ABO-GROUP - Half Year Results 2024

Ghent, 19 September 2024 – 6.30 p.m. CET – Press

release / regulated information

Highlights of the first half of

2024

- ABO-GROUP can once again present a double-digit growth

- 14.3% growth due to the integration of the Belgian acquisitions

from the second half of 2023, the acquisition of Eau &

Perspectives in France in early 2024 and an organic growth of

4.2%

- Operating margins in line with the first half of last

year as strong performance of the geotechnical activities in

Belgium and the Netherlands is partly offset by challenges in the

geotechnical and monitoring activities in France

- A strong balance sheet and cash flow support the

further expansion of ABO-GROUP

Outlook

- The integration of the French acquisitions Odace and

Soltech, the Belgian Demey INFRAbureau and the Dutch Eco Reest will

contribute to the continuous expansion of the specialisms within

the group

- The second half of the year presents a positive outlook

with the expected recovery in geotechnical and mining

activities

ABO-GROUP remains on track to achieve revenues ranging

between €95 and €100 million this year

Frank De Palmenaer, CEO of ABO-GROUP

Environment: “The acquisitions from 2023, the recovery

of the geotechnical market in the Netherlands and the further

development of our environmental activities ensure that we can

again report strong growth, despite the declining demand for

geotechnical surveying and monitoring in France halfway through

this year. We thereby continue to focus on acquiring specialised

knowledge and expertise, with a view to gaining a technical

leadership position within the market. By means of targeted

acquisitions, we aim to create a climate of interaction within our

group of companies that is rich in cross-fertilisation, mutual

inspiration and bold innovation.

Building further on this strategy, we have already acquired

five companies this year. The integration of these companies will

contribute to the continuous expansion of our knowledge and

expertise. For example, Demey INFRAbureau will actively pursue the

further development of our digital infrastructure services in

collaboration with MEET HET, which was acquired last year. Based on

all these aspects, we are fully confident in our continuously

growing capacity to provide tailor-made solutions to the

increasingly complex demands from the market.”

HY 2024 highlights

14% revenue growth due to the

combination of the strong contribution from new entities and

continued organic expansion

The acquisitions in 2023, i.e., Rimeco, MEET HET, SWBO and SEGED (6

months each, except for SEGED, which contributed an additional 1.5

months compared to the first six months of 2023), together with the

new Eau & Perspectives, accounted for €4.0 million in

revenue, a growth of 10.1% compared to the first six months of

2023. Despite the challenges in several sub-markets, existing

entities also managed to grow by 4%, increasing the total revenues

of ABO-GROUP to €45.6 million in the first six months of 2024,

an increase of 14% compared to the first half of 2023.

Geotechnical activities in France came under pressure. Due to

project delays and unscheduled machine maintenance, the mining

operations faced a temporary decline in revenue. Thanks to the

strong performance in Belgium and the Netherlands, however, the

geotechnical branch can still record a first-rate growth of 4%,

with a revenue of €21.6 million, representing 47% of the total

revenue of ABO-GROUP (€20.7 million in 1H 2023). The impact of

the acquisitions of SEGED and Rimeco in 2023 and Eau &

Perspectives in 2024 ensured a strong increase of €2.3 million

for environmental activities. In addition, a strong organic growth

of 4% was also recorded in this segment, with the environmental

activities increasing their revenue by a total of

€3.1 million, to €21.7 million, which represents an

increase of 17% compared to the €18.6 million in the first

half of 2023. As a result, the share of the environmental branch

further increased to 48%. Monitoring and infrastructure services

contributed €2.3 million to the revenue in 1H24, of which

€1.7 million originated from the new entities MEET HET and

SWBO, accounting for 5% of the total revenue.

Geographically, the Belgian operations made a

strong leap in revenue, from €12.6 million to

€16.1 million, an increase of no less than 27%. The

acquisitions of SWBO, Rimeco and MEET HET represent an increase of

€3.1 million, or a growth of 25%. The geotechnical activities

of Geosonda in Belgium also recorded a pleasing increase in

revenue, thanks to the further expansion of its innovative

supporting services in the area of preliminary studies and soil

modelling. This was partially offset, however, by the decline in

demand for asbestos-related lab services at Translab, resulting in

the organic growth in Belgium settling at 2%. The result is a total

growth in revenue, from €12.6 million in the first semester of

2023 to €16.1 million in the first half of 2024, which

represents a 35% share of the total ABO-GROUP revenue.

The part of SEGED not previously consolidated

and the contribution of the newly-acquired Eau & Perspectives

led to a 4% increase in revenue in France. The above-mentioned

slowdown in mining activities at Geosonic, however, as well as a

decline in demand for DynaOpt's monitoring services in the Paris

region after the end of the Olympics ensured that the French

business remained organically stable compared to the first half of

2023. As a result, the French revenue amounts to €22.1 million

after the first 6 months of 2024. Due to the strong growth of the

Belgian branch, this means that the contribution of the French

activities falls from 53% to 48% of total Group revenue.

The Dutch entities ended the first half of the

year with a strong revenue of €7.5 million, a fully organic

growth of 25% compared to the €6.0 million in 1H 2023 which

was impacted by cost increases and the nitrogen issue. Geomet's

consultancy division and Geosonda Nederland's geotechnical survey

took full advantage of the upturn in the construction market.

Thanks to targeted investments in the expansion of their teams and

machinery, ABO-Milieuconsult and Sialtech were also able to further

develop their consulting and fieldwork activities.

Investments and delays affected the

operating margins

In the first half of 2024, several entities within ABO-GROUP were

committed to expanding their teams to enable further growth in the

future. In addition, further investments were made in the expansion

of the geotechnical laboratory activities at Translab in Belgium.

Together with the temporary delays at GeoSonic and the decline in

the demand at DynaOpt, this had an impact on the operating margins.

The settlement of the legal dispute at ABO Logistics further

impacted the EBITDA for the first six months of 2024, whereby the

provision of €0.5 million (below EBITDA) was converted into a

non-recurring cost of €0.5 million (above EBITDA). Adjusted

for this effect, the EBITDA in the first half of 2024 amounts to

€5.3 million, representing a margin of 11.4% and up 14% from

the €4.6 million in the same period one year earlier.

Due to the reversal of the ABO Logistics

provision, depreciation and provisions increased slightly to

€3.1 million (€3.6 million when adjusted for this effect).

This resulted in an increase in operating profit to

€1.7 million (compared to €1.6 million in 1H 2023).

As a result of the M&A financing from the

second half of 2023 and the increased interest rates, ABO-GROUP was

faced with an increase of the negative financial result from

€0.5 million to €0.8 million. This reduces the net profit

of ABO-GROUP from €0.7 million (€0.06 per share) to

€0.5 million (€0.05 per share).

Robust cash-flow generation and debt

position

ABO-GROUP succeeded in achieving a solid operating cash flow of

€1.9 million (compared to €0.8 million in the first half

of 2023) for the first half of the year. In the first half of the

year, efforts were again made to limit the annual seasonal increase

in working capital (€3.0 million, as in the first 6 months of

2023), which partially absorbed the lower margins.

As a result of investments in working capital

and fixed assets, and the Eau & Perspectives acquisition, which

was financed with own cash resources, the net financial debt

increased from €16.2 million at the end of 2023 to

€21.9 million at the end of June 2024. The annualised debt

ratio thereby increased to 1.9x relative to the EBITDA (1.5x at the

end of 2023), and thereby remains healthy.

The balance sheet total at the end of June 2024

amounted to €83.2 million, a decrease of 3.5% from

€86.3 million at year-end 2023. On the assets side, this was

mainly the result of the decrease in the cash position, which more

than offsets the increase in fixed assets. On the liabilities side,

this arose from the decrease in trade and tax liabilities. Total

equity amounts to €26.4 million, up €0.6 million over the

first semester of 2024. The equity ratio settled at 31.7% (compared

to 29.9% at the end of last year).

The full consolidated income statement and

balance sheet, the statement of changes in equity and the

consolidated cash flow statement are shown below.

Outlook

A positive outlook for the second half

of the year

Based on the order books and project planning at

ABO-GROUP entities, the second half of the year is expected to be

positive. Whereas the Belgian and Dutch companies active in the

geotechnical and environmental markets can build further on their

strong first half of the year, the French geotechnical and mining

services are expected to recover thanks to the resumption of a

number of large contracts. Moreover, with the integration of the

French acquisitions Odace and Soltech, the Belgian Demey INFRA

agency and the Dutch Eco Reest, ABO-GROUP aims to give an

additional boost to internal commercial cooperation and development

of new services to support the Group's further growth.

Thanks to the recent acquisitions and robust

underlying organic growth, ABO-GROUP remains on track to achieve

revenues between €95m and €100m this year, one year ahead of its

2025 plan.

Financial calendar

27/03/2025: Annual figures for 2024

28/05/2025: General Meeting

Statement regarding the fair

presentation of the interim condensed consolidated financial

information and the fair overview of the interim

report

Frank De Palmenaer, CEO, declares that, to his

knowledge, the interim condensed consolidated financial information

for the six-month period ending 30 June 2024, which was prepared in

accordance with IAS 34 “Interim Financial Reporting” as approved by

the European Union, gives a true and fair view of the assets, the

financial position and the results of the company and the companies

included in the consolidation. The interim report gives a fair

overview of the most significant events and key transactions with

associated parties that have taken place during the first six

months of the financial year, and their impact on the interim

condensed financial information, as well as a description of the

major risks and uncertainties for the remaining months of the

financial year.

About ABO-GROUP

ABO-GROUP is a specialised, listed engineering

company focused on geotechnical engineering, the environment and

soil remediation. Through its consultancy and testing &

monitoring departments, ABO-GROUP operates in Belgium, the

Netherlands and France, as well as internationally. ABO-GROUP

guarantees its customers a sustainable solution. For a more

detailed description of the operations of the group, please consult

the ABO-GROUP website (www.abo-group.eu).

For more information:

Frank De Palmenaer

CEO ABO-Group Environment NV

frank.depalmenaer@abo-group.eu

T +32 496 59 88 88

Derbystraat 255, Maaltecenter Block G, B-9051 Ghent (SDW),

Belgium

This press release is available on our website

www.abo-group.eu

- ABO-GROUP HY Results 2024 - Press release - EN

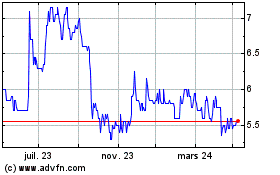

ABO Group Environment NV (EU:ABO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

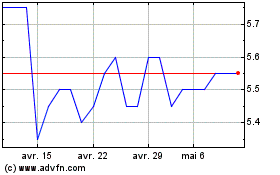

ABO Group Environment NV (EU:ABO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024