KEY FIGURES OF DASSAULT AVIATION

GROUP

|

|

2021 |

2020 |

|

Order intake |

EUR 12,080 million49 Rafaleof which 37 Rafale

Export (1)and 12 Rafale France BALZAC support contract51

Falcon(1)80 Rafale UAE order not booked |

EUR 3,463 millionOCEAN support contract15

Falcon |

|

Adjusted net sales (*) |

EUR 7,233 million25 Rafale Export30 Falcon |

EUR 5,489 million13 Rafale Export34 Falcon |

|

Backlogas of December 31 |

EUR 20,762 million86 Rafaleof which 46 Rafale

Export (1) and 40 Rafale France 55 Falcon(1)80 Rafale UAE order not

booked |

EUR 15,895 million62 Rafaleof which 28 Rafale

Franceand 34 Rafale Export34 Falcon |

|

Adjusted operating income (*)Adjusted operating margin |

EUR 527 million7.3% of net sales |

EUR 261 million4.8% of net sales |

|

Research and Development |

EUR 551 million7.6% of net sales |

EUR 538 million9.8% of net sales |

|

Adjusted net income (*) Adjusted net marginEarnings per share |

EUR 693 million9.6% of net sales€8.34 per

share |

EUR 396 million7.2% of net sales€4.76 per share

(2) |

|

Available cashas of December 31 |

EUR 4,879 million |

EUR 3,441 million |

|

Dividends |

EUR 208

million€2.49 per share |

EUR 103 million€1.23 per share (2) |

|

Employee profit-sharing and incentivesincl. 20% correlated social

taxHeadcount as of December 31 |

EUR 139 million12,371 |

EUR 85 million12,441 |

(2) 2021 proforma following the stock split

NB: Dassault Aviation recognizes Rafale Export

contracts in their entirety (including the Thales and Safran

parts).

Main IFRS aggregates (see reconciliation

table below)

|

(*) Consolidated net sales |

EUR 7,246 million |

EUR 5,492 million |

|

(*) Consolidated operating income |

EUR 545 million |

EUR 246 million |

|

(*) Consolidated net income |

EUR 605 million |

EUR 303 million |

Saint-Cloud,

on march

4th,

2022 – In a context of a new

crisis related to the war between Russia and Ukraine, the Board of

Directors chaired by Mr. Éric Trappier held yesterday approved the

2021 statement of accounts. The audit procedures have been

completed and the audit opinion is in the process of being

issued.

« Last year we mourned the

death of Olivier Dassault who, like all members of his family,

strongly supported the Group’s development throughout his whole

life.

The Covid-19 crisis continued in 2021. The Group

adapted during the year and regularly updated its prevention,

employee protection and remote working measures in response to the

guidance issued by the authorities. Global economic activity saw a

strong rebound in 2021, particularly in the industry. However, this

rapid recovery has caused disruption to the supply chain in a

background of inflationary tension. 2021 was also marked by growing

environmental pressures.

For Dassault Aviation, 2021 was a good year for

both civil aviation and military sectors, with an exceptional order

intake of 100 aircraft (49 Rafale and 51 Falcon) and net sales of

EUR 7.2 billion. In addition, the Group delivered 30 Falcon

(compared with the guidance of 25) and 25 Rafale (consistent with

the guidance).

In the military sector, 2021 saw:

- marketing

efforts for the Rafale succeeding, leading to:

- the order for 49

new Rafale (Egypt 30+1, France 12, Greece 6) and 12 pre-owned

Rafale (Greece). The backlog as of December 31, 2021 now includes

86 new Rafale (46 Export, 40 France),

- the signing of a

contract for 80 Rafale for the United Arab Emirates, awaiting

T0,

- the purchase by

Croatia, following an international call for tenders, of Rafale

previously in service with the French Air and Space Force.

Alongside this order, Dassault Aviation signed a contract to

provide associated support for the fleet ordered,

- the delivery of 25

Rafale to our export customers, Qatar and India,

- the continuation of

development work on the Rafale F4 standard,

- the award by France

of a new vertically integrated support contract (Balzac) for the

support of its Mirage 2000. The other vertically integrated

contracts signed with France for the Rafale (Ravel) and the ATL2

(Ocean) are continuing, with performance exceeding the contractual

targets.

- for the FCAS, an

area in which Dassault Aviation is the leader with the New

Generation Fighter demonstrator, the initial work phases on the

demonstrators (Phase 1A) continued in 2021 and will be completed in

first semester 2022. Joint Concept Studies (JCS) are ongoing. The

next phase of the work (Phase 1B) has not been awarded no agreement

having been found with Airbus Defence & Space.

Rafale success has also been confirmed in early

2022 by signature of a 42 (6+36) Rafale contract for Indonesia for

which the T0 is awaited and the authorization by the Greek

parliament of the signature a contract for an additional 6 new

Rafale.

Regarding the Eurodrone, on February 24th 2022,

Airbus GmbH as prime contractor and on behalf of the 3 main

contractors, Airbus Defence and Space S.A.U in Spain, Dassault

Aviation in France and Leonardo S.p.A. in Italia and the

Organization for Joint Armament Cooperation (OCCAR) representing

the first 4 customers (Germany, France, Italy and Spain) signed the

Eurodrone contract relative to the development, the production and

the 5 year maintenance of 20 systems. Dassault Aviation will be in

charge of flight control and mission communication systems, (with

Thales).

For the multi-mission Falcon, work continued on

“Albatros” (surveillance and maritime response aircraft on a Falcon

2000LXS platform) and “Archange” (electronic warfare aircraft on a

Falcon 8X platform). The sixth Falcon 2000 for the Japan Coast

Guard was delivered. Furthermore, commercial prospections are

ongoing.

In the civil aviation segment, 30 Falcon were

delivered (for guidance of 25) and 51 Falcon were ordered in 2021.

This increase in activity is due to the recovery of business

aviation market and expansion of the product line with the Falcon

6X and Falcon 10X. The year also saw:

- the maiden flight

of the Falcon 6X on March 10, 2021,

- the announcement of

the Falcon 10X, an ultra-long-range aircraft with the most spacious

and luxurious cabin on the market,

- recognition of

Falcon customer support, ranked top by AIN for the third year in a

row.

The backlog as of December 31, 2021 is 55 new

Falcon, compared with 34 at the end of 2020.

The “Leading Our Future” transformation plan

continued in 2021. The aim of this plan is to modernize the

infrastructures and processes to improve the competitiveness of the

Group. In 2021, we were able to put in place the new methodological

framework, collaborative platforms and modernized infrastructure

and resources by relying on digital levers.

The Company also pursued its efforts to reduce

the impact of its processes and products on the environment. The

Falcon range is already capable of operating with 50% sustainable

fuel.

in the continuity of the elapsed year, our

objectives for 2022 are:

- Rafale: to perform

contracts, secure the first advance on the contracts signed and

continue business development

- Military

developments: to continue the programs under way and prepare future

Rafale standards

- Falcon: to support

the market recovery and boost sales

- Falcon 6X: to

ensure a successful entry into service and ramp up mass

production

- Falcon 10X: to

adhere to the development schedule for an entry into service in

late 2025

- Civil and military

aircraft support and availability: to maintain the highest

standards

- Energy transition:

to pursue the R&T in conception

- Make in India: to

continue ramping up the activities transferred to DRAL

- New Generation

Fighter: decide on Phase 1B

- Eurodrone: to

perform the contract

The Guidance for 2022 is to deliver 13 Rafale

and 35 Falcon. Net sales will be down compared to

2021».

Éric TRAPPIER, Chairman and Chief Executive

Officer of Dassault Aviation.

Order Intake

2021 order

intake was EUR 12,080 million versus EUR

3,463 million in 2020. Export represented

74%.

Recent year figures are as follows, in

millions of euros:

|

|

2021 |

2020 |

2019 |

|

|

|

|

|

|

Defense |

9,165 |

1,546 |

3,385 |

|

Defense Export |

6,173 |

224 |

769 |

|

Defense France |

2,992 |

1,322 |

2,616 |

|

|

|

|

|

|

Falcon |

2,915 |

1,917 |

2,308 |

|

|

|

|

|

|

Total order

intake |

12,080 |

3,463 |

5,693 |

|

% Export |

74% |

41% |

49% |

The order intake is composed entirely of firm

orders.

Defense programs

In 2021, Defense order intake

totaled EUR 9,165 million,

compared with EUR 1,546 million in 2020.

The Defense Export figure was

EUR 6,173 million in 2021, versus EUR 224 million

in 2020. We recorded orders from Egypt for 30 Rafale – followed by

an order for an additional aircraft to complete the original order

of 2015 – from Greece for 6 new and 12 pre-owned Rafale (which we

bought back from the French Air and Space Force) and a support

contract for Croatia following its acquisition of 12 pre-owned

Rafale directly from the French government.

The Defense France amounted to

EUR 2,992 million in 2021, compared with EUR 1,322

million in 2020. It mainly includes the order for 12 Rafale, the

14-year “Balzac” support contract for the Mirage 2000 (excluding

engines), and a productibility contract for Tranche 5 of the

Rafale. In 2020, it was essentially the 10-year “Ocean” integrated

support contract (excluding engines) for the ATL2 with the French

Naval Air Force that was recorded.

Falcon programs

In 2021, 51 Falcon orders were

recorded, compared with 15 in 2020. Order intake totaled

EUR 2,915 million, versus EUR 1,917 million in

2020. The growth in orders is being driven by the recovery of the

business jet market.

In 2020, the main order was for 7 Falcon 2000LXS

“Albatros” maritime surveillance and response aircraft for France,

plus the associated support.

adjusted net sales

Net sales for 2021 were EUR 7,233

million versus EUR 5,489 million in 2020.

Export represented 89%.

Recent year figures are as follows, in

EUR million:

|

|

2021 |

2020 |

2019 |

|

|

|

|

|

|

Defense |

5,281 |

3,263 |

5,148 |

|

Defense Export |

4,549 |

2,699 |

4,261 |

|

Defense France |

732 |

564 |

887 |

|

|

|

|

|

|

Falcon |

1,952 |

2,226 |

2,193 |

|

|

|

|

|

|

Total adjusted net

sales |

7,233 |

5,489 |

7,341 |

|

% Export |

89% |

89% |

88% |

Defense

programs

In 2021, 25 Rafale Export were

delivered, in line with our forecast, versus 13 Rafale Export in

2020.

Defense net

sales in 2021 were EUR 5,281 million

versus EUR 3,263 million in 2020.

The Defense Export share was

EUR 4,549 million versus EUR 2,699 million in

2020. The strong growth is largely due to the delivery of 25 new

Rafale Export with the associated support, whereas 13 Rafale Export

were delivered in 2020. In addition, 2021 net sales include the

first 6 pre-owned Rafale delivered to Greece, among the 12

ordered.

The Defense France share was

EUR 732 million versus EUR 564 million in 2020. As

in 2020, Defense France net sales in 2021 do not include the

delivery of Rafale in accordance with France’s Military Procurement

Law. However, they do take into account maintenance services (for

the Rafale under the Ravel contract and the ATL2 under the Ocean

contract), as well as support for other aircraft in service.

Falcon programs

There were 30 Falcon delivered

in 2021 (higher than the 25 guidance), versus 34 in 2020.

Falcon net

sales in 2021 totaled EUR 1,952 million,

versus EUR 2,226 million in 2020. The decrease is mainly due to the

number of Falcon delivered (30 vs 34).

****

The “book-to-bill ratio” of the Group (order

intake/net sales) is 1.67 for 2021.

Backlog

The consolidated

backlog as of December 31, 2021 (determined in accordance

with IFRS 15) was EUR 20,762 million, versus EUR

15,895 million as of December 31, 2020. The backlog has evolved as

follows:

|

As of December 31 |

2021 |

2020 |

2019 |

|

|

|

|

|

|

Defense |

17,633 |

13,748 |

15,465 |

|

Defense Export |

9,874 |

8,249 |

10,725 |

|

Defense France |

7,759 |

5,499 |

4,740 |

|

|

|

|

|

|

Falcon |

3,129 |

2,147 |

2,333 |

|

|

|

|

|

|

Total backlog |

20,762 |

15,895 |

17,798 |

|

% Export |

58% |

59% |

72% |

The backlog as of December 31, 2021 consists of

the following:

- Defense Export:

EUR 9,874 million versus EUR 8,249 million as of

December 31, 2020. This figure notably includes 46 new Rafale and 6

pre-owned Rafale, compared with 34 new Rafale as of December 31,

2020,

- Defense France:

EUR 7,759 million versus EUR 5,499 million as of

December 31, 2020. This figure mainly comprises 40 Rafale (versus

28 as of December 31, 2020), the Ravel support contract for the

Rafale, the Balzac support contract for the Mirage 2000, the Ocean

support contract for the ATL2, and the Rafale F4 standard,

- Falcon (including

the Albatros and Archange mission aircraft): EUR 3,129

million versus EUR 2,147 million as of December 31, 2020.

It includes 55 Falcon, compared with 34 as of December 31,

2020.

2021 adjusted results

Adjusted operating income

Adjusted operating income for

2021 was EUR 527 million,

compared with EUR 261 million in 2020.

R&D costs totaled EUR 551 million in 2021

and accounted for 7.6% of net sales, as against EUR 538 million and

9.8% of net sales in 2020. These amounts reflect the self-funded

R&D effort focused on the Falcon 6X and Falcon 10X

programs.

Operating margin was

7.3%, versus 4.8% in 2020. This increase is mainly

due to the reduction in the rate of self-funded R&D.

The foreign exchange hedging rate was $1.19/€ in

2021, compared with $1.18/€ in 2020.

Adjusted financial income

2021 adjusted financial

income was EUR -26 million compared to

EUR -34 million in 2020. In 2021, the impact associated with the

financing component recorded under long-term military contracts was

less significant due to deliveries of Rafale Export.

Adjusted net income

Adjusted net income for 2021

was up 75% at EUR 693

million compared with EUR 396 million in 2020.

Thales’ contribution to the Group’s net income was EUR 336 million,

versus EUR 231 million in 2020.

As a result, adjusted net

margin was 9.6% in 2021, as against 7.2%

in 2020. This increase is mainly due to the increase in operating

income).

Net income per share for 2021 was €8.34,

compared with €4.76* in 2020

* 2021 proforma following the stock split.

2021 key

figures - ifrs

Consolidated

operating income

(IFRS)

Consolidated operating income

for 2021 was EUR 545 million,

compared with EUR 246 million in 2020.

R&D costs totaled EUR 551 million in 2021

and accounted for 7.6% of consolidated net sales (EUR 7,246

million), as against EUR 538 million and 9.8% of consolidated net

sales in 2020. These amounts reflect the self-funded R&D effort

focused on the Falcon 6X and Falcon 10X programs.

Consolidated operating margin

was 7.5%, versus 4.5% in 2020.

This increase is mainly due to the reduction of

the amount of self-funded R&D.

Consolidated financial income

(IFRS)

Consolidated financial income for

2021 was EUR -69 million, compared with

EUR 12 million in 2020. The decline in financial income was mainly

due to the negative change in the market value of hedging

instruments not eligible for hedge accounting under IFRS. The

market value of these instruments, purchased because of the

efficient economic hedge they offer the Group, was adversely

impacted by the evolution in the dollar exchange rate ($1.1326/€ at

yearend-2021, versus $1.2271/€ at yearend-2020). The reduced impact

of the financing component recognized under long-term military

contracts due to Rafale Export deliveries partially offsets this

decrease.

Consolidated net income

Consolidated net income for

2021 was up 100% at EUR 605

million, compared with EUR 303 million in 2020. Thales’

contribution to the Group’s net income was EUR 266 million, versus

EUR 116 million in 2020.

As a result, consolidated net

margin was 8.4% in 2021, as against 5.5%

in 2020. This increase is mainly due to the increase in operating

income.

Consolidated net income per share for 2021 was €

7.28, compared with €3.64 in 2020*

* 2021 proforma following the stock split.

available cash

The Group uses a specific indicator called

“Available cash”, which reflects the amount of total cash available

to the Group, net of financial debts. It includes the following

balance sheet items: cash and cash equivalents, current financial

assets (at market value) and financial debt, excluding lease

liabilities. The calculation of this indicator is detailed in the

consolidated financial statements (see Note 9 of the 2021

consolidated financial statements).

The Group’s available cash

stands at EUR 4,879 million, an

increase of EUR 1,438 million from December 31, 2020. The increase

is mainly due to operating cash flow generated during the year

and the decline in working capital requirement, partially offset by

investments during the year and the payment of dividends.

The decline in working capital requirement is

largely due to advances and progress payments received under the

Defense France and Falcon contracts. This is partially offset by

the decrease in advances and progress payments under the Rafale

export contracts, following the services delivered during the

period.

Balance sheet

(IFRS)

Total equity stood at

EUR 5,300

million as of December 31, 2021, versus EUR 4,560

million as of December 31, 2020.

Borrowings and financial debt stood at EUR 226

million as of December 31, 2021, compared with EUR 270 million as

of December 31, 2020. Borrowings and financial debt include

locked-in employees’ profit-sharing funds, for EUR 98 million, and

lease liabilities, for EUR 128 million.

Inventories and work-in-progress rose to EUR

3,480 million as of December 31, 2021, compared with EUR 3,382

million as of December 31, 2020. The increase in inventories and

work-in-progress relating to the performance of Defense France

contracts and Falcon operations was partially offset by the

decrease in inventories and work-in-progress for Defense Export

following the services delivered during the period.

Advances and progress payments received on

orders, net of advances and progress payments paid, rose by EUR 278

million as of December 31, 2021. This was mainly due to progress

payments received on Defense France and Falcon orders, partially

offset by the reversal of Rafale Export progress payments following

the services delivered during the period.

Derivative financial instruments had a market

value of EUR -81 million as of December 31, 2021, compared with EUR

81 million as of December 31, 2020. This change is essentially due

to the change in the US dollar exchange rate between December 31,

2021 and December 31, 2020 ($1.1326/€ as of 12.31.2021 versus

$1.2271/€ as of 12.31.2020).

Dividends and

profit-sharing/incentives

The Board of Directors decided to propose to the

Annual General Meeting a dividend distribution, in 2022, of

€2.49 per share, corresponding to

a total of EUR 208 million, i.e.

a payout of 30%.

For 2021, the Group will pay EUR 139

million in employee profit-sharing and incentives,

including 20% correlated social tax, whereas the application of the

legal formula would have resulted in a EUR 28 million payment.

Dividends per share over the five last years are

outlined in Note 32 to the Parent Company Financial Statements.

This Financial Press Release may contain

forward-looking statements which represent objectives and cannot be

construed as forecasts regarding the Company's results or any other

performance indicator. The actual results may differ significantly

from the forward-looking statements due to various risks and

uncertainties, as described in the Directors’ report.

CONTACTS:

Corporate

CommunicationStéphane Fort - Tel. +33 (0)1 47 11

86 90 - stephane.fort@dassault-aviation.comMathieu Durand - Tel.

+33 (0)1 47 11 85 88 - mathieu.durand@dassault-aviation.com

Investor RelationsNicolas

Blandin - Tel. +33 (0)1 47 11 40 27 -

nicolas.blandin@dassault-aviation.com

APPENDIX

Definition of alternative performance

indicators

To reflect the Group’s actual economic

performance, and for monitoring and comparability reasons, the

Group presents an income statement adjusted with the following

elements:

- gains and losses

resulting from the exercise of hedging instruments, which do not

qualify for hedge accounting under IFRS standards. This income,

presented as financial income in the consolidated financial

statements, is reclassified as net sales and thus as operating

income in the adjusted income statement,

- the valuation of

foreign exchange derivatives which do not qualify for hedge

accounting, by neutralizing the change in fair value of these

instruments (the Group considering that gains or losses on hedging

should only impact income as commercial flows occur), with the

exception of derivatives allocated to hedge balance-sheet positions

whose change in fair value is presented as operating income,

- amortization of

assets valued as part of the purchase price allocation (business

combinations), known as “PPA,”

-

adjustments made by Thales in its financial reporting.

The Group also presents the “available cash”

indicator, which reflects the amount of the Group’s total

liquidities, net of financial debt. It covers the following balance

sheet items:

- cash and cash

equivalents,

- other current

financial assets (essentially available-for-sale marketable

securities at their market value),

- financial

debt, excluding lease liabilities.

The calculation of this indicator is detailed in

the consolidated financial statements (Note 9).

Only consolidated financial statements are

audited by statutory auditors. Adjusted financial data are subject

to the verification procedures applicable to all information

provided in the annual report.

Impact of ajustements

The impact in 2021 of adjustments to income

statement aggregates is presented below:

|

(in EUR thousands) |

2021 consolidated income statement |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

2021 adjusted income statement |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

7,246,197 |

-13,005 |

-686 |

|

|

7,232,506 |

|

Operating income |

545,069 |

-13,005 |

-8,655 |

3,349 |

|

526,758 |

|

Net financial income/expense |

- 68,512 |

13,005 |

29,604 |

|

|

-25,903 |

|

Share in net income of equity associates |

271,611 |

|

|

3,003 |

67,102 |

341,716 |

|

Income tax |

-142,776 |

|

-5,614 |

-735 |

|

-149,125 |

|

Net income |

605,392 |

0 |

15,335 |

5,617 |

67,102 |

693,446 |

|

Group share of net income |

605,392 |

0 |

15,335 |

5,617 |

67,102 |

693,446 |

|

Group share of net income per share (in euros) |

7.28 |

|

|

|

|

8.34 |

The impact in 2020 of adjustments to income

statement aggregates is presented below:

|

(in EUR thousands) |

2020 consolidated income statement |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

2020 adjusted income statement |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

5,491,592 |

-873 |

-1,608 |

|

|

5,489,111 |

|

Operating income |

246,163 |

-873 |

11,488 |

4,221 |

|

260,999 |

|

Net financial income/expense |

12,216 |

873 |

-46,811 |

|

|

-33,722 |

|

Share in net income of equity associates |

121,282 |

|

|

2,852 |

111,924 |

236,058 |

|

Income tax |

-76,902 |

|

9,992 |

-802 |

|

-67,712 |

|

Net income |

302,759 |

0 |

-25,331 |

6,271 |

111,924 |

395,623 |

|

Group share of net income |

302,759 |

0 |

-25,331 |

6,271 |

111,924 |

395,623 |

|

Group share of net income per share (in euros) |

3.64 (1) |

|

|

|

|

4.76 (1) |

(1) 2021 proforma following the stock split

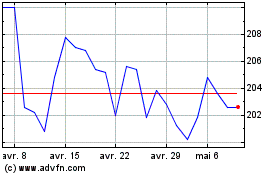

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Dassault Aviation (EU:AM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024