Statement of Investments

July 31, 2023

| Reaves Utility Income Fund |

Statement of Investments |

| |

July 31, 2023 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS - 122.30% | |

| | |

| |

| Diversified Telecommunications Services - 17.18% | |

| | |

| |

| BCE, Inc. | |

| 1,946,500 | | |

$ | 84,127,730 | |

| Cogent Communications Holdings, Inc. (a) | |

| 140,000 | | |

| 8,573,600 | |

| Deutsche Telekom AG | |

| 4,268,042 | | |

| 93,113,237 | |

| Rogers Communications, Inc., Class B | |

| 1,365,000 | | |

| 59,769,537 | |

| Telus Corp. | |

| 4,170,100 | | |

| 74,253,174 | |

| Verizon Communications, Inc. | |

| 1,221,924 | | |

| 41,643,170 | |

| | |

| | | |

| 361,480,448 | |

| | |

| | | |

| | |

| Electric Utilities - 28.87% | |

| | | |

| | |

| American Electric Power Co., Inc.(a) | |

| 675,000 | | |

| 57,199,500 | |

| Duke Energy Corp.(a) | |

| 956,000 | | |

| 89,500,720 | |

| Edison International (a) | |

| 545,000 | | |

| 39,218,200 | |

| Entergy Corp.(a) | |

| 918,900 | | |

| 94,371,031 | |

| Exelon Corp. | |

| 1,175,161 | | |

| 49,192,239 | |

| FirstEnergy Corp.(a) | |

| 348,100 | | |

| 13,711,659 | |

| Fortis, Inc. | |

| 53,000 | | |

| 2,259,390 | |

| NextEra Energy, Inc.(a) | |

| 1,100,000 | | |

| 80,630,000 | |

| Pinnacle West Capital Corp. | |

| 698,000 | | |

| 57,808,360 | |

| PPL Corp. | |

| 3,015,046 | | |

| 83,004,216 | |

| Southern Co. | |

| 566,000 | | |

| 40,944,440 | |

| | |

| | | |

| 607,839,755 | |

| | |

| | | |

| | |

| Gas Utilities - 0.16% | |

| | | |

| | |

| Atmos Energy Corp. | |

| 20,000 | | |

| 2,434,200 | |

| Northwest Natural Holding Co. | |

| 20,000 | | |

| 859,400 | |

| | |

| | | |

| 3,293,600 | |

| | |

| | | |

| | |

| Independent Power and Renewable Electricity Producers - 2.53% | |

| | | |

| | |

| Constellation Energy Corp. | |

| 550,667 | | |

| 53,221,966 | |

| | |

| | | |

| | |

| Media - 5.66% | |

| | | |

| | |

| Charter Communications, Inc., Class A (a)(b) | |

| 70,500 | | |

| 28,565,895 | |

| Comcast Corp., Class A(a) | |

| 2,000,000 | | |

| 90,520,000 | |

| | |

| | | |

| 119,085,895 | |

| | |

| | | |

| | |

| Multi-Utilities - 39.93% | |

| | | |

| | |

| Alliant Energy Corp.(a) | |

| 1,503,103 | | |

| 80,776,755 | |

| Ameren Corp.(a) | |

| 926,000 | | |

| 79,330,420 | |

| CMS Energy Corp.(a) | |

| 1,650,500 | | |

| 100,796,035 | |

| DTE Energy Co.(a) | |

| 737,200 | | |

| 84,261,960 | |

| Enel SpA | |

| 6,465,257 | | |

| 44,585,038 | |

| NiSource, Inc. | |

| 3,804,966 | | |

| 105,930,254 | |

See Accompanying Notes to Statement of Investments

| www.utilityincomefund.com |

2 |

| Reaves Utility Income Fund |

Statement of Investments |

| |

July 31, 2023 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS - 122.30% (continued) | |

| | |

| |

| Multi-Utilities - 39.93% (continued) | |

| | |

| |

| OGE Energy Corp. | |

| 1,739,971 | | |

$ | 62,899,952 | |

| PG&E Corp.(b) | |

| 3,288,300 | | |

| 57,906,963 | |

| Public Service Enterprise Group, Inc. | |

| 796,998 | | |

| 50,306,514 | |

| Sempra Energy | |

| 404,800 | | |

| 60,323,296 | |

| WEC Energy Group, Inc. | |

| 612,590 | | |

| 55,047,337 | |

| Xcel Energy, Inc. | |

| 926,300 | | |

| 58,106,799 | |

| | |

| | | |

| 840,271,323 | |

| | |

| | | |

| | |

| Oil, Gas & Consumable Fuels - 7.17% | |

| | | |

| | |

| DT Midstream, Inc. | |

| 770,000 | | |

| 41,210,400 | |

| ONEOK, Inc. | |

| 205,000 | | |

| 13,743,200 | |

| TC Energy Corp. | |

| 1,150,000 | | |

| 41,250,500 | |

| Williams Cos., Inc. | |

| 1,590,000 | | |

| 54,775,500 | |

| | |

| | | |

| 150,979,600 | |

| | |

| | | |

| | |

| Real Estate Investment Trusts (REITs) - 9.55% | |

| | | |

| | |

| American Tower Corp.(a) | |

| 267,072 | | |

| 50,826,472 | |

| Crown Castle, Inc.(a) | |

| 312,500 | | |

| 33,840,625 | |

| Digital Realty Trust, Inc.(a) | |

| 152,000 | | |

| 18,942,240 | |

| Equinix, Inc.(a) | |

| 51,000 | | |

| 41,305,920 | |

| Rexford Industrial Realty, Inc.(a) | |

| 295,000 | | |

| 16,251,550 | |

| SBA Communications Corp., Class A | |

| 181,700 | | |

| 39,783,215 | |

| | |

| | | |

| 200,950,022 | |

| | |

| | | |

| | |

| Road & Rail - 8.10% | |

| | | |

| | |

| Canadian Pacific Kansas City Ltd. | |

| 562,000 | | |

| 46,246,980 | |

| Norfolk Southern Corp. | |

| 235,100 | | |

| 54,917,009 | |

| Union Pacific Corp. | |

| 299,100 | | |

| 69,397,182 | |

| | |

| | | |

| 170,561,171 | |

| | |

| | | |

| | |

| Water Utilities - 2.64% | |

| | | |

| | |

| American Water Works Co., Inc.(a) | |

| 376,619 | | |

| 55,524,939 | |

| | |

| | | |

| | |

| Wireless Telecommunication Services - 0.51% | |

| | | |

| | |

| Telenor ASA | |

| 1,012,388 | | |

| 10,838,042 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (Cost $2,500,235,968) | |

| | | |

| 2,574,046,761 | |

See Accompanying Notes to Statement of Investments

| Statement of Investments | July 31, 2023 |

3 |

| Reaves Utility Income Fund |

Statement of Investments |

| |

July 31, 2023 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| CORPORATE BONDS - 0.22% | |

| | |

| |

| Cable & Satellite - 0.09% | |

| | |

| |

| CSC Holdings, LLC, 6/1/2024, 5.250% | |

| 2,000,000 | | |

$ | 1,867,035 | |

| | |

| | | |

| | |

| Pipelines - 0.13% | |

| | | |

| | |

| TC Pipelines, L.P., 3/13/2025, 4.375% | |

| 2,952,000 | | |

| 2,869,718 | |

| | |

| | | |

| | |

| TOTAL CORPORATE BONDS | |

| | | |

| | |

| (Cost $4,826,961) | |

| | | |

| 4,736,753 | |

| | |

| | | |

| | |

| PREFERRED STOCKS - 0.05% | |

| | | |

| | |

| Utilities - 0.05% | |

| | | |

| | |

| SCE Trust III, Class H, Perpetual Maturity, 5.750%(c) | |

| 15,473 | | |

| 363,616 | |

| SCE Trust IV, Class J, Perpetual Maturity, 5.375%(a)(c) | |

| 29,927 | | |

| 609,912 | |

| | |

| | | |

| 973,528 | |

| | |

| | | |

| | |

| TOTAL PREFERRED STOCKS | |

| | | |

| | |

| (Cost $846,585) | |

| | | |

| 973,528 | |

| | |

| | | |

| | |

| MONEY MARKET FUNDS - 1.88% | |

| | | |

| | |

| Federated Treasury Obligations Money Market Fund, 5.130% (7-Day Yield) | |

| 39,504,552 | | |

| 39,504,552 | |

| TOTAL MONEY MARKET FUNDS | |

| | | |

| | |

| (Cost $39,504,552) | |

| | | |

| 39,504,552 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS - 124.45% | |

| | | |

| | |

| (Cost $2,545,414,066) | |

| | | |

| 2,619,261,594 | |

| | |

| | | |

| | |

| Leverage Facility - (24.71)% | |

| | | |

| (520,000,000 | ) |

| | |

| | | |

| | |

| Other Assets in Excess of Liabilities- 0.26% | |

| | | |

| 5,338,714 | |

| | |

| | | |

| | |

| NET ASSETS - 100% | |

| | | |

$ | 2,104,600,308 | |

| (a) | Pledged security; a portion or all of the security is pledged

as collateral for borrowings as of July 31, 2023. |

| (b) | Non-income producing security. |

| (c) | This security has no contractual maturity date, is not redeemable

and contractually pays an indefinite stream of interest. |

See Accompanying Notes to Statement of Investments

| www.utilityincomefund.com |

4 |

| Reaves Utility Income Fund |

Statement of Investments |

| |

July 31, 2023 (Unaudited) |

Percentages are stated as a percent of the net

assets applicable to common shareholders.

See Accompanying Notes to Statement of Investments

| Statement of Investments | July 31, 2023 |

5 |

| Reaves Utility Income Fund |

Notes to Statement of Investments |

| |

July 31, 2023 (Unaudited) |

NOTE

1. SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

Reaves

Utility Income Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”),

as a closed-end management investment company. The Fund was organized under the laws of the state of Delaware by an Agreement and Declaration

of Trust dated September 15, 2003. The Fund’s investment objective is to provide a high level of after-tax income and total return consisting

primarily of tax-advantaged dividend income and capital appreciation. The Fund is a diversified investment company for purpose of the

1940 Act. The Agreement and Declaration of Trust provides that the Trustees may authorize separate classes of shares of beneficial interest.

The Fund’s common shares are listed on the NYSE American LLC (the “Exchange”) and trade under the ticker symbol “UTG”.

The

following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation

of financial statements is in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”),

which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements.

Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting

and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification

Topic 946.

Investment

Valuation: The net asset value per common share (“NAV”) of the Fund is determined no less frequently than daily, on each

day that the Exchange is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). The

NAV is determined by dividing the value of the Fund’s total assets less its liabilities by the number of shares outstanding.

The

Board of Trustees (the “Board”) has established the following procedures for valuation of the Fund’s asset values under normal

market conditions. For domestic equity securities, foreign equity securities and funds that are traded on an exchange, the market price

is usually the closing sale or official closing price on that exchange. In the case of a domestic and foreign equity security not traded

on an exchange, or if such closing prices are not otherwise available, the mean of the closing bid and ask price will be used. The fair

value for debt obligations is generally the evaluated mean price supplied by the Fund’s primary and/or secondary independent third-party

pricing service, approved by the Board. An evaluated mean is considered to be a daily fair valuation price which may use a matrix, formula

or other objective method that takes into consideration various factors, including, but not limited to: structured product markets, fixed

income markets, interest rate movements, new issue information, trading, cash flows, yields, spreads, credit quality and other pertinent

information as determined by the pricing services evaluators and methodologists. If the Fund’s primary and/ or secondary independent

third-party pricing services are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may

be determined using quotations received from one or more broker-dealers that make a market in the security. Investments in non-exchange

traded funds are fair valued at their respective net asset values.

Pursuant

to Rule 2a-5 under the 1940 Act, the Board has designated the Fund’s investment adviser, Reaves Asset Management (“Reaves”

or the “Adviser”), as the valuation designee with respect to the fair valuation of the Fund’s portfolio securities, subject

to oversight by and periodic reporting to the Board. Fair valued securities are those for which market quotations are not readily available,

including circumstances under which the Adviser determines that prices received are not reflective of their market values. In fair valuing

the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business

data relating to the issuer, borrower or counterparty; an evaluation of the forces which influence the market in which the investments

are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment;

the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon

payments, yield data/cash flow data; the quality, value and saleability of collateral, if any, securing the investment; the business

prospects of the issuer, borrower or counterparty, as applicable, including any ability to obtain money or resources from a parent or

affiliate and an assessment of the issuer’s, borrower’s or counterparty’s management; the prospects for the industry of the issuer, borrower

or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one

or more non-affiliated independent broker quotes for the sale price of the portfolio security; and other relevant factors.

| www.utilityincomefund.com |

6 |

| Reaves Utility Income Fund |

Notes to Statement of Investments |

| |

July 31, 2023 (Unaudited) |

The

Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure

fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions

about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing

the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable

inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability

that are developed based on the best information available.

Various

inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into

different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined

based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not

necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy

under applicable financial accounting standards:

| Level

1 |

— |

Unadjusted

quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access

at the measurement date; |

| |

|

|

| Level

2 |

— |

Quoted

prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices

that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| |

|

|

| Level

3 |

— |

Significant

unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is

little or no market activity for the asset or liability at the measurement date. |

| Statement of Investments July 31, 2023 |

7 |

| Reaves Utility Income Fund |

Notes to Statement of Investments |

| |

July 31, 2023 (Unaudited) |

The

following is a summary of the Fund’s investments in the fair value hierarchy as of July 31, 2023:

| Investments in Securities at Value* | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

$ | 2,574,046,761 | | |

$ | – | | |

$ | – | | |

$ | 2,574,046,761 | |

| Corporate Bonds | |

| – | | |

| 4,736,753 | | |

| – | | |

| 4,736,753 | |

| Preferred Stocks | |

| 973,528 | | |

| – | | |

| – | | |

| 973,528 | |

| Money Market Funds | |

| 39,504,552 | | |

| – | | |

| – | | |

| 39,504,552 | |

| TOTAL | |

$ | 2,614,524,841 | | |

$ | 4,736,753 | | |

$ | – | | |

$ | 2,619,261,594 | |

| * | For

detailed descriptions and other security classifications, see the accompanying Statement

of Investments. |

Foreign

Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and

liabilities initially expressed in foreign currencies are converted each business day the Exchange is open into U.S. dollars based upon

current exchange rates. Prevailing foreign exchange rates may generally be obtained at the close of the Exchange (normally, 4:00 p.m.

New York time). The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange

rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Distributions

to Shareholders: The Fund intends to make a level distribution each month to common shareholders after payment of interest on any

outstanding borrowings. The level dividend rate may be modified by the Board of Trustees from time to time. Any net capital gains earned

by the Fund are distributed at least annually. Distributions to shareholders are recorded by the Fund on the ex- dividend date.

Investment

Transactions: Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend

date, or as soon as information is available to the Fund. Interest income, which includes amortization of premium and accretion of discount,

is accrued as earned. Realized gains and losses from investment transactions are determined using the first-in first-out basis for both

financial reporting and income tax purposes.

NOTE

2. BORROWINGS

On

April 27, 2022, the Fund entered into a Credit Agreement with State Street Bank and Trust Company. Under the terms of the Credit Agreement,

the Fund is allowed to borrow up to $650,000,000 (“Commitment Amount”). Interest is charged at a rate of the one month SOFR

(“Secured Overnight Financing Rate”) plus 0.65%. Borrowings under the Credit Agreement are secured by all or a portion of assets

of the Fund that are held by the Fund’s custodian in a memo-pledged account (the “pledged collateral”). Borrowing commenced

under the terms of the Credit Agreement on April 27, 2022. Under the terms of the Credit Agreement, effective June 27, 2022, a commitment

fee applies when the amount outstanding is less than 80% of the Commitment Amount. This commitment fee is equal to 0.15% times the Commitment

Amount less the amount outstanding under the Credit Agreement and is computed daily and payable quarterly in arrears.

As

of July 31, 2023, the amount of outstanding borrowings was $520,000,000, the interest rate was 5.90% and the fair value of pledged collateral

was $1,040,000,053.

| www.utilityincomefund.com |

8 |

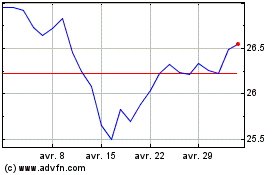

Reaves Utility Income (AMEX:UTG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Reaves Utility Income (AMEX:UTG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024