false

0001842556

0001842556

2024-01-29

2024-01-29

0001842556

HNRA:ClassCommonStockParValue0.0001PerShareMember

2024-01-29

2024-01-29

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 29, 2024

HNR ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(Address of principal executive offices, including

zip code)

(713) 834-1145

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading symbol |

|

Name of each exchange on which registered |

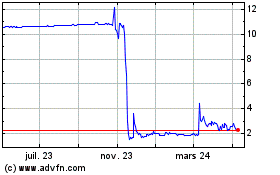

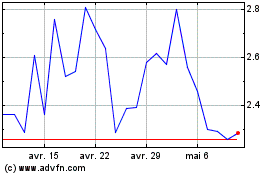

| Class A Common stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 29, 2024,

HNR Acquisition Corp (the “Company”), announced that Mark H. Williams, age 54, was hired as Corporate Controller and Vice

President of Finance and Administration. Mitchell B. Trotter, Chief Financial Officer of the Company, will continue to serve as the Company’s

principal financial officer but will no longer perform the functions of principal accounting officer.

Mr. Williams has served as

an accounting consultant to the Company since September 2023. Prior to this, Mr. Williams served as a Group Director at Worley Limited

from May 2019 to February 2023. From July 2004 to April 2019, Mr. Williams served as Director of Accounting and then Regional Controller

with Jacobs Solutions. Mr. Williams holds a Bachelor of Business Administration degree in Accounting from The College of William &

Mary.

In connection with the hiring of Mr. Williams

as Corporate Controller and Vice President of Finance and Administration, the Company and Mr. Williams entered into an Executive Employment

Agreement, effective as of January 29, 2024 (the “Employment Agreement”). The Employment Agreement is on the Company’s

standard form for officers, and provides that the Company shall pay to Mr. Williams an annual base salary of $175,000. In addition, the

Company agreed to issue a one-time Equity Sign-On Incentive to Mr. Williams under the 2023 HNR Acquisition Corp Omnibus Incentive Plan

(the “Plan”), which consists of restricted stock units (“RSUs”), equal to 200% of base salary divided by $10 (i.e.

35,000 RSUs), subject to time-based vesting as follows: 1/3 on the first anniversary of the date of grant, 1/3 on the second anniversary

of the date of grant, and 1/3 on the third anniversary of the date of grant. Mr. Williams will be permitted to participate in any broad-based

retirement, health and welfare plans that will be offered to all of the Company’s employees.

Pursuant to the Employment Agreement, if the Company

terminates Mr. Williams’ employment without Cause (as defined in the Employment Agreement) or Mr. Williams terminates his employment

for Good Reason (as defined in the Employment Agreement), then Mr. Williams will be entitled to: (i) any accrued obligations as of the

date of termination, including base salary, PTO and holidays, and continued benefits required by the Company’s employee benefit

plans; (ii) continued base salary for 12 months following the date of termination, paid in accordance with the Company’s payroll

practices; (iii) the total monthly cost of coverage for Mr. Williams and his covered dependents under COBRA, if elected; and (iv) full

vesting in all equity grants as of the date of termination. To receive such severance benefits, Mr. Williams will be required to execute

a non-competition agreement, non-solicitation agreement, or confidentiality agreement or invention assignment agreement and release of

claims.

The foregoing summary of the Employment Agreement

is qualified in its entirety by reference to the text of the Employment Agreement, which is filed as Exhibit 10.1 to this Report and is

incorporated herein by reference.

There are no family relationships

between Mr. Williams and any director or executive officer of the Company and he was not selected by the Board of Directors to serve as

a director or as an executive officer pursuant to any arrangement or understanding with any person. Mr. Williams has not engaged in any

transaction that would be reportable as a related party transaction under Item 404(a) of Regulation S-K.

Item 8.01 Other Events.

On February 1, 2024,

the Company issued a press release announcing the appointment of Mr. Williams. A copy of the press release is filed as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| February 1, 2024 |

HNR Acquisition Corp |

| |

|

|

| |

By: |

/s/ Mitchell B. Trotter |

| |

Name: |

Mitchell B. Trotter |

| |

Title: |

Chief Financial Officer |

3

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

This EXECUTIVE

EMPLOYMENT AGREEMENT (this “Agreement”) is entered by and between HNR Acquisition Corp, a Delaware corporation

(the “Company”), and Mark Williams, an individual residing in Fulshear, Fort Bend, County, Texas (“Executive”),

must be approved by a majority of the Board of Directors of the Company in order to be binding upon the Company prior to the Effective

Date of January 29, 2024 (the “Effective Date”). Each of the Company and Executive are a “Party,”

and collectively, they are the “Parties.”

WHEREAS, the Company wishes to employ Executive as of the

Effective Date; and

WHEREAS, Executive wishes to be employed by the Company as of the Effective Date;

NOW THEREFORE,

in consideration of the above recitals, which are incorporated herein, the mutual covenants and mutual benefits set forth herein, and

other good and valuable consideration, the receipt and sufficiency of which is acknowledged, the Company and Executive agree as follows:

1.

Representations and Warranties. Executive represents and warrants to the Company that Executive is not bound by any restrictive

covenants or other obligations or commitments of any kind that would in any way prevent, restrict, hinder or interfere with

Executive’s acceptance of employment under the terms and conditions set forth herein or the performance of all duties and

services hereunder to the fullest extent of Executive’s ability and knowledge. Executive understands and acknowledges that

Executive is not expected or permitted to use or disclose confidential information belonging to any prior employer in the course of

performing Executive’s duties for the Company.

2. Term

of Employment. As of the Effective Date, the Company will employ Executive and Executive accepts employment by the Company on the

terms and conditions herein that shall commence on the Effective Date and shall continue until terminated pursuant to Section 5 (the “Employment

Period”). Notwithstanding anything set forth in Section 5 and for the avoidance of doubt, Executive’s employment is

on an at-will basis, meaning that Executive or the Company can terminate Executive’s employment at any time for any reason or no

reason, with or without notice. The at-will nature of Executive’s employment cannot be changed except by written agreement signed

by Executive and the Company.

3. Duties

and Functions.

(a) Executive shall be

employed as the Vice-President of Finance and Administration of the Company and shall report to the Chief Financial Officer (the

“Supervisor”). Executive’s primary place of employment shall be in a yet to be established HNRA

office (“Primary Place of Employment”). Notwithstanding the foregoing, (i) Executive must obtain advance

written approval from Executive’s Supervisor if Executive desires to move Executive’s Primary Place of Employment to a

different state, (ii) the Company and Executive shall periodically reevaluate Executive’s Primary Place of Employment, and

(iii) the Company and Executive shall reevaluate Executive’s Primary Place of Employment if circumstances change.

Notwithstanding the foregoing, Executive agrees that, as a result of these periodic evaluations or changes in circumstance, the

Company may request that Executive consent to work primarily or partially from the Company’s facilities, which consent may not

be unreasonably withheld.

(b) Executive

agrees to undertake the duties and responsibilities inherent in the position, which may encompass different or additional duties as may,

from time to time, be assigned by Executive’s Supervisor, or the Supervisor’s designee, and the duties and responsibilities

undertaken by Executive may be altered or modified from time to time by Supervisor, or by the Supervisor’s designee. Executive agrees

to abide by the rules, regulations, instructions, personnel practices and policies of the Company and any change thereof which may be

adopted at any time by the Company.

(c) During

the Employment Period, Executive will devote Executive’s full time and efforts to the business of the Company and will not, without

the consent of the Company, engage in consulting work or any trade or business for Executive’s own account or for or on behalf of

any other person, firm or corporation that competes, conflicts or interferes with the performance of Executive’s duties hereunder

in any way.

4. Compensation.

(a) Base Salary:

As compensation for Executive’s services hereunder, the Company agrees to pay Executive a base salary at an annual rate of ONE

HUNDRED SEVENTY-FIVE THOUSAND DOLLARS ($175,000.00), payable in accordance with the Company’s normal payroll schedule, but in no

event less frequently than monthly. Executive’s base salary shall be reviewed annually by the Board or the Compensation Committee

thereof which may be increased from time to time in the Board’s and/or the Compensation Committee’s sole discretion. The

Compensation committee, at their sole discretion may vote to temporarily defer up to one-half (1/2) the base salary or any equity awards

for a term not to exceed 6 months which shall accrue and be paid to Executive at the end of such 6 month term only for the following

reasons: to meet short term cashflow limitations as identified by the CFO; or to accommodate limitations on the number of shares that

can be awarded pursuant to an Company equity plan; or meet the requirement of a lender who limits the Company’s administrative

budget as a condition of a loan (for example, the first several months following an acquisition).

(b) Equity Compensation:

On the Effective Date, in accordance with the employment inducement grant rules set forth in Section 711(a) of the NYSE American

LLC Company Guide, Executive shall be granted an equity award covering the Company’s common stock (collectively, the “Equity

Sign-On Incentive”) which will consist of the number of RSUs equal to 200% of base salary divided by ten dollars of restricted

stock units (“RSUs”), which will include piggyback registration rights and which will be subject to time-based vesting.

The Equity Sign-On Incentive will vest 1/3 on the first anniversary of the applicable date of grant, 1/3 on the second anniversary

of the applicable date of grant, and 1/3 on the third anniversary of the applicable date of grant, so long as Executive remains continuously

employed by us through such vesting date. Vesting of the Grant will accelerate in full upon a termination by us of the recipient’s

employment without cause or, following a change in control of us, by the recipient for Good Reason (Defined below).

(c) Options:

Commencing in 2024, Executive may be eligible to receive stock options “Options”) under the applicable equity

incentive plan of the Company as then in effect, as determined by the Compensation Committee based on Executive’s performance.

(d) Other Expenses:

In addition to the compensation provided for above, the Company agrees to pay or to reimburse Executive during Executive’s employment

for all reasonable, ordinary and necessary, properly documented, business expenses incurred in the performance of Executive’s services

hereunder in accordance with Company policy in effect from time to time; provided, however, that the amount available to Executive for

such travel, entertainment and other expenses may require advance approval from his Supervisor. Executive shall submit vouchers and receipts

for all expenses for which reimbursement is sought.

(e) Paid Time

Off and Paid Holidays: Executive shall accrue days of paid time off (“PTO”) annually for every year of

employment, which shall expire at the end of each calendar year if unused. PTO shall accrue pro rata in the Company’s regular payroll

on a calendar basis and shall be subject to the Company’s PTO policies in place from time to time and all applicable state and

local law.

In addition to

the PTO, Executive shall also be entitled to up to eight (8) paid holidays per calendar year. Executive may also be entitled to additional

paid or unpaid leave under Company policy and applicable law.

(f) Fringe Benefits.

In addition to Executive’s compensation provided by the foregoing, Executive shall be entitled to all benefits available generally

to Company employees pursuant to Company programs which may now or, if not terminated, shall hereafter be in effect, or that may be established

by the Company, as and to the extent any such programs are or may from time to time be in effect, as determined by the Company and the

terms hereof, subject to the applicable terms and conditions of the benefit plans in effect at that time. Nothing herein shall affect

the Company’s ability to modify, alter, terminate or otherwise change any benefit plan it has in effect at any given time, to the

extent permitted by law.

(g) Reimbursements.

With respect to any reimbursement of expenses of Executive, such reimbursement of expenses shall be subject to the following conditions:

(i) the expenses eligible for reimbursement in one taxable year shall not affect the expenses eligible for reimbursement in any other

taxable year; (ii) the reimbursement of an eligible expense shall be made no later than the end of the year after the year in which such

expense was incurred; and (iii) the right to reimbursement shall not be subject to liquidation or exchange for another benefit.

5. Termination.

(a) Termination by

Executive. Executive may terminate the employment relationship at any time by giving the Company written notice, with such

termination taking effect upon written notice of the termination being provided to the Company. If Executive chooses to terminate

the employment relationship other than for Good Reason (defined below), Executive will not be entitled to and shall not receive any

compensation or benefits of any type following the effective date of termination, other than (i) payment of base salary through the

last day of employment, (ii) payment for any accrued but unused PTO and holidays consistent with this agreement and applicable law,

(iii) reimbursement for unreimbursed business expenses properly incurred by Executive, which shall be subject to and paid in

accordance with the Company’s expense reimbursement policy, and (iv) any right to continued benefits required by law or under

the Company’s employee benefit plans and vested as of the termination date (the “Accrued

Obligations”). If Executive terminates the employment relationship for Good Reason (defined below), Executive will be

entitled to the Accrued Obligations and the Termination Compensation, as applicable and described below, subject to the terms,

conditions and restrictions set forth in Section 5(c)(ii).

(i) “Good Reason”

means the occurrence of any of the following without Executive’s express written consent: (A) a material reduction in Executive’s

base salary; (B) a relocation of Executive to a facility or location that is more than fifty (50) miles from Executive’s Primary

Place of Employment as of the Effective Date and represents a material increase in Executive’s commuting distance; (C) a material

diminution in Executive’s authority, position, duties, or responsibilities individually or taken as a whole and including any such

diminution that takes place following a Change in Control; or (D) a material breach by the Company of the terms of this Agreement or

any other agreement between the Company and Executive; provided, that no such event described above will constitute Good Reason unless:

(x) Executive gives notice to the Company specifying the condition or event relied upon for such termination within sixty (60) days of

the initial existence of such event; and (y) the Company fails to cure the condition or event constituting Good Reason within thirty

(30) days following receipt of such notice (the “Cure Period”). If the Company fails to remedy the condition

constituting Good Reason during the applicable Cure Period, Executive’s termination of employment must occur, if at all, within

ninety (90) days following the last day of such Cure Period in order for such termination as a result of such condition to constitute

a termination for Good Reason. A “Change of Control” shall be deemed to have occurred if, after the Effective

Date, (i) the beneficial ownership (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”)) of securities representing more than 50% of the combined voting power of the Company is acquired by any “person”

as defined in sections 13(d) and 14(d) of the Exchange Act (other than the Company, any subsidiary of the Company, or any trustee or

other fiduciary holding securities under an employee benefit plan of the Company), (ii) the merger or consolidation of the Company with

or into another corporation where the shareholders of the Company, immediately prior to the consolidation or merger, would not, immediately

after the consolidation or merger, beneficially own (as such term is defined in Rule 13d-3 under the Exchange Act), directly or indirectly,

shares representing in the aggregate 50% or more of the combined voting power of the securities of the corporation issuing cash or securities

in the consolidation or merger (or of its ultimate parent corporation, if any) in substantially the same proportion as their ownership

of the Company immediately prior to such merger or consolidation, or (iii) the sale or other disposition of all or substantially all

of the Company’s assets to an entity, other than a sale or disposition by the Company of all or substantially all of the Company’s

assets to an entity, at least 50% of the combined voting power of the voting securities of which are owned directly or indirectly by

shareholders of the Company, immediately prior to the sale or disposition, in substantially the same proportion as their ownership of

the Company immediately prior to such sale or disposition.

(b) Termination

by Company for Cause.

(i) At

any time during the Employment Period, the Company may terminate Executive’s employment for Cause (defined below), with such termination

taking effect upon the later of written notice of the termination for Cause being provided to Executive or the expiration of any applicable

cure period related thereto (provided that Executive may be relieved from his duties hereunder during such cure period in the reasonable

direction of the Board). If Executive’s employment is terminated for Cause, Executive will not be entitled to and shall not receive

any compensation or benefits of any type following the effective date of termination, other than the Accrued Obligations, and shall forfeit

the Grant and Options, whether vested or unvested.

(ii) “Cause”

shall be defined as: (A) in connection with Executive’s services hereunder, Executive commits a material act of fraud or material

act of dishonesty with respect to the Company, which act causes (or could reasonably be expected to cause) material economic or material

reputational harm to the Company; (B) Executive is convicted of (or pleads guilty or nolo contendere to) a felony or a crime involving

moral turpitude, which demonstrably causes material economic or material reputational harm to the Company; (C) Executive engages in negligence

or willful misconduct in the performance of his duties hereunder that materially violates the Company’s policies and which misconduct

causes (or could reasonably be expected to cause) material economic or material reputational harm to the Company; (D) Executive willfully

refuses to follow the lawful written directions of his Supervisor, the Supervisor’s designee, or the Board; (E) Executive materially

breaches any material provision of any proprietary information and inventions agreement with the Company; or (F) Executive breaches any

Restrictive Covenant as defined in Section 5(c)(ii). Notwithstanding Section 5(b)(ii)(D), if Executive refuses to follow the Company’s

request that Executive work primarily or partially from the Company’s facilities or another location, such refusal will only give

the Company Cause to terminate the Executive if the facilities are located 50 miles or less from Executive’s Primary Place of Employment

as of the Effective Date and represents a material increase in Executive’s commuting distance. Notwithstanding anything in this

Agreement or elsewhere to the contrary, if an event or occurrence that is alleged to constitute Cause is curable (as determined by the

Board in good faith), the Company may terminate Executive’s employment for Cause only if (x) the Company gives Executive notice

of termination prior to the termination and within thirty (30) days after the Board learns of the event or occurrence that is alleged

to constitute Cause, specifying the grounds upon which Cause is alleged, (y) Executive fails to cure such grounds for Cause within thirty

(30) days after Executive receives such notice, and (z) the termination occurs within sixty (60) days after such event or occurrence.

For purposes of this Agreement, no act or failure to act, on Executive’s part, will be considered “willful” unless it

is done, or omitted to be done, by Executive in bad faith or without reasonable belief that Executive’s action or omission was in

the best interests of the Company.

(c) Termination

by Company Without Cause.

(i) The Company may

terminate Executive without Cause immediately by giving Executive written notice of such termination. Subject to the conditions set

forth in Section 5(c)(ii), if Executive’s employment is terminated by the Company without Cause, in addition to the Accrued

Obligations, Executive shall be entitled to (i) continued base salary for twelve (12) months following date of such termination (the

“Severance Period”) paid pursuant to the Company’s normal payroll practices; and (ii) if Executive and/or

Executive’s covered dependents timely elect(s) to receive health care continuation coverage pursuant to COBRA, the total

monthly cost of coverage for Executive (and such covered dependents) during the Severance Period, provided, for the avoidance of

doubt, that such covered dependents participated in the Company’s health plans prior to such termination, and provided,

further, that if at any time the Company determines that its payment of Executive’s (or Executive’s eligible

dependents’) premiums would result in a violation of law, then in lieu of providing the premiums described above, the Company

will instead pay Executive a fully taxable monthly cash payment in an amount equal to the applicable premiums for such month, with

such monthly payment being made on the last day of each month for the remainder of the Severance Period; and (iii) Executive shall

become fully vested in the Grant or any Options. (together, the “Termination Compensation”). The

Termination Compensation shall, as applicable and in each case, be subject to the terms, conditions and restrictions set forth below

in Section 5(c)(ii).

(ii) Executive

shall not be entitled to Termination Compensation unless (A) Executive complies with all surviving provisions of any non-competition agreement,

non-solicitation agreement, or confidentiality agreement or invention assignment agreement signed by Executive, including those contained

in this Agreement (the “Restrictive Covenants”) and (B) Executive executes and delivers to the Company, and

does not revoke a separation agreement and general release in form and substance reasonably acceptable to the Company within thirty (30)

days after Executive’s separation date, by which Executive releases the Company from any obligations and liabilities of any type

whatsoever, except for the Company’s obligations with respect to, as applicable, the Termination Compensation (the “Release”).

Such Release shall not affect Executive’s right to indemnification, if any, for actions taken within the scope of Executive’s

employment. The Termination Compensation, as applicable, shall begin, or if lump-sum, be paid on the first payroll following the Release

becoming irrevocable; provided, however, if the thirty (30) day period during which Executive has discretion to execute or revoke the

Release straddles two taxable years of Executive, then the Company shall pay the Termination Compensation, as applicable, starting in

the second of such taxable years, regardless of which taxable year Executive actually delivers the executed Release to the Company. The

Parties hereto acknowledge that the Termination Compensation, as applicable, to be provided under Section 5(c)(i) is to be provided in

consideration for the above-specified Release. If Executive breaches any of the Restrictive Covenants at any time during the Severance

Period, (1) the Company will have no further obligation to pay Executive any unpaid Termination Compensation, as applicable, (2) Executive

must repay any portion of the Termination Compensation, as applicable, already paid to him, to the extent permitted by law, and (3) the

Company may take any additional action to enforce its rights under the Restrictive Covenants. Finally, if Executive becomes employed during

the Severance Period, Executive will no longer be entitled to receive his continued base salary from the Company.

(iii) Disqualification

for Other Severance. The Termination Compensation described in this Section 5(c) is intended to supersede any other

similar compensation provided by any Company policy, plan or practice. Therefore, Executive shall be disqualified from receiving any

similar compensation under any other Company severance policy, plan or practice, if any. Notwithstanding the foregoing, Executive

shall continue to be eligible for any benefits pursuant to the terms of any health or retirement plan sponsored by the Company,

subject to and in accordance with the terms of the applicable plan.

(d) Termination

for Executive’s Permanent Disability. To the extent permissible under applicable law, in the event Executive becomes permanently

disabled during employment with the Company, the Company may terminate this Agreement by giving thirty (30) days’ notice to Executive

of its intent to terminate, and unless Executive resumes performance of the duties set forth in Section 3 within five (5) days of the

date of the notice and continues performance for the remainder of the notice period, this Agreement shall terminate at the end of the

thirty (30) day period. For purposes of this Agreement, “permanently disabled” shall mean if Executive is considered totally

disabled under any group disability plan maintained by the Company and in effect at that time, or in the absence of any such plan, under

applicable Social Security regulations, to the extent not inconsistent with applicable law. In the event of any dispute under this Section

5(d), Executive shall submit to a physical examination by a licensed physician mutually satisfactory to the Company and Executive, the

cost of such examination to be paid by the Company, and the determination of such physician shall be determinative. In the event the

Executive is terminated pursuant to this Section 5(d), Executive will be entitled to the Accrued Obligations and the Termination Compensation,

subject to the terms, conditions and restrictions set forth in Section 5(c)(ii).

(e) Termination

Due to Executive’s Death. This Agreement will terminate immediately upon Executive’s death and the Company shall not

have any further liability or obligation to Executive, Executive’s executors, heirs, assigns or any other person claiming under

or through Executive’s estate, except that Executive’s estate shall receive any Accrued Obligations. In addition, Executive’s

estate shall be entitled to accelerated vesting of the portion of the Grant and Options that would have otherwise vested during the twelve

(12) months period following such termination.

(f) Continuing

Obligations. The obligations imposed on Executive with respect to non-competition, non-solicitation, confidentiality, non-disclosure

and assignment of rights to inventions or developments in this Agreement or any other agreement executed by the Parties shall continue,

notwithstanding the termination of the employment relationship between the Parties and regardless of the reason for such termination.

6. Company Property. All correspondence,

records, documents, software, promotional materials, and other Company property, including all copies, which come into

Executive’s possession by, through or in the course of Executive’s employment, regardless of the source and whether

created by Executive, are the sole and exclusive property of the Company, and immediately upon the termination of Executive’s

employment, or at any time the Company shall request, Executive shall return to the Company all such property of the Company,

without retaining any copies, summaries or excerpts of any kind or in any format whatsoever. Executive shall not destroy any Company

property, such as by deleting electronic mail or other files, other than in the normal course of Executive’s employment.

Executive further agrees that should Executive discover any Company property or Confidential Information in Executive’s

possession after the return of such property has been requested, Executive agrees to return it promptly to Company without retaining

copies, summaries or excerpts of any kind or in any format whatsoever.

7. Non-Competition

and Non-Solicitation.

(a) Executive

agrees and acknowledges that for one (1) year period following the end of Executive’s employment for any reason, Executive shall

not, either on Executive’s own behalf or on behalf of any third party (A) directly or indirectly hire any employee, independent

contractor, or consultant or any person who was an employee, independent contractor, or consultant of the Company within the preceding

six (6) months, or (B) directly or indirectly encourage, induce, attempt to induce, solicit or attempt to solicit (on Executive’s

own behalf or on behalf of any other business, enterprise, or individual) any employee, independent contractor, or consultant to leave

or curtail his or her employment or engagement with the Company or any of its affiliates; provided, however, that notwithstanding the

foregoing, this Section 7(a) shall not prevent Executive from undertaking general solicitations of employment not targeted at employees,

independent contractors, or consultants of the Company or any of its affiliates (so long as Executive does not, directly or indirectly,

hire any such employee, independent contractor, or consultant).

(b) The

Parties agree that the relevant public policy aspects of post-employment restrictive covenants have been discussed, and that every effort

has been made to limit the restrictions placed upon Executive to those that are reasonable and necessary to protect the Company’s

legitimate interests. Executive acknowledges that, based upon Executive’s education, experience, and training, the restrictions

set forth in this Section 7 will not prevent Executive from earning a livelihood and supporting Executive and Executive’s family

during the relevant time period. Executive further acknowledges that, because the Company markets its products and services throughout

the Restricted Territory, a more narrow geographic limitation on the restrictive covenants set forth above would not adequately protect

the Company’s legitimate business interests.

(c) If

any restriction set forth in this Section 7 is found by any court of competent jurisdiction or arbitrator to be unenforceable because

it extends for too long a period of time or over too great a range of activities or geographic area, it shall be interpreted to extend

over the maximum period of time, range of activities or geographic area as to which it may be enforceable.

(d) The

restrictions contained in Section 7 are necessary for the protection of the business and goodwill of the Company and/or its affiliates

and are considered by Executive to be reasonable for such purposes. Executive agrees that any material breach of Section 7 will result

in irreparable harm and damage to the Company and/or its affiliates that cannot be adequately compensated by a monetary award. Accordingly,

it is expressly agreed that in addition to all other remedies available at law or in equity (including, without limitation, money damages

from Executive), the Company and/or such affiliate shall be entitled to a temporary restraining order, preliminary injunction or such

other form of injunctive or equitable relief as may be issued by any court of competent jurisdiction or arbitrator to restrain or enjoin

Executive from breaching any such covenant or provision or to specifically enforce the provisions hereof, without the need to post any

bond or other security.

(e) The

existence of a claim, charge, or cause of action by Executive against the Company shall not constitute a defense to the enforcement by

the Company of the foregoing restrictive covenants.

(f) The

provisions of this Section 7 shall apply regardless of the reason for the termination of Executive’s employment.

8. Non-Circumvention/Non-Interference.

Executive acknowledges and agrees that during the Employment Period, other than acting on behalf of the Company in his capacity as

an employee of the Company, Executive shall not, and shall not authorize or permit any of Executive’s Representatives to, directly

or indirectly, interfere, discuss, contact, initiate, or engage, encourage, solicit, initiate, facilitate or continue inquiries to any

third parties concerning any business opportunities related to the Company. It is understood that, during the Employment Period, without

previous written consent from the Company, the Executive will not enter, either directly or indirectly, into any discussions, solicit

or accept offers, enter into any agreements, conduct negotiations with or otherwise engage in any other independent communications unrelated

to the Company’s business with: any third party to whom Executive was introduced to by any member, shareholder, officer, director,

employee, agent, customer, supplier, vendor, or other representative of the Company, Factor Bioscience, or Novellus, Inc.; any third party

to whom Executive was informed of by any member, shareholder, officer, director, employee, agent, customer, supplier, vendor, or other

representative of Company, Factor Bioscience, or Novellus, Inc. or any employee, financial partner, investor, contractor of the Company.

For purposes of this Agreement, “Representatives” means, as to Company, its affiliates, and respective consultants (including

attorneys, financial advisors and accountants). Further, after termination of Executive’s employment with the Company, Executive

will not take any action or omit to take an action intended to interfere with existing contractual and or business relationships with

the Company in a manner prohibited by law.

9. Protection

of Confidential Information.

(a) Executive

agrees that all information, whether or not in writing, relating to the business, technical or financial affairs of the Company and that

is generally understood in the industry as being confidential and/or proprietary information, is the exclusive property of the Company.

Executive agrees to hold in a fiduciary capacity for the sole benefit of the Company all secret, confidential and/or proprietary information,

knowledge, and data, including trade secrets, relating to the Company or any of its affiliates obtained during Executive’s employment

with the Company or any of its predecessors or affiliates, including but not limited to any trade secrets, confidential or secret designs,

website technologies, content, processes, formulae, plans, manuals, devices, machines, know-how (including without limitation the manufacturing

of IRX-2), methods, compositions, ideas, improvements, financial and marketing information, costs, pricing, sales, sales volume, salaries,

methods and proposals, customer and prospective customer lists, customer identities, customer volume, or customer contact information,

identity of key personnel in the employ of customers and prospective customers, amount or kind of customer’s purchases from the

Companies or their affiliates, manufacturer lists, manufacturer identities, manufacturer volume, or manufacturer contact information,

identity of key personnel in the employ of manufacturers, amount or kind of the Companies’ or their affiliates’ purchases

from manufacturers, system documentation, hardware, engineering and configuration information,

computer programs, source and object

codes (whether or not patented, patentable, copyrighted or copyrightable), related software development information, inventions or other

confidential or proprietary information (including without limitation information relating to IRX-2 and its intellectual property that

has not yet issued) belonging to the Companies or their affiliates or directly or indirectly relating to the Companies’ or their

affiliates’ business and affairs (“Confidential Information”). Executive agrees that Executive will not

at any time, either during the Employment Period or the Confidentiality Period (as defined below), disclose to anyone any Confidential

Information, or utilize such Confidential Information for Executive’s own benefit, or for the benefit of third parties without

written approval by an officer of the Company. For purposes of this section, the “Confidentiality Period” means

so long as such information, data, or material remains confidential. Executive further agrees that all memoranda, notes, records, data,

schematics, sketches, computer programs, prototypes, or written, photographic, magnetic or other documents or tangible objects compiled

by Executive or made available to Executive during the Employment Period concerning the business of the Company and/or its clients, including

any copies of such materials, shall be the property of the Company and shall be delivered to the Company on the termination of Executive’s

employment, or at any other time upon request of the Company.

(b) In

the event Executive is questioned by anyone not employed by the Company or by an employee of or a consultant to the Company not authorized

to receive such information, in regard to any Confidential Information or any other secret or confidential work of the Company, or concerning

any fact or circumstance relating thereto, or in the event that Executive becomes aware of the unauthorized use of Confidential Information

by any party, whether competitive with the Company or not, Executive will promptly notify an executive officer of the Company.

(c) Court-Ordered

Disclosure. In the event that, at any time during Executive’s employment with the Company or at any time thereafter, Executive

receives a request to disclose any Confidential Information under the terms of a subpoena or order issued by a court or by a governmental

body, Executive agrees to notify the Company immediately of the existence, terms, and circumstances surrounding such request, to consult

with the Company on the advisability of taking legally available steps to resist or narrow such request; and, if disclosure of such Confidential

Information is required to prevent Executive from being held in contempt or subject to other penalty, to furnish only such portion of

the Confidential Information as, in the written opinion of counsel satisfactory to the Company, Executive is legally compelled to disclose,

and to exercise Executive’s best efforts to obtain an order or other reliable assurance that confidential treatment will be accorded

to the disclosed Confidential Information.

(d) Defend Trade

Secrets Act. Pursuant to the Defend Trade Secrets Act of 2016, Executive acknowledges that Executive shall not have criminal or

civil liability under any federal or state trade secret law for the disclosure of a trade secret that (A) is made (i) in confidence

to a federal, state, or local government official, either directly or indirectly, or to an attorney and (ii) solely for the purpose

of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or

other proceeding, if such filing is made under seal. In addition, if Executive files a demand for arbitration alleging retaliation

by the Company for reporting a suspected violation of law, Executive may disclose the trade secret to Executive’s attorney and

may use the trade secret information in the arbitration proceeding, if Executive (X) files any document containing the trade secret

under seal and (Y) does not disclose the trade secret, except pursuant to an order of the arbitrator.

10. Intellectual

Property.

(a) Disclosure

of Inventions. Executive will promptly disclose in confidence to the Company all inventions, improvements, processes, products, designs,

original works of authorship, formulas, processes, compositions of matter, computer software programs, Internet products and services,

e-commerce products and services, e-entertainment products and services, databases, mask works, trade secrets, product improvements,

product ideas, new products, discoveries, methods, software, uniform resource locators or proposed uniform resource locators (“URLs”),

domain names or proposed domain names, any trade names, trademarks or slogans, which may or may not be subject to or able to be patented,

copyrighted, registered, or otherwise protected by law (the “Inventions”) that Executive makes, conceives or

first reduces to practice or creates, either alone or jointly with others, during the Employment Period, whether or not in the course

of Executive’s employment (i) that result from any work performed by the Executive for the Company; (ii) that are developed from

using the Company’s equipment, supplies, facilities or trade secret information; or (iii) that relate at the time of conception or reduction

to practice of the invention to the Company’s business, or actual or demonstrably anticipated research or development of the Company.

(b) Assignment

of Company Inventions; Work for Hire. Executive agrees that all Inventions that (i) are developed using equipment, supplies, facilities

or trade secrets of the Company, (ii) result from work performed by Executive for the Company, or (iii) relate to the Company’s

business or current or anticipated research and development (the “Company Inventions”), will be the sole and

exclusive property of the Company and the Executive hereby agrees to irrevocably assign to the Company any such Company Inventions. Executive

further acknowledges and agrees that any copyrightable works prepared by Executive within the scope of Executive’s employment are

“works for hire” under the Copyright Act and that the Company will be considered the author and owner of such copyrightable

works from the moment of their creation and fixation in tangible media.

(c) Assignment

of Other Rights. In addition to the foregoing assignment of Company Inventions to the Company, Executive hereby irrevocably transfers

and assigns to the Company: (i) all worldwide patents, patent applications, copyrights, mask works, trade secrets and other intellectual

property rights in any Company Invention; and (ii) any and all “Moral Rights” (as defined below) that Executive

may have in or with respect to any Company Invention. Executive also hereby forever waives and agrees never to assert any and all Moral

Rights Executive may have in or with respect to any Company Invention, even after termination of Executive’s work on behalf of

the Company. “Moral Rights” means any rights to claim authorship of an Company Invention, to object to or prevent

the modification of any Company Invention, or to withdraw from circulation or control the publication or distribution of any Company

Invention, and any similar right, existing under judicial or statutory law of any country in the world, or under any treaty, regardless

of whether or not such right is denominated or generally referred to as a “moral right.”

(d) Assistance. Executive agrees to assist the

Company in every proper way to obtain for the Company and enforce patents, copyrights, mask work rights, trade secret rights and

other legal protections for the Company Inventions in any and all countries. Executive will execute any documents that the Company

may reasonably request for use in obtaining or enforcing such patents, copyrights, mask work rights, trade secrets and other legal

protections. Executive’s obligations under this section will continue beyond the termination of Executive’s employment

with the Company, provided that the Company will compensate Executive at a reasonable rate after such termination for time or

expenses actually spent by Executive at the Company’s request on such assistance. Executive appoints the Secretary of the

Company as Executive’s attorney-in-fact to execute documents on Executive’s behalf for this purpose.

11. Publicity;

Non-disparagement. Neither Party shall issue, without consent of the other Party, any press release or make any public announcement

with respect to this Agreement or the employment relationship between them, or the ending of such relationship. Following the date of

this Agreement and regardless of any dispute that may arise in the future, Executive agrees that Executive will not disparage, criticize

or make statements which are negative, detrimental or injurious to Company or any of its affiliates, or any of their affiliates to any

individual, company or client, including within the Company. This Section 11 does not, in any way, restrict or impede the parties

hereto from exercising protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable

law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance

does not exceed that required by the law, regulation, or order. Nothing contained herein shall prevent Executive from providing true testimony

to the extent required within any legal proceeding (or in any discovery in connection therewith) or investigation by a governmental authority.

12. Binding

Agreement. This Agreement shall be binding upon and inure to the benefit of the Parties hereto, their heirs, personal representatives,

successors and assigns. Executive acknowledges and agrees that the Company may, in its sole discretion, assign this Agreement (i) to an

affiliate of the Company at any time, or (ii) in the event the Company is acquired, is a non-surviving party in a merger, or transfers

substantially all of its assets, to the transferee or surviving company, in each case without being required to obtain Executive’s

consent. The Parties understand that the obligations of Executive are personal and may not be assigned by him.

13. Entire

Agreement. This Agreement contains the entire understanding of Executive and the Company with respect to employment of Executive.

This Agreement may not be amended, waived, discharged or terminated orally, but only by an instrument in writing, specifically identified

as an amendment to this Agreement, and signed by all Parties. By entering into this Agreement, Executive certifies and acknowledges that

Executive has carefully read all of the provisions of this Agreement and that Executive voluntarily and knowingly enters into said Agreement.

14.

Severability. Any provision of this Agreement which is prohibited or unenforceable in any jurisdiction shall, as to such

jurisdiction, be deemed severable from the remainder of this Agreement, and the remaining provisions contained in this Agreement

shall be construed to preserve to the maximum permissible extent the intent and purposes of this Agreement.

15. Tax

Consequences. If any payment or benefit the Executive would receive pursuant to this Agreement (“Payment”)

would (a) constitute a “Parachute Payment” within the meaning of Section 280G of the Code, and (b) but for this

sentence, be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then such Payment

shall be equal to the Reduced Amount. The “Reduced Amount” shall be either (i) the largest portion of the Payment

that would result in no portion of the Payment being subject to the Excise Tax or (ii) the largest portion, up to and including the total

of the Payment, whichever amount, after taking into account all applicable federal, state and local employment taxes, income taxes, and

the Excise Tax (all computed at the highest applicable marginal rate), results in the Executive’s receipt, on an after-tax basis,

of the greatest economic benefit notwithstanding that all or some portion of the Payment may be subject to the Excise Tax. If a reduction

in payments or benefits constituting Parachute Payments is necessary so that the Payment equals the Reduced Amount, reduction shall occur

in the manner that results in the greatest economic benefit for Executive to the extent permitted by Section 409A of the Code, to the

extent applicable, and Section 280G of the Code. Except as otherwise specifically provided in this Agreement, the Company will have no

obligation to any person entitled to the benefits of this Agreement with respect to any tax obligation any such person incurs as a result

of or attributable to this Agreement, including all supplemental agreements and employee benefits plans incorporated by reference therein,

or arising from any payments made or to be made under this Agreement or thereunder. All determinations under this Section 15 will

be made by an actuarial firm, accounting firm, law firm, or consulting firm experienced and generally recognized in 280G matters (the

“280G Firm”) that is chosen by the Company prior to a change in ownership or control of a corporation (within the meaning

of Treasury regulations under Section 280G of the Code). The 280G Firm shall be required to evaluate the extent to which payments are

exempt from Section 280G as reasonable compensation for services rendered before or after the Change in Control. All fees and expenses

of the 280G Firm shall be paid solely by the Company or its successor. The Company and Executive shall furnish the tax firm such information

and documents as the tax firm may reasonably request in order to make its required determination. The 280G Firm will provide its calculations,

together with detailed supporting documentation, to the Company and Executive as soon as practicable following its engagement. Any good

faith determinations of the 280G Firm made hereunder will be final, binding and conclusive upon the Company and Executive.

16. Withholding.

The Company shall have the right to withhold from any amount payable hereunder any federal, state, local and foreign taxes in order

for the Company to satisfy any withholding tax obligation it may have under any applicable law or regulation. Notwithstanding any other

provision of this Agreement, the Company does not guarantee any particular tax result for Executive with respect to any payment provided

to Executive hereunder, and Executive shall be solely responsible for any taxes imposed on Executive with respect to any such payment.

17. Section

409A.

(a) This Agreement

is intended to comply with, or otherwise be exempt from, Section 409A of the Code and any regulations and Treasury guidance

promulgated thereunder (“Section 409A of the Code”) and shall be construed and administered in accordance

with such intent. Notwithstanding any other provision of this Agreement, payments provided under this Agreement may only be made

upon an event and in a manner that complies with Section 409A of the Code or an applicable exemption. Any payments under this

Agreement that may be excluded from Section 409A of the Code either as separation pay due to an involuntary separation from service

or as a short-term deferral shall be excluded from Section 409A of the Code to the maximum extent possible. Notwithstanding the

foregoing, the Company makes no representations that the payments and benefits provided under this Agreement comply with Section

409A of the Code and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other

expenses that may be incurred by the Executive on account of non-compliance with Section 409A of the Code.

(b) For

purposes of Section 409A of the Code, the right to a series of installment payments under this Agreement shall be treated as a right to

a series of separate payments. In no event may Executive, directly or indirectly, designate the calendar year of payment.

(c) With

respect to any reimbursement of expenses of, or any provision of in-kind benefits to, Executive, as specified under this Agreement, such

reimbursement of expenses or provision of in-kind benefits shall be subject to the following conditions: (1) the expenses eligible for

reimbursement or the amount of in-kind benefits provided in one taxable year shall not affect the expenses eligible for reimbursement

or the amount of in-kind benefits provided in any other taxable year, except for any medical reimbursement arrangement providing for the

reimbursement of expenses referred to in Section 105(b) of the Code; (2) the reimbursement of an eligible expense shall be made no later

than the end of the year after the year in which such expense was incurred; and (3) the right to reimbursement or in-kind benefits shall

not be subject to liquidation or exchange for another benefit.

(d) “Termination

of employment,” “resignation,” or words of similar import, as used in this Agreement means, for

purposes of any payments under this Agreement that are payments of deferred compensation subject to Section 409A of the Code, Executive’s

“separation from service” as defined in Section 409A of the Code.

(e) If

a payment obligation under this Agreement arises on account of Executive’s separation from service while Executive is a “specified

employee” (as defined under Section 409A of the Code and determined in good faith by the Company), any payment of “deferred

compensation” (as defined under Treasury Regulation Section 1.409A-1(b)(1), after giving effect to the exemptions in Treasury Regulation

Sections 1.409A-1(b)(3) through (b)(12)) that is scheduled to be paid within six (6) months after such separation from service shall accrue

without interest and shall be paid within fifteen (15) days after the end of the six-month period beginning on the date of such separation

from service or, if earlier, within fifteen (15) days after the appointment of the personal representative or executor of Executive’s

estate following Executive’s death.

18. Governing

Law. This Agreement shall be governed by, and construed and enforced in accordance with, the laws of the state of Texas, without giving

effect to the principles of conflicts of law thereof.

19. Notices. Any

notice provided for in this Agreement shall be provided in writing. Notices shall be effective from the date of service, if served

personally on the Party to whom notice is to be given, or on the second day after mailing, if mailed by first class mail, postage

prepaid.

Notices shall be properly addressed to the Parties at their respective addresses or to such other address as either Party

may later specify by notice to the other.

20. Dispute

Resolution.

(a) Executive

and the Company mutually agree that any controversy or claim arising out of or relating to this Agreement or the employment relationship

between Executive and the Company, including any dispute regarding the scope or enforceability of this arbitration provision, shall be

settled by individual arbitration administered by Judicial Arbitration and Mediation Services (JAMS) in accordance with the JAMS Employment

Arbitration Rules and Procedures in effect as of the date of this Agreement (“JAMS Rules”), to the extent the

JAMS Rules are consistent with the terms of this provision. Judgment on the award may be entered in any court having jurisdiction thereof.

The parties also mutually agree that, except as otherwise required by enforceable law, arbitration shall be the sole and exclusive forum

for resolving such disputes (including any dispute with the Company, any related parties, and any of their respective employees, officers,

owners or agents, who shall be third-party beneficiaries of this provision), and both parties agree that they are hereby waiving any right

to have their disputes resolved in civil litigation by a court or jury trial, including but not limited to any disputes arising under

statutes such as Title VII of the Civil Rights Act or the Age Discrimination in Employment Act. The arbitrator’s decisions on such

matters shall be final and binding on the parties to the fullest extent permitted by law. The JAMS Rules are incorporated herein by reference,

to the extent they are consistent with the terms of this provision, and may be found at available at https://www.jamsadr.com/rules-employment-arbitration/.

The place of arbitration shall be in Houston, Harris County, Texas or an alternate location selected by the parties. Any arbitration hereunder

shall be conducted only on an individual basis and not in a class, consolidated, or representative action. The Company shall pay the administrative

costs and fees directly related to the arbitration, including the fees of the arbitrator. Each party shall otherwise bear its own respective

attorneys’ fees and costs, including the costs of any depositions or for expert witnesses, unless any applicable law provides otherwise

to the prevailing party, in which case the arbitrator shall have the authority to award costs and attorneys’ fees to the prevailing

party in accordance with the applicable law. Neither a party nor the arbitrator may disclose the existence, content, or results of any

arbitration hereunder without the prior written consent of both parties, unless otherwise provided by law. The parties’ agreement

to arbitrate does not apply to claims that, pursuant to applicable law, cannot be subject to mandatory arbitration, including claims under

the Private Attorney General Act; provided that, in the event of a dispute regarding whether, or the extent to which, any dispute is subject

to arbitration, the parties agree that no underlying dispute or any facts regarding such dispute shall be submitted to a court until and

unless a declaratory judgment is issued by the duly appointed arbitrator that allows a dispute to proceed in court based on a claim by

a party that this arbitration provision is unenforceable as a matter of law as to an asserted claim. Moreover, nothing in this Agreement

prevents Executive from filing or prosecuting a charge with any government agency (such as the Equal Employment Opportunity Commission)

over which such agency has jurisdiction, or from participating in an investigation or proceeding conducted by any such agency. Any matter

required to be arbitrated under this Section 20 shall be submitted to mediation in a manner agreed to by Executive and the Company. Executive

and the Company agree to use mediation to attempt to resolve any such matter prior to filing for arbitration. Executive and the Company

will select a mediator agreeable to both parties. The costs of the mediation and fees of the mediator will be borne entirely by the Company.

BY AGREEING

TO ARBITRATION, THE PARTIES ACKNOWLEDGE THAT THEY WAIVE THE RIGHT TO BRING AND/OR PARTICIPATE IN ANY CLASS OR COLLECTIVE ACTION. THE ARBITRATOR

SHALL HAVE NO POWER TO ARBITRATE ANY CLASS AND/OR COLLECTIVE CLAIMS. BY AGREEING TO ARBITRATION, THE PARTIES ACKNOWLEDGE THAT THEY ARE

WAIVING THEIR STATUTORY AND COMMON LAW RIGHTS TO SEEK RELIEF IN A COURT OF LAW AND ARE WAIVING THEIR RIGHTS TO A TRIAL BY JURY.

(b) Notwithstanding

the provisions of Section 20(a), the Parties further acknowledge and agree that, due to the nature of the confidential information, trade

secrets, and intellectual property belonging to the Company to which Executive has or will be given access, and the likelihood of significant

harm that the Company would suffer in the event that such information was disclosed to third parties, the Company shall have the right

to file suit in a court of competent jurisdiction to seek injunctive relief to prevent Executive from violating the obligations established

in Sections 7, 8, 9 or 10 of this Agreement without first submitting the claim, controversy, or dispute to JAMS mediation or arbitration.

21. Indemnification.

The Company shall indemnify and hold harmless Executive for any liability to any third-party incurred by reason of any act or omission

performed by Executive while acting in good faith on behalf of the Company and within the scope of the authority of Executive pursuant

to this Agreement and under the rules and policies of the Company, except that Executive must have in good faith believed that such action

was in the best interest of the Company and such course of action or inaction must not have constituted gross negligence, fraud, willful

misconduct, or breach of a fiduciary duty.

22. Miscellaneous.

(a) Compensation

Recovery Policy. Executive acknowledges and agrees that, to the extent the Company adopts any claw-back or similar policy pursuant

to the Dodd-Frank Wall Street Reform and Consumer Protection Act or otherwise, and any rules and regulations promulgated thereunder,

he or she shall take all action necessary or appropriate to comply with such policy (including, without limitation, entering into any

further agreements, amendments or policies necessary or appropriate to implement and/or enforce such policy with respect to past, present

and future compensation, as appropriate).

(b) No

delay or omission by the Company in exercising any right under this Agreement shall operate as a waiver of that or any other right. A

waiver or consent given by the Company on any one occasion shall be effective only in that instance and shall not be construed as a bar

or waiver of any right on any other occasion.

(c) The

captions of the sections of this Agreement are for convenience of reference only and in no way define, limit or affect the scope or substance

of any section of this Agreement.

(d) The

language in all parts of this Agreement will be construed, in all cases, according to its fair meaning, and not for or against

either Party hereto. The Parties acknowledge that each Party and its counsel have reviewed and revised this Agreement and that the

normal rule of construction to the effect that any ambiguities are to be resolved against the drafting Party will not be employed in

the interpretation of this Agreement.

(e) The

obligations of Company under this Agreement, including its obligation to pay the compensation provided for in this Agreement, are contingent

upon Executive’s performance of Executive’s obligations under this Agreement.

(f) This

Agreement may be executed in counterparts, each of which shall constitute an original, but all of which shall constitute one agreement.

(g) The

Parties agree that the digital signatures of the parties included in this Agreement are intended to authenticate this writing and to have

the same force and effect as the use of manual signatures.

IN WITNESS WHEREOF, Executive and the undersigned duly authorized representative

of the Company have executed this Agreement effective as of the Effective Date.

| |

EXECUTIVE |

| |

|

|

| |

/s/ Mark Williams |

| |

Mark Williams |

| |

|

|

| |

HNR ACQUISTION CORP |

| |

|

|

| |

By: |

/s/ Mitchell B. Trotter |

| |

|

Mitchell B. Trotter, Chief Financial Officer |

[Signature Page to Executive Employment Agreement]

17

Exhibit 99.1

HNR Acquisition Corp Announces

Mark H. Williams Appointment as Corporate Controller

HOUSTON, TX / February 1, 2024 / HNR Acquisition

Corp (NYSE American: HNRA) (the “Company” or “HNRA”) is an independent oil and gas company focused on the

acquisition, development, exploration and production of oil and gas properties in the Permian Basin in Eddy County, New Mexico. Today,

the Company announces that Mark H. Williams, age 54, has accepted the position of Corporate Controller and Vice President of Finance and

Administration.

Mark has more than 30 years of experience in various

controller-type roles with major global public companies. In his past roles, Mark supported business operations, including budgets/forecasts,

systems design, purchasing, client contracts and sales support. He was involved in monthly financials, audits, SOX compliance, policy,

acquisitions, integrations, system enhancements, and other financial matters. Mark graduated with a BBA in Accounting from William &

Mary.

Mark has provided consulting services to HNRA

since September 2023 providing invaluable support to the efforts to complete the Company’s initial acquisition, and the transition

of both finance and operations. In support of the financial transition, he managed: the migration of the two accounting systems to a single

enhanced accounting system; the structuring of accounts and reporting systems to best serve HNRA; the establishment of bank accounts to

transition to a new banking relationship; and establishing the processes of payables, receivables and cash disbursements. In supporting

the administrative and operations transitions, he supported: the transfer of records; benefits enrollment for the field staff; research

of neighboring oil field owners; and transition of action plans.

In his finance role as Corporate Controller, Mark

will be responsible for the accounting services, audit lead, equipment financing, cash flow forecasts, payables and receivables management,

and tax support. He will also support in policy documentation, system and IT support, benefits and HR coordination, and M&A activities.

“I have been working with Mark for much

of the past 30 years, and he was my first choice for consulting to assist with our initial acquisition,” said Mitch Trotter, CFO

of HNRA. “Mark stepped in and immediately started handling key aspects of the transition not only for finance, but supporting operations

as well. His contributions to the entire management group made the decision easy to hire him as an addition to the management team.”

“Mark stepped in and has been tremendous

support for our CFO and our VP of Operations. He is an excellent addition to our team,” said Dante Caravaggio, President and CEO

of HNRA.

About HNR Acquisition Corp

HNRA is an independent upstream energy company

focused on maximizing total returns to its shareholders through the development of onshore oil and natural gas properties in the United

States. HNRA’s long-term goal is to maximize total shareholder value from a diversified portfolio of long-life oil and natural gas

properties built through acquisition and through selective development, production enhancement, and other exploitation efforts on its

oil and natural gas properties. On November 15, 2023, HNRA acquired its operating entity, LH Operating, LLC, whose assets include interests

in the Grayburg-Jackson oil field in the prolific Permian Basin in Eddy County, New Mexico.

HNRA’s Class A common stock trades on the

NYSE American Stock Exchange (NYSE American: HNRA). For more information on HNRA, please visit the Company website: https://www.hnra-nyse.com/

Forward-Looking Statements

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause actual results to differ materially from what is expected. Words

such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks,”

“may,” “might,” “plan,” “possible,” “should” and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company’s

management’s current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company’s expectations are disclosed

in the Company’s documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

of this press release. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

Key search words

HNRA, Pogo, oil and gas, reserves,

Pogo Resources, HNR Acquisition, Permian Basin, Eddy County, New Mexico, SPAC, HNRAW

v3.24.0.1

Cover

|

Jan. 29, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 29, 2024

|

| Entity File Number |

001-41278

|

| Entity Registrant Name |

HNR ACQUISITION CORP

|

| Entity Central Index Key |

0001842556

|

| Entity Tax Identification Number |

85-4359124

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3730 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

713

|

| Local Phone Number |

834-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A Common stock, par value $0.0001 per share

|

| Trading Symbol |

HNRA

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HNRAW

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |