Ad Spending Cuts by U.S. Consumer Giants Hit Publicis -- Update

06 Février 2019 - 9:53PM

Dow Jones News

By Lara O'Reilly

Publicis Groupe SA said cutbacks in ad spending from

consumer-goods companies in the U.S. weighed on its sales in the

fourth quarter, but the French advertising giant is banking on a

host of recent new business wins to buoy its performance in

2019.

The owner of agencies Saatchi & Saatchi, Leo Burnett, and

Starcom Mediavest Group said sales in the three months ended Dec.

31 fell 0.3% from a year earlier on an organic basis -- a key

industry measure of the company's performance that strips out

currency effects and acquisitions -- to EUR2.49 billion ($2.85

billion). Analysts had expected a rise of 2.5%.

The sales figure includes the Publicis Health Services

pharmaceutical contract sales support business the company sold to

Altamont Capital Partners for around EUR100 million at the end of

January this year. With that unit factored out, Publicis recorded

0.5% organic growth in the quarter.

The Paris-based company said a higher-than-expected pullback in

traditional ad spending from clients, mainly from U.S.-based

consumer-goods companies, had negatively weighed on its business to

the tune of EUR150 million in 2018. Its operating margin rate

improved to 16.7% from 15.5% in 2017, as the company kept a tight

lid on costs and simplified its organization.

Consumer goods giants, which have typically driven revenue at

the largest advertising companies, are struggling to boost sales

amid pressure on a number of fronts, and some have been vocal

recently about trimming their ad agency costs.

For example, Procter & Gamble Co., the biggest ad-spender in

the U.S. and a Publicis client, said last month it had delivered

almost $1 billion in savings from agency fees and ad-production

costs over the last four years and it sees room for more potential

cutbacks in these areas. Its annual spend on advertising in the

U.S., excluding social media ad spending, rose 4.7% to $2.9 billion

in 2018, according to estimates from ad-tracking firm Kantar

Media.

Publicis Chief Executive Arthur Sadoun told reporters in Paris

on Wednesday that consumer-goods clients account for around 25% of

the company's revenue.

The loss in revenue from consumer-goods companies "doesn't mean

we have a bad relationship with them," Mr. Sadoun said, adding that

Publicis understands why these clients are cutting costs and that

the ad group is "suffering with them."

Publicis's sales in North America dropped 2.6% in the quarter on

an organic basis, or 1.1% excluding the disposed-of health group.

North America was also a soft spot for rival ad group WPP PLC in

the three months to Sept. 30, its most-recently reported

quarter.

Aside from consumer-goods spending cutbacks, Madison Avenue is

facing an array of challenges amid a fast-shifting marketing

landscape. Those range from clients seizing more control of their

advertising functions, to a swarm of new entrants looking to take a

slice of marketers' budgets, including consulting firms. Meanwhile,

digital ad spending in the U.S. eclipsed spend on TV ads for the

first time in the U.S. in 2016, according to research firm

eMarketer.

Agency businesses have responded to these new trends by trimming

their ranks and by attempting to reorganize their businesses around

the shifting needs of clients, particularly in the areas of

technology and data. Publicis has set about an integration strategy

to unite its operations, dubbed the "Power of One."

Publicis confirmed it is targeting 4% organic growth by 2020,

but warned in its earnings release of a "bumpy ride" in the first

quarter of 2019, owing to the prolonged impact of cutbacks from

consumer goods clients.

The warning shot from Publicis reverberated around Madison

Avenue. Shares in Interpublic Group of Cos. were down around 6% and

shares of Omnicom Group Inc. fell almost 5% in midafternoon trading

Wednesday.

Publicis is looking ahead to a host of recent new business wins

-- including GlaxoSmithKline PLC's global media account and Fiat

Chrysler Automobiles NV's North America media business -- to begin

to have a positive impact as the year progresses. R3, a consulting

firm that helps match marketers with agencies, said in a report

released last month that Publicis outperformed its rival holding

companies by generating $736.4 million in net new business revenue

last year. That was followed by WPP, with $579.1 million, according

to R3.

"We have demonstrated we have the right model," said Mr.

Sadoun.

Publicis said Wednesday it had promoted Steve King, CEO of

Publicis Media, to the role of chief operating officer for the

wider holding company. Elsewhere, Nigel Vaz has been promoted to

CEO of Publicis.Sapient, its digital agency network, from his

current position of EMEA and APAC CEO. Publicis has also hired a

marketer from outside the company -- Ros King, recently a top

marketer at Lloyds Banking Group PLC -- who will join as executive

vice president for global clients.

The company also announced a EUR400 million share buyback

program, which includes the proceeds from the disposal of its

health group.

--Nick Kostov contributed to this article.

Write to Lara O'Reilly at lara.oreilly@wsj.com

(END) Dow Jones Newswires

February 06, 2019 15:38 ET (20:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

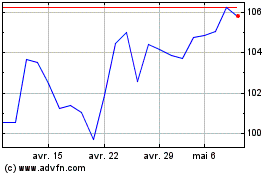

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024