Fagron NV: Turnover increase of 10.6%; REBITDA increased to €55.6

million

Regulated informationNazareth (Belgium)/Rotterdam (Netherlands),

5 August 2019

Turnover increase of 10.6%; REBITDA increased to €55.6

million

Acquisitions strengthen market position in Latin America

and Europe

New sustainable credit facility of €375

million

S1-2019 Highlights1 – Financial

- Turnover increased to €255.4 million

(+10.6%)

- REBITDA2 increased to €55.6 million

(+6.4%)

- EBITDA increased to €54.2 million

(+13.8%)

- Net profit3 increased to €26.8 million

(+44.4%)

- Strong operational cash flow of €37.5

million

- Net financial debt/REBITDA ratio of 2.55 on 30 June

2019

Strategic – Operational

- Successful continuation of buy-and-build strategy with

acquisitions in Brazil, Czech Republic and Mexico

- Start construction of new GMP repackaging facility in

Poland

- Sterile GMP compounding facility in the Netherlands

fully operational since July

- Promising start for Fagron Genomics with 2,200 DNA

tests sold in Q2-19

- New sustainable credit facility of €375 million with

improved terms

- Settlement in principle with US Department of

Justice

Rafael Padilla, CEO of Fagron:

“We are very pleased with the results and progress made in the

first semester of 2019. Not only did Fagron once again show good

growth in turnover, but also the construction of the new facility

in Poland and the investments in North America strengthen our

foundation for further growth. We are therefore convinced that we

are well-positioned to benefit from the substantial growth

opportunities in the markets for personalised medicine.

The strong turnover growth was especially driven

by the excellent performance in North America and the solid

turnover development in Latin America. In addition to strong

organic growth, we further strengthened our leading market

positions in Brazil and the Czech Republic with four acquisitions

and made a robust entrance in the Mexican market. Once again, these

are important steps in the execution of our disciplined

buy-and-build strategy in our core markets.

We are confident that we will realise a nice

increase of turnover and profitability in the second semester of

2019 in comparison to the same period in 2018.

Update buy-and-buildIn the

second quarter of 2019, Fagron further strengthened its market

leadership in Brazil with the acquisitions of Levviale, Apace and

Ortofarma Laboratories. Fagron completed the acquisition of Dr.

Kulich Pharma in the Czech Republic in July 2019.

The three Brazilian acquisitions (Levviale,

Apace and Ortofarma) realised a combined turnover of approximately

€9.9 million and an EBITDA margin of approximately 7.4% in 2018.

Dr. Kulich Pharma realised turnover of approximately €5.1 million

and an EBITDA margin of approximately 17.8% in 2018. The total

consideration for Levviale, Apace, Ortofarma and Dr. Kulich Pharma

amounted to approximately €10.6 million. The acquisitions are

financed from the existing credit facilities of Fagron.

Dr. Kulich Pharma - Czech RepublicDr. Kulich Pharma is a

supplier of pharmaceutical raw materials, creams and ointments and

packaging materials to compounding pharmacies in the Czech

Republic. Dr. Kulich Pharma is the number two in the Czech Republic

after market leader Fagron. Established in 1992, Dr. Kulich employs

66 employees (in FTE), is situated in Prague and has warehouses and

repackaging facilities in Hradec Králové as well as in Otrokovice.

The acquisition of Dr. Kulich Pharma provides significant

operational synergies for Fagron.

Ortofarma Laboratories - BrazilOrtofarma is an innovative

company that provides a wide range of services to more than 1,000

compounding pharmacies in Brazil. The offer ranges from analytical

testing and advice to the development of innovative products and

training. The strong strategic fit between Ortofarma and Fagron,

combined with the capacity expansion in product development,

ensures that Fagron’s position is further reinforced in the growing

demand for Brands that are used in compounding. Ortofarma was

established in 1999 and employs 39 employees (in FTE). Ortofarma is

situated in Juiz de Fora, a city in the southeast of Brazil.

Levviale - BrazilLevviale is a supplier of

active pharmaceutical ingredients, excipients and Brands to

compounding pharmacies in Brazil. The innovative Levviale Brands,

such as Baseffer®, Celulomax® and Oro-tab®, are all based on

excipients to increase the biological availability of medicines.

The Levviale Brands will also be introduced in Europe and North

America at the beginning of 2020. Levviale was established in 1992

and employs 75 employees (in FTE). Levviale is situated in São

Paulo and has a repackaging facility for raw materials in

Anápolis.

Apace - BrazilApace is a developer and supplier

of packaging materials to compounding pharmacies and the

pharmaceutical industry in Brazil. Apace’s product offering fully

complements Fagron’s comprehensive range. Apace, situated in São

Paulo, was established in 1983 and employs 41 employees (in

FTE).

Cedrosa - MexicoFagron completed the acquisition of Central de

Drogas, S.A de C.V. (“Cedrosa”) in July 2019. Cedrosa is a leading

supplier of pharmaceutical raw materials to compounding pharmacies

and the pharmaceutical industry in Mexico. The press release about

the acquisition of Cedrosa can be downloaded here.

Operational updateStart

construction of new repackaging facility in PolandIn the first

semester of 2019, Fagron started with the construction of a new GMP

facility for the repackaging of raw materials in Krakow, Poland.

The 5,000 m2 facility will comply with all quality

requirements and will have 1,000 m2 of clean rooms for the

repackaging of raw materials under GMP and 800 m2 of

laboratory for analysing raw materials. The new facility will not

only replace the current Polish facility but is also an important

step in the process to more centralise the repackaging of raw

materials in Europe. The location in Poland is very suitable for

this purpose given its central location in Europe and the

high-quality standards that are applicable here. The total

investment is currently estimated at €8 million. The new facility

is expected to be operational in the second semester of 2020 and a

structural annual margin improvement of €2 million is expected,

starting in 2021.

Sterile compounding facility in the Netherlands

fully operationalFagron’s sterile compounding facility in The

Netherlands started up again in the second quarter of 2019 and is

fully operational again since July. The facility was audited by the

Dutch Health Care and Youth Inspectorate (IGJ). IGJ stated in its

report that the facility complies with all requirements and issued

a GMP-certificate.

Financing updateNew sustainable

credit facility with improved termsOn 1 August 2019, Fagron entered

into a new syndicated multi-currency credit facility of €375

million with improved terms, resulting in greater flexibility and

lower financing costs. The new credit facility has a maturity of

five years with two one-year extension options. The new credit

facility ultimately expires in 2026 and replaces the current

facility of €325 million. ING acted as Coordinator for the

facility.

The credit facility is a so-called

Sustainability Linked Loan. The interest on the new credit facility

is linked to Fagron’s sustainability aim to reduce greenhouse

emissions (Scope 1 and Scope 2 of the GHG protocol) in six years by

approximately 30%. Based on the annual progress measured, a

discount or surcharge can be applied to the credit facility’s

interest rate.

The syndicate for the new credit facility

consists of ING Belgium NV/SA (also Facility Agent), BNP Paribas

Fortis SA/NV and KBC Bank NV as “Bookrunning Mandated Lead

Arrangers” and Belfius Bank SA/NV, Commerzbank Aktiengesellschaft

(Luxembourg branch) and HSBC France (Brussels branch) as “Mandated

Lead Arrangers”.

Settlement in principle with the US

Department of JusticeAs announced earlier, Fagron entered

into a settlement in principle with the US Department of Justice on

26 June 2019 regarding the previously announced civil investigation

in the context of the sector-wide investigation into the pricing of

pharmaceutical products. The settlement consists of a payment by

Fagron of US$ 22.3 million. In the results of the first semester of

2019, Fagron took, in addition to the current provision of US$ 8.4

million, an additional provision of US$ 13.9 million. The final,

legally binding, settlement between the US Department of Justice

and Fagron is expected to be formalised in the second semester of

2019. The press release about the settlement in principle can be

downloaded here.

Please open the link below for the press release:

Turnover increase of 10.6%; REBITDA increased to €55.6

million

Please open the link below for the interim financial

statements:

Interim financial statements first semester 2019

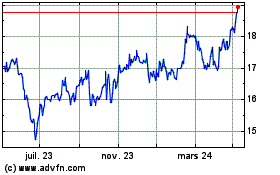

Fagron NV (EU:FAGR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Fagron NV (EU:FAGR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024