information contained in this press release to

reflect events or circumstances after the date hereof.

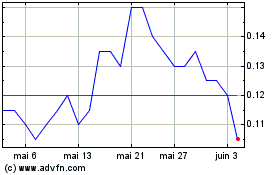

P2 Gold (TSXV:PGLD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

P2 Gold (TSXV:PGLD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025