Form 8-K - Current report

26 Janvier 2024 - 2:33PM

Edgar (US Regulatory)

0001383650false00013836502024-01-262024-01-260001383650dei:FormerAddressMember2024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2024

| | |

| CHENIERE ENERGY PARTNERS, L.P. |

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33366 | 20-5913059 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

845 Texas Avenue, Suite 1250

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

700 Milam Street, Suite 1900 Houston, Texas 77002

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | CQP | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On January 26, 2024, Cheniere Energy Partners, L.P. (the “Partnership”) declared a quarterly cash distribution of $1.035 per common unit payable on February 14, 2024 to unitholders of record as of February 7, 2024. On January 26, 2024, the Partnership issued a press release announcing the distribution, a copy of which is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety. Information included on the Partnership’s website is not incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | CHENIERE ENERGY PARTNERS, L.P. |

| | | | |

| | | By: | CHENIERE ENERGY PARTNERS GP, LLC, |

| | | | Its general partner |

| | | | |

Date: | January 26, 2024 | | By: | /s/ Zach Davis |

| | | Name: | Zach Davis |

| | | Title: | Executive Vice President and |

| | | | Chief Financial Officer |

Exhibit 99.1

CHENIERE ENERGY PARTNERS, L.P. NEWS RELEASE

Cheniere Partners Declares Quarterly Distributions

Houston–(BUSINESS WIRE)– Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE American: CQP) today declared (i) a cash distribution of $1.035 per common unit to unitholders of record as of February 7, 2024, comprised of a base amount equal to $0.775 and a variable amount equal to $0.260, and (ii) the related distribution to its general partner. These distributions are payable on February 14, 2024.

Publicly traded partnerships that earn net income in a calendar year that is effectively connected with the conduct of a US trade or business are generally required to withhold US income tax from distributions paid to foreign persons. The portion of our quarterly cash distributions that are paid to foreign persons will generally be subject to US withholding tax.

This press release serves as qualified notice to nominees as provided for under Treasury Regulation Section 1.1446-4 and 1.446(f)-4. Please note that 100 percent of Cheniere Partners’ distributions to foreign investors are attributable to income that is effectively connected with a US trade or business and subject to withholding under Treasury Regulation Sections 1.1446-1 – 1.1446-6. Accordingly, all of Cheniere Partners’ distributions to foreign investors are subject to federal income tax withholding at the highest applicable effective tax rate. Furthermore, 100 percent of Cheniere Partners’ distributions to foreign investors is in excess of cumulative net income for purposes of Treasury Regulation Section 1.1446(f)-4(c)(2)(iii). Nominees are treated as withholding agents responsible for withholding distributions received by them on behalf of foreign investors.

About Cheniere Partners

Cheniere Partners owns the Sabine Pass LNG terminal located in Cameron Parish, Louisiana, which has natural gas liquefaction facilities consisting of six liquefaction Trains with a total production capacity of approximately 30 million tonnes per annum of liquefied natural gas (“LNG”). The Sabine Pass LNG terminal also has operational regasification facilities that include five LNG storage tanks, vaporizers, and three marine berths. Cheniere Partners also owns the Creole Trail Pipeline, which interconnects the Sabine Pass LNG terminal with a number of large interstate and intrastate pipelines.

For additional information, please refer to the Cheniere Partners website at www.cheniere.com and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the Securities and Exchange Commission.

Forward-Looking Statements

This press release contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical or present facts or conditions, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things, (i) statements regarding Cheniere Partners’ financial and operational guidance, business strategy, plans and objectives, including the development, construction and operation of liquefaction facilities, (ii) statements regarding Cheniere Partners’ anticipated quarterly distributions and ability to make quarterly distributions at the base amount or any amount, (iii) statements regarding regulatory authorization and approval expectations, (iv) statements expressing beliefs and expectations regarding the development of Cheniere Partners’ LNG terminal and liquefaction business, (v) statements regarding the business operations and prospects of third-parties, (vi) statements regarding potential financing arrangements, and (vii) statements regarding future discussions and entry into contracts. Although Cheniere Partners believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Cheniere Partners’ actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in Cheniere Partners’ periodic reports that are filed with and available from the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required under the securities laws, Cheniere Partners does not assume a duty to update these forward-looking statements.

Contacts

Cheniere Partners

| | | | | |

Investors | |

| Randy Bhatia | 713-375-5479 |

| Frances Smith | 713-375-5753 |

| |

Media Relations | |

| Eben Burnham-Snyder | 713-375-5764 |

| Bernardo Fallas | 713-375-5593 |

Document Entity Information Document

|

Jan. 26, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001383650

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity Registrant Name |

CHENIERE ENERGY PARTNERS, L.P.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33366

|

| Entity Tax Identification Number |

20-5913059

|

| Entity Address, Address Line One |

845 Texas Avenue

|

| Entity Address, Address Line Two |

Suite 1250

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

375-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Units Representing Limited Partner Interests

|

| Trading Symbol |

CQP

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Former Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

700 Milam Street

|

| Entity Address, Address Line Two |

Suite 1900

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

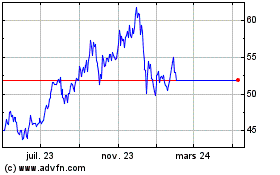

Cheniere Energy Partners (AMEX:CQP)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cheniere Energy Partners (AMEX:CQP)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024