Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the third

quarter of 2020.

THIRD QUARTER

2020 RESULTS

(Stated in Canadian dollars except per share and

unit data)

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

For the |

2020 |

2019 |

2020 |

2019 |

|

(stated in CDN$) |

($) |

($) |

($) |

($) |

|

(unaudited) |

|

|

|

|

|

Revenue |

1,066,851 |

8,293,734 |

6,587,045 |

23,377,705 |

|

Gross Profit (Loss) |

(442,261) |

4,034,759 |

1,507,868 |

13,019,726 |

|

Profit (Loss) for the period |

(961,869) |

1,968,285 |

(943,927) |

6,366,206 |

|

Per share — basic |

(0.04) |

0.07 |

(0.03) |

0.23 |

|

Per share — diluted |

(0.04) |

0.07 |

(0.03) |

0.23 |

| |

|

|

|

|

|

As at |

September 30, 2020 |

December 31, 2019 |

|

Working capital, end of period |

|

19,893,304 |

|

17,425,861 |

|

Total assets, end of period |

|

39,820,873 |

|

42,110,012 |

|

Total equity, end of period |

|

34,765,898 |

|

35,333,667 |

(1) Weighted average shares outstanding

during the year.

Questor’s Consolidated Financial Statements and

Management’s Discussion and Analysis for the three and nine months

ended September 30, 2020 are available on the Company’s website at

www.questortech.com and through SEDAR at www.sedar.com.

PRESIDENTS MESSAGE

The worldwide pandemic and resulting negative

economic impact continue to affect the Company’s financial results

this quarter. Our revenue for the third quarter of 2020 was $1.1

million declining from $8.3 million during the same period last

year, for the nine months ended September 30th, 2020 our revenue

was $6.6 million declining from $23.4 million during the same

period last year. The sharp decline in North American oilfield

activity in the second quarter continued into the third quarter.

North American rig count and the industry activity remains at or

near historic lows in all of the Company's key markets. Discussions

with our customer during the quarter continued to center on reduced

spending and activity during 2020.

We have continued to live within our cash flow

for the nine months ended September 30th, 2020 and finished this

quarter with a cash balance of $17 million which is a $3.5 million

increase from December 31, 2019. We are strongly positioned to

manage during this tough market cycle. In this period of

uncertainty, we will continue to be disciplined and focus on

preserving positive operating cash flow in order to maintain our

strong balance sheet.

Leveraging our strong financial position, we are

expanding our team to solidify our foundation, ready to serve a

rapidly growing global focus on eliminating methane emissions by

implementing Questors’ strategic market and industry

diversification initiatives. Darko Ulakovic, our previously

announced new COO, brings the leadership to implement our strategic

priorities. Our teams are focused on educating current and

potential customers around our solutions for combating emissions.

In addition, we continue to build our digital capability by

developing an emissions platform that will eventually enable us to

credibly quantify emission reductions for our clients and guarantee

a zero emissions site, with the end goal of monetizing the emission

reduction offsets. Our 2020 and 2021 strategic priorities are

continuing to grow our clean combustion business to eliminate

methane emissions, diversification into industries, and the

expansion of our waste heat to power product offering.

The previously disclosed purchase of Heat to

Power equipment in the southern United States is an example of

product and market diversification. In the fourth quarter of 2020,

we will be supplying our ClearPower technology to generate 200 kW

of clean emission free power at our client’s glass recycling plant.

In the US, the conversion of waste heat to power is seen as green,

clean energy with tax and pricing incentives.

We have been recently awarded a new contract to

provide our combustion solutions to a renewable gas facility in

British Columbia converting biomass to Renewable Natural Gas (RNG).

The market opportunity in the RNG space includes industries such as

agriculture, food processing, landfills, waste management, water

treatment, bio-mass, and bio-digestors. In this market space both

our combustion technology and our waste heat to power technology

are relevant. There are opportunities dealing with the left-over

waste gas stream after the RNG is extracted and alternatively

cleanly combusting the syn-gas to generate clean renewable

distributed power.

There is growing global recognition that

eliminating methane emissions into the atmosphere is one of the

most effective ways to arrest the temperature rise related to

Climate Change because it is 86 times worse that CO2 from a global

warming perspective. Additionally, methane emissions from industry,

particularly the oil and gas industry, have been significantly

underestimated. The Canadian Federal Government has recently

established a $750 million fund to support the deployment of

methane abatement technologies. The Alberta Provincial government

has earmarked an additional $750MM to invest in projects to reduce

greenhouse gas (GHG) emissions. Specifics on the deployment of

these funds are evolving and we are taking a proactive role and are

currently working on with our clients, targeting methane reduction

projects to access the funding. The following speaks to the

importance of dealing with the methane going into the atmosphere;

in September, the French government blocked a $7 billion contract

to purchase American liquified natural gas (LNG), arguing that gas

produced without controls on methane leaks was too harmful to the

climate.

“We remain on track to deliver on our 2020

strategic priorities, including our long-term diversification

initiatives, while we preserve our strong liquidity. We believe our

technology, people, assets and operational experience will continue

to strengthen Questor even through these difficult times,” said Ms.

Mascarenhas, Questor’s President and CEO.

THIRD QUARTER 2020

OVERVIEW

➢ The worldwide

pandemic and resulting negative economic impact continued to affect

the Company’s financial results this quarter.

➢ The Company

continues to be in a strong financial position at September 30,

2020:

○ Cash increased

to $17.0 million from $13.5 million at December 31, 2019 and $15.2

million at June 30, 2020;

○ The Company has an

undrawn $1.0 million revolving demand loan facility and an undrawn

$5.0 million capital loan facility;

○ The Company

entered into a repayable government assistance agreement with

Western Economic Diversification Canada which provided $966,187 to

help fund its operating costs. Repayment commences in 2023;

○ Cash reserves

provide the working capital to thrive during tough market

cycles;

○ A strong

balance sheet will serve as a foundation to launch into new

products and markets once the economy rebounds;

○ Capital

expansion plans are suspended until there is a sustained economic

recovery. This strategy preserves our liquidity while improving

capital efficiency; and,

○ Increased

focus on operating efficiencies and enhancing cash flow by working

with our service providers to further reduce costs will serve us

well during this difficult time.

➢ Revenue

decreased $7.2 million for the three months ended September 30,

2020 versus the same period in 2019:

○ Revenue from

incinerator rentals decreased from $4.0 million in 2019 to $0.6

million in 2020;

○ Incinerator

equipment sales decreased from $3.6 million in 2019 to $0.3 million

in 2020;

○ Incinerator

service revenue decreased from $0.7 million in 2019 to $0.2 million

in 2020;

➢ Gross loss of

$0.4 million in 2020 compared to a gross profit of $4.5 million in

2019:

○ The Company

continued its mitigation strategy during the third quarter 2020,

revolving around

◾ Managing

operations infrastructure ensuring indirect operational resources

are consistent with activity; and,

◾ Commitment to

supply chain management focused on procuring quality materials at

competitive prices.

OUTLOOK

In response to the COVID-19 pandemic,

governmental authorities in Canada and internationally have

introduced various recommendations and measures to try to limit the

spread of the virus, including travel restrictions, border

closures, non-essential business closures, quarantines,

self-isolations, shelters-in-place and social distancing. Those

measures are having a significant impact on the private sector and

individuals, including unprecedented business, employment and

economic disruptions. The continued spread of COVID-19 nationally

and globally has had, and will continue to have, a material adverse

effect on our business, operations and financial results. As such,

overall market conditions have been uncertain and are anticipated

to remain uncertain for the foreseeable future. It is likely that

companies will continue to reduce or carefully manage spending for

capital projects and operations where possible until some sort of

market stability has returned.

On March 27, 2020, in response to COVID-19, the

Government of Canada announced the Canada Emergency Wage Subsidy

(CEWS). The CEWS enables eligible Canadian employers who have been

impacted by COVID-19 to apply for a subsidy of a specified amount

of eligible employee wages under this program. Questor was eligible

for the subsidy in the second and third quarter of 2020. In

addition, the Canadian federal government has established a $750

million Emission Reduction Fund, with a focus on methane reduction,

to create and maintain jobs through pollution reduction

efforts.

In April 2020, Questor became the first

ETV-certified clean combustion company in the world. ISO 14034 is

an internationally recognized certificate that verifies the

performance of innovative environmental technologies. The project

was supported by Standards Council of Canada and the certification

issued by 350Solutions. We are the only company accredited by

national accreditation board of ANSI, in the United States. This

certification confirms Questor’s performance claims of 99.99

percent combustion efficiency and H2S destruction efficiency. It

also confirms our methodology of calculating GHG emission

reductions.

Notwithstanding the 2020 financial performance,

Questor maintains a strong financial position accomplished through

managing costs and maintaining capital discipline while providing

best in class equipment and services to our customers. Our focus

has not changed and remains consistent despite this downturn. We

will continue to provide exceptional service to our customers while

efficiently managing our costs.

Questor believes that the clean technology

industry will remain an integral component of resource development

over the medium to long term. We are well positioned given our

focus on top-tier service, quality and technology to meet our

client’s emission commitments in the future. The resilient

companies that survive these challenging times will continue to

focus on addressing the commitments they have made to their

investors and the public, which includes reducing greenhouse gas

emissions. Questor’s proven, cost effective technology solutions

will play an instrumental role in enabling these companies to meet

their goals and targets.

ABOUT QUESTOR TECHNOLOGY

INC.

Headquartered in Calgary, Alberta, with

operations across North America, the Company provides specialized

waste gas incineration products and services that destroy harmful

pollutants in any waste gas stream at 99.99 percent efficiency

enabling our clients to meet emission regulations, address

community concerns and improve safety at industrial sites.

There are several methods for handling waste

gases at oil and gas industrial facilities, the most common being

combustion. Flaring and incineration are two methods of combustion

accepted by many provincial and state regulators. Historically, the

most common type of combustion has been flaring which is the

igniting of natural gas at the end of a long metal tube or flare

stack. This action causes the characteristic flame associated with

flaring.

Incineration is the mixing and combusting of

waste gas streams, air, and fuel in an enclosed chamber which are

mixed at a controlled rate and ignited so that no flame is visible

when operating properly. A correctly designed and operated

incinerator can yield higher combustion efficiencies through proper

mixing, gas composition, retention time, and combustion

temperature. Combustion efficiency, generally expressed as a

percentage, is represented by the amount of methane converted to

CO2, or H2S converted to SO2. The more converted, the better the

efficiency.

The Company designs, manufactures and services

proprietary high efficiency waste gas incineration systems. The

Company’s incineration product line is based on clean combustion

technology that was developed by the Company and initially patented

in both Canada and the United States in 1999. The Company has

continued to evolve the technology over the years making several

improvements from the original patent which expired in November

2019. The Company currently has five new pending patent

filings.

The Company’s highly specialized technical team

works with the client to understand the waste gas volume and

composition allowing it to determine the correct incineration

product specification to achieve 99.99 percent combustion

efficiency. The incinerators vary in size to accommodate small to

large amounts of gas handling ranging from 20 mcf/d to 5,000 mcf/d.

The incinerators also vary in automation and instrumentation

depending on the client’s requirements. The Company’s incinerators

are currently used in multiple segments of the energy

infrastructure industry including drilling, completions,

production, midstream, downstream, and transportation and

distribution.

The Company has three primary incinerator

related revenue streams: sales, rentals and services. Incinerator

services include hauling, commissioning, repairs, maintenance and

decommissioning. The Company’s current key incineration markets are

Colorado, North Dakota, Mexico, Pennsylvania, Texas, Alberta and

North East BC. The United States Environmental Protection Agency

(EPA) issued regulations to reduce harmful air pollution arising

from crude oil and natural gas industry activities with a

particular focus on the efficient destruction of volatile organic

compounds (VOC’s) and hazardous air pollutants (HAP’s) and has

recently introduced methane emission reduction legislation. In

conjunction with EPA regulations, Colorado’s Regulation 7 mandates

the use of enclosed combustion (incinerators) and now targets

methane, resulting in a statewide focus on the responsible

management of potentially fugitive hydrocarbons. North Dakota also

has additional requirements that reflect some of the unique and

specific needs that extend beyond the EPA’s requirements.

Pennsylvania is proposing legislation that will limit VOC emissions

to 1.7t/year and 200t/year of methane per site, necessitating the

need for highly efficient combustion equipment to deal with waste

and fugitive gas emissions. California has banned open flaring by

2021. Other US states are working on enhancing regulations that

deal with waste gas emissions. Mexico set a target to reduce

methane emissions by 75 percent by 2025 creating an opportunity for

the Company to eliminate the venting of methane through our clean

combustion technology. Over 90 percent of the Company’s incinerator

rental fleet is in Colorado and North Dakota where regulation

supports demand for its proprietary high efficiency waste gas

incineration systems.

The Company services its key markets with field

locations in Brighton and Fort Lupton, Colorado; Watford City,

North Dakota and Grande Prairie, Alberta. The infrastructure at the

field locations consist of field and maintenance technicians and

technical sales staff. The facilities generally include, office

space, maintenance shop and storage yard. We also have a sales

presence in Texas and Pennsylvania. Personnel based out of

Company’s head office in Calgary, Alberta include Officers of the

Corporation, management, engineering, technical sales, accounting

and administration.

QUESTOR TRADES ON THE TSX VENTURE

EXCHANGE UNDER THE SYMBOL ‘QST’.

|

Audrey Mascarenhas |

Dan Zivkusic |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

Phone: |

(403) 571-1530 |

Phone: |

(403) 539-4371 |

|

Facsimile: |

(403) 571-1539 |

Facsimile: |

(403) 571-1539 |

|

Email: |

amascarenhas@questortech.com |

Email: |

dzivkusic@questortech.com |

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words "may", "would", "could", "will", "intend",

"plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives, expected growth,

results of operations, performance, business projects and

opportunities and financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

based on certain material factors and assumptions and are subject

to certain risks and uncertainties, including without limitation,

changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out

in the Company’s public disclosure documents. Many factors could

cause the Company’s actual results, performance or achievements to

vary from those described in this news release, including without

limitation those listed above. These factors should not be

construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release and such

forward-looking statements included in, or incorporated by

reference in this news release, should not be unduly relied upon.

Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

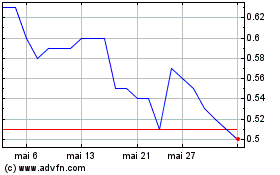

Questor Technology (TSXV:QST)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Questor Technology (TSXV:QST)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024