$200 Million In Crypto Longs Wiped Out As Altcoins Crash To Start Week

24 Février 2025 - 11:30PM

NEWSBTC

Data shows that the cryptocurrency derivatives sector has seen a

high amount of liquidation during the past day as Ethereum and

other altcoins plunged. Altcoins Have Just Witnessed Massive Long

Liquidations According to data from CoinGlass, liquidations have

piled up on the cryptocurrency futures market in the last 24 hours.

“Liquidation” here refers to the forceful closure that any open

contract undergoes after it has accumulated losses of a certain

degree. Related Reading: Is It Time To Buy XRP? TD Sequential Says

Yes When a large amount of liquidations occur at once, the event is

popularly known as a squeeze. The chances of a squeeze taking place

come down to two factors. The first is naturally the volatility, as

a larger swing in the price would mean a wider span of contracts

gets pushed into the red. The other factor is leverage, a loan

amount that derivatives market traders can opt to take against

their initial collateral. Leverage is often many times the position

itself, so the benefit of having it is that any profits earned are

multiplied by the same factor. But as this also applies to losses,

it’s easier to get liquidated with leverage if the bet doesn’t work

out. In the cryptocurrency sector, assets can often be volatile and

positions tend to be overleveraged, so a squeeze can occur from

time to time. During the past day, the market has once again seen a

surge in volatility, which has led to yet another liquidation

squeeze. Here is a table that breaks down the relevant numbers

related to this event: As is visible above, the cryptocurrency

derivatives sector has registered a total of $268 million in

liquidations during the last 24 hours. Out of these, $217 million

of the positions involved were bullish bets. The long contract

holders taking the brunt of the liquidations is naturally down to

the fact that the altcoins have gone through a price crash inside

this window. Now, here is a heatmap that displays how the

contribution to the squeeze has looked from the individual assets:

Generally, Bitcoin (BTC) tops this list, but it would appear that

the number one cryptocurrency has failed to make even the top two

this time around. This is due to the fact that the coin has seen

relatively flat movement during this crash of the altcoins. Related

Reading: Dogecoin Open Interest Plunges 58%: How Do Shiba Inu &

Pepe Compare? Ethereum (ETH), the largest among the altcoins, has

provided the largest share of liquidations at $56 million. Solana

(SOL), which has faced the worst decline among the top 10 digital

assets of 6%, has come second at $33 million. ETH Price Ethereum

made some recovery during the weekend, but it seems the coin has

already retraced those gains to start the new week as its price has

gone down 4%, dropping to $2,700. Featured image from Dall-E,

CoinGlass.com, chart from TradingView.com

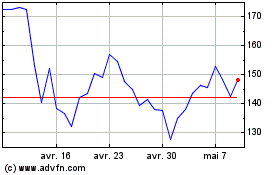

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025