UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File No. 001-32210

NORTHERN DYNASTY MINERALS LTD.

(Translation of registrant's name into English)

14th Floor - 1040 West Georgia Street

Vancouver, British Columbia, V6E 4H1, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 23, 2024

NORTHERN DYNASTY MINERALS LTD.

(Registrant)

"Trevor Thomas"

Trevor Thomas

Secretary and General Counsel

NORTHERN DYNASTY MINERALS LTD.

SHARE OPTION PLAN

Last Amended May 17, 2024

TABLE OF CONTENTS

Page

Schedules:

NORTHERN DYNASTY MINERALS LTD.

(the "Company")

SHARE OPTION PLAN

(the "Plan")

Dated for Reference June 20, 2006 as amended November 24, 2006,

June 17, 2008, May 5, 2011, June 20, 2012, May 16, 2014,

May 16, 2017, May 19, 2021 and May 17, 2024.

ARTICLE 1

INTERPRETATION

Purpose and Overview

1.1 The purpose of this Plan is to advance the interests of the Company by encouraging equity participation in the Company through the acquisition of Common Shares of the Company through considered grants of options to purchase Common Shares. It is the intention of the Company that this Plan will at all times be in compliance with the Company Manual of The Toronto Stock Exchange (or "TSX") (the "TSX Policies") and any inconsistencies between this Plan and the TSX Policies, whether due to inadvertence or changes in TSX Policies, will be resolved in favour of the latter.

1.2 It is further intended that all Incentive Stock Options issued under the Plan to a person who qualifies as a U.S. Optionee are intended to comply with the requirements of Section 422 of the U.S. Internal Revenue Code. Any person who would otherwise qualify as a US Optionee and who is granted an Option that would otherwise be an Incentive Stock Option, but who prefers to receive a Non-Qualified Option, is free to do so upon written request to the Company at the time of receiving an Option Commitment Form in the form of Schedule B hereto. For avoidance of doubt, nothing herein respecting the treatment of a portion of the shares hereunder for US purposes is intended to enlarge the aggregate number of shares reserved under the plan which shall notwithstanding anything else herein remain at 8% of the Outstanding Shares as contemplated by section 2.2.

Definitions

1.3 In this Plan the following capitalized words have the assigned meanings.

(a) Affiliate means a company that is a parent or subsidiary of the Company, or that is controlled by the same entity as the Company.

(b) Associate has the meaning set out in the Securities Act.

(c) Blackout Period means any period of time during which a participant in the Plan is unable to trade securities of the Company as a consequence of the implementation of a general restriction on such trading by an authorized Officer or Director pursuant to the Company's governance policies that authorize general and/or specific restrictions on trading by Service Providers in circumstances where there may exist undisclosed material changes or undisclosed material facts in connection with the Company's affairs.

(d) Board means the board of directors of the Company or any committee thereof duly empowered or authorized to grant Options under this Plan.

(e) Business Day means a day that the TSX is open for trading.

(f) Change of Control includes situations where after giving effect to the contemplated transaction and as a result of such transaction:

(i) any one Person holds a sufficient number of voting shares of the Company or resulting company to affect materially the control of the Company or resulting company, or,

(ii) any combination of Persons, acting in concert by virtue of an agreement, arrangement, commitment or understanding, holds in total a sufficient number of voting shares of the Company or its successor to affect materially the control of the Company or its successor,

where such Person or combination of Persons did not previously hold a sufficient number of voting shares to affect materially control of the Company or its successor. In the absence of evidence to the contrary, any Person or combination of Persons acting in concert by virtue of an agreement, arrangement, commitment or understanding, holding more than 20% of the voting shares of the Company or resulting company is deemed to materially affect control of the Company or resulting company.

(g) "Code" means U.S. Internal Revenue Code of 1986 as amended from time to time and including any successor legislation thereto.

(h) Common Shares means common shares without par value in the capital of the Company.

(i) Company means the company named at the top hereof and includes, unless the context otherwise requires, all of its Affiliates and successors according to law.

(j) Consultant means a Person or Consultant Company, other than an Employee, Officer or Director that:

(i) provides on an ongoing bona fide basis, consulting, technical, managerial or like services to the Company or an Affiliate of the Company, other than services provided in relation to a Distribution;

(ii) provides the services under a written contract between the Company or an Affiliate and the Person or the Consultant Company;

(iii) in the reasonable opinion of the Company, spends or will spend a significant amount of time and attention on the business and affairs of the Company or an Affiliate of the Company; and

(iv) has a relationship to provide services to the Company or an Affiliate of the Company that enables the Person or Consultant Company to be knowledgeable about the business and affairs of the Company.

(k) Consultant Company means for a Person consultant, a company or partnership of which the Person is an employee, shareholder or partner.

(l) Director(s) mean a member of the board of directors of the Company as may be elected from time to time and Directors means the full Board and any committee thereof, duly authorized to administer this Plan.

(m) Disinterested Shareholder Approval means approval by a majority of the votes cast by all the Company's shareholders at a duly constituted shareholders' meeting, excluding votes attached to Common Shares beneficially owned by Insiders who are Service Providers or their Associates.

(n) Distribution has the meaning assigned by the Securities Act, and generally refers to a distribution of securities by the Company from treasury.

(o) Effective Date for an Option means the date of grant thereof by the Board.

(p) Employee means:

(i) a Person who is considered an employee under the Income Tax Act (Canada) generally meaning a person for whom income tax and other source deductions must be made but does not include a person who serves the Company only as a Director or as a Consultant;

(ii) a Person who works full-time for the Company or a subsidiary thereof providing services normally provided by an employee and who is subject to the same control and direction by the Company over the details and methods of work as an employee of the Company, but for whom income tax deductions are not made at source;

(iii) a Person who works for the Company or its subsidiary on a continuing and regular basis for a minimum amount of time per week providing services normally provided by an employee and who is subject to the same control and direction by the Company over the details and methods of work as an employee of the Company, but for whom source tax deductions need not be made; or

(iv) a Person who is qualified as a US Optionee.

(q) Exercise Price means the amount payable per Common Share on the exercise of an Option, as determined in accordance with the terms hereof.

(r) Expiry Date means the day on which an Option lapses as specified in the Option Commitment therefor or in accordance with the terms of this Plan.

(s) Incentive Stock Option means an Option intended to satisfy the requirements of section 422 of the Code, and thereby qualify for the deferred tax treatment under section 421(a) of the Code.

(t) Insider means

(i) an insider as defined in the TSX Policies or as defined in the Securities Act; and

(ii) an Associate of any person who is an Insider by virtue of §(i) above.

(u) Investor Relations Activities means generally any activities or communications that can reasonably be seen to be intended to or be primarily intended to promote the merits or awareness of or the purchase or sale of securities of the Company.

(v) Listed Shares means the number of issued and outstanding shares of the Company that have been accepted for listing on the TSX, but excluding dilutive securities not yet converted into Listed Shares.

(w) Management Company Employee means a Person employed by another Person or a corporation providing management services to the Company which are required for the ongoing successful operation of the business enterprise of the Company, but excluding a corporation or Person engaged primarily in Investor Relations Activities.

(x) Market Price means the 5-day volume weighted average trading price as calculated pursuant to TSX Policies.

(y) Non-Qualified Options means for persons who are otherwise US Optionees or US Taxpayers, an Option which does not qualify for deferred compensation treatment under Section 421(a) of the Code.

(z) Officer means a duly appointed senior officer of the Company.

(aa) Option means the right to purchase Common Shares granted hereunder to a Service Provider and unless the context otherwise clearly requires, includes an Incentive Stock Option.

(bb) Option Commitment means the notice of grant of an Option delivered by the Company hereunder to a Service Provider and substantially in the form of Schedule A attached hereto.

(cc) Optioned Shares means Common Shares that may be issued in the future to a Service Provider upon the exercise of an Option.

(dd) Optionee means the recipient of an Option hereunder.

(ee) Outstanding Shares means at the relevant time, the number of issued and outstanding Common Shares of the Company from time to time.

(ff) Participant means a Service Provider that becomes an Optionee or a US Optionee.

(gg) Person means a company or an individual.

(hh) Plan means this share option plan, the terms of which are set out herein or as may be amended.

(ii) Plan Shares means the total number of Common Shares which may be reserved for issuance as Optioned Shares under the Plan as provided in §2.2.

(jj) Regulatory Approval means any approval required under TSX Policies and any other approval of any other stock exchange where the Company's shares may be listed.

(kk) Securities Act means the Securities Act, R.S.B.C. 1996, c. 418, or any successor legislation.

(ll) Service Provider means a Person who is a bona fide Director, Officer, Employee, Management Company Employee, Consultant or Consultant Company, and also includes a company, of which 100% of the share capital of which is beneficially owned by one or more Service Providers.

(mm) Share Compensation Arrangement means any Option under this Plan but also includes any other stock option, stock option plan, employee stock purchase plan or any other compensation or incentive mechanism involving the issuance or potential issuance of Common Shares to a Service Provider.

(nn) Shareholder Approval means approval by a majority of the votes cast by eligible shareholders of the Company at a duly constituted shareholders' meeting.

(oo) Take Over Bid means a take over bid as defined in National Policy 62-203 or the analogous provisions of any other securities legislation applicable to the Outstanding Shares.

(pp) TSX means the Toronto Stock Exchange and any successor thereto.

(qq) TSX Policies means the rules and policies of the TSX as amended from time to time.

(rr) US means United States of America.

(ss) US Optionee means a Service Provider who qualifies as an employee of the Company or an Affiliate under the Code, generally meaning a person for whom income tax and other source deductions must be made pursuant to the Code, and who by virtue of being an employee is eligible to receive an Incentive Stock Option but for avoidance of doubt does not include a person who serves solely as a Director.

(tt) US Taxpayer means a Service Provider who to the knowledge or belief of the Company is a US citizen or resident who is obligated to file a tax return under the Code.

Other Words and Phrases

1.4 Words and phrases used in this Plan but which are not defined in the Plan, but are defined in the TSX Policies or the Code, will have the meaning assigned to them in the TSX Policies or Code as the case may be.

Gender

1.5 Words importing the masculine gender include the feminine or neuter, words in the singular include the plural, words importing a corporate entity include individuals, and vice versa.

ARTICLE 2

SHARE OPTION PLAN

Establishment of Share Option Plan

2.1 The Plan is hereby established to recognize contributions made by Service Providers and to create an incentive for their continuing assistance to the Company and its Affiliates.

Maximum Plan Shares and Maximum Shares for US Optionees

2.2 The maximum aggregate number of Plan Shares that may be reserved for issuance under the Plan at any point in time is 8% of the Outstanding Shares at the time Plan Shares are reserved for issuance as a result of the grant of an Option, less any Common Shares reserved for issuance under all Share Compensation Arrangements including this Plan, unless this Plan is amended pursuant to the requirements of TSX Policies. Notwithstanding anything to the contrary, subject to the provisions of section 3.6 relating to adjustments and subject to TSX Policies, the aggregate maximum number of Shares that may be issued pursuant to Incentive Stock Options is 5,000,000.

Eligibility

2.3 Options to purchase Common Shares may be granted hereunder to Service Providers from time to time by the Board. Service Providers that are not individuals will be required to undertake in writing not to effect or permit any transfer of ownership or option of any of its securities, or to issue more of its securities (so as to indirectly transfer the benefits of an Option), as long as such Option remains outstanding, unless the written permission of the TSX and the Company is obtained.

Options Granted Under the Plan

2.4 All Options granted under the Plan to other than US Optionees will be evidenced by an Option Commitment in the form attached as Schedule A, showing the number of Optioned Shares, the term of the Option, a reference to vesting terms, if any, and the Exercise Price.

2.5 All Options granted under the Plan to US Optionees will be evidenced by an Option Commitment in the form attached as Schedule B, showing the number of Optioned Shares, the term of the Option, a reference to vesting terms, if any, and the Exercise Price.

2.6 Subject to specific variations approved by the Board, all terms and conditions set out herein will be deemed to be incorporated into and form part of an Option Commitment made hereunder.

Options Not Exercised

2.7 In the event an Option granted under the Plan expires unexercised or is terminated by reason of dismissal of the Optionee for cause or is otherwise lawfully cancelled prior to exercise of the Option, the Optioned Shares that were issuable thereunder will be returned to the Plan and will be eligible for re-issue. For greater certainty options which are exercised thereupon increase the number available to the Plan by the relevant percentage of outstanding shares as provided hereunder.

Powers of the Board

2.8 The Board will be responsible for the general administration of the Plan and the proper execution of its provisions, the interpretation of the Plan and the determination of all questions arising hereunder. Without limiting the generality of the foregoing, the Board has the power to

(a) allot Common Shares for issuance in connection with the exercise of Options;

(b) grant Options hereunder;

(c) subject to any necessary Regulatory Approval, amend, suspend, terminate or discontinue the Plan, or revoke or alter any action taken in connection therewith, except that no general amendment or suspension of the Plan will, without the prior written consent of all Optionees, alter or impair any Option previously granted under the Plan unless the alteration or impairment occurred as a result of a change in the TSX Policies or other applicable legal requirements;

(d) delegate all or such portion of its powers hereunder as it may determine to one or more committees of the Board, either indefinitely or for such period of time as it may specify, and thereafter each such committee may exercise the powers and discharge the duties of the Board in respect of the Plan so delegated to the same extent as the Board is hereby authorized so to do; and

(e) in its sole discretion amend this Plan (except for previously granted and outstanding Options) to reduce the benefits that may be granted to Service Providers (before a particular Option is granted) subject to the other terms hereof.

Restrictions on Option Grants to Insiders

2.9 The Plan is subject to restrictions that:

(a) the number of Common Shares that may be issued to Insiders as a group under the Plan, when combined with Common Shares that may be issued to Insiders under all the Company's other security based compensation plans may not exceed 8% of the issued Common Shares within any 12 month period;

(b) the number of Common Shares issuable to Insiders as a group under the Plan, when combined with Common Shares issuable to Insiders under all the Company's other security based compensation plans, may not exceed 8% of the Company's issued Common Shares;

(c) the aggregate annual value of Common Shares being issuable to directors who are non-employee directors of the Company may not exceed the following limits for each individual director:

(i) $100,000 in any twelve-month period in the form of stock options granted under this Plan, and

(ii) $150,000 in any twelve-month period when combined with all of the Company's other Share Compensation Arrangements currently in effect for their benefit (for avoidance of doubt excluding any previously exercised Options or other Share Compensation Arrangement already paid).

(d) no exercise price of an option granted to an Insider may be reduced nor an extension to the term of an option granted to an Insider extended without Disinterested Shareholder Approval.

Terms or Amendments Requiring Disinterested Shareholder Approval

2.10 Subject to the requirements of the TSX Policies and the prior receipt of any necessary Regulatory Approval, Disinterested Shareholder Approval shall be required in respect of:

(a) any amendment which reduces the Exercise Price of an Option;

(b) any amendment to extend the term of an option;

(c) amendments to increase any of the limits on the number of Options that may be granted;

(d) any amendment to eligible participants that may permit an increase to the proposed limit non-employee director participation;

(e) any amendment to the transferability or assignability of an Option;

(f) any amendment to this section 2.10; and

(g) any amendments required to be approved by shareholders under applicable law.

Amendment of the Plan by the Board of Directors

2.11 Subject to the requirements of the TSX Policies and the prior receipt of any necessary Regulatory Approval, the Board may in its absolute discretion, without shareholder approval, amend or modify the Plan or any Option granted as follows:

(a) it may make amendments which are of a typographical, grammatical or clerical nature;

(b) it may change the vesting provisions of an Option granted hereunder;

(c) it may change the termination provision of an Option granted hereunder which does not entail an extension beyond the original Expiry Date of such Option;

(d) it may add a cashless exercise feature payable in cash or Common Shares;

(e) it may make amendments necessary as a result of changes in securities laws applicable to the Company;

(f) if the Company becomes listed or quoted on a stock exchange or stock market senior to the TSX, it may make such amendments as may be required by the policies of such senior stock exchange or stock market; and

(g) it may make such amendments as reduce, and do not increase, the benefits of this Plan to Service Providers.

ARTICLE 3

TERMS AND CONDITIONS OF OPTIONS

Exercise Price

3.1 The Exercise Price of an Option will be set by the Board at the time such Option is allocated under the Plan, and cannot be less than the Market Price calculated the day before the grant.

Term of Option

3.2 An Option can be exercisable for a maximum of 5 years from the Effective Date. If the Expiry Date for an Option occurs during a Blackout Period applicable to the relevant Service Provider, or within five business days after the expiry of a Blackout Period applicable to the relevant Service Provider, then the Expiry Date for that Option will be the date that is the tenth business day after the expiry date of the Blackout Period.

Vesting of Options

3.3 Vesting of Options shall be at the discretion of the Board, and will generally be subject to:

(a) the Service Provider remaining employed by or continuing to provide services to the Company or any of its subsidiaries and Affiliates as well as, at the discretion of the Board, achieving certain milestones which may be defined by the Board from time to time or receiving a satisfactory performance review by the Company or any of its subsidiaries and Affiliates during the vesting period; or

(b) the Service Provider remaining as a Director of the Company or any of its Affiliates during the vesting period.

Optionee Ceasing to be Director, Employee or Service Provider

3.4 No Option may be exercised after the Service Provider has left his employ/office or has been advised by the Company that his services are no longer required or his service contract has expired, except as follows:

(a) in the case of the death of an Optionee, any vested Option held by him at the date of death will become exercisable by the Optionee's lawful personal representatives, heirs or executors until the earlier of one year after the date of death of such Optionee and the date of expiration of the term otherwise applicable to such Option;

(b) subject to the other provisions of this §3.4, an Option granted to any Service Provider will expire the earlier of the date of expiration of the term or 90 days after the date the Optionee ceases to be employed by or provide services to the Company, but only to the extent that such Option has vested at the date the Optionee ceased to be so employed by or to provide services to the Company;

(c) in the case of an Optionee being dismissed from employment or service for cause, such Optionee's Options, whether or not vested at the date of dismissal, will immediately terminate without right to exercise same.

(d) in the event of a Change of Control occurring, Options which are subject to vesting provisions shall be deemed to have immediately vested upon the occurrence of the Change of Control; and

(e) in the event of a Director not being nominated for re-election as a Director of the Company, although consenting to act and being under no legal incapacity which would prevent the Director from being a member of the Board, Options granted which are subject to a vesting provision shall be deemed to have vested on the date of Meeting upon which the Director is not re-elected.

Non Assignable

3.5 Subject to §3.4(a), all Options will be exercisable only by the Optionee to whom they are granted and will not be assignable or transferable.

Adjustment of the Number of Optioned Shares

3.6 The number of Common Shares subject to an Option will be subject to adjustment in the events and in the manner following:

(a) in the event of a subdivision of Common Shares as constituted on the date hereof, at any time while an Option is in effect, into a greater number of Common Shares, the Company will thereafter deliver at the time of purchase of Optioned Shares hereunder, in addition to the number of Optioned Shares in respect of which the right to purchase is then being exercised, such additional number of Common Shares as result from the subdivision without an Optionee making any additional payment or giving any other consideration therefor;

(b) in the event of a consolidation of the Common Shares as constituted on the date hereof, at any time while an Option is in effect, into a lesser number of Common Shares, the Company will thereafter deliver and an Optionee will accept, at the time of purchase of Optioned Shares hereunder, in lieu of the number of Optioned Shares in respect of which the right to purchase is then being exercised, the lesser number of Common Shares as result from the consolidation;

(c) in the event of any change of the Common Shares as constituted on the date hereof, at any time while an Option is in effect, the Company will thereafter deliver at the time of purchase of Optioned Shares hereunder the number of shares of the appropriate class resulting from the said change as an Optionee would have been entitled to receive in respect of the number of Common Shares so purchased had the right to purchase been exercised before such change;

(d) in the event of a capital reorganization, reclassification or change of outstanding equity shares (other than a change in the par value thereof) of the Company, a consolidation, merger or amalgamation of the Company with or into any other company or a sale of the property of the Company as or substantially as an entirety at any time while an Option is in effect, an Optionee will thereafter have the right to purchase and receive, in lieu of the Optioned Shares immediately theretofore purchasable and receivable upon the exercise of the Option, the kind and amount of shares and other securities and property receivable upon such capital reorganization, reclassification, change, consolidation, merger, amalgamation or sale which the holder of a number of Common Shares equal to the number of Optioned Shares immediately theretofore purchasable and receivable upon the exercise of the Option would have received as a result thereof. The subdivision or consolidation of Common Shares at any time outstanding (whether with or without par value) will not be deemed to be a capital reorganization or a reclassification of the capital of the Company for the purposes of this §3.6;

(e) an adjustment will take effect at the time of the event giving rise to the adjustment, and the adjustments provided for in this section are cumulative;

(f) the Company will not be required to issue fractional shares in satisfaction of its obligations hereunder. Any fractional interest in a Common Share that would, except for the provisions of this §3.6, be deliverable upon the exercise of an Option will be cancelled and not be deliverable by the Company; and

(g) if any questions arise at any time with respect to the Exercise Price or number of Optioned Shares deliverable upon exercise of an Option in any of the events set out in this §3.6, such questions will be conclusively determined by the Company's auditors, or, if they decline to so act, any other firm of Chartered Accountants, in Vancouver, British Columbia (or in the city of the Company's principal executive office) that the Company may designate and who will be granted access to all appropriate records. Such determination will be binding upon the Company and all Optionees.

Effect of Take Over Bid

3.7 If a Take Over Bid is made to the shareholders generally then the Company shall, immediately upon receipt of notice of the Take Over Bid, notify each Optionee currently holding an Option of the Take Over Bid, with full particulars thereof whereupon such Option may, notwithstanding any vesting requirements set out in any Option Commitment, be permitted to exercise in whole or in part by the Optionee, provided that the Board considers the Take Over Bid to be successful. A Take Over Bid will be deemed successful in the event that:

(a) a competing bid emerges with superior terms or conditions;

(b) the Board endorses the Take Over Bid and recommends that shareholders tender into it;

(c) holders of at least 20% of the Company's Listed Shares, or Insiders who hold at least 50% of Listed Shares held by Insiders, agree to, or announce their intention to, tender such shares to the Take Over Bid; but

provided always that the Board may also consider other criteria to be adequate evidence that the Take Over Bid is a successful one.

Adjustment of Options Expiring During Blackout Period

3.8 Should the Expiry Date for an Option fall within a Blackout Period, or within five (5) Business Days following the expiration of a Blackout Period, such Expiry Date shall be automatically adjusted without any further act or formality to that day which is the tenth (10th) Business Day after the end of the Blackout Period, such tenth Business Day to be considered the Expiry Date for such Option for all purposes under the Plan. Notwithstanding §2.7, the tenth Business Day period referred to in this §3.8 may not be extended by the Board.

ARTICLE 4

COMMITMENT AND EXERCISE PROCEDURES

Option Commitment

4.1 Upon grant of an Option hereunder, an authorized officer of the Company will deliver to the Optionee an Option Commitment in the form of either Schedule A or Schedule B (US Optionees) detailing the terms of such Options and upon such delivery the Optionee will be subject to the Plan and have the right to purchase the Optioned Shares at the Exercise Price set out therein subject to the terms and conditions hereof.

Manner of Exercise

4.2 An Optionee who wishes to exercise his Option may do so by delivering

(a) a written notice to the Company specifying the number of Optioned Shares being acquired pursuant to the Option; and

(b) cash or a certified cheque, wire transfer or bank draft payable to the Company for the aggregate Exercise Price by the Optioned Shares being acquired plus the required withholding amount under section 4.3.

Tax Withholding and Procedures

4.3 Notwithstanding anything else contained in this Plan, the Company may, from time to time, implement such procedures and conditions as it determines appropriate with respect to the withholding and remittance of taxes imposed under applicable law, or the funding of related amounts for which liability may arise under such applicable law. Without limiting the generality of the foregoing, an Optionee who wishes to exercise an Option must, in addition to following the procedures set out in §4.2 and elsewhere in this Plan, and as a condition of exercise:

(a) deliver a certified cheque, wire transfer or bank draft payable to the Company for the amount determined by the Company to be the appropriate amount on account of such taxes or related amounts; or

(b) otherwise ensure, in a manner acceptable to the Company (if at all) in its sole and unfettered discretion, that the amount will be securely funded;

and must in all other respects follow any related procedures and conditions imposed by the Company.

The Company may appoint a share compensation administrative service at the Company's discretion and expense, to co-ordinate and administer the exercise of Optioned Shares and to co-ordinate the payment of the Exercise Price therefor, including establishment of a web-based exercise and accounting function.

Delivery of Optioned Shares and Hold Periods

4.4 As soon as practicable after receipt of the notice of exercise described in §4.2 and payment in full for the Optioned Shares being acquired, the Company will direct its transfer agent, or a share compensation administrative service ("administrative service") chosen by the Company, to issue to the Optionee the appropriate number of Optioned Shares. The transfer agent or administrative service will either issue a certificate representing the Option Shares or a written notice in the case of uncertificated shares. Such certificate or written notice, as the case may be, will bear a legend stipulating any resale restrictions required under applicable securities laws.

US Optionees and US Taxpayers

4.5 (a) The Corporation and its Affiliates, if applicable, shall withhold taxes according to the requirements of applicable laws, rules and regulations, including the withholding of taxes at source to satisfy any applicable US federal, state or local tax withholding obligation and employment taxes in addition to any such federal Canadian requirements. Without limiting the generality of the foregoing, if the U.S. Optionee sells or otherwise disposes of any of the Shares acquired pursuant to an Incentive Stock Option on or before the later of:

(i) the date two years after the date the Option is granted, or

(ii) the date one year after the issuance of such Shares to the U.S. Optionee upon exercise of the Option,

the U.S. Optionee shall notify the Corporation in writing within 30 days after the date of any such disposition and shall remit to the Corporation or its Affiliate, as applicable, the amount of any applicable federal, state, provincial and local withholding and employment taxes.

(b) All Incentive Stock Options granted to U.S. Optionees under the Plan are designed so as not to constitute a deferral of compensation for purposes of Section 409A of the Code. No U.S. Optionee or U.S. Taxpayer shall be permitted to defer the recognition of income beyond the exercise date of a Non-Qualified Option or beyond the date that the Shares received upon the exercise of an Option are sold.

(c) Non-Qualified Options (i.e., not Incentive Stock Options) may be granted to U.S. Optionees and U.S. Taxpayers who are officers, employees, directors or Consultants of the Corporation, and its Affiliates, if applicable, as may be designated from time to time by the Board. A U.S. Taxpayer who is a Consultant or who is a director but is not an employee as defined by the Code shall only be eligible to receive Non-Qualified Options.

(d) To the extent that the aggregate fair market value (determined as of the time the Option is granted) of the Shares with respect to which Incentive Stock Options are exercisable for the first time by the U.S. Optionee during any calendar year under all plans of the Corporation and its Affiliates, if applicable, exceeds US$100,000, the Options or portions thereof that exceed such limit (according to the order in which they are granted) shall be treated as Non-Qualified Options, notwithstanding any contrary provision of the Plan, any applicable Option or Stock Option Agreement, in accordance with Section 422(d) of the Code or any successor thereto.

(e) The Company will provide an exercise report in the form attached as Schedule C to each US Optionee who exercises an Incentive Stock Option and will also report the exercise of an Incentive Stock Option to the applicable US governmental authority under the Code.

(f) The Company will report and withhold applicable taxes, to the extent required by law, with respect to each US Taxpayer that exercises an Option (other than under subsection (e)) and, for avoidance of doubt, will report and withhold applicable taxes, to the extent required by law on any other income or benefit paid that person by the Company.

ARTICLE 5

GENERAL

Employment and Services

5.1 Nothing contained in the Plan will confer upon or imply in favour of any Optionee any right with respect to office, employment or provision of services with the Company, or interfere in any way with the right of the Company to lawfully terminate the Optionee's office, employment or service at any time pursuant to the arrangements pertaining to same. Participation in the Plan by an Optionee will be voluntary.

No Representation or Warranty

5.2 The Company makes no representation or warranty as to the future market value of Common Shares issued in accordance with the provisions of the Plan or to the effect of the Income Tax Act (Canada) or any other taxing statute governing the Options or the Common shares issuable thereunder or the tax consequences to a Service Provider. Compliance with applicable securities laws as to the disclosure and resale obligations of each Participant is the responsibility of such Participant and not the Company.

Interpretation

5.3 The Plan will be governed and construed in accordance with the laws of the Province of British Columbia.

Continuation of the Plan

5.4 This Plan will become effective from and after the date hereof, subject to any required Regulatory Approval, and will remain effective provided that the Plan, or any amended version thereof, receives Shareholder Approval on or before each third annual general meeting of the Company.

Termination

5.5 The Board reserves the right in its absolute discretion to terminate the Plan with respect to all Plan Shares in respect of Options which have not yet been granted hereunder.

SCHEDULE A

TO NORTHERN DYNASTY MINERALS LTD. SHARE OPTION PLAN

OPTION COMMITMENT FORM

Notice is hereby given that, effective this ________ day of ________________, __________ (the "Effective Date") Northern Dynasty Minerals Ltd. (the "Company") has granted to ___________________________________________ (the "Optionee"), an Option to acquire ______________ Common Shares ("Optioned Shares") up to 5:00 p.m. Vancouver Time on the __________ day of ____________________, ______ (the "Expiry Date") at an Exercise Price of Cdn$____________ per share.

Optioned Shares will vest and may be exercised as follows:

{COMPLETE ONE}

____________ In accordance with Section 3.3 of the Plan

or

____________ As follows:

The grant of the Option evidenced hereby is made subject to the terms and conditions of the Plan, which are hereby incorporated herein and forms part hereof.

[Note: if the Option is granted to a US employee and is intended to qualify as an Incentive Stock Option, include the following statement:

"The Option qualifies as an Incentive Stock Option, except to the extent that the aggregate fair market value of the common shares with respect to which such Option (together with any other Incentive Stock Options that have been granted to you) is exercisable for the first time in any calendar year, exceeds US$100,000."]

To exercise your Option, deliver a written notice specifying the number of Optioned Shares you wish to acquire, together with cash or a certified cheque, wire transfer or bank draft payable to the Company for the aggregate Exercise Price plus the required tax withholding amount to the Company. A certificate, or written notice, for the Optioned Shares so acquired will be issued by the transfer agent as soon as practicable thereafter.

The Company and the Optionee represent that the Optionee under the terms and conditions of the Plan is a bona fide Service Provider (as defined in the Plan), entitled to receive Options under TSX Policies.

NORTHERN DYNASTY MINERALS LTD.

___________________________________________

Authorized Signatory

SCHEDULE B

TO NORTHERN DYNASTY MINERALS LTD. SHARE OPTION PLAN

INCENTIVE STOCK OPTION COMMITMENT FORM

Notice is hereby given that, effective this ________ day of ________________, __________ (the "Effective Date") Northern Dynasty Minerals Ltd. (the "Company") has granted to ___________________________________________ (the "US Optionee"), an Incentive Stock Option as contemplated by Section 422 of the U.S. Internal Revenue Code to acquire ______________ Common Shares ("Optioned Shares") up to 5:00 p.m. Vancouver Time on the __________ day of ____________________, ______ (the "Expiry Date") at an Exercise Price of Cdn$____________ per share.

Optioned Shares will vest and may be exercised as follows:

{COMPLETE ONE}

____________ In accordance with Section 3.3 of the Plan

or

____________ as follows:

The grant of the Incentive Stock Option evidenced hereby is made subject to the terms and conditions of the Plan, which are hereby incorporated herein and forms part hereof.

Note: if the Option is granted to a US employee and is intended to qualify as an Incentive Stock Option, include the following statement:

"The Option qualifies as an Incentive Stock Option, except to the extent that the aggregate fair market value of the common shares with respect to which such Option (together with any other Incentive Stock Options that have been granted to you) is exercisable for the first time in any calendar year, exceeds US$100,000."

To exercise your Incentive Stock Option, deliver a written notice specifying the number of Optioned Shares you wish to acquire, together with cash or a certified cheque, wire transfer or bank draft payable to the Company for the aggregate Exercise Price to the Company plus the required Code withholding amount (if any). A certificate, or written notice, for the Optioned Shares so acquired will be issued by the transfer agent as soon as practicable thereafter.

The Company and the US Optionee represent that the Optionee under the terms and conditions of the Plan is a bona fide Service Provider (as defined in the Plan), entitled to receive Options under TSX Policies and is an employee as defined by the Code.

NORTHERN DYNASTY MINERALS LTD.

___________________________________________

Authorized Signatory

SCHEDULE C

TO NORTHERN DYNASTY MINERALS LTD. SHARE OPTION PLAN

U.S. OPTIONEE REPORTING FORM

TO: [______________ _________who as US Optionee who exercised an Incentive Stock Option during 20__]

FROM: Northern Dynasty Minerals Ltd.

RE: Exercise of Incentive Stock Option (as described in §422 of the Internal Revenue Code) Section 6039 Notice Regarding Exercise of Incentive Stock Option

Dear ___________________:

Pursuant to § 6039(a)(1) of the Internal Revenue Code of 1986, as amended (the "Code"), the following information is being furnished to you with regard to your exercise during 20__ of an incentive stock option under Northern Dynasty Minerals Ltd.'s Share Option Plan, as last amended May 19, 2021:

1. Corporation transferring the stock to you upon exercise of the option:

Name:

Address:

Employer Identification Number:

2. Corporation whose stock was transferred upon exercise of the option (if different from corporation named in item 1):

Name:

Address:

3. Person to whom stock was transferred upon exercise of the option:

Name:

Address:

Social Security Number:

4. Date option granted:

5. Date of transfer of stock to you upon exercise of the option:

6. Total fair market value (at time of exercise) of stock transferred to you upon exercise of the option*:

7. Number of shares transferred to you upon exercise of the option:

8. The shares transferred were acquired pursuant to the exercise of an incentive stock option described in § 422(b) of the Code.

9. Aggregate option exercise price:

Please keep this statement for income tax purposes.

Dated: _____________________________

Northern Dynasty Minerals Ltd.

By:_________________________________

* This amount is used to determine the adjustment to income made in calculating alternative minimum tax for optionees whose stock is not subject to a "substantial risk of forfeiture" pursuant to § 83 of the Internal Revenue Code. US Optionees whose stock was subject to a "substantial risk of forfeiture" at the time of exercise should consult their own tax advisors regarding the amount and timing of the adjustment.

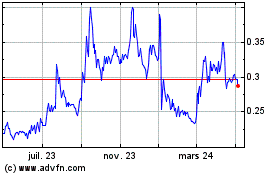

Northern Dynasty Minerals (AMEX:NAK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

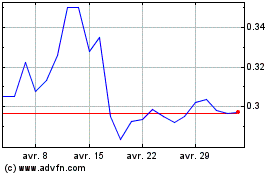

Northern Dynasty Minerals (AMEX:NAK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025