This Is How A Hacker Stole Roughly $200 Million From Euler Finance, A DeFi Protocol

13 Mars 2023 - 11:00PM

NEWSBTC

Euler Finance, a decentralized finance (DeFi) lending protocol on

Ethereum, has lost approximately $200 million through a flash loan

hack. This loss makes it the biggest DeFi hack in 2023. Euler

Finance’s $200 Million Exploit On Mar. 13, 2023, Euler Finance

confirmed that it had suffered an attack, resulting in

approximately a $200 million loss. The protocol is now working with

law enforcement and security professionals. We are aware and our

team is currently working with security professionals and law

enforcement. We will release further information as soon as we have

it. https://t.co/bjm6xyYcxf — Euler Labs (@eulerfinance) March 13,

2023 To execute the hack, the attacker targeted four tokens: DAI,

an algorithmic stablecoin; wrapped-Bitcoin (WBTC); staked-Ethereum

(sETH); and USDC, a fiat-backed stablecoin. In recent months, Euler

Finance has become popular for offering liquid staking derivatives

(LSD) services. Notably, it comes ahead of the Shanghai-Capella

upgrade on Ethereum, a smart contract platform. According to

Dedaub, a smart contract auditing service provider, the attacker

used flash loans from Aave, a non-custodial lending protocol, to

carry out the attack. Ahead of this, funds were first bridged from

BNB Smart Chain (BSC) before it was deployed to break Euler

Finance. In a flash loan attack, the attacker borrows a

large token amount without collateral, typically using a flash

loan. Afterward, they use that loan to manipulate other tokens’

value in a pool, in most cases driving down the price of the target

asset. With this, they can buy that token at a lower price and

quickly sell it back for a profit once the price recovers. The

Flash Loan Attack In Euler Finance’s case, the flash loan was

leveraged in two instances forcing massive liquidations.

Specifically, the attacker tricked the protocol into falsely

assuming it held a low amount of eToken, a collateral token issued

by Euler based on whichever token is deposited on the protocol.

They then borrowed 10x the deposited amount from Euler, receiving

195.6 million eDAI and 200 million dDAI. 🚨 Euler suffered an attack

Analyzing 1 tx that shows an $8.9m+ return for the attacker 1.

Flash loan2. Deposit 20m DAI3. Mint 200m eDAI4. Repay 10m DAI5.

Mint 200m eDAI6. Donate 100m eDAI to reserves7. Liquidate yourself

for 259m eDAI yields 38.9m DAI8. Close flashloan

pic.twitter.com/8cjHwDgX3y — Dedaub (@dedaub) March 13, 2023 This

type of exploit is known as a liquidity attack. It’s also one of

the most common types of DeFi hacks. Related Reading: Trust Wallet

Comes Clean On Rumors Regarding $4 Million ‘Hack’ Essentially,

attackers manipulate the protocol’s liquidity calculations, which

allows the attacker to borrow more funds than they should be able

to, leading to massive losses for the protocol and its users. The

Euler hack is the latest in many DeFi exploits that have plagued

the industry recently. According to blockchain analytics firm

Chainalysis, over $3 billion was stolen from DeFi protocols via

hacks or exploits in 2022 alone. 2/ At this rate, 2022 will likely

surpass 2021 as the biggest year for hacking on record. So far,

hackers have grossed over $3 billion dollars across 125 hacks.

pic.twitter.com/vgT3pz2iOu — Chainalysis (@chainalysis) October 12,

2022 DeFiLlama data shows hackers stole over $20 million

in February 2023. Among those targeted include Orion, dForce

network, and Platypus Finance. Related Reading: A Botched Heist: A

Look At The Sloppy $8.5M Hack On Platypus Protocol In February, the

dForce network lost $3.65 million, while Platypus Finance was

hacked for over $8 million. Feature Image From Canva, Chart From

TradingView

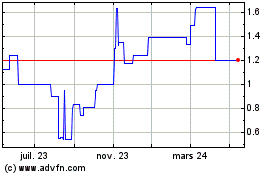

Trust Wallet (COIN:TWTUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Trust Wallet (COIN:TWTUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024