false

0001848948

0001848948

2024-01-08

2024-01-08

0001848948

VCXB:UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001AndonehalfofOneRedeemableWarrantMember

2024-01-08

2024-01-08

0001848948

VCXB:ClassOrdinarySharesParValue0.0001PerShareMember

2024-01-08

2024-01-08

0001848948

VCXB:WarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareEachAtExercisePriceOf11.50PerShareMember

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 8, 2024

10X CAPITAL VENTURE ACQUISITION CORP. III

(Exact name of registrant as specified in its charter)

|

Cayman Islands |

|

001-41216 |

|

98-1611637 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1 World Trade Center, 85th Floor |

|

|

|

New York,

New York

|

|

10007

|

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 257-0069 |

| (Registrant’s telephone number, including area code) |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each

class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Units, each consisting of one Class A ordinary share, par value $0.0001, and one-half of one redeemable warrant |

|

VCXB.U |

|

NYSE American LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

VCXB |

|

NYSE American LLC |

| Warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

VCXB WS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Hans Thomas as Chief Executive Officer

On January 9, 2024, Hans Thomas and 10X Capital

Venture Acquisition Corp. III (“10X III”) agreed that Mr. Thomas will no longer serve as 10X III’s Chief Executive Officer,

effective January 9, 2024. Mr. Thomas will continue to serve as Chairman of the Board of Directors of 10X III (the “Board”).

Appointment of David Weisburd as Chief Executive

Officer

On January 9, 2024, the Board appointed David Weisburd

as 10X III’s Chief Executive Officer, effective January 9, 2024.

Mr. Weisburd has been 10X III’s Chief Operating

Officer, Head of Origination and a member of the Board since February 2021. Mr. Weisburd founded the venture capital firm Growth

Technology Partners in May 2015 and served as general partner until December 2019, when the firm was acquired by 10X Capital

Holdings LLC (“10X Capital”). The portfolio companies of Growth Technology Partners include 23andMe, CaaStle, Circle, Palantir,

Pipefy, Punchh, Ripple, Tonal, Vicarious and Wish. Mr. Weisburd now serves as General Partner and co-head of venture capital

at 10X Capital, where he has led the firm’s investments into Robinhood, Compass Therapeutics, HeadSpace and DraftKings Inc. (Nasdaq:

DKNG). Mr. Weisburd also serves as a partner of Flight VC, an investment syndicate with over 2700 members across Silicon Valley and

other tech hubs including Boston, Los Angeles, and New York, and whose members range from angel investors to entrepreneurs and venture

capitalists. Flight VC has a prolific track record investing in companies including Betterment, Carta, Cruise Automotive, Discord, Dollar

Shave Club, Fastly, Inc. (NYSE: FSLY), LinkedIn, Paypal, Inc. (Nasdaq: PYPL), Rent the Runway, and many others. In addition to his

direct investment activity, Mr. Weisburd has also conducted a substantial amount of secondary market investment into companies such

as Lyft, Inc. (Nasdaq: LYFT), One Medical Group (Nasdaq: ONEM), Space X, and Spotify (NYSE: SPOT). Prior to his venture capital

career, Mr. Weisburd was on the founding teams of two venture-backed technology startups, isocket (acquired by Magnite (Nasdaq:

MGNI)) and RoomHunt (acquired by RentLingo). Mr. Weisburd received a BS in management and entrepreneurship from Indiana University —

Kelley School of Business, an MBA from Dartmouth — Tuck School of Business, and a masters in psychology from Harvard University.

There are no family relationships between Mr. Weisburd

and any director or executive officer of 10X III. In addition, Mr. Weisburd has no direct or indirect material interest in any transaction

or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

10X III did not enter into an employment agreement

with Mr. Weisburd in connection with his appointment as Chief Executive Officer.

Departure of Oliver Wriedt as President and Head

of Capital Markets

On January 9, 2024, Oliver Wriedt and 10X III agreed

that Mr. Wriedt will no longer serve as 10X III’s President and Head of Capital Markets, effective January 9, 2024.

Appointment of Osman Ahmed as President

On January 9, 2024, the Board appointed Osman Ahmed

as 10X III’s President, effective January 9, 2024.

Mr. Ahmed is a Managing Director and Head

of Private Equity at 10X Capital. He has over 12 years of principal investment, advisory, and operating experience. Prior to joining 10X

Capital, Mr. Ahmed was the CEO of Founder SPAC, a $321M special purpose acquisition company focused on digital transformation. Founder

SPAC successfully completed its merger with Rubicon Technologies (NYSE: RBT) in August 2022. Previously, Mr. Ahmed was an investor

at KCK Group, a private markets investor. He also served as CFO of Beehive Industries, a KCK Group Portfolio company. Mr. Ahmed previously

has held roles at Volition Capital, Scale Venture Partners, and Stifel Financial (NYSE: SF). Throughout his career, Mr. Ahmed has

executed leveraged buyout, special situations, and growth equity investments in technology, business services, industrials, and healthcare.

Prior closed deals include: Harvest Food Distributors, Sherwood Food Distributors, Hibernia Networks (acquired by GTT), RingCentral (NYSE:

RNG), TraceLink, Al Fakher Tobacco, Better.com (NASDAQ: BETR), and others. He currently sits on the board of directors of Rubicon Technologies

(NYSE: RBT) and serves as the company’s lead independent director and sits on the board of directors of African Agriculture

Holdings Inc. (Nasdaq: AAGR). Mr. Ahmed holds a B.S. in Computer Science from the University of Southern California and an M.B.A.

from the University of Chicago Booth School of Business.

There are no family relationships between Mr. Ahmed

and any director or executive officer of 10X III. In addition, Mr. Ahmed has no direct or indirect material interest in any transaction

or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

10X III did not enter into an employment agreement

with Mr. Ahmed in connection with his appointment as President.

Item 7.01. Regulation FD Disclosure.

In connection with the officer resignations and

appoints described in Item 5.02 above, 10X III issued a press release announcing the planned changes, a copy of which is also being furnished

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 7.01 of this

Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 is deemed to be “furnished” and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section. The information set forth in this Item 7.01, including Exhibit 99.1, shall not

be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly

set forth by specific reference in such a filing.

Item 8.01. Other Events.

In connection with Mr. Ahmed’s appointment

as President of 10X III, as described in Item 5.02 above, on January 9, 2024, Mr. Ahmed entered into the following agreements with 10X

III:

| ● | A joinder agreement to the letter agreement, dated January 9, 2024 (the “Joinder to the Letter Agreement”), pursuant to

which Mr. Ahmed became a party to that certain letter agreement, dated January 11, 2022, between 10X III, 10X Capital SPAC Sponsor III

LLC, a Cayman Islands limited liability company (the “Sponsor”), and other insiders signatory thereto, wherein Mr. Ahmed has

agreed to be bound by and comply with the provisions of that certain letter agreement applicable to insiders in the same manner as if

Mr. Ahmed were an original signatory thereto and in such capacity as an insider therein; and |

| ● | An indemnity agreement, dated January 9, 2024, (the “Indemnity Agreement”), between 10X III and Mr. Ahmed, providing Mr.

Ahmed contractual indemnification substantially in the form previously presented to the Board in addition to the indemnification provided

for in 10X III’s second amended and restated memorandum and articles of association, as amended. |

The foregoing descriptions of the Joinder to the

Letter Agreement and the Indemnity Agreement do not purport to be complete and are qualified in their entireties by reference to the Joinder

to the Letter Agreement and the form of Indemnity Agreement, copies of which are attached hereto as Exhibits 10.1 and 10.2, respectively,

and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 9, 2024

| |

10X CAPITAL VENTURE ACQUISITION CORP. III |

| |

|

|

| |

By: |

/s/ David Weisburd |

| |

Name: |

David Weisburd |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

Execution Version

JOINDER

to LETTER Agreement

This Joinder to Letter Agreement

(this “Joinder”) is made this 9th day of January, 2024, by Osman Ahmed (the “Officer”),

in respect of that certain Letter Agreement (the “Letter Agreement”), dated as of January 11, 2022, by and among 10X

Capital SPAC Sponsor III LLC (the “Sponsor”), 10X Capital Venture Acquisition Corp. III (the “Company”),

and each of the other parties thereto. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them

in the Letter Agreement.

RECITALS:

WHEREAS, the Company

desires to appoint the Officer as President of the Company and the Officer has accepted such offer and agrees to be bound by the binding

provisions of the Letter Agreement.

NOW, THEREFORE, for

and in good and valuable consideration, the receipt of which is hereby acknowledged, Officer agrees as follows:

| 1. | Officer hereby agrees to be bound by the terms and conditions of the Letter Agreement as a party thereunder. |

| 2. | This Joinder shall be governed by and construed in accordance with the laws of the State of New York without

giving effect to any choice or conflicts of law provision or rule that would cause the application of the domestic substantive laws of

any other jurisdiction. |

IN WITNESS WHEREOF, this Joinder

has been executed and delivered by the undersigned as of the date set forth above.

| |

/s/ Osman Ahmed |

| |

Name: |

Osman Ahmed |

Signature Page to Joinder to Letter Agreement

| |

ACKNOWLEDGED AND AGREED BY: |

| |

|

|

| |

10X CAPITAL VENTURE ACQUISITION CORP. III |

| |

|

|

| |

By: |

/s/ David Weisburd |

| |

Name: |

David Weisburd |

| |

Title: |

Chief Executive Officer |

| |

10X CAPITAL SPAC SPONSOR III LLC |

| |

|

|

| |

By: |

/s/ David Weisburd |

| |

Name: |

David Weisburd |

| |

Title: |

Manager |

Signature Page to Joinder to Letter Agreement

Exhibit 99.1

10X Capital Venture Acquisition Corp.

III Announces Expected Change in Management

NEW YORK, NY (United States), Jan. 08, 2024

(GLOBE NEWSWIRE) -- 10X Capital Venture Acquisition Corp. III (“10X III”) (NYSE American:VCXB), a publicly

traded special purpose acquisition company, announced today that, subject to approval by the board of directors, it expects David Weisburd,

the current Chief Operating Officer and Head of Origination, to succeed Hans Thomas as Chief Executive Officer of 10X III, and expects

Osman Ahmed to succeed Oliver Wriedt as President. Mr. Thomas will remain as Chairman of the board of directors.

About 10X Capital

10X Capital is an alternative asset management

firm leveraging advancements in data analytics & AI to generate signals, deliver insights, and drive returns across asset classes. 10X

Capital is amongst the most active venture capital firms globally, aligning Wall Street & Silicon Valley by bringing institutional

capital to high growth opportunities in private & public markets. For more information, visit https://www.10XCapital.com.

10X Capital Venture Acquisition Corp. III (NYSE

American: VCXB.U, VCXB, VCXB WS) is a special purpose acquisition company sponsored by 10X Capital, focused on identifying high growth

businesses domestically and abroad and bringing them to the public markets. For more information visit https://www.10xspac.com/spaciii.

Additional Information and Where to Find It

As previously announced on August 9, 2023, 10X

III has entered into a merger agreement with American Gene Technologies International Inc., a Delaware corporation (“AGT”),

for a business combination that would result in the combined company being a publicly listed company (the public company following the

business combination to be renamed “Addimmune”). In connection with the proposed transaction, the parties have filed a registration

statement on Form S-4 (“Form S-4”), which includes a proxy statement/prospectus of 10X III, along with other documents regarding

the proposed transaction. 10X III’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus

and the amendments thereto and the definitive proxy statement and documents incorporated by reference therein filed in connection with

the proposed business combination, as these materials will contain important information about AGT, 10X III and the proposed business

combination. Promptly after the Form S-4 is declared effective by the SEC, 10X III will mail the definitive proxy statement/prospectus

and a proxy card to each shareholder entitled to vote at the meeting relating to the approval of the transactions and other proposals

set forth in the proxy statement/prospectus. The Form S-4, the proxy statement/prospectus, as well as other filings containing information

about AGT and 10X III will be available without charge at the SEC’s Internet site (http://www.sec.gov). Copies of the definitive

proxy statement/prospectus can be obtained, when available, without charge, from 10X III’s website https://www.10xspac.com/spaciii. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE FORM S-4 AND THE PROXY STATEMENT/PROSPECTUS

AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION.

Participants in the Solicitation

AGT, 10X III and certain of their respective directors,

executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation

of proxies from 10X III’s shareholders in connection with the proposed business combination. You can find more information about

10X III’s directors and executive officers in 10X III’s Annual Report on Form 10-K, as amended, for the year ended December

31, 2022 (the “Annual Report”), which was filed with the SEC on May 22, 2023, as modified or supplemented by any Form 3 or

Form 4 filed with the SEC since the date of such filing. Additional information regarding the participants in the proxy solicitation and

a description of their direct and indirect interests is included in the proxy statement/prospectus. Shareholders, potential investors

and other interested persons should read the proxy statement/prospectus carefully before making any voting or investment decisions. You

may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This press release shall not constitute a solicitation

of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination. This press release

shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally are accompanied by words such as “will,”

“expect,” “anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors,

many of which are outside 10X III’s control, that could cause actual results or outcomes to differ materially from those discussed

in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include those factors discussed

in the Annual Report, any subsequent Quarterly Reports on Form 10-Q filed with the SEC and in any subsequent filings with the SEC, including

the Form S-4 and the proxy statement/prospectus which forms a part thereof relating to the business combination. 10X III does not undertake

any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

Contact

ir@10xcapital.com

v3.23.4

Cover

|

Jan. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

001-41216

|

| Entity Registrant Name |

10X CAPITAL VENTURE ACQUISITION CORP. III

|

| Entity Central Index Key |

0001848948

|

| Entity Tax Identification Number |

98-1611637

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

1 World Trade Center

|

| Entity Address, Address Line Two |

85th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10007

|

| City Area Code |

212

|

| Local Phone Number |

257-0069

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, par value $0.0001, and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, par value $0.0001, and one-half of one redeemable warrant

|

| Trading Symbol |

VCXB.U

|

| Security Exchange Name |

NYSEAMER

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

VCXB

|

| Security Exchange Name |

NYSEAMER

|

| Warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share

|

| Trading Symbol |

VCXB WS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VCXB_UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001AndonehalfofOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VCXB_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VCXB_WarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

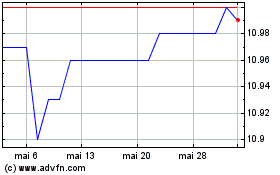

10X Capital Venture Acqu... (AMEX:VCXB)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

10X Capital Venture Acqu... (AMEX:VCXB)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024