Altcoins Rally: What’s Next After The Breakout

07 Novembre 2023 - 3:00AM

NEWSBTC

Altcoins have witnessed a significant surge recently, with their

collective market capitalization rising from $575 billion to $615

billion in just a few days – an increase of 7%. This momentum hints

at the potential for further growth in the Altcoin sector. Breakout

From Descending Triangle The Altcoin market capitalization had been

trading within a descending triangle pattern since its yearly peak

in April. This technical pattern, characterized by a series of

lower highs but consistent lows, typically signals a bearish

sentiment – suggesting that each rally is met with increasing

selling pressure, keeping upward price movements in check. Related

Reading: November Outlook For Bitcoin Price: Another Pump Or

Retrace? However, this past weekend marked a pivotal change. The

market capitalization decisively broke through the pattern’s upper

resistance line, surging by 7%. Such a breakout from a descending

triangle is a bullish pattern, often indicating a reversal of the

prior downtrend. With this breakout, the market cap is now eyeing

the target set by the initial peak of the pattern, which could mean

an additional increase of 7%. Altcoin market capitalization.

Source: TOTAL2 from TradingView The significance of this

breakout is further highlighted by the fact that the Altcoin market

cap has not only broken through the resistance but also surpassed

the previous high set in July. This breach could signal that the

market is transitioning from a bear-dominated phase to a bullish

one, where buyers are regaining control and pushing the market to

new heights. Bitcoin Decreasing Dominance Bitcoin’s dominance on

the market has recently slipped to 52.50%, down from its annual

peak of 54%. This is a normal market fluctuation, considering

Bitcoin had been on a ten-week streak of increasing dominance.

Related Reading: Bitcoin Season: Leading The Charge In The Crypto

Market Yet, it’s crucial to note that Bitcoin’s market share has

dipped below the pivotal 53% support level. Should Bitcoin fail to

reclaim dominance above this support level, we could anticipate a

further decrease to the next support at 49%, opening the door for

Altcoins to capture a greater portion of the cryptocurrency market

cap. In bear markets, Bitcoin’s dominance tends to increase as the

market pulls back, which suggests that if Bitcoin manages to hold

or increase its price, Altcoins could experience further rallies.

Bitcoin dominance (market share % in the cryptocurrency

market) on the weekly chart. Source: BTC.D from TradingView

Conversely, an increase above the 53% support could set Bitcoin out

for the next resistance at 58%, at the expense of Altcoins’ market

share. Historically, bull markets often begin with Bitcoin leading

the way due to events like the halving event, which reduces the

inflow of new Bitcoin. Nonetheless, there are still phases when

Altcoins rapidly gain momentum, experiencing significant and rapid

price increases. The current market breakout, along with a

reduction in Bitcoin’s dominance, hints that such a phase could

potentially unfold now. Top Altcoins Gains In the past week, many

Altcoins have witnessed remarkable gains. Here are the top

performers: Pancake Swap: +95% Trust Wallet Token: +53% Neo: +48%

MultiversX: +46% Blur: +45% Investment Disclaimer: The content

provided in this article is for informational and educational

purposes only. It should not be considered investment advice.

Please consult a financial advisor before making any investment

decisions. Trading and investing involve substantial financial

risk. Past performance is not indicative of future results. No

content on this site is a recommendation or solicitation to buy or

sell securities or cryptocurrencies. Featured image from

ShutterStock, Charts from TradingView.com Predycto is the author of

a cryptocurrency newsletter. Sign up for free. Follow @Predycto on

Twitter.

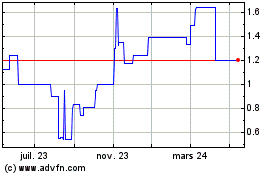

Trust Wallet (COIN:TWTUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

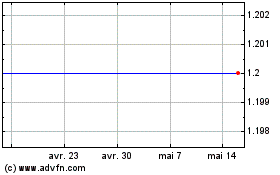

Trust Wallet (COIN:TWTUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024