July 14, 2020 -- InvestorsHub NewsWire -- via Seeking Alpha

-- About: Data443 Risk Mitigation, Inc. (ATDS), Includes: ADBE, CHKP, CRWD, FB, FTNT

- New Data Privacy laws such as the EU

GDPR and California CCPA are

fueling unprecedented demand for Cyber Security and COVID-19 driven

remote work is further fueling demand

- Open Source software model is “free” and has been enormous

growth driver in countless successful software enterprises such as

YouTube, RHAT, FB, TWTR, GOOG, NFLX, MSFT, ADBE, ORCL

- Data443 Risk Mitigation, Inc., (OTCPK:ATDS) “Open Source”

data protection is being met with very strong demand

- Over 30,000 web sites with a reach to millions of end users,

sales increased from zero in 2018 to over $1.4 million in 2019, and

estimated 2020 sales projected at over $5 million. First quarter

2020 was $477,877 versus $142,971 for same period 2019

- Recently signed Miami Dolphins with

potential for entire NFL as well as other major sports leagues

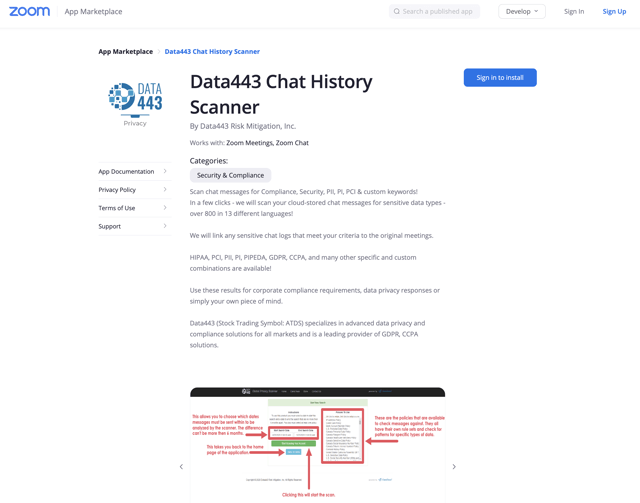

- ZOOM now offers DATA443 to millions of users

- ATDS shares have been EXTREMELY OVERSOLD down from $1.90 in

last 12 months by convertible note holders whose only goal was to

liquidate at any price and with no regard to share price. The

company has now struck a deal to halt the

aggressive selling

- BioResearchAlert finds ATDS shares undiscovered and undervalued

with current market cap of only $1.7 million and share price of one

cent. Current market comps point to current ATDS share value over

$.40 per share and significantly higher as current growth rate

continues to accelerate

Summary

Countless examples point to the enormous success of the “open

source” model for software apps where apps offered to users for

free have the potential to mushroom the number of users in a short

time and create value from additional offerings such as premium

upgrades or ad-free services. Examples are numerous and include

well-known names such as YouTube, RHAT, FB, TWTR, GOOG, NFLX, MSFT,

ADBE, ORCL. Each has their own unique product, but “open source” or

“free” apps is one of the primary drivers of huge growth.

Data443 Risk Mitigation (OTCPK: ATDS) is the first to

combine the growing need for new Data Privacy with free “open

source” solutions to attract a large number of users. Underlying

value to investors and to potential suitors increases as the number

of users grows, even if they are free. WordPress powers over

1,000,000,000 websites globally and operates its own app store like

Apple and Google. In 2016, 1.5 Billion plugins were downloaded from

the WordPress.org repository alone.

Data443 has seen active users of its GDPR Framework for

WordPress go from less than 5,000 to over 30,000 in less than 1

year! The Company expects to continue to expand its open source

overrings significantly this year.

The following February 23, 2020 article explains the undervalued

share price and the current market comps indicating substantially

higher valuations with the potential for unusually large gains:

COVID-19, TOUGH NEW CYBER SECURITY LAWS, STRONG GROWTH

AND MARKET COMPS POINT TO ATDS OVER 400X POTENTIAL

GAINS

- ATDS is a leading Cyber Security provider with over 30,000

company users.

- Executed letter of intent to acquire the assets and customer

base of Internet Software Sciences with over 100,000 installations

and over 1 million end users worldwide from corporations,

educational institutions, non-profits and government agencies

- With the number of COVID-19 remote workers soaring, with B2B

customers eager to meet new legal requirements for effective Cyber

Security solutions and with the unrealistic low market cap of

$140,000, ATDS has become a serious buyout candidate and at the

same time a very attractive investment.

- ATDS shares have been oversold and pounded to almost giveaway

prices by toxic convertible debt buyers who have no regard for

value and who only liquidate at any price as quickly as possible

they can move on to their next deal. Shares have traded as high as

$17 in 2018 on news of their powerful Cyber Security

solutions.

- Effective July 1, 2020, new Consumer Protection laws exposing

companies to draconian penalties will drive already mushrooming

cybersecurity sales to even greater record growth.

- After recent share consolidation followed by retirement of 2

million shares, the number of ATDS shares plummeted from 9.5

billion down to under 153 million.

- Market comps point to well over $.40 per share based on

projected $5 million 2020 revenues.

- CEO Jason Remillard recently committed to buying almost $4

million convertible debt that will keep those shares off

market.

Summary

In early 2018, Data 443 (ATDS:

OTC) shares were trading at levels well above today's when

they announced their first

acquisition of the award winning “Classidocs” that met many of the

requirements of the then upcoming GDPR Cyber Security requirements

in Europe. Shortly thereafter, the market realized the opportunity

and saw ATDS shares run to over $17.00 per share in just a few

short months.

As is frequently the case, market excitement got ahead of itself

and shares gradually drifted back down in normal profit taking.

Selling also picked up pace from the convertible investors who

helped finance the company but sold their shares so they could be

paid back. Combined, these selling pressures created this

outstanding buying opportunity today.

Market comparisons based on actual sales demonstrate that ATDS

shares are exceptionally undervalued and when share prices catch up

with the market through investors becoming aware of this disparity,

the price has the potential to increase over 6,000% from current

levels.

With the recent increase in sales and projected strong growth

from new laws requiring the services of ATDS, and with the drastic

reduction in the number of shares reduced from 9.5 billion to about

153 million, it appears that the stage is now set for ATDS to begin

a new run to higher prices that have the potential to challenge and

even set new highs for 2020 and 2021.

Mushrooming Need For Cyber Security

Data breaches are

becoming more frequent, bigger, and increasingly expensive, and the

risk of jaw-dropping penalties and settlements for data breaches

just got even higher after the European Union’s General Data

Protection Regulation (GDPR) on May 25, 2018. In late June, 2018,

California passed a consumer privacy act, AB

375, that could have more repercussions on U.S. companies than the

European Union’s General Data Protection

Regulation (GDPR) that went into effect this past

spring.

If a company covered under the new bill is not in compliance

with California’s CCPA they will have 30 days to comply once

regulators notify them of a violation. If the issue isn't resolved,

there's a fine of up to $750 per record and considering that the

number of customers in most data banks is very large and frequently

in the millions, this kind of penalty could be enough to drive many

companies into bankruptcy.

Clearly, the risk is too big to chance and the need for Cyber

Security is increasing dramatically. A few recent examples of how

steep the fines can be are:

According to a report from

IBM, the average cost of a data breach has increased to US$ 3.92

million, which is a 1.6 percent increase in costs in 2018 and a 12

percent rise over the last five years.

Cyber-attacks, data thefts, weak security, mistakes, and

cover-ups have cost these companies a huge fortune.

1. British Airways

The UK’s data protection watchdog ICO (Information Commissioner

Office) fined British

Airways on July 08, 2019, with £183.39 million (around US$ 230

million) after the airline failed to protect its customers’ data.

The fine was related to a data breach that occurred in September

2018, exposing around 500,000 customers’ personal information.

The ICO said its investigation found the breach compromised

customer details, including login, payment card, name, address, and

travel booking information which is collected after being diverted

to a fraudulent website. The data breach, which began in June 2018,

occurred due to the poor security measures to protect customer

information, ICO stated.

2. Yahoo

In one of the biggest class-action lawsuit settlements in the

United States’ history, Yahoo Inc. has agreed to pay US$ 117.5 million over a

series of data breaches that affected its users between 2012 and

2016. The affected users will likely get US$ 100 in compensation or

two years of credit monitoring services for free.

Yahoo urged the Settlement Class Members to claim for the

reimbursement. In case users already hold credit monitoring

services, they can opt for cash payment, which is less than US$ 100

or more (up to US$ 358) per user, depending on how many users are

claiming for the settlement, Yahoo said in a statement.

According to Yahoo, anyone who had a Yahoo account between

January 1, 2012, and December 31, 2016, and is a resident of the

United States or Israel is eligible for the settlement.

3. Uber

In 2016, taxi aggregator Uber had 600,000 drivers and 57 million

user accounts breached. Instead of reporting the issue, the company

paid the perpetrators, Glover and Mereacre, US$ 100,000 in ransom

to keep the hack a secret. These actions cost the company deeply.

Uber was fined US$ 148 million in 2018 for violation of state data

breach notification laws.

In October 2019, the two hackers pleaded guilty for their

extortion scheme to steal sensitive information of 57 million Uber

passengers and drivers. According to the statement from the Federal

Court, California, the hackers admitted stealing personal

information from the ride-hailing service provider that was stored

on Amazon Web Services from October 2016 to January 2017 and then

demanded a ransom.

4. Marriott International

In July 2019, popular hospitality group Marriott International

was charged with

£99,200,396 (around US$ 123,705,870) fine by ICO for the data

breach reported in 2018. The ICO stated that Marriott failed to

protect its customers’ information, thus violating the GDPR

regulations.

Marriott faced a massive data breach affecting up to 500 million

guests last year. Hackers extracted people’s personal data as well

as a loyalty program, payment, and reservation information. That’s

not all, encrypted credit card data of 100 million customers was

also stolen.

5. Facebook

Facebook is set to pay the largest

fine imposed on a technology company by the Federal

Trade Commission (FTC). On July 24, 2019, the social media giant

was slapped with a massive US$ 5 billion fine for allegedly

violating privacy practices and mishandling user data during the

infamous Cambridge Analytica scandal and other privacy breaches.

The FTC ordered Facebook to adopt new policies for protecting

users’ data and expand these policies across Instagram and

WhatsApp.

Facebook has also agreed to pay £500,000 (around US$ 645,000)

penalty imposed by ICO for failing to safeguard the users’ data

gathered by political data firm Cambridge Analytica.

According to the settlement deal, Facebook has agreed to drop

its legal appeal against the penalty. The ICO stated that Facebook

can retain some documents that the ICO disclosed during the appeal

process to use for its own investigation into issues around

Cambridge Analytica.

6. Equifax

In July this year, the Federal Trade Commission (FTC) and

Consumer Financial Protection Bureau fined Equifax around US$ 700

million following a massive data breach in 2017 that leaked a

massive amount of information of more than 143 million people in

the U.S. alone.

According to the official reports, the proposed penalty could be

between US$ 650 and US$ 700 million. It’s said that the final

amount could vary depending on how many people file claims and

their expected compensation.

On September 7, 2017, the Atlanta-based consumer credit

reporting agency disclosed that its databases had been breached

between May and June 2017, and hackers had gained access to company

data that potentially compromised sensitive information for 143

million American consumers, including Social Security numbers,

credit card numbers, and driver’s license numbers. Equifax

discovered the breach on July 29, 2017. It waited until after the

close of trading nearly six weeks later to disclose the breach to

consumers and Equifax’s investors, after hackers exfiltrated data

for 76 days.

Goldman Small Cap Research published

bullish report on

ATDS.

Enviable Corporate Success Has Been Overlooked

"ATDS offers what is the longest running DRM platform for

mobile. Moreover, in its open source solution, ATDS boasts over

30,000 users---this number rivals and exceeds some of the largest

and leading companies in the space. Clearly, many are ripe for

conversion to paying customers and thousands are trusted

relationships---a highly valuable and hidden asset. New

cloud-based, multi-functional and integrated offerings are slated

to be introduced following a series of customer tests. This new

integrated platform could generate $1500/mo/per customer seeking

comprehensive data and privacy solutions," commented Goldman.

ATDS Represents an M&A Prospect

Goldman concludes, "Revenue could approach $1.8M for 2019 and

possibly $5M in 2020-the first full year that its three

acquisitions will generate revenue and organic growth is

demonstrated. This excludes potential 2H20 M&A. Based on these

forecasts, ATDS is undervalued relative to current prices and its

peer group on a pre-revenue basis. Furthermore, once additional

M&A is executed, these figures will likely have to be revised

upward. In the meantime, ATDS could be viewed as an attractive

takeover candidate. It has a large open- source user base, broad

customer base, and low relative industry valuation. An acquirer

could buy ATDS and grab tech and market share for a fraction of the

industry's valuations. Thus, opportunistic investors may view

prices represent an attractive entry point."

Current Market Comps – Price to Sales Ratio Based on

Last 12 Month Sales

Splunk - SPLK 6.75 to 1

CheckPoint – CHKP 8 to 1

CrowdStrike – CRWD 25.5 to 1

OKTA – OKTA 25 to 1

Fortinet – FTNT 8 to 1

Zscaler – ZS 23 to 1

ProofPoint – PFPT 6.3 to 1

Average Price to sales Ratio = 11.8

Current ATDS market cap is $1,530,000 with share price of $.01.

Based on reported 2019 revenues of $1.4 million and projected 2020

sales of $5 million, with current Price to Sales ratio of 11.8 to

1, ATDS shares are projected to trade at $.40 in 2020.

Business Highlights for the Third Quarter of

2019:

ATDS Expands Sales

During Q1-2020 Data443 has onboarded 9 new sales and marketing

professionals and has a continuous growing inbound funnel of

professional and capable staff team members going through the

application and assessment process at the company. “During hiring,

we look for many things – in addition to the basics of course -

attitude, the ability to respond to and execute change and quickly

cycle between product lines are major considerations for anyone

joining our team. Our methodology is being applied across all of

our product lines, so the expectations and requirements apply to

those as well.”, added Mr. Bruni.

The recently announced Global Privacy Manager™ by

Data443 product is built on the award winning data classification

platform ClassiDocs™ and Data443’s WordPress GDPR Framework, which is

currently powering more than 30,000 businesses worldwide for the

EU’s GDPR Privacy Law will be rolled out immediately. The combined

platform automatically searches the data residing in cloud

application, databases, servers, and endpoints used by businesses

to discover, classify and map customer data.

“The new sales and marketing methodology are already garnering

results for the organization and we are excited to expand the

program to the other product lines. This approach enables us to be

more responsive and dynamic to changing market and customer demands

– while managing costs and investment in direct to our financial

models. This highly algorithmic approach is more appropriate for

our business and today’s market conditions – giving us more

accurate and timely information on the return of our efforts. These

provide the foundation for our next evolution of the product line

into consumer-facing capabilities which will be marketed directly

and with partners to be announced at a later time.” said

Remillard.

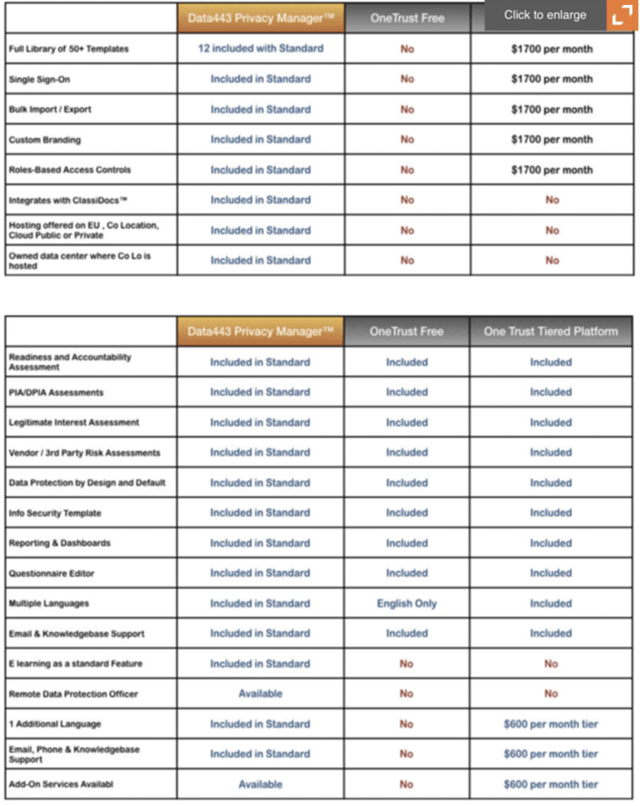

Fresh Comp

One quick look at a recent $210 million

funding for $2.7 billion Cyber Security company called

OneTrust further supports ATDA undervaluation and 2 tables

illustrate the advantages held by ATDS over OneTrust.

Cloud-Based Data Storage, Protection, and Workflow Automation

Platform

Personal and Corporate Privacy and Compliance Scanner

for Group Video and WebinarsExposes Data443 Brand

and Product Line to Millions of New Potential Clients

RESEARCH TRIANGLE PARK, NORTH CAROLINA, July 14, 2020 (GLOBE

NEWSWIRE) -- Data443 Risk Mitigation, Inc. (“Data443” or the

“Company”) (OTCPK:

ATDS), a leading data security and privacy software company,

today released to the general public its latest advance in its

cloud Global Privacy

Manager product line – Data443 Chat History

Scanner - powered

by the Company’s award winning ClassiDocs™.

What it is:

- Effortlessly scan your recorded chat history logs for privacy,

financial, security and other sensitive information types

- Test different languages and sensitive data types against

recordings to detect anomalies

- Detect policy breaches by your staff or other vendors on

webinars or group meetings

- Remove recordings, webinars or other content that violates

policy

- Available for free to all subscribers; premium version to

follow at reasonable cost

Why it matters:

- Online meeting platforms have exploded in popularity during the

recent pandemic, with significant room to grow.

- Roughly two-thirds of U.S. workers who have been working from

home prefer to continue working remotely as much as possible even

when pandemic restrictions lift, according to a recent Gallup

poll.1

- Exposes Data443 brand and all other products to millions of end

users and customers

- Leading charge in the burgeoning online data storage and

management space, providing the Company with significant market

penetration

1 https://www.wsj.com/articles/seven-rules-of-zoom-meeting-etiquette-from-the-pros-11594551601?mod=searchresults&page=1&pos=2

Management Commentary:

Jason Remillard, CEO of Data443, commented, “Today’s

announcement is another key accomplishment for Data443, and

continues the development of our Global Privacy Manager product

segment that includes a plethora of products that ensure corporate

compliance and personal privacy online – for both consumers and

businesses alike. This effort has taken months of work by our

dedicated engineering staff, securing certification from the

vendor, and enabling us to deliver another world-first product to

the marketplace.”

“The combination of compliance requirements, massive data

collection and storage of both consumer and commercial information,

without the ability to scan, parse and understand this data in a

massively growing virtual environment, continues to be a

significant risk for organizations of any size. By creating the

Data443 Chat History Scanner, we saw a “blue ocean” opportunity in

creating a simple, quick and easy way to meet these challenges,

while aligning Data443 with the global leader in online video

communications.

“Being on the first page of security and compliance products in

the App Store is another notch in our belt as we continue to

deliver products for a wide range of SaaS information providers on

many platforms. Being distributed and available on multiple

providers is part of our new approach to expand our business and

reach new potential customers,” concluded Mr. Remillard

Conclusion

TDA – Data 443 is ranked in the top 15 U.S. based Cyber Security

companies by Black Book Market Research and provides services to

big name clients like Hewlett Packard, Ripple, MicroSoft, Twitter,

Facebook and Linkedin. Sales started at zero and were $1.4 million

for 2019 and projected to hit $5 million in 2020. With an

aggressive and smart acquisition program adding to sales and with

strong organic internal sales growth, ATDS is expected to achieve

strong sales growth and become a takeover target for the cash rich,

sales hungry, software giants. There are about 153 million shares

outstanding and the potential exists for prices at many multiples

of today’s price and possibly even record highs in 2021. Displaying

a strong vote of confidence, CEO, Jason Remillard, stepped up

and negotiated a deal with

convertible debt holders amounting to around $4 million that has

now been extended between 6 months and one year and thereby

eliminates those potential shares from ever hitting the market.

2019 revenues were driven by sales for 6 months from only one

product and only 1 quarter of the second product, while 2020 sales

are being driven by the ENTIRE YEAR OF SALES FROM ALL 3 PRODUCTS

PLUS ACQUISITIONS.

Goldman

Research recently rated ATDS as a Speculative Buy with a

price target of $3.65.

With current market Sales to Price ratio of 11.8 to 1, if ATDS

executes as they are currently doing and delivers 2020 sales of $5

million, it is reasonable to expect ATDS share price to achieve

$.40 in 2020 and as growth accelerates share price has the

potential to rapidly increase over $1.00.

Legal Disclaimer:

Except for the historical information presented herein, matters

discussed in this release contain forward-looking statements that

are subject to certain risks and uncertainties that could cause

actual results to differ materially from any future results,

performance or achievements expressed or implied by such

statements. The Information contains forward-looking statements,

i.e. statements or discussions that constitute predictions,

expectations, beliefs, plans, estimates, or projections as

indicated by such words as ''expects,'' ''will,'' ''anticipates,''

and ''estimates''; therefore, you should proceed with extreme

caution in relying upon such statements and conduct a full

investigation of the Information and the Profiled Issuer as well as

any such forward-looking statements.

Original Publication: https://seekingalpha.com/instablog/21922151-bioresearch-alert/5472520-why-1-cent-atds-shares-down-from-1_90-are-expected-to-soar-zoom-jumps-on-board

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025