Form 8-K - Current report

24 Septembre 2024 - 11:13PM

Edgar (US Regulatory)

false

0001532619

0001532619

2024-09-24

2024-09-24

0001532619

PW:CommonSharesMember

2024-09-24

2024-09-24

0001532619

PW:Sec7.75SeriesCumulativeRedeemablePerpetualPreferredStockLiquidationPreference25PerShareMember

2024-09-24

2024-09-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): September 24, 2024

POWER

REIT

(Exact

name of registrant as specified in its charter)

Maryland

(State

or other jurisdiction of incorporation)

001-36312

(Commission

File Number)

45-3116572

(IRS

Employer Identification No.)

301

Winding Road

Old

Bethpage, NY 11804

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (212) 750-0371

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Shares |

|

PW |

|

NYSE

(American) |

| |

|

|

|

|

| 7.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share |

|

PW.A |

|

NYSE

(American) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.02. Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On

September 24, 2024, Power REIT (the “Trust”) determined that the Trust’s unaudited consolidated Balance Sheets

in its previously issued financial statements contained in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 should

be restated due to an error in the classification of its Series A 7.75% Cumulative Redeemable Perpetual Preferred Stock Par Value $25.00

(the “Preferred Shares”). After consulting with MaloneBailey LLP, the Trust’s independent registered public accounting

firm, Management and the Audit Committee concluded that the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 should

no longer be relied upon due to the error identified. The error in the unaudited Balance Sheet will be corrected in restated financial

statements by filing an amended Quarterly Report on Form 10-Q (the “Form 10-Q/A”) contemporaneous with the filing of this

Current Report on Form 8-K.

The

Preferred Shares in question were previously classified as mezzanine equity based on an incorrect interpretation of the accounting guidance.

However, upon further analysis, the Trust concluded that the Preferred Shares meet the criteria for classification as equity under the

applicable accounting standards.

As

previously disclosed in a Current Report on Form 8-K filed on September 3, 2024, the Trust received a letter from the NYSE American regarding

a lack of compliance with listing requirements. Specifically, since the Trust had incurred losses in two out of the last three years,

it is required to have total equity of greater than $2 million. As part of evaluating a plan to comply with the NYSE American listing

requirements, the Trust embarked on analysis of the accounting treatment for its Preferred Shares which historically were classified

as Mezzanine Equity. Based on its review, the Trust determined that the Preferred Shares should be treated as Equity. The Trust retained

a qualified third-party consultant to assist with its analysis of the accounting treatment for the Preferred Shares. Ultimately, the

Trust concluded that it has incorrectly classified the Preferred Shares on its balance sheet and that they should be treated as Equity

(not mezzanine equity) and the financial statements should be re-stated accordingly. The restatement increases the Trust’s Total

Equity on its consolidated Balance Sheet to approximately $10 million which is above the threshold required for NYSE American compliance

as of June 30, 2024.

The

change in accounting treatment is non-cash in nature, and does not affect revenue, gross margin, net income or income per share or the

presentation of its non-GAAP metrics, including Funds from Operations. The change did not result from a change in published accounting

guidance during the relevant time period or override of controls or misconduct, nor has the Audit Committee or Board of Trustees been

informed of any issues related to an override of controls or misconduct.

The

only changes to the financial statements contained in the original Form 10-Q are:

| |

– |

Reclassification

of the Preferred Shares on the Consolidated Balance Sheet to Equity |

| |

– |

Elimination

of the accrual of undeclared dividends for the Preferred Shares consistent with treatment of the Preferred Shares as Equity (previously

accrued as an increase to the carrying value of the Preferred Shares on the Balance Sheet) |

| |

– |

An

Updated Consolidated Statement of Changes in Shareholders Equity to include the Preferred Shares |

| |

– |

Removal of dividends from the supplemental disclosure

contained in the Consolidated Statement of Cash Flows |

The

Form 10-Q-A discloses that the Trust did not have effective internal controls over financial reporting as of June 30, 2024 due to a material

weakness in the Trust’s design and operation of effective internal controls over the accounting for the treatment of complex transactions.

The original Form 10-Q did not contain any material weakness or a reference to ineffective Disclosure Control and Procedures.

Safe

Harbor

This

Current Report on Form 8-K contains express or implied “forward-looking statements” within the meaning of the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by

words such as: “target,” “believe,” “expect,” “will,” “may,” “anticipate,”

“estimate,” “would,” “positioned,” “future,” and other similar expressions that predict

or indicate future events or trends or that are not statements of historical matters. Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based only on Power REIT management’s current beliefs, expectations

and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes

in circumstances that are difficult to predict and many of which are outside of Power REIT’s control. These risks and uncertainties

include, but are not limited to, the following: Power REIT’s ability to timely submit its Plan to the NYSE American, the acceptance

of its Plan by the NYSE American and Power REIT’s ability to regain compliance with the listing standards set forth in the Company

Guide by November 23, 2025. Therefore, investors should not rely on any of these forward-looking statements and should review the risks

and uncertainties described under the caption “Risk Factors” in Power REIT’s Annual Report on Form 10-K filed with

the Securities and Exchange Commission (the “SEC”) on March 29, 2024, and additional disclosures Power REIT makes in its

other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Forward-looking statements are made as of

the date of this Current Report on Form 8-K, and except as provided by law Power REIT expressly disclaims any obligation or undertaking

to any update forward-looking statements.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWER

REIT |

| |

|

| Date:

September 24, 2024 |

By |

/s/

David H. Lesser |

| |

|

David

H. Lesser |

| |

|

Chairman

of the Board and Chief Executive Officer |

v3.24.3

Cover

|

Sep. 24, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 24, 2024

|

| Entity File Number |

001-36312

|

| Entity Registrant Name |

POWER

REIT

|

| Entity Central Index Key |

0001532619

|

| Entity Tax Identification Number |

45-3116572

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

45-3116572

|

| Entity Address, Address Line Three |

301

Winding Road

|

| Entity Address, City or Town |

Old

Bethpage

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11804

|

| City Area Code |

(212)

|

| Local Phone Number |

750-0371

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Shares |

|

| Title of 12(b) Security |

Common

Shares

|

| Trading Symbol |

PW

|

| Security Exchange Name |

NYSE

|

| 7.75% Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share |

|

| Title of 12(b) Security |

7.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share

|

| Trading Symbol |

PW.A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PW_CommonSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PW_Sec7.75SeriesCumulativeRedeemablePerpetualPreferredStockLiquidationPreference25PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

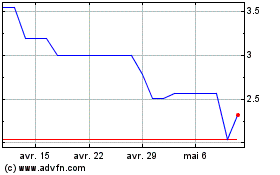

Power REIT (AMEX:PW-A)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Power REIT (AMEX:PW-A)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025