TRIUS

DETAILS

CORPORATE

STRATEGY

Fredericton,

New Brunswick – October

13,

2020 --

InvestorsHub NewsWire -- Trius

Investments Inc. (TSXV:

TRU)

("Trius"

or

the "Company")

wishes

to provide the

following details and

updates

regarding its corporate strategy.

Portfolio

Strategy

The

Company

seeks

unique opportunities to create value through

its portfolio holdings, via investments and

acquisitions that may not be available to individual

investors. To date in

2020, the

Company has opted to concentrate its portfolio

in

fewer but

larger holdings

across

two sectors identified

as presenting

the most

promising opportunities.

The

Company's

primary focus is

currently

precious

metals,

and in particular,

gold

exploration.

Against

a macroeconomic

and

monetary policy backdrop highly

favourable for gold, and

spurred by a

major discovery in the

Central Newfoundland Gold Belt by New Found Gold Corp., Trius is

increasingly shifting its portfolio

composition towards

acquiring

gold

exploration

properties in Newfoundland. This

growing

collection

within

the

Company's portfolio

is

referred to as the Newfoundland Gold Exploration segment

("NL

Gold"). The Company also owns

a small equity position in

Pasofino Gold

Limited.

The

Company's current

holdings within NL Gold

are

the

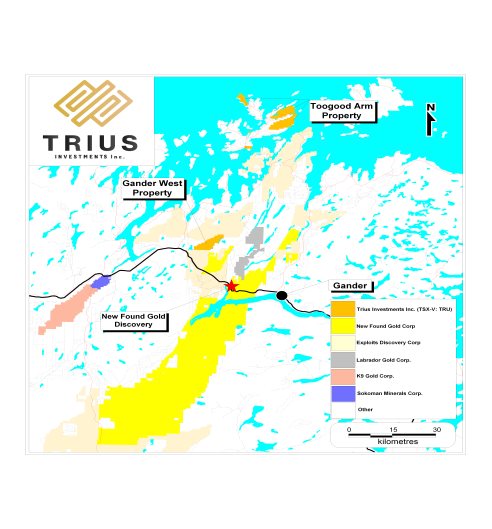

Gander

West property,

which was

acquired as announced

on September 21, 2020, and the Toogood Arm property,

which acquisition is

pending closing as most recently announced on September 24,

2020. This

property

package

is shown in the image

below.

Figure

1: Trius Newfoundland Gold Exploration

Holdings

Trius

believes that its strategy of

assembling

a property

portfolio segment

will

provide the greatest

flexibility for

value

creation. Trius

is

acquiring these

properties

as

passive

investments, and does not intend

to operate its properties

directly.

However, from time to

time Trius may engage

third party technical and

exploration consultants to advance

its

mineral property holdings so as to increase their monetization

potential.

The other

sector in which Trius has

meaningful portfolio exposure is e-commerce

and

specifically ready-to-eat meals, by

virtue of

the Company's $1,250,000

secured loan to Revive Organics

Inc.

as

announced on March 20, 2020. The loan remains in good

standing and continues to pay

interest at a rate of 10% per annum, and

matures on March 20,

2021.

NL

Gold

The

Company's near-term

corporate

strategy for NL Gold

is as

follows:

-

The

Company currently

has

two

grassroots properties, and

is

targeting the acquisition

of one or

two additional,

more advanced

exploration-stage

projects in Newfoundland,

which provide

exploration upside

potential

and may

generally be expected to increase in resale

value as

interest grows

for gold

exploration in Central Newfoundland. The

Company has

an

existing

pipeline of such

projects which it is

already

evaluating.

-

The

Company

currently

has three Newfoundland-based technical

and property advisors. The Company

is

actively working

to add

additional geological

expertise

to

its leadership

team,

and

has

identified

potential

candidates, in

order to

help

manage

investing

activities at NL Gold and any

follow-on

deployments

of capital, such as sourcing

external exploration personnel or acquiring nearby mineral

claims.

-

Alongside

the foregoing objectives,

the

Company's

management team, board of directors, and consultants

are consistently

evaluating how

NL Gold

can be monetized

so as

to achieve a return on

invested capital and enhance shareholder

value. Options currently

under consideration include funding

incremental

investments in

exploration

work to

develop the properties,

or building NL Gold to a

critical size and stage of

development where it could

attract option, joint

venture, or investment

partners.

Trius

President and CEO

Joel Freudman

summarized:

"We're working

hard

to

add properties of

merit at

justifiable

prices, and

to

gain

access to more local technical

expertise,

so we

can determine

the

optimal

path forward

to monetization, whether through

incremental exploration and

development, spin-out,

or

partnership. The market is

starting to recognize the

upside potential

of

junior gold

exploration companies

in Newfoundland,

and our

immediate

goal

is to

develop

NL

Gold

so that

it can be valued comparably as an asset

package."

Other

A

director of Trius has exercised an aggregate

of 175,000

options for gross

proceeds

to the

Company of $28,000. These funds have been

added to the

Company's general

working

capital.

About

Trius

Investments Inc.

Trius

seeks

unique value-creation opportunities,

currently

increasing its exposure to

the precious metals sector by

assembling a

portfolio

of gold

exploration properties in the

Central

Newfoundland

Gold

Belt. Trius'

common

shares trade

on

the

TSXV

under the

symbol "TRU".

Trius

is a portfolio company

of Resurgent Capital Corp.

("Resurgent"), a merchant bank providing venture

capital

markets

advisory

services and proprietary

financing. Resurgent

works with promising

public

and

pre-public micro-capitalization

Canadian companies.

For

further

information, please contact:

Joel

Freudman

President

& CEO

Trius

Investments Inc.

Phone:

(647)

880-6414

Cautionary

Statements

Neither

TSX Venture Exchange nor

its Regulation

Services

Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the

adequacy or accuracy of this release.

This

press release

contains certain

forward-looking statements,

including those

relating to

Trius'

portfolio

strategy,

completing

the

acquisition of Toogood

Arm, corporate

strategy for NL

Gold, the

acquisition

of other mineral

exploration investments,

and

exploring,

advancing

and monetizing

NL

Gold. These

statements

are based on numerous

assumptions

believed

by management to be

reasonable in the circumstances, including

that

the Company will complete its purchase of

Toogood Arm, and

that

the

Company will be able to

execute its

overall

portfolio

strategy and its corporate strategy relating to

NL Gold,

and are

subject to a number of risks and

uncertainties, including without

limitation:

mineralization hosted

on adjacent and/or nearby properties is not necessarily indicative

of mineralization hosted

on the Company's

properties;

the

exploration

or

monetization

potential of

NL

Gold; challenges in

identifying, structuring, and executing additional investments and

acquisitions, on

favourable terms or at all; risks inherent in

mineral exploration

activities

and

investments

in

the

mineral

exploration sector; volatility in

financial

markets, economic conditions, and precious metals prices;

and

those

other

risks

described in the Company's

continuous disclosure documents. Actual

results may differ materially

from results

contemplated

by the

forward-looking

statements herein.

Investors and others

should carefully consider the foregoing factors and should not

place undue reliance on such

forward-looking statements. The Company does not

undertake to update any

forward-looking

statements

herein

except as

required by

applicable

securities

laws.