Franklin Limited Duration Income Trust Announces Sources of Monthly Dividend Distribution

14 Septembre 2021 - 8:10PM

Business Wire

The Franklin Limited Duration Income Trust [NYSE American: FTF]

(CUSIP 35472T101) has declared a dividend of $0.0776 per common

share payable September 15, 2021, to shareholders of record as of

August 31, 2021. It is currently estimated that $0.0420 per share

represents net investment income and $0.0356 per share represents

return of principal.

The Fund adopted a managed distribution plan and will make

monthly distributions to common shareholders at an annual minimum

fixed rate of 10 percent, based on the average monthly net asset

value (NAV) of the Fund’s common shares. The Fund will calculate

the average NAV from the previous month based on the number of

business days in that month on which the NAV is calculated. The

distribution will be calculated as 10 percent of the previous

month’s average NAV, divided by 12. Management will generally

distribute amounts necessary to satisfy the Fund’s plan and the

requirements prescribed by excise tax rules and Subchapter M of the

Internal Revenue Code. The plan is intended to provide shareholders

with a constant, but not guaranteed, fixed minimum rate of

distribution each month and is intended to narrow the discount

between the market price and the NAV of the Fund’s common shares,

but there is no assurance that the plan will be successful in doing

so.

Under the managed distribution plan, to the extent that

sufficient investment income is not available on a monthly basis,

the Fund will distribute long-term capital gains and/or return of

capital in order to maintain its managed distribution level. No

conclusions should be drawn about the Fund’s investment performance

from the amount of the Fund’s distributions or from the terms of

the Fund’s managed distribution plan.

The Board may amend the terms of the plan or terminate the plan

at any time without prior notice to the Fund’s shareholders. The

amendment or termination of the plan could have an adverse effect

on the market price of the Fund’s common shares. The plan will be

subject to the periodic review by the Board, including a yearly

review of the annual minimum fixed rate to determine if an

adjustment should be made.

In compliance with Rule 19a-1 of the Investment Company Act of

1940, shareholders will receive a notice that details the source of

income for each dividend, such as net investment income, gain from

the sale of securities and return of principal. Please note:

Determination of the actual source of the Fund’s dividend can only

be made at year-end. The actual source amounts of all Fund

dividends will be included in the Fund’s annual or semiannual

reports.

In addition, the tax treatment may differ from the accounting

treatment used to calculate the source of the Fund’s dividends as

shown on your statement. Please refer to your Form 1099-DIV for the

character and amount of distributions for income tax reporting

purposes. Since each shareholder’s tax situation is unique, please

consult your tax advisor as to the appropriate treatment of Fund

distributions.

You may request a copy of the Fund's current Report to

Shareholders by contacting Franklin Templeton’s Fund Information

Department at 1-800/DIAL BEN® (1-800-342-5236) or by visiting

franklintempleton.com. All investments involve risks, including

possible loss of principal. Interest rate movements and mortgage

prepayments will affect the Fund's share price and yield. Bond

prices generally move in the opposite direction of interest rates.

As the prices of bonds in a fund adjust to a rise in interest

rates, the fund’s share price may decline. Investments in

lower-rated bonds include higher risk of default and loss of

principal. The Fund is actively managed but there is no guarantee

that the manager's investment decisions will produce the desired

results. For portfolio management discussions, including

information regarding the Fund’s investment strategies, please view

the most recent Annual or Semi-Annual Report to Shareholders which

can be found at franklintempleton.com or sec.gov.

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 165 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company brings extensive capabilities in equity, fixed income,

multi-asset solutions and alternatives. With offices in more than

30 countries and approximately 1,300 investment professionals, the

California-based company has over 70 years of investment experience

and over $1.5 trillion in assets under management as of August 31,

2021. For more information, please visit franklintempleton.com.

Copyright © 2021. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210914006054/en/

Franklin Templeton Shareholders/Financial Advisors: (800)

342-5236

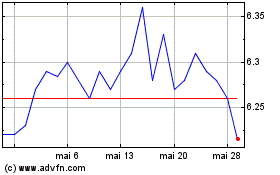

Franklin Limited Duratio... (AMEX:FTF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Franklin Limited Duratio... (AMEX:FTF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025