0001842556

false

--12-31

0001842556

2023-11-15

2023-11-15

0001842556

HNRA:ClassCommonStockParValue0.0001PerShareMember

2023-11-15

2023-11-15

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-11-15

2023-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 15, 2023

HNR ACQUISITION CORP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston,

Texas 77098

(Address

of principal executive offices, including zip code)

(713)

834-1145

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Class A Common stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

INTRODUCTORY

NOTE

As previously announced, HNR Acquisition Corp,

a Delaware corporation (“HNRA” or the “Company”), entered into that certain Amended and Restated

Membership Interest Purchase Agreement, dated as of August 28, 2023 (as amended, the “MIPA”), by and among HNRA, HNRA

Upstream, LLC, a newly formed Delaware limited liability company which is managed by, and is a subsidiary of, HNRA (“OpCo”),

and HNRA Partner, Inc., a newly formed Delaware corporation and wholly owned subsidiary of OpCo (“SPAC Subsidiary”,

and together with the Company and OpCo, “Buyer” and each a “Buyer”), CIC Pogo LP, a Delaware limited

partnership (“CIC”), DenCo Resources, LLC, a Texas limited liability company (“DenCo”), Pogo Resources

Management, LLC, a Texas limited liability company (“Pogo Management”), 4400 Holdings, LLC, a Texas limited liability

company (“4400” and, together with CIC, DenCo and Pogo Management, collectively, “Seller” and each

a “Seller”), and, solely with respect to Section 6.20 of the MIPA, HNRAC Sponsors LLC, a Delaware limited liability

company (“Sponsor”). HNRA’s stockholders approved the transactions contemplated by the MIPA at a special meeting

of stockholders that was originally convened October 30, 2023, adjourned, and then reconvened on November 13, 2023 (the “Special

Meeting”).

On November 15, 2023 (the “Closing Date”),

as contemplated by the MIPA:

| ● | HNRA

filed a Second Amended and Restated Certificate of Incorporation (the “Second A&R Charter”) with the Secretary

of State of the State of Delaware, pursuant to which the number of authorized shares of HNRA’s capital stock, par value $0.0001

per share, was increased to 121,000,000 shares, consisting of (i) 100,000,000 shares of Class A common stock, par value $0.0001 per share

(the “Class A Common Stock”), (ii) 20,000,000 shares of Class B common stock, par value $0.0001 per share (the “Class

B Common Stock”), and (iii) 1,000,000 shares of preferred stock, par value $0.0001 per share; |

| |

● |

The current shares of common stock of HNRA were reclassified as Class A Common Stock; the Class B Common Stock has no economic rights but entitles its holder to one vote on all matters to be voted on by stockholders generally; holders of shares of Class A Common Stock and shares of Class B Common Stock will vote together as a single class on all matters presented to HNRA’s stockholders for their vote or approval, except as otherwise required by applicable law or by the Second A&R Charter; |

| ● | (A)

HNRA contributed to OpCo (i) all of its assets (excluding its interests in OpCo and the aggregate amount of cash required to satisfy

any exercise by HNRA stockholders of their Redemption Rights (as defined below)) and (ii) 2,000,000 newly issued shares of Class B Common

Stock (such shares, the “Seller Class B Shares”) and (B) in exchange therefor, OpCo issued to HNRA a number of Class

A common units of OpCo (the “OpCo Class A Units”) equal to the number of total shares of Class A Common Stock issued

and outstanding immediately after the closing (the “Closing”) of the transactions (the “Transactions”)

contemplated by the HNRA (following the exercise by HNRA stockholders of their Redemption Rights) (such transactions, the “SPAC

Contribution”); and |

| ● | Immediately

following the SPAC Contribution, OpCo contributed $900,000 to SPAC Subsidiary in exchange for 100% of the outstanding common stock of

SPAC Subsidiary (the “SPAC Subsidiary Contribution”); |

| ● | Immediately following the SPAC Subsidiary

Contribution, Seller sold, contributed, assigned, and conveyed to (A) OpCo, and OpCo acquired and accepted from Seller,

ninety-nine percent (99.0%) of the outstanding membership interests of Pogo Resources, LLC, a Texas limited liability company

(“Pogo” or the “Target”),

and (B) SPAC Subsidiary, and SPAC Subsidiary purchased and accepted from Seller, one percent (1.0%) of the outstanding membership

interest of Target (together with the ninety-nine percent (99.0%) interest, the “Target

Interests”), in each case, in exchange for (x) $900,000 of the Cash Consideration (as defined below) in the case of

SPAC Subsidiary and (y) the remainder of the Aggregate Consideration (as defined below) in the case of OpCo (such transactions,

together with the SPAC Contribution and SPAC Subsidiary Contribution, the “Business

Combination”). |

The “Aggregate Consideration”

for the Target Interests was: (a) cash in the amount of $31,074,127 in immediately available funds (the “Cash Consideration”),

(b) 2,000,000 Class B common units of OpCo (“OpCo Class B Units”) valued at $10.00 per unit (the “Common Unit

Consideration”), which will be equal to and exchangeable into 2,000,000 shares of Class A Common Stock issuable upon exercise

of the OpCo Exchange Right (as defined below), as reflected in the amended and restated limited liability company agreement of OpCo that

became effective at Closing (the “A&R OpCo LLC Agreement”), (c) the Seller Class B Shares, (d) $15,000,000 payable

through a promissory note to Seller (the “Seller Promissory Note”), (e) 1,500,000 preferred units (the “OpCo

Preferred Units” and together with the Opco Class A Units and the OpCo Class B Units, the “OpCo Units”) of

OpCo (the “Preferred Unit Consideration”, and, together with the Common Unit Consideration, the “Unit Consideration”),

and (f) an agreement for Buyer, on or before November 21, 2023, to settle and pay to Seller $1,925,873 from sales proceeds received from

oil and gas production attributable to Pogo, including pursuant to its third party contract with affiliates of Chevron. At Closing, 500,000

Seller Class B Shares (the “Escrowed Share Consideration”) were placed in escrow for the benefit of Buyer pursuant

to an escrow agreement and the indemnity provisions in the MIPA. The Aggregate Consideration is subject to adjustment in accordance with

the MIPA.

In connection with the Business Combination, holders

of 3,323,707 shares of common stock sold in HNRA’s initial public offering (the “public shares”) properly exercised

their right to have their public shares redeemed (the “Redemption Rights”) for a pro rata portion of the trust account

(the “Trust Account”) which held the proceeds from HNRA’s initial public offering, funds from HNRA’s payments

to extend the time to consummate a business combination and interest earned, calculated as of two business days prior to the Closing,

which was approximately $10.95 per share, or $49,362,479 in the aggregate. The remaining balance in the Trust Account (after giving effect

to the Redemption Rights) was $12,979,300.

Immediately upon the Closing, Pogo Royalty exercised

the OpCo Exchange Right as it relates to 200,000 OpCo Class B units (and 200,000 shares of Class B Common Stock). After giving effect

to the Business Combination, the redemption of public shares as described above and the exchange mentioned in the preceding sentence,

there are currently (i) 5,097,009 shares of Class A Common Stock issued and outstanding, (ii) 1,800,000 shares of Class B Common Stock

issued and outstanding and (iii) no shares of preferred stock issued and outstanding.

The

Class A Common Stock and HNRA warrants continued to trade, but now as an operating company, on the NYSE American LLC (“NYSE

American”) under the symbols “HNRA” and “HNRAW,” respectively, on November 16, 2023.

A more detailed description of the Business Combination

can be found in the section titled “Proposal No. 1—The Purchase Proposal” beginning on page 112 of HNRA’s

definitive proxy statement dated October 13, 2023 (the “Proxy Statement”) filed with the Securities and Exchange Commission

(the “SEC”), and such description is incorporated herein by reference. Further, the foregoing description of the MIPA

is a summary only and is qualified in its entirety by reference to the MIPA, that certain First Amendment to Membership Interest Purchase

Agreement, dated November 15, 2023 (the “MIPA Amendment”), and that certain Letter Agreement between Buyer and Seller

Re: Settle Up between Buyer and Seller, dated November 15, 2023 (the “Settle Up Letter Agreement”), copies of which

are included as Exhibit 2.1, Exhibit 2.2, and Exhibit 2.3, respectively, to this Current Report on Form 8-K (this “Report”),

and are incorporated herein by reference.

All references herein to the “Board”

refer to the board of directors of HNRA. Terms used in this Report but not defined herein, or for which definitions are not otherwise

incorporated by reference herein, shall have the meaning given to such terms in the Proxy Statement, and such definitions are incorporated

herein by reference.

This

Report incorporates by reference certain information from reports and other documents that were previously filed with the SEC, including

certain information from the Proxy Statement. To the extent there is a conflict between the information contained in this Report and

the information contained in such prior reports and documents incorporated by reference herein, the information in this Report controls.

Item

1.01. Entry into a Material Definitive Agreement.

The

Purchase

First

Amendment to Amended and Restated Membership Interest Purchase Agreement

On

November 15, 2023, Buyer, Seller, and Sponsor entered into the MIPA Amendment, whereby the Parties agreed to extend the outside date

for the transaction to November 30, 2023, and to place 500,000 shares of Seller Class B Shares into escrow instead of 500,000 OpCo Class

B Units.

The

above description of the MIPA Amendment is a summary only and is qualified in its entirety by the text of the MIPA Amendment, which is

included as Exhibit 2.2 to this Report and is incorporated herein by reference.

Settle

Up Letter Agreement

On November 15, 2023, Buyer and Seller entered

into the Settle Up Letter Agreement, whereby Seller agreed to accept a minimum amount of cash at Closing less than $33,000,000, provided

that, on or before November 21, 2023, Buyer must settle and pay to Seller $1,925,873 from sales proceeds received from oil and gas production

attributable to Pogo, including pursuant to its third party contract with affiliates of Chevron.

The

above description of the Settle Up Letter Agreement is a summary only and is qualified in its entirety by the text of the Settle Up Letter

Agreement, which is included as Exhibit 2.3 to this Report and is incorporated herein by reference.

OpCo A&R

LLC Agreement

In

connection with the Closing, HNRA and Pogo Royalty, LLC, a Texas limited liability company, an affiliate of Seller and Seller’s

designated recipient of the Aggregate Consideration (“Pogo Royalty”), entered into an amended and restated limited

liability company agreement of OpCo (the “OpCo A&R LLC Agreement”). Pursuant to the A&R OpCo LLC Agreement,

each OpCo unitholder (excluding HNRA) will, subject to certain timing procedures and other conditions set forth therein, have the right

(the “OpCo Exchange Right”) to exchange all or a portion of its OpCo Class B Units for, at OpCo’s

election, (i) shares of Class A Common Stock at an exchange ratio of one share of Class A Common Stock for each OpCo Class B

Unit exchanged, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions,

or (ii) an equivalent amount of cash. Additionally, the holders of OpCo Class B Units will be required to exchange all

of their OpCo Class B Units (a “Mandatory Exchange”) upon the occurrence of the following: (i) upon

the direction of HNRA with the consent of at least fifty percent (50%) of the holders of OpCo Class B Units; or (ii) upon the

one-year anniversary of the Mandatory Conversion Trigger Date. In connection with any exchange of OpCo Class B Units pursuant

to the OpCo Exchange Right or acquisition of OpCo Class B Units pursuant to a Mandatory Exchange, a corresponding number of

shares of Class B Common Stock held by the relevant OpCo unitholder will be cancelled.

The

OpCo Preferred Units will be automatically converted into OpCo Class B Units on the two-year anniversary of the

issuance date of such OpCo Preferred Units (the “Mandatory Conversion Trigger

Date”) at a rate determined by dividing (i) $20.00 per unit (the “Stated

Conversion Value”), by (ii) the Market Price of the Class A Common Stock (the “Conversion

Price”). The “Market Price” means the simple average of the

daily VWAP of the Class A Common Stock during the five (5) trading days prior to the date of conversion. On the Mandatory

Conversion Trigger Date, HNRA will issue a number of shares of Class B Common Stock to Pogo Royalty equivalent to the number of

OpCo Class B Units issued to Pogo Royalty. If not exchanged sooner, such newly issued OpCo Class B Units shall

automatically exchange into Class A Common Stock on the one-year anniversary of the Mandatory Conversion Trigger Date at a

ratio of one OpCo Class B Unit for one share of Class Common Stock. An equivalent number of shares of Class B Common

Stock must be surrendered with the OpCo Class B Units to the Company in exchange for the Class A Common Stock. As

noted above, the OpCo Class B Units must be exchanged upon the one-year anniversary of the Mandatory Conversion Trigger

Date.

The

material terms of the OpCo A&R LLC Agreement are described in the section of the Proxy Statement beginning on page 32 titled “Summary

of the Proxy Statement — Related Agreements — OpCo A&R LLC Agreement.” Such description

is incorporated by reference in this Report and is qualified in its entirety by the text of the OpCo A&R LLC Agreement, which is

included as Exhibit 10.1 to this Report and is incorporated herein by reference.

Promissory

Note

In connection

with the Closing, OpCo issued the Seller Promissory Note to Pogo Royalty in the principal amount of $15,000,000. The Seller Promissory

Note provides for a maturity date that is six (6) months from the Closing Date, bears an interest rate equal 12% per annum, and

contains no penalty for prepayment. If the Seller Promissory Note is not repaid in full on or prior to its stated maturity date, OpCo

will owe interest from and after default equal to the lesser of 18% per annum and the highest amount permissible under law, compounded

monthly. The Seller Promissory Note is subordinated to the Term Loan (as defined below).

The

material terms of the Seller Promissory Note are described in the section of the Proxy Statement beginning on page 30 titled “Summary

of the Proxy Statement — Related Agreements — Promissory Note.” Such description is incorporated

by reference in this Report and is qualified in its entirety by the text of the Seller Promissory Note, which is included as Exhibit

10.2 to this Report and is incorporated herein by reference.

Registration

Rights Agreement

In connection with the Closing, HNRA and Pogo

Royalty entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which HNRA

has agreed to provide Pogo Royalty with certain registration rights with respect to the shares of Class A Common Stock issuable upon exercise

of the OpCo Exchange Right, including filing with the SEC an initial registration statement on Form S-1 covering the resale

by the Pogo Royalty of the shares of Class A Common Stock issuable upon exercise of the OpCo Exchange Right so as to permit their resale

under Rule 415 under the Securities Act, no later than thirty (30) days following the Closing, use its commercially reasonable

efforts to have the initial registration statement declared effective by the SEC as soon as reasonably practicable following the filing

thereof with the SEC, and use commercially reasonable efforts to convert the Form S-1 (and any subsequent registration statement)

to a shelf registration statement on Form S-3 as promptly as practicable after HNRA is eligible to use a Form S-3 Shelf.

In

certain circumstances, Pogo Royalty can demand the Company’s assistance with underwritten offerings, and Pogo Royalty will be entitled

to certain piggyback registration rights.

The

material terms of the Registration Rights Agreement are described in the section of the Proxy Statement beginning on page 30 titled “Summary

of the Proxy Statement — Related Agreements — Registration Rights Agreement.” Such description

is incorporated by reference in this Report and is qualified in its entirety by the text of the Registration Rights Agreement, which

is included as Exhibit 10.3 to this Report and is incorporated herein by reference.

Option

Agreement

In connection with the Closing, HNRA Royalties,

LLC, a newly formed Delaware limited liability company and wholly-owned subsidiary of HNRA (“HNRA Royalties”) and Pogo

Royalty entered into an Option Agreement (the “Option Agreement”). Pogo Royalty owns certain overriding royalty interests

in certain oil and gas assets owned by Pogo(the “ORR Interest”). Pursuant to the Option Agreement, Pogo Royalty granted

irrevocable and exclusive option to HNRA Royalty to purchase the ORR Interest for the Option Price (as defined below) at any time prior

to November 15, 2024. The option is not exercisable while the Seller Promissory Note is outstanding.

The

purchase price for the ORR Interest upon exercise of the option is: (i) (1) $30,000,000 the (“Base Option Price”),

plus (2) an additional amount equal to interest on the Base Option Price of twelve percent (12%), compounded monthly, from the Closing

Date through the date of acquisition of the ORR Interest, minus (ii) any amounts received by Pogo Royalty in respect of the ORR

Interest from the month of production in which the effective date of the Option Agreement occurs through the date of the exercise of

the option (such aggregate purchase price, the “Option Price”).

The

Option Agreement and the option will immediately terminate upon the earlier of (a) Pogo Royalty’s transfer or assignment of

all of the ORR Interest in accordance with the Option Agreement and (b) November 15, 2024.

The

material terms of the Option Agreement are described in the section of the Proxy Statement beginning on page 31 titled “Summary

of the Proxy Statement — Related Agreements — Option Agreement.” Such description is incorporated

by reference in this Report and is qualified in its entirety by the text of the Option Agreement, which is included as Exhibit 10.4 to

this Report and is incorporated herein by reference.

Director

Nomination and Board Observer Agreement

In

connection with the Closing, the Company entered into Director Nomination and Board Observer Agreement (the “Board Designation

Agreement”) with CIC. Pursuant to the Board Designation Agreement, CIC has the right, at any time CIC beneficially owns capital

stock of the Company, to appoint two board observers to attend all meetings of the board of directors of the Company. In addition, after

the time of the conversion of the OpCo Preferred Units owned by Pogo Royalty, CIC will have the right to nominate a certain number

of members of the board of directors depending on Pogo Royalty’s ownership percentage of Class A Common Stock as further provided

in the Board Designation Agreement.

The

material terms of the Board Designation Agreement are described in the section of the Proxy Statement beginning on page 32 titled “Summary

of the Proxy Statement — Related Agreements — Director Nomination and Board Observer Agreement.”

Such description is incorporated by reference in this Report and is qualified in its entirety by the text of the Board Designation Agreement,

which is included as Exhibit 10.5 to this Report and is incorporated herein by reference.

Backstop

Agreement

In connection with the Closing, HNRA entered

a Backstop Agreement (the “Backstop Agreement”) with Pogo Royalty and certain of HNRA’s founders listed therein

(the “Founders”) whereby Pogo Royalty will have the right (“Put Right”) to cause the Founders

to purchase Pogo Royalty’s OpCo Preferred Units at a purchase price per unit equal to $10.00 per unit plus the product of

(i) the number of days elapsed since the effective date of the Backstop Agreement and (ii) $10.00 divided by 730. Seller’s

right to exercise the Put Right will survive for six (6) months following the date the Trust Shares (as defined below) are not restricted

from transfer under the Letter Agreement (as defined in the MIPA) (the “Lockup Expiration Date”).

As

security that the Founders will be able to purchase the OpCo Preferred Units upon exercise of the Put Right, the Founders agreed

to place at least 1,300,000 shares of Class A Common Stock into escrow (the “Trust Shares”), which the Founders

can sell or borrow against to meet their obligations upon exercise of the Put Right, with the prior consent of Seller. HNRA is not obligated

to purchase the OpCo Preferred Units from Pogo Royalty under the Backstop Agreement. Until the Backstop Agreement is terminated,

Pogo Royalty and its affiliates are not permitted to engage in any transaction which is designed to sell short the Class A Common

Stock or any other publicly traded securities of HNRA.

The

material terms of the Backstop Agreement are described in the section of the Proxy Statement beginning on page 32 titled “Summary

of the Proxy Statement — Related Agreements — Backstop Agreement.” Such description is incorporated

by reference in this Report and is qualified in its entirety by the text of the Backstop Agreement, which is included as Exhibit 10.6

to this Report and is incorporated herein by reference.

Founder

Pledge Agreement

In

connection with the Closing, HNRA entered a Founder Pledge Agreement (the “Founder Pledge Agreement”) with the Founders

whereby, in consideration of placing the Trust Shares into escrow and entering into the Backstop Agreement, HNRA agreed: (a) by January

15, 2024, to issue to the Founders an aggregate number of newly issued shares of Class A Common Stock equal to 10% of the number of Trust

Shares; (b) by January 15, 2024, to issue to the Founders number of warrants to purchase an aggregate number of shares of Class A Common

Stock equal to 10% of the number of Trust Shares, which such warrants shall be exercisable for five years from issuance at an exercise

price of $11.50 per shares; (c) if the Backstop Agreement is not terminated prior to the Lockup Expiration Date, to issue an aggregate

number of newly issued shares of Class A Common Stock equal to (i) (A) the number of Trust Shares, divided by (B) the simple average

of the daily VWAP of the Class A Common Stock during the five (5) Trading Days prior to the date of the termination of the Backstop Agreement,

subject to a minimum of $6.50 per share, multiplied by (C) a price between $10.00-$13.00 per share (as further described in the

Founder Pledge Agreement), minus (ii) the number of Trust Shares; and (d) following the purchase of OpCo Preferred Units by a

Founder pursuant to the Put Right, to issue a number of newly issued shares of Class A Common Stock equal to the number of Trust Shares

sold by such Founder. Until the Founder Pledge Agreement is terminated, the Founders are not permitted to engage in any transaction which

is designed to sell short the Class A Common Stock or any other publicly traded securities of HNRA.

The

above description of the Founder Pledge Agreement is a summary only and is qualified in its entirety by the text of the Founder Pledge

Agreement, which is included as Exhibit 10.7 to this Report and is incorporated herein by reference.

Debt

Financing

Senior

Secured Term Loan Agreement

Consistent

with the previously disclosed commitment letter (the “Debt Commitment Letter”) between HNRA and First

International Bank & Trust (“FIBT” or “Lender”), in connection with the Closing, HNRA

(for purposes of the Loan Agreement, the “Borrower”), OpCo, SPAC Subsidiary, Pogo, and LH Operating, LLC (for purposes

of the Loan Agreement, collectively, the “Guarantors” and together with the Borrower, the “Loan Parties”),

and FIBT entered into a Senior Secured Term Loan Agreement on November 15, 2023 (the “Loan Agreement”), setting forth

the terms of a senior secured term loan facility in an aggregate principal amount of $28 million (the “Term Loan”).

Pursuant to the terms

of the Term Loan Agreement, the Term Loan was advanced in one tranche on the Closing Date. The proceeds of the Term Loan were used to

(a) fund a portion of the purchase price, (b) partially fund a debt service reserve account funded with $2,600,000 at the Closing

Date, (c) pay fees and expenses in connection with the purchase and the closing of the Term Loan and (e) other general corporate purposes.

The Term Loan accrues interest at a per annum rate equal to the FIBT prime rate plus 6.5% and fully

matures on the third anniversary of the Closing Date (“Maturity Date”). Payments of principal and interest

will be due on the 15th day of each calendar month, beginning December 15, 2023, each in an amount equal to the Monthly Payment

Amount (as defined in the Term Loan Agreement), except that the principal and interest payment due on the Maturity Date will be in the

amount of the entire remaining principal amount of the Term Loan and all accrued but unpaid interest then outstanding. An additional

one-time payment of principal is due on the date the quarterly financial report for the year ending December 31, 2024, is due to be delivered

by Borrower to Lender in an amount that Excess Cash Flow (as defined in the Term Loan Agreement) exceeds the Debt Service Coverage Ratio

(as defined in the Term Loan Agreement) of 1.35x as of the end of such quarter; provided that in no event shall the amount of the payment

exceed $5,000,000.

The Borrower may elect

to prepay all or a portion greater than $1,000,000 of the amounts owed prior to the Maturity Date. In addition to the foregoing, the

Borrower is required to prepay the Term Loan with the net cash proceeds of certain dispositions and upon the decrease in value of collateral.

On

the Closing Date, Borrower deposited $2,600,000 into a Debt Service Reserve Account (the “Debt Service Reserve Account”)

and, within 60 days following the Closing Date, Borrower must deposit such additional amounts such that the balance of the Debt Service

Reserve Account is equal to $5,000,000 at all times. The Debt Service Reserve Account may be used by Lender at any time and from

time to time, in Lender’s sole discretion, to pay (or to supplement Borrower’s payments of) the obligations due under the

Term Loan Agreement.

The

Term Loan Agreement contains affirmative and restrictive covenants and representations and warranties. The Loan Parties are bound by

certain affirmative covenants setting forth actions that are required during the term of the Term Loan Agreement, including, without

limitation, certain information delivery requirements, obligations to maintain certain insurance, and certain notice requirements. Additionally,

the Loan Parties from time to time will be bound by certain restrictive covenants setting forth actions that are not permitted to be

taken during the term of the Term Loan Agreement without prior written consent, including, without limitation, incurring certain additional

indebtedness, entering into certain hedging contracts, consummating certain mergers, acquisitions or other business combination transactions,

consummating certain dispositions of assets, making certain payments on subordinated debt, making certain investments, entering into

certain transactions with affiliates, and incurring any non-permitted lien or other encumbrance on assets. The Term Loan Agreement also

contains other customary provisions, such as confidentiality obligations and indemnification rights for the benefit of the Lender.

The

above description of the Term Loan Agreement is a summary only and is qualified in its entirety by the text of the Term Loan Agreement,

which is included as Exhibit 10.8 to this Report and is incorporated herein by reference.

Pledge

and Security Agreement

In

connection with the Term Loan, FIBT and the Loan Parties entered into a Pledge and Security Agreement

on November 15, 2023 (the “Security Agreement”), whereby the Loan Parties granted a senior security interest to FIBT

on all assets of the Loan Parties, except certain excluded assets described therein, including, among other things, any interests in

the ORR Interest.

The

above description of the Security Agreement is a summary only and is qualified in its entirety by the text of the Security Agreement,

which is included as Exhibit 10.9 to this Report and is incorporated herein by reference.

Guaranty

Agreement

In

connection with the Term Loan, FIBT and the Loan Parties entered into a Guaranty Agreement on November

15, 2023 (the “Guaranty Agreement”), whereby the Guarantors guaranteed payment and performance of all Loan Parties

under the Term Loan Agreement.

The

above description of the Guaranty Agreement is a summary only and is qualified in its entirety

by the text of the Guaranty Agreement, which is included as Exhibit 10.10 to this Report

and is incorporated herein by reference.

Item

2.01. Completion of Acquisition or Disposition of Assets.

The

disclosure set forth in the “Introductory Note” above is incorporated into this Item 2.01 by reference. At the Special

Meeting, the HNRA stockholders considered and adopted, among other matters, a proposal to approve the Business Combination. The Business

Combination was completed on November 15, 2023.

FORM

10 INFORMATION

In

accordance with Item 2.01(f) of Form 8-K, the Company is providing below the information that would be required if the Company were filing

a general form for registration of securities on Form 10. Please note that the information provided below relates to the combined company

after the consummation of the Business Combination, unless otherwise specifically indicated or the context otherwise requires.

The

Company acknowledges that certain of the information referenced below is required to be updated for the year ended December 31, 2023,

including the annual audit of HNRA, and HNRA will update such information through an amendment to this Current Report on Form 8-K once

the annual audit of HNRA is completed and related annual financial information for the year ended December 31, 2023 is available which

HNRA expects by April 1, 2024.

Cautionary

Note Regarding Forward-Looking Statements

Certain

statements in this Report (including in the information that is incorporated by reference in this Report) may constitute “forward-looking

statements” for purposes of the federal securities laws. The Company’s forward-looking statements include, but are not limited

to, statements regarding the Company’s or the Company’s management team’s expectations, hopes, beliefs, intentions

or strategies regarding the future, including those relating to the Business Combination. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar expressions may

identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking

statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside the control of the Company, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual

results or outcomes include:

| ● | the

financial and business performance of HNRA; |

| | | |

| ● | the

ability to maintain the listing of the Class A Common Stock and the public warrants on NYSE

American, and the potential liquidity and trading of such securities; |

| | | |

| ● | the

diversion of management in connection with the Business Combination and HNRA’s ability

to successfully integrate Pogo’s operations and achieve or realize fully or at all

the anticipated benefits, savings or growth of the Transactions; |

| | | |

| ● | the

impact of the announcement of the Business Combination on relationships with third parties,

including commercial counterparties, employees and competitors, and risks associated with

the loss and ongoing replacement of key personnel; |

| | | |

| ● | HNRA’s

abilities to execute its business strategies; |

| | | |

| ● | changes

in general economic conditions, including the material and adverse negative consequences

of the COVID-19 pandemic and its unfolding impact on the global and national economy and/or

as a result of the armed conflict in Ukraine and associated economic sanctions on Russia; |

| | | |

| ● | the

actions of the Organization of Petroleum Exporting Countries (“OPEC”) and other

significant producers and governments, including the armed conflict in Ukraine and the potential

destabilizing effect such conflict may pose for the global oil and natural gas markets, and

the ability of such producers to agree to and maintain oil price and production controls; |

| | | |

| ● | the

effect of change in commodity prices, including the volatility of realized oil and natural

gas prices, as a result of the Russian invasion of Ukraine that has led to significant armed

hostilities and a number of severe economic sanctions on Russia or otherwise; |

| | | |

| ● | the

level of production on our properties; |

| | | |

| ● | overall

and regional supply and demand factors, delays, or interruptions of production; |

| | | |

| ● | our

ability to replace our oil and natural gas reserves; |

| | | |

| ● | ability

to identify, complete and integrate acquisitions of properties or businesses; |

| | | |

| ● | general

economic, business or industry conditions, including the cost of inflation; |

| | | |

| ● | competition

in the oil and natural gas industry; |

| | | |

| ● | conditions

in the capital markets and our ability, and the ability of our operators, to obtain capital

or financing on favorable terms or at all; |

| | | |

| ● | title

defects in the properties in which HNRA invests; |

| ● | risks

associated with the drilling and operation of crude oil and natural gas wells, including

uncertainties with respect to identified drilling locations and estimates of reserves; |

| | | |

| ● | the

availability or cost of rigs, equipment, raw materials, supplies, oilfield services or personnel; |

| | | |

| ● | restrictions

on the use of water; |

| | | |

| ● | the

availability of pipeline capacity and transportation facilities; |

| | | |

| ● | the

ability of our operators to comply with applicable governmental laws and regulations, including

environmental laws and regulations and to obtain permits and governmental approvals; |

| | | |

| ● | the

effect of existing and future laws and regulatory actions, including federal and state legislative

and regulatory initiatives relating to hydraulic fracturing and environmental matters, including

climate change; |

| | | |

| ● | future

operating results; |

| | | |

| ● | risk

related to our hedging activities; |

| | | |

| ● | exploration

and development drilling prospects, inventories, projects, and programs; |

| | | |

| ● | the

impact of reduced drilling activity in our focus areas and uncertainty in whether development

projects will be pursued; |

| | | |

| ● | operating

hazards faced by our operators; |

| | | |

| ● | technological

advancements; |

| | | |

| ● | weather

conditions, natural disasters and other matters beyond our control; and |

| | | |

| ● | other

factors detailed under the section titled “Risk Factors” beginning on

page 52 of the Proxy Statement and incorporated herein by reference. |

The

forward-looking statements contained in this Report are based on the Company’s current expectations and beliefs concerning future

developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will

be those that the Company has anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are

beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those

factors described or incorporated by reference under the heading “Risk Factors” below. Should one or more of these risks

or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. There may be additional risks that the Company considers immaterial or which are unknown.

It is not possible to predict or identify all such risks. The Company will not and does not undertake any obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws.

Business

The

business of the Company is described in the Proxy Statement in the section titled “Information About Pogo” beginning

on page 145 thereof and that information is incorporated herein by reference.

Risk

Factors

The

risks associated with the Company’s business are described in the Proxy Statement in the section titled “Risk Factors”

beginning on page 52 thereof and are incorporated herein by reference. A summary of the risks associated with the Company’s business

are also described on page 43 of the Proxy Statement under the heading “Summary of Risk Factors” and are incorporated

herein by reference.

Financial

Information

The consolidated financial statements of Pogo as of September 30,

2023 (unaudited) and December 31, 2022 and for the nine months ended September 30, 2023 and 2022 (unaudited) and the related notes is

filed as Exhibit 99.1 to this Report and is incorporated herein by reference.

The

audited consolidated financial statements of Pogo as of December 31, 2022 and 2021, and for the year ended December 31, 2022 and 2021

and the related notes are included in the Proxy Statement beginning on page F-45.

The

unaudited pro forma condensed combined financial information of HNRA as of September 30, 2023 and for the year ended December 31, 2022

and the nine months ended September 30, 2023 is filed as Exhibit 99.2 to this Report and is incorporated herein by reference.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Management’s

Discussion and Analysis of the Financial Condition and Results of Operations of Pogo for the nine months ended September 30, 2023 and

2022 is set forth in Exhibit 99.3 hereto and is incorporated herein by reference.

Properties

The

properties of the Company are described in the Proxy Statement in the section titled “Information About Pogo” beginning

on page 145 thereof and that information is incorporated herein by reference.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth information known to the Company regarding the beneficial ownership of Class A Common Stock immediately following

consummation of the Business Combination by:

| ● | each

person who is the beneficial owner of more than 5% of the outstanding shares of Class A Common Stock; |

| ● | each

of the Company’s named executive officers and directors; and |

| ● | all

of the Company’s executive officers and directors as a group. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she or it possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes

securities that the individual or entity has the right to acquire, such as through the exercise of warrants or stock options or the vesting

of restricted stock units, within 60 days of the Closing Date. Shares subject to warrants or options that are currently exercisable or

exercisable within 60 days of the Closing Date or subject to restricted stock units that vest within 60 days of the Closing Date are

considered outstanding and beneficially owned by the person holding such warrants, options or restricted stock units for the purpose

of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership

of any other person. Shares issuable pursuant to the exchange of OpCo Class B Units listed in the table below are represented in shares

of Class A Common Stock.

Except

as described in the footnotes below and subject to applicable community property laws and similar laws, the Company believes that each

person listed above has sole voting and investment power with respect to such shares.

The beneficial ownership of HNRA securities is based

on (i) 5,097,009 shares of Class A Common Stock issued and outstanding immediately following consummation of the Business Combination,

after giving effect to the Redemption Rights, and (ii) 1,800,000 shares of Class B Common Stock issued and outstanding immediately following

the consummation of the Business Combination.

| Name and Address of Beneficial Owners(1) | |

Number of Shares | | |

% | |

| Directors of officers: | |

| | |

| |

| Byron Blount | |

| 63,700 | | |

| * | |

| Diego Rojas | |

| — | | |

| — | |

| Joseph V. Salvucci, Sr. | |

| — | | |

| — | |

| Joseph V. Salvucci, Jr.(2) | |

| — | | |

| — | |

| Mitchell B. Trotter | |

| 22,125 | | |

| * | |

| David M. Smith | |

| 142,500 | | |

| 2.1 | % |

| | |

| | | |

| | |

| All directors and officers after as a group (6 persons) | |

| 228,325 | | |

| 3.3 | % |

| | |

| | | |

| | |

| Five Percent Holders: | |

| | | |

| | |

| JVS Alpha Property, LLC(3) | |

| 1,232,621 | | |

| 17.9 | % |

| HNRAC Sponsor LLC(4) | |

| 490,625 | | |

| 7.1 | % |

| Pogo Royalty, LLC(5) | |

| 2,000,000 | | |

| 29.0 | % |

| Dante Caravaggio(6) | |

| 539,040 | | |

| 7.8 | % |

| Donald H. Goree(7) | |

| 367,969 | | |

| 5.3 | % |

| * |

Less than one percent (1%)

|

| |

|

| (1) |

Unless otherwise noted,

the business address of each of the following entities or individuals is 3730 Kirby Drive, Suite 1200, Houston, Texas 77098. |

| (2) |

Mr. Salvucci Jr. has sole

voting and dispositive control over the securities held by JVS Alpha Property, LLC, however he disclaims any beneficial ownership

of such shares. |

| (3) |

JVS Alpha Property, LLC’s

Manager is Joseph V. Salvucci, Jr., who has voting and dispositive control over the shares held by such entity. |

| (4) |

Don Orr, as Manager of

HNRAC Sponsors LLC, has voting and dispositive control over the securities held by such entity, however he disclaims any beneficial

ownership of such shares. Includes the assumption that 378,750 shares of common stock underlying 505,000 private placement warrants

have been issued. |

| (5) |

Consists of (1) 1,800,000 shares of Class B Common Stock (and corresponding OpCo Class B Units) and (2) 200,000 shares of Class A Common Stock received following exercise of the OpCo Exchange Right. Includes all Class B Common Stock held by Pogo Royalty following Closing of the Business Combination. Fouad Bashour, Amir Yoffe, Michael Rawlings and Marshall Payne have voting and dispositive control over the securities held by such entity. Does not include any Class B Common Stock upon conversion of OpCo Preferred Units, due to conversion only occurring on the date that is two (2) years after Closing. The address of Messrs. Bashour, Yoffe, Rawlings and Payne is 3879 Maple Avenue, Suite 400, Dallas, Texas 75219 and the telephone number at that address is 214-871-6812. |

| (6) |

Consists of (1) 450,040

shares of Class A Common Stock held by Dante Caravaggio, LLC, of which Mr. Caravaggio has voting and dispositive control over the

shares held by such entity and (2) 89,000 shares of Class A Common Stock held by Alexandria VMA Capital, LLC, of which Mr. Caravaggio

has voting and dispositive control over the shares held by such entity. The business address of Mr. Caravaggio is 22415

Keystone Trail, Katy, TX 77450. |

| |

|

| (7) |

Mr.

Goree has sole voting and dispositive control over the securities held by Rhone Merchant House Ltd, which indirectly holds 367,969

private placement shares by virtue of its 75% ownership in HNRAC Sponsors LLC, which owns 490,625 private placement shares. Includes

the assumption that 378,750 shares of common stock underlying 505,000 private placement warrants have been issued to Sponsor. The

business address of Rhone Merchant House Ltd. is 81 Rue de France, 5TH Floor, Nice, France 06000.

|

Directors

and Executive Officers

The

Company’s directors and executive officers upon the Closing are described in the Proxy Statement in the section titled “Management

After the Purchase” beginning on page 204 thereof and that information is incorporated herein by reference.

Directors

Upon the Closing, the Company’s Board has

five directors. The Company’s Board is divided into two classes with only one class of directors being elected in each year and

each class (except for those directors appointed prior to HNRA’s first annual meeting of stockholders) serving a two-year term.

The class I directors consist of Diego Rojas and Joseph V. Salvucci, Jr., and their term will expire at HNRA’s first annual meeting

of stockholders. The class II directors consist of Mitchell Trotter, Byron Blount, and Joseph V. Salvucci, Sr. and their term will

expire at the second annual meeting of stockholders. Biographical information for these individuals is set forth in the Proxy Statement

in the section titled “Management After the Purchase” beginning on page 204 thereof and that information is incorporated

herein by reference.

Committees

of the Board of Directors

The

standing committees of the Company’s Board consist of an audit committee (the “Audit Committee”), a compensation

committee (the “Compensation Committee”), and a Nominating, Corporate Governance, and ESG Committee (the “Nominating

Committee”). The Audit Committee, Compensation Committee, and the Nominating Committee report to the Board.

Audit

Committee

The

Board appointed Messrs. Blount and Salvucci Sr. to serve on the Audit Committee, with Mr. Blount serving as the chair. Mr. Blount also

serves as the Audit Committee’s “audit committee financial expert” under SEC rules. As described below under “Directors

Independence,” the Board has determined that Messrs. Blount and Salvucci Sr. are “independent” as that term is

defined under the applicable rules and regulations of the SEC and the listing requirements and rules of NYSE American.

Compensation

Committee

The

Board appointed Messrs. Salvucci Sr., Salvucci, Jr., and Blount to serve on the Compensation Committee, with Mr. Salvucci, Jr. serving

as the chair. As described below under “Directors Independence,” the Board has determined that Messrs. Salvucci Sr.,

Salvucci, Jr., and Blount are “independent” as that term is used under the applicable rules and regulations of the SEC and

the listing requirements and rules of NYSE American.

Nominating

Committee

The

Board appointed Messrs. Salvucci Sr., Salvucci, Jr., and Blount to serve on the Nominating Committee, with Mr. Salvucci, Jr. serving

as the chair.

Executive

Officers

Effective

as of the Closing, the executive officers are:

| Name |

|

Position |

|

Age |

| Diego Rojas |

|

Chief Executive Officer |

|

69 |

| Mitchell B. Trotter |

|

Chief Financial Officer |

|

64 |

| David M. Smith |

|

General Counsel and Secretary |

|

68 |

Biographical

information for these individuals is set forth in the Proxy Statement in the section titled “Management After the Purchase”

beginning on page 204 thereof and that information is incorporated herein by reference.

Executive

Compensation

A

description of the compensation of the executive officers and directors of HNRA after the consummation of the Business Combination is

set forth in the section of the Proxy Statement titled “Compensation of Executive Officers and Directors After the Purchase,”

beginning on page 211 thereof which is incorporated herein by reference.

At

the Special Meeting, HNRA stockholders approved the HNR Acquisition Corp 2023 Omnibus Incentive Plan (the “2023 Plan”),

which is included as Exhibit 10.11 to this Report and is incorporated herein by reference. A summary of the 2023 Plan is set forth in

the section of the Proxy Statement titled “Proposal No. 2—The Incentive Plan Proposal” beginning on page 132

thereof, which is incorporated herein by reference.

Certain

Relationships and Related Person Transactions, and Director Independence

Certain

Relationships and Related Person Transactions

Certain

relationships and related person transactions are described in the Registration Statement on Form S-1 filed with the SEC on November

7, 2023 in the section titled “Certain Relationships and Related Person Transactions” beginning on page 151 thereof

and are incorporated herein by reference.

Directors

Independence

The NYSE American listing standards require that a majority of the

Board be independent. An “independent director” is defined generally as a person other than an officer or employee of the

company or its subsidiaries or any other individual having a relationship which in the opinion of the company’s board of directors,

would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Of the

current members of the Board, Messrs. Salvucci Sr., Salvucci Jr., and Byron Blount are each considered an “independent director”

under the NYSE American listing standards and applicable SEC rules. HNRA’s independent directors will have regularly scheduled

meetings at which only independent directors are present.

Legal

Proceedings

Reference

is made to the disclosure regarding legal proceedings in the sections of the Proxy Statement titled “Information About Pogo—Legal

Proceedings” and “Business of HNRA and Certain Information About HNRA—Legal Proceedings” beginning

on pages 164 and 186, respectively, which are incorporated herein by reference.

Market

Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Market

Information and Dividends

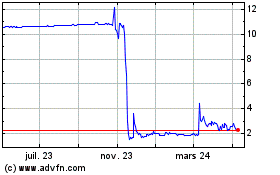

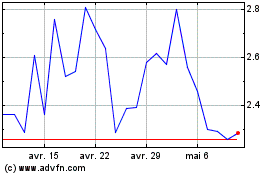

On

November 16, 2023, the HNRA Class A Common Stock and HNRA public warrants began trading on NYSE American as an operating company under

the trading symbols of “HNRA” and “HNRAW.” The Company has never declared or paid any cash dividends and does

not presently plan to pay cash dividends in the foreseeable future.

Holders

of Record

Following the completion of the Business Combination,

including the redemption of public shares as described above, the Company had 5,097,009 shares of Class A Common Stock outstanding that

were held of record by approximately 450 holders, 1,800,000 shares of Class B Common Stock outstanding that were held of record by one

holder, and no shares of preferred stock outstanding.

Securities

Authorized for Issuance Under HNR Acquisition Corp Omnibus Equity Incentive Plan

Reference

is made to the disclosure described in the Proxy Statement in the section titled “Proposal No. 2—The Incentive Plan Proposal”

beginning on page 132 thereof, which is incorporated herein by reference. The 2023 Plan and the material terms thereunder, including

the authorization of the initial share reserve thereunder, were approved by HNRA’s stockholders at the Special Meeting.

Recent

Sales of Unregistered Securities

Reference is made to the disclosure set forth

under “Introductory Note” above, Item 1.01 of this Report, and Item 3.02 below of this Report, which is incorporated

herein by reference.

Set

forth below is information regarding securities sold and issued by us in the past three years that were not registered under the Securities

Act of 1933, as amended (the “Securities Act”), as well as the consideration received by us for such securities and

information relating to the section of the Securities Act, or rule of the SEC, under which exemption from registration was claimed.

The

Sponsor, together with such other members, if any, of the Company’s executive management, directors, advisors or third party investors

as determined by the Sponsors in its sole discretion, purchased, in the aggregate, 505,000 units (“Private Placement Units”)

at a price of $10.00 per Private Placement Unit in a private placement which included a share of common stock and warrant to purchase

three quarters of one share of common stock at an exercise price of $11.50 per share, subject to certain adjustments (“Private

Placement Warrants” and together, the “Private Placement”) that occurred immediately prior to the Initial

Public Offering in such amounts as is required to maintain the amount in the Trust Account at $10.30 per Unit sold. The Sponsor agreed

that if the over-allotment option was exercised by the underwriter in full or in part, the Sponsor and/or its designees shall purchase

from us additional private placement units on a pro rata basis in an amount that is necessary to maintain in the trust account $10.30.

Since the over-allotment was exercised in full, the Sponsor purchased 505,000 Private Placement Units. The purchase price of the

Private Placement Units was added to the proceeds from the Public Offering to be held in the Trust Account pending completion of

the Company’s initial Business Combination.

On

December 24, 2020, the Sponsor purchased 2,875,000 founder shares for an aggregate purchase price of $25,000, up to 375,000 founder

shares of which were subject to forfeiture. On February 4, 2022, the Sponsor forfeited 373,750 founder shares and as a result, there

are currently 2,501,250 founder shares issued and outstanding.

In January 2023, HNRA

issued 50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $50,000 in cash and the issuance of a promissory note.

In January 2023, HNRA

issued 10,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $10,000 in cash and the issuance of a promissory note.

In January 2023, HNRA

issued 75,000 warrants to a stockholder having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $75,000 in cash and the issuance of a promissory note.

In January 2023, HNRA

issued 100,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $100,000 in cash and the issuance of a promissory note.

In January 2023, HNRA

issued 100,000 warrants to a stockholder having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $100,000 in cash and the issuance of a promissory note.

In January 2023, HNRA

issued 50,000 warrants to a director nominee having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $50,000 in cash and the issuance of a promissory note.

In February 2023, HNRA

issued 700,000 warrants to a stockholder controlled by a director having terms substantially similar to the Private Placement Warrants

in connection with the receipt of $700,000 in cash and the issuance of a promissory note.

In February 2023, HNRA

issued 179,000 warrants to a stockholder having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $179,000 in cash and the issuance of a promissory note.

In March 2023, HNRA issued

33,000 warrants to a stockholder controlled by a director having terms substantially similar to the Private Placement Warrants in connection

with the receipt of $33,000 in cash and the issuance of a promissory note.

In April 2023, HNRA issued

67,000 warrants to a stockholder controlled by a director having terms substantially similar to the Private Placement Warrants in connection

with the receipt of $67,000 in cash and the issuance of a promissory note.

In April 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt of

$50,000 in cash and the issuance of a promissory note.

In May 2023, HNRA

issued 50,000 warrants to a stockholder controlled by a director having terms substantially similar to the Private Placement Warrants

in connection with the receipt of $50,000 in cash and the issuance of a promissory note.

In May 2023, HNRA issued

15,000 warrants to a stockholder having terms substantially similar to the Private Placement Warrants in connection with the receipt of

$15,000 in cash and the issuance of a promissory note.

In May 2023, HNRA issued

100,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $100,000 in cash and the issuance of a promissory note.

In May 2023, HNRA issued

250,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $250,000 in cash and the issuance of a promissory note.

In June 2023, HNRA issued

150,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $150,000 in cash and the issuance of a promissory note.

In July 2023, HNRA issued

150,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $150,000 in cash and the issuance of a promissory note.

In July 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt of

$50,000 in cash and the issuance of a promissory note.

In July 2023, HNRA issued

25,000 warrants to a stockholder having terms substantially similar to the Private Placement Warrants in connection with the receipt of

$25,000 in cash and the issuance of a promissory note.

In July 2023, HNRA issued

10,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt of

$10,000 in cash and the issuance of a promissory note.

In August 2023, HNRA

issued 50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $50,000 in cash and the issuance of a promissory note.

In August 2023, HNRA

issued 150,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $150,000 in cash and the issuance of a promissory note.

In August 2023, HNRA

issued 100,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $100,000 in cash and the issuance of a promissory note.

In September 2023, HNRA

issued 125,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $125,000 in cash and the issuance of a promissory note.

In September 2023, HNRA

issued 20,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the receipt

of $20,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

875,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $875,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

100,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $100,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

500,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $500,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $50,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $50,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

125,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $125,000 in cash and the issuance of a promissory note.

In October 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $50,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

600,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $600,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

500,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $500,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

250,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $250,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

50,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $50,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

200,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $200,000 in cash and the issuance of a promissory note.

In November 2023, HNRA issued

250,000 warrants to a third-party having terms substantially similar to the Private Placement Warrants in connection with the

receipt of $250,000 in cash and the issuance of a promissory note.

On November 2, 2023,

HNRA entered into a subscription agreement (the “FPA Funding Amount PIPE Subscription Agreement”) with (i)

Meteora Capital Partners, LP (“MCP”), (ii) Meteora Select Trading Opportunities Master, LP (“MSTO”),

and (iii) Meteora Strategic Capital, LLC (“MSC” and, collectively with MCP and MSTO, “Meteora”).

Pursuant to the FPA Funding PIPE Subscription Agreement, Meteora agreed to subscribe for and purchase, and HNRA agreed to issue and sell

to Meteroa, on the Closing Date, an aggregate of up to 3,000,000 shares of Class A Common Stock, less the

number of shares of Class A Common Stock purchased by Meteora separately from third parties through a broker in the open market.

On November 13, 2023,

HNRA entered into an agreement with Meteora (the “Non-Redemption Agreement”) pursuant to which Meteora agreed to reverse the

redemption of up to the lesser of (i) 600,000 shares of Class A Common Stock, and (ii) such number of shares of Class A Common Stock such

that the number of shares beneficially owned by Meteora and its affiliates and any other persons whose beneficial ownership of Class A

Common Stock would be aggregated with those of Meteora for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), does not exceed 9.99% of the total number of issued and outstanding shares of Class A Common

Stock.

All issuances of warrants

described above were not registered under the Securities Act in reliance upon the exemption provided in Section 4(a)(2) of the Securities

Act and/or Regulation D promulgated thereunder.

Description of Registrant’s Securities

Pursuant to the Second A&R Charter, HNRA’s

authorized capital stock consists of 121,000,000 shares, consisting of (i) 100,000,000 shares of Class A Common Stock, (ii) 20,000,000

shares of Class B Common Stock, par value $0.0001 per share, and (iii) 1,000,000 shares of preferred stock, par value $0.0001 per share;

consist of 100,000,000 shares of common stock, $0.0001 par value, and 1,000,000 shares of undesignated preferred stock, $0.0001

par value. The following description summarizes the material terms of HNRA’s capital stock. Because it is only a summary, it may

not contain all the information that is important to investors.

Units

Public Units

Pursuant to the Company’s initial Public

Offering (the “IPO”), the Company sold 7,500,000 units at a price of $10.00 per unit (the “Units”).

Each Unit consisted of one (1) share of the Company’s common stock, $0.0001 par value and one (1) warrant to purchase

three quarters of one share of common stock (the “Warrants”). On April 4, 2022, the Units separated into

common stock and warrants, and ceased trading.

Private Placement Units

The Sponsor purchased 505,000 Private Placement Units at a price of $10.00

per Private Placement Unit in a private placement which included a share of common stock and Private Placement Warrants that

occurred immediately prior to the IPO in such amounts as was required to maintain the amount in the Trust Account at $10.30 per Unit

sold. The Sponsor agreed that if the over-allotment option was exercised by the underwriter in full or in part, the Sponsor

and/or its designees would purchase from the Company additional Private Placement Units on a pro rata basis in an amount that was

necessary to maintain in the trust account $10.30. Since the over-allotment was exercised in full, the Sponsor

purchased 505,000 Private Placement Units. The purchase price of the Private Placement Units was added to the

proceeds from the IPO to be held in the Trust Account pending completion of the Company’s initial Business Combination. The

Private Placement Units (including the warrants and common stock issuable upon exercise of the Private Placement Units) are not

be transferable, assignable, or salable until 30 days after the completion of the initial Business Combination and they are

non-redeemable so long as they are held by the original holders or their permitted transferees. If the Private Placement

Units are held by someone other than the original holders or their permitted transferees, the Private Placement Units will

be redeemable by the Company and exercisable by such holders on the same basis as the Warrants included in the Units sold in

the IPO. Otherwise, the Private Placement Units have terms and provisions that are substantially identical to those of the

Warrants sold as part of the Units in the IPO.

Common Stock

Class A Common Stock

Holders of record of Class A Common Stock are

entitled to one vote for each share held on all matters to be voted on by stockholders. Unless specified in the Second A&R Charter

or the HNRA bylaws, or as required by applicable provisions of the Delaware General Corporation Law (“DGCL”) or applicable

stock exchange rules, the affirmative vote of a majority of HNRA’s common stock (with Class A Common Stock and Class B Common Stock

voting together in one class) that are voted is required to approve any such matter voted on by HNRA’s stockholders. HNRA’s

board of directors is divided into two classes, each of which will generally serve for a term of one year with only one class of directors

being elected in each year. There is no cumulative voting with respect to the election of directors, with the result that the holders

of more than 50% of the shares voted for the election of directors can elect all of the directors. The holders of Class A Common Stock

are entitled to receive ratable dividends when, as and if declared by the board of directors out of funds legally available therefor.

Under Section 211(b) of the DGCL, HNRA is

required to hold an annual meeting of stockholders for the purposes of electing directors in accordance with the bylaws unless such election

is made by written consent in lieu of such a meeting. HNRA did not hold an annual meeting of stockholders to elect new directors prior

to the consummation of the Business Combination, and thus HNRA may not be in compliance with Section 211(b) of the DGCL, which requires

an annual meeting.

In the event of a liquidation, dissolution or

winding up of the Company, the Company’s holders of Class A Common Stock are entitled to share ratably in all assets remaining available

for distribution to them after payment of liabilities and after provision is made for each class of stock, if any, having preference over

the Class A Common Stock. HNRA’s stockholders have no preemptive or other subscription rights. There are no sinking fund provisions

applicable to the Class A Common Stock.

Class B Common Stock

Each share of Class B Common Stock has no

economic rights but entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of shares of Class A

Common Stock and shares of Class B Common Stock will vote together as a single class on all matters presented to the stockholders

for their vote or approval, except as otherwise required by applicable law or by the Second A&R Charter. HNRA does not intend to list

any shares of Class B Common Stock on any exchange.

Preferred Stock

The Second A&R Charter provides that shares

of preferred stock may be issued from time to time in one or more series. The Board is authorized to fix the voting rights, if any, designations,

powers, preferences, the relative, participating, optional or other special rights and any qualifications, limitations and restrictions

thereof, applicable to the shares of each series. The Board is able to, without stockholder approval, issue preferred stock with voting

and other rights that could adversely affect the voting power and other rights of the holders of the common stock and could have anti-takeover effects.

The ability of the Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing

a change of control of the Company or the removal of existing management. HNRA has no preferred stock outstanding at the date hereof.

Although the Company does not currently intend to issue any shares of preferred stock, the Company cannot assure investors that it will

not do so in the future.

Warrants

Public Warrants

There are currently 8,625,000 warrants outstanding

held by public shareholders (“Public Warrants”).

Each Public Warrant entitles the registered holder

to purchase three quarters of one share of Class A Common Stock at a price of $11.50 per share, subject to adjustment as discussed below,

at any time commencing 30 days after the completion of the Business Combination. However, no Public Warrants will be exercisable for cash

unless the Company has an effective and current registration statement covering the shares of Class A Common Stock issuable upon exercise