EUROBIO SCIENTIFIC: 2023 ANNUAL RESULTS

2023 ANNUAL RESULTS

Growth in Core Business and strategic

deployment

- Core business1 revenues up 39% to

€130m

- proprietary products

account for 30% of revenues

- 38% of revenues generated outside France

- Resilient results within a

strategic transformation phase

- Free cash flow of

€26.4m

- Net financial debt reduced to €5.5m, with €89m cash

position

Paris, April 10, 2024 - 5.40pm - Eurobio

Scientific (FR0013240934, ALERS), a leading French group

in in vitro medical diagnostics and life sciences, today announced

its consolidated annual results for 2023, prepared under French

GAAP and approved by the company's Board of Directors at its

meeting on 09 April 2024. 2

Eurobio Scientific's annual results for

2023 reflect both the end of the COVID business, partly offset by

strong growth in the core business, and the strategic

transformation underway, notably with the integration of GenDx over

a full year.

| in €m |

2023consolidated |

2022 consolidated |

Change |

| Revenues |

130.0 |

152.6 |

-17% |

|

R&D subsidies and research tax credit |

0.6 |

0.3 |

- |

|

Total revenues |

130.6 |

152.9 |

-15% |

|

Cost of goods sold |

(68.8) |

(81.7) |

-16% |

|

Operating gross margin |

61.9 |

71.2 |

-13% |

|

Impact of sale of inventory value allocated to PPA |

(4.4) |

|

|

|

Gross margin 3 |

57.5 |

71.2 |

-19% |

|

R&D expenses |

(5.9) |

(3.5) |

+70% |

| Marketing and

sales expenses |

(19.2) |

(19.6) |

-2% |

|

G&A expenses |

(14.3) |

(11.4) |

+25% |

|

Adjusted EBITDA 4 |

27.3 |

40.5 |

-33% |

| Amortisation of

intangible assets from PPA |

(4.5) |

(3.0) |

+53% |

| Amortisation of

goodwill |

(3.4) |

(3.0) |

+15% |

|

|

|

|

|

|

Operating result |

10.1 |

30.8 |

|

|

Adjusted operating result5 |

22.5 |

36.8 |

-39% |

|

Financial result |

(1.7) |

(0.5) |

- |

| Extraordinary

result |

(1.4) |

(0.7) |

- |

| Taxes |

(2.2) |

(4.7) |

- |

|

Net result |

4.8 |

24.9 |

-81% |

| |

|

|

|

|

Cash |

89.0 |

85.9 |

|

|

Financial debt excluding leasing |

94.5 |

108.0 |

|

|

Shareholders’ equity |

175.0 |

172.7 |

|

39% growth in core business and increase in the share of

proprietary products

Eurobio Scientific recorded revenues of €130.0m

in 2023, entirely linked to its core business, with the COVID

activities now integrated into the multiplex respiratory panels,

and in particular the flue syndrome respiratory panels. These

represented total sales of around €6m for the year.

Excluding perimeter effects linked to

acquisitions and non-recurring items, proforma growth in the core

business was 12%.

The integration of GenDx over a full year led to

a sharp increase in the share of proprietary products to 30% of

2023 revenues, compared with 18% in 2022.

Another effect of the integration of GenDx

combined with the other acquisitions, the most recent of which are

BMD (Belgium, 2022) and DID (Italy, 2023), is that the share of

international revenues has risen from 25% of core business in 2022

to 38% in 2023.

The gross operating margin, before the

non-recurring effect of the sale of GenDx inventories allocated as

part of the PPA (purchase price allocation), rose to 47.6% in 2023,

compared to 46.7% in 2022.

Resilient results against a background of increased

R&D and inflation

The integration of GenDx's development

activities has created a leading-edge team in molecular biology and

bioinformatics, resulting in a 70% increase in R&D expenditure

to €5.9m. Marketing and selling expenses remained stable (-2%) at

€19.2m, while general and administrative expenses rose by 25%,

mainly due to the integration of GenDx and BMD on a full-year basis

and of DID from July 3, 2023.

As a result, EBITDA adjusted for the effects of

the inventories allocated to PPA came to €27.3m (21% of revenues),

down 33% compared with 2022, which still included a very

significant proportion of COVID business.

Operating profit adjusted for the effects of the

PPA and goodwill amortization came to €22.5m, down 39% on the

previous year.

With financial debt linked to the loans used to

finance external growth, and cash remunerated at an interest rate

lower than the debt rate, financial income was negative at

€1.7m.

Exceptional items totalled €1.4m, mainly as a

result of write-downs on GenDx balance sheet items.

Net profit for 2023 was therefore €4.8m.

Free cash flow of €26.4m

With an €18.4m cash flow from operations,

combined with an €8.4m reduction in working capital mainly due to

the end of the COVID business, Eurobio Scientific generated an

operating cash flow of €26.8m in 2023 (€43.1m in 2022).

Cash flow from investment activities included

-€2.2m from net acquisitions of fixed assets, and -€4.5m from the

inclusion of DID in the scope of consolidation. These flows were

largely offset by the repayment of guarantee deposits of €6.3m made

in connection with foreign exchange transactions. As a result, with

a net cash outflow of -€0.3m linked to investments, free cash flow

amounted to €26.4m.

At the end of December 2023, Eurobio Scientific

had an €89m cash position and a financial debt (excluding finance

leases) of €94.5m, leading to a net financial debt of €5.5m,

compared with €22m a year earlier.

Continued strategic deployment

With a good resilience of its results despite

the end of the COVID business and a background of integration of

strategic acquisitions, Eurobio Scientific is continuing to deploy

its three strategic priorities: development of proprietary

products, internationalization, and opening up of new markets.

Their aim is to enable the Group to continue its development, with

both growth in sales and increase in margins.

Next financial meeting

Annual General Meeting: June 13, 2024

|

About Eurobio ScientificEurobio Scientific is a

key player in the field of specialty in vitro diagnostics. It is

involved from research to manufacturing and commercialization of

diagnostic tests in the fields of transplantation, immunology and

infectious diseases, and sells instruments and products for

research laboratories, including biotechnology and pharmaceutical

companies. Through many partnerships and a strong presence in

hospitals, Eurobio Scientific has established its own distribution

network and a portfolio of proprietary products in the molecular

biology field. The Group has approximately 290 employees and four

production units based in the Paris region, in Germany, in the

Netherlands and in the United States, and several affiliates based

in Dorking UK, Sissach Switzerland, Bünde Germany, Antwerp Belgium,

Utrecht in The Netherlands and Milan in Italy.Eurobio Scientific's

reference shareholder is the EurobioNext holding company which

brings together its two directors, Jean-Michel Carle and Denis

Fortier, alongside the "Pépites et Territoires" by AXA &

NextStage AM investment program, managed by NextStage AM. For more

information, please visit: www.eurobio-scientific.comThe company is

publicly listed on the Euronext Growth market in ParisEuronext

Growth BPI Innovation, PEA-PME 150 and Next Biotech indices,

Euronext European Rising Tech label.Symbol: ALERS - ISIN Code:

FR0013240934 - Reuters: ALERS.PA - Bloomberg: ALERS:FP |

|

Contacts |

|

Groupe Eurobio ScientificDenis Fortier, Chairman

and CEOOlivier Bosc, Deputy CEO / CFOTel. +33(0) 1 69 79 64 80 |

CalyptusMathieu CalleuxInvestors RelationsTel.

+33(1) 53 65 68 68 - eurobio-scientific@calyptus.net |

1 Excluding COVID revenues.2 The auditing

procedures of the financial statements by the statutory auditors

are still in progress.3 Included in 2023 the value of inventory

(€4.4m) allocated to the PPA related to the GenDx acquisition and

sold since then – non recurring4 Adjusted for the value of

inventory (€4.4m) allocated to the PPA related to the GenDx

acquisition and sold since then – non recurring5 Adjusted (i) for

the value of inventory allocated to PPA, (ii) the amortisation of

intangible assets allocated to PPA and (iii) goodwill

amortisation

- CP_Eurobio_Scientific_RA2023_EN

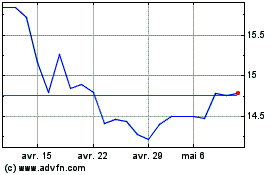

Eurobio Scientific (EU:ALERS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Eurobio Scientific (EU:ALERS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024